Best Mobile Pos System For Small Business

Running a small business means watching every penny. Forget fancy features you'll never use. We're diving into the best mobile POS systems that won't break the bank, perfect for the truly cost-conscious.

Why a Mobile POS System Matters (Especially When You're Broke)

Think a cash register is good enough? Think again. A mobile POS (point of sale) system can streamline transactions, manage inventory, and even track sales, all from a smartphone or tablet. All that equals efficiency, less error, and *more* money in your pocket.

Plus, ditching the clunky countertop setup saves space and makes you look professional. This is crucial for market stalls, pop-up shops, or any business on the move.

The Shortlist: POS Systems That Won't Gut Your Wallet

Here are a few options catering to various needs and extremely tight budgets:

- Square Point of Sale: The go-to for basic needs. Free to start, pay-as-you-go transaction fees.

- SumUp: A simple, affordable option with no monthly fees and a low transaction rate.

- Clover Go: A good choice if you want to scale up later, but still keep initial costs low.

Detailed Reviews: The Nitty-Gritty on Each System

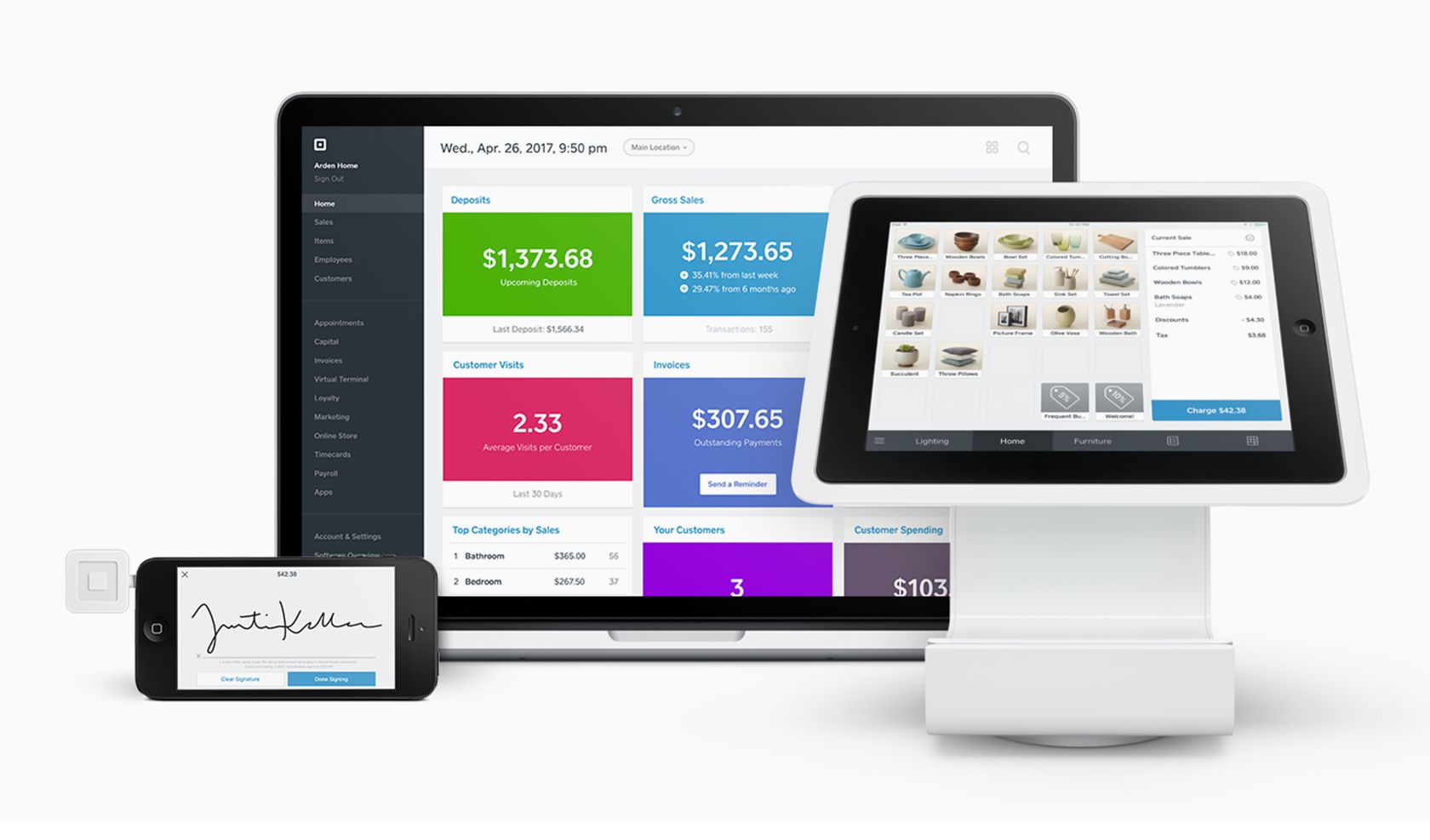

Square Point of Sale: The Champion of "Free"

Square is the reigning champ of the "free" POS world. The basic app is completely free, and you only pay a transaction fee per sale. It's super easy to set up and use, even for the tech-challenged.

Square offers basic reporting, inventory management, and customer directory features. Don't expect advanced analytics, but it's perfect for startups and micro-businesses.

SumUp: The Low-Rate Rockstar

SumUp is another excellent option with no monthly fees. It shines with its consistently lower transaction rates compared to Square. The card reader is also sleek and portable.

SumUp's features are slightly less comprehensive than Square's, but it covers all the essentials. It's ideal for businesses focused on low processing fees.

Clover Go: The Scalability Saver

Clover Go is a solid option if you anticipate growth. It offers a more robust platform with more features than Square or SumUp. While the initial cost might be a bit higher (card reader purchase), you can upgrade to a full Clover system as your business expands.

Clover Go integrates seamlessly with other Clover hardware and software. It's a good investment if you plan to scale up your operations significantly in the future.

Specs Showdown: Side-by-Side Performance

| Feature | Square Point of Sale | SumUp | Clover Go |

|---|---|---|---|

| Monthly Fee | $0 | $0 | $0 (for basic plan) |

