Best Accounting Software Small Business

Running a small business is a juggling act. Keeping finances organized shouldn't add to the chaos. Selecting the right accounting software can be the difference between thriving and just surviving.

This review is tailored for value-conscious small business owners. We'll explore affordable options that offer robust features without breaking the bank. Our goal is to empower you to choose the best software for your specific needs and budget.

Why Accounting Software Matters

Manual accounting is time-consuming and prone to errors. Accounting software automates crucial tasks. This includes tracking income and expenses, generating reports, and managing invoices.

Accurate financial data is essential for making informed business decisions. It also ensures compliance with tax regulations. The right software can save you time, money, and potential headaches down the road.

Shortlist of Recommended Accounting Software

Here are a few top contenders, catering to different needs and budgets:

- Best Overall (Budget-Friendly): Wave Accounting (Free)

- Best for Growing Businesses: Zoho Books (Paid, scalable plans)

- Best for Freelancers: QuickBooks Self-Employed (Paid, tailored features)

- Best for E-Commerce: Xero (Paid, integrates with popular platforms)

Detailed Reviews

Wave Accounting (Free)

Wave Accounting is a completely free accounting solution for small businesses. It offers essential features. This includes invoicing, expense tracking, and financial reporting.

Pros: Free, user-friendly interface, unlimited invoices and transactions, bank reconciliation. Cons: Limited integrations, payroll is an add-on service, not suitable for larger businesses.

Ideal for very small businesses, freelancers, and startups. Especially those on a tight budget looking for basic accounting functionality.

Zoho Books (Paid)

Zoho Books is a comprehensive accounting solution that scales with your business. It offers advanced features. This includes inventory management, project accounting, and customer relationship management (CRM) integration.

Pros: Scalable plans, robust features, excellent customer support, mobile app. Cons: Can be overwhelming for beginners, pricing can increase as you add users, steeper learning curve compared to Wave.

Suited for growing businesses that need more than just basic accounting. It's also great for those who value strong customer support.

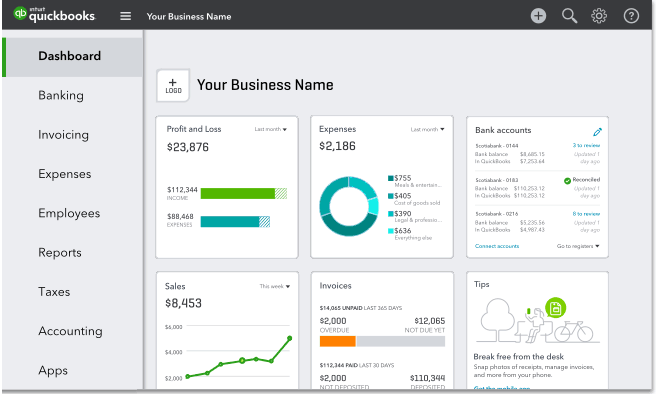

QuickBooks Self-Employed (Paid)

QuickBooks Self-Employed is designed specifically for freelancers and independent contractors. It simplifies tax preparation. It also helps track income and expenses related to self-employment.

Pros: Easy to use, mileage tracking, estimates quarterly taxes, integrates with TurboTax. Cons: Limited features compared to other QuickBooks products, not suitable for businesses with employees, primarily focused on sole proprietorships.

Best for freelancers and gig workers who need help managing their finances and taxes.

Xero (Paid)

Xero is a cloud-based accounting platform. It is well-suited for e-commerce businesses. It integrates seamlessly with popular e-commerce platforms and payment gateways.

Pros: Strong e-commerce integrations, inventory management, multi-currency support, robust reporting. Cons: Can be expensive, user interface can be confusing for some, requires a learning curve.

Ideal for e-commerce businesses needing robust features and integrations. It's also suitable for businesses operating in multiple currencies.

Side-by-Side Specs Table

| Feature | Wave Accounting | Zoho Books | QuickBooks Self-Employed | Xero |

|---|---|---|---|---|

| Pricing | Free | Paid (starts at $15/month) | Paid (starts at $15/month) | Paid (starts at $13/month) |

| Invoicing | Yes | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes | Yes |

| Bank Reconciliation | Yes | Yes | Yes | Yes |

| Reporting | Basic | Advanced | Basic | Advanced |

| Inventory Management | No | Yes | No | Yes |

| Payroll | Add-on | Add-on | No | Add-on |

| Integrations | Limited | Extensive | Limited | Extensive |

| E-commerce Integration | No | Yes | No | Yes |

| User Friendly Score (1-5, 5 best) | 5 | 3 | 4 | 3 |

| Value for Money Score (1-5, 5 best) | 5 | 4 | 3 | 3 |

Practical Considerations

Before making a decision, consider your business's specific needs. What features are essential for your day-to-day operations? How many users will need access to the software?

Think about scalability. Will the software be able to grow with your business? Also consider the learning curve and customer support availability.

Most accounting software providers offer free trials. Take advantage of these to test out the software. Ensure it meets your needs before committing to a subscription.

Summary

Choosing the right accounting software is a crucial decision for any small business. Wave Accounting is a great free option for startups with basic needs. Zoho Books offers scalability and robust features for growing businesses.

QuickBooks Self-Employed is tailored for freelancers. Xero excels in e-commerce integrations. Consider your budget, business size, and specific requirements.

Make an informed decision that empowers you to manage your finances effectively. This sets your business up for long-term success.

Call to Action

Ready to streamline your accounting processes? Start your free trial of Zoho Books or Xero today! Explore Wave Accounting for a completely free solution. Take control of your finances and empower your business!

Frequently Asked Questions (FAQ)

Q: Is free accounting software really sufficient for a small business?

A: It depends on your needs. For very small businesses with simple accounting requirements, a free option like Wave Accounting can be sufficient. As your business grows, you may need to upgrade to a paid solution with more advanced features.

Q: What is cloud-based accounting software?

A: Cloud-based accounting software is hosted on remote servers. You can access it from anywhere with an internet connection. It offers benefits such as automatic backups, real-time data updates, and collaboration capabilities.

Q: How important is integration with other software?

A: Integration can save you time and effort by automating data transfer between different systems. Consider which software your business uses. Choose an accounting solution that integrates seamlessly with those tools.

Q: What if I need help setting up the software?

A: Most accounting software providers offer customer support resources. This includes tutorials, documentation, and live chat or phone support. Look for a provider with a reputation for excellent customer service.