Best Financial Software For Small Business

Feeling overwhelmed by spreadsheets and shoeboxes full of receipts? You're not alone. For small business owners, managing finances can feel like navigating a minefield. But fear not! The right financial software can be your guiding light, transforming chaos into clarity and empowering you to make informed decisions.

This guide is designed for first-time buyers, entrepreneurs just like you, who are ready to ditch the manual grind and embrace the power of digital finance. We'll cut through the jargon, explore the top options, and arm you with the knowledge to choose the perfect software for your needs.

Why Financial Software Matters for Your Small Business

Why even bother with financial software? Well, imagine trying to build a house without a blueprint. Financial software provides that blueprint, giving you a real-time view of your cash flow, expenses, and overall financial health.

It's not just about staying organized. Good financial software also helps you comply with tax regulations, track invoices and payments, and forecast future performance. Ultimately, it frees up your time to focus on what you do best: growing your business.

Top 5 Financial Software Options for Small Businesses

Let's dive into the contenders. We've compiled a comparison of five popular options, focusing on features that matter most to small business owners.

| Software | Starting Price | Key Features | Warranty/Support |

|---|---|---|---|

| QuickBooks Online | $30/month | Invoicing, Expense Tracking, Reporting, Payroll Integration | Phone & Chat Support |

| Xero | $15/month | Bank Reconciliation, Inventory Management, Mobile App | Email & Chat Support |

| Zoho Books | $0/month (limited) | Invoicing, Time Tracking, Project Management | Email Support |

| FreshBooks | $17/month | Invoicing, Time Tracking, Client Management | Phone & Email Support |

| Sage Business Cloud Accounting | $25/month | Cash Flow Forecasting, Bank Feeds, Reporting | Phone & Chat Support |

Detailed Reviews: A Closer Look

QuickBooks Online

QuickBooks Online is the industry giant, known for its comprehensive features and integrations. It's a robust solution that can scale with your business, but the price can increase as you add features or users. A solid choice for businesses that need advanced capabilities.

Xero

Xero stands out for its user-friendly interface and strong bank reconciliation features. It's a great option for businesses that need help managing their cash flow and staying on top of their bank transactions. Mobile app is a plus!