| Transaction Fee | Variable (around 2.6% + $0.10) | Variable (around 2.75%) | Variable (Varies by plan, similar to Square) |

| Inventory Management | Basic | Basic | Robust |

| Reporting | Basic | Basic | Detailed |

| Ease of Use | Excellent | Excellent | Good |

| Scalability | Limited | Limited | Excellent |

Customer Satisfaction: What Are People Saying?

We scoured online reviews to get a sense of real-world user satisfaction:

- Square: Praised for ease of use and free features, but some complain about account holds and customer service.

- SumUp: Loved for low rates and simple setup, but fewer features than competitors.

- Clover Go: Appreciated for scalability and features, but some find the system more complex.

Maintenance Costs: The Hidden Expenses

Don't forget about ongoing expenses. These include replacement card readers (plan for $50-$100 every few years), receipt paper (if you use a printer), and potential software upgrades (especially with Clover).

Consider the long-term costs of payment processing fees. Even small differences can add up over time.

Key Takeaways: Choose Wisely

Choosing the right mobile POS system is crucial for your business. Square is great for simple needs. SumUp is the low-cost king. And Clover Go is ready for growth.

Consider your budget, current needs, and future plans. Customer reviews and hidden costs matter.

Ready to Choose? Start Saving Today!

Don't wait! Visit the websites of Square, SumUp, and Clover Go. Compare their offerings, and start streamlining your business today!

Frequently Asked Questions (FAQ)

Q: Do I need an internet connection to use a mobile POS system?

Yes, a stable internet connection (Wi-Fi or mobile data) is typically required to process payments and sync data.

Q: Can I use a mobile POS system with my existing bank account?

Yes, most mobile POS systems allow you to link your business bank account for deposits. Check compatibility before signing up.

Q: Are mobile POS systems secure?

Reputable mobile POS systems use encryption and other security measures to protect your data and your customers' information.

Q: Can I use a mobile POS system offline?

Some systems offer limited offline functionality. But the data must be synced when you regain connectivity. Confirm what’s available prior to subscribing.

Q: Do I need to purchase additional hardware, like a printer or barcode scanner?

While not always necessary, additional hardware such as printers and barcode scanners, will improve overall system efficiency. Determine your business needs, and select the add-ons that best meets those requirements.