Best Simple Accounting Software

Staring a business is a thrilling journey, but let's face it: numbers can be intimidating. You're not alone if the thought of accounting software conjures up images of complex spreadsheets and endless data entry. This guide is designed for you – the first-time business owner, freelancer, or side-hustler who needs a simple, effective way to manage finances without a degree in accounting.

We’ll explore the world of simple accounting software, stripping away the jargon and focusing on what truly matters: ease of use, affordability, and functionality. Our goal is to equip you with the knowledge to confidently choose the right tool for your needs.

Why Simple Accounting Software Matters

Tracking income and expenses is crucial for any business, regardless of size. Simple accounting software automates this process, freeing up your time to focus on what you do best: growing your business. Without a clear understanding of your finances, you're flying blind, making it difficult to make informed decisions about pricing, investments, and overall profitability.

By using accounting software, you can gain real-time insights into your business's financial health, streamline tax preparation, and ensure compliance with regulations. These platforms are designed to remove the stress of manual calculations and offer clarity into your business's performance.

Top 5 Simple Accounting Software Options: A Quick Comparison

| Software | Price (Starting) | Key Features | Ease of Use (Rating 1-5, 5 being easiest) | Support |

|---|---|---|---|---|

| Zoho Books | $0 (Free plan available) | Invoicing, expense tracking, reporting | 4 | Email, Phone, Chat |

| QuickBooks Self-Employed | $15/month | Mileage tracking, estimated taxes, invoice creation | 4.5 | Phone, Chat |

| FreshBooks | $17/month | Invoicing, time tracking, project management | 5 | Email, Phone, Chat |

| Wave Accounting | Free (Payment processing fees apply) | Invoicing, accounting, payroll | 4 | Email, Chat |

| Xero | $15/month | Invoicing, bank reconciliation, reporting | 3.5 | Email, Chat |

Detailed Reviews of Each Software

Zoho Books

Zoho Books stands out with its comprehensive suite of features, even in its free plan. It's a great option for small businesses that need more than just basic invoicing. Its integration with other Zoho applications is seamless and powerful.

The learning curve might be slightly steeper than some others on this list, but its robustness makes it worth the effort. A detailed help center and readily available customer support can assist users with setup and navigating the system.

QuickBooks Self-Employed

QuickBooks Self-Employed is specifically designed for freelancers and independent contractors. Its strongest feature is the ability to track mileage automatically. It simplifies tax season by estimating quarterly taxes.

While it's not as comprehensive as QuickBooks' full suite, it's perfectly suited for single-person operations. The simplicity and focus on tax preparation make it a popular choice.

FreshBooks

FreshBooks is renowned for its user-friendly interface and focus on invoicing. It’s visually appealing and intuitive, making it easy to get started even with no prior accounting experience. Project management tools are seamlessly integrated.

If invoicing and time tracking are your primary needs, FreshBooks is an excellent choice. The platform is known for its excellent customer service, offering responsive support to address user queries and issues.

Wave Accounting

Wave Accounting is a completely free accounting solution, which is its biggest selling point. It offers a solid set of features including invoicing, accounting, and payroll (for a fee). The software is designed for very small businesses and freelancers.

While the core accounting features are free, Wave makes