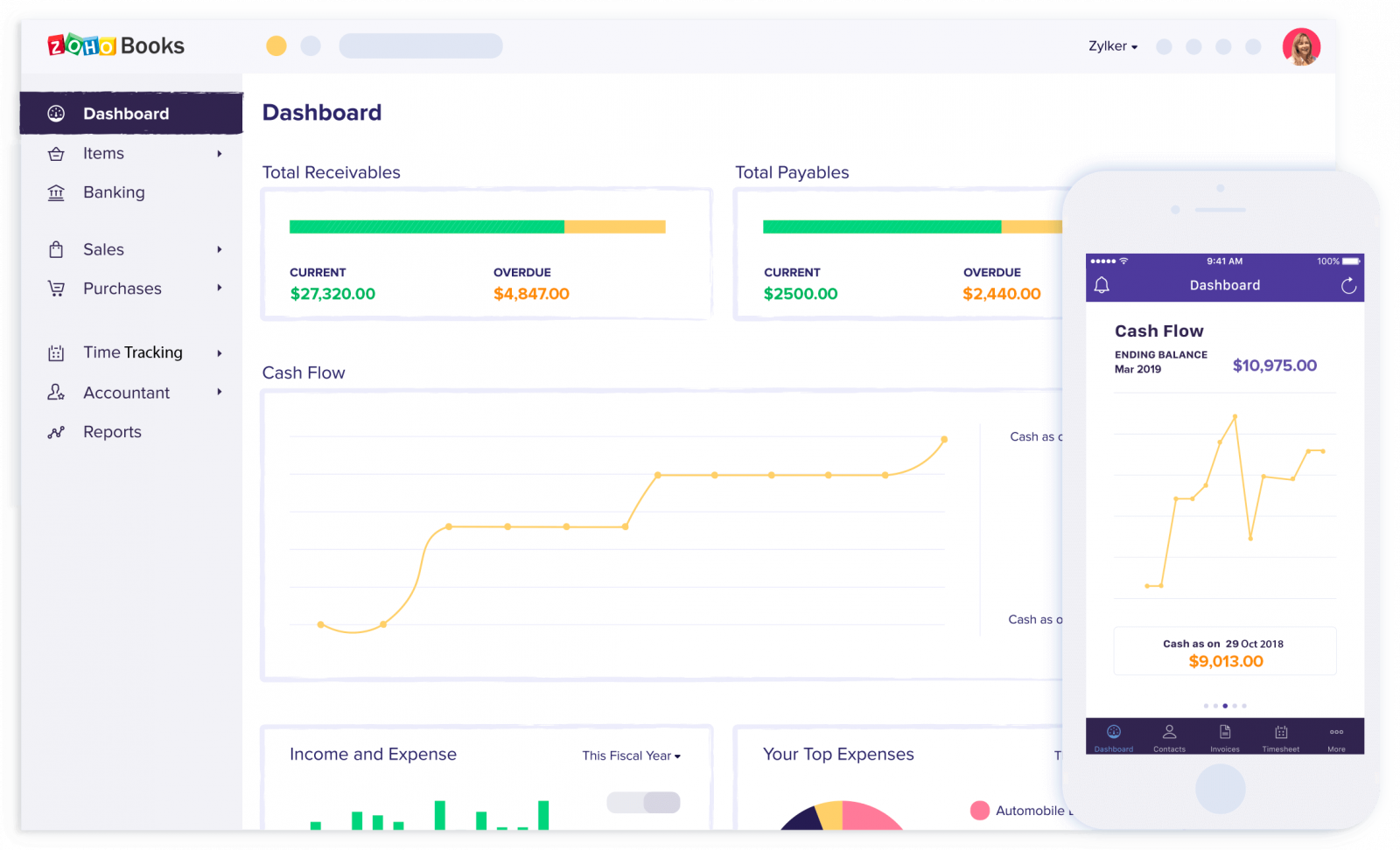

Zoho Books

Zoho Books is a cost-effective option, especially for startups. The free plan is limited, but it can be a good starting point. It seamlessly integrates with other Zoho applications, making it a great choice for businesses already using the Zoho ecosystem.

FreshBooks

FreshBooks is designed specifically for service-based businesses. It focuses on invoicing, time tracking, and client management, making it a simple solution for freelancers and consultants. If you need to manage projects and bill clients, this is a good option.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a powerful solution for businesses that need advanced features like cash flow forecasting. It offers a range of modules to customize the software to your specific needs. A good fit for companies with more complex accounting requirements.

Used vs. New: Exploring Your Options

Used Financial Software

Technically, "used" financial software isn't really a thing. Most software operates on a subscription basis, so you're paying for access, not ownership. Focus on free trials and affordable starting plans if cost is a concern.

New Financial Software

Opting for a new subscription ensures you're always using the latest version with the newest features and security updates. You'll also have access to the software provider's customer support. Essential for reliable business operation.

Reliability Ratings by Brand

Reliability is crucial when it comes to financial software. Here's a general overview based on user reviews and industry reports:

- QuickBooks Online: Generally reliable, but can experience occasional glitches, especially during updates.

- Xero: Known for its stable platform and consistent performance.

- Zoho Books: Relatively new, but generally reliable with a growing user base.

- FreshBooks: Solid performance, particularly for its core features like invoicing.

- Sage Business Cloud Accounting: A robust solution with a long history of reliability.

Checklist: 5 Must-Check Features Before Buying

Before you commit to a specific software, make sure it ticks these boxes:

- Invoicing: Can you easily create and send professional invoices?

- Expense Tracking: Can you track your expenses and categorize them for tax purposes?

- Bank Reconciliation: Can you easily connect your bank accounts and reconcile transactions?

- Reporting: Does it offer the reports you need to understand your financial performance?

- Integration: Does it integrate with other tools you use, like your CRM or payroll system?

Key Takeaways and Recommendations

Choosing the right financial software is a crucial decision for your small business. Consider your budget, the size and complexity of your business, and the features you need most. Don't be afraid to take advantage of free trials to test out different options before making a commitment.

Prioritize features like invoicing, expense tracking, bank reconciliation, and reporting to ensure you have a comprehensive view of your finances. Integration with other tools can also streamline your workflow and save you time. Ultimately, the best software is the one that meets your unique needs and helps you achieve your financial goals.

Ready to Transform Your Finances?

Take the next step! Explore the free trials offered by the software mentioned in this article. Compare the features and find the perfect fit for your small business. Invest in your financial future today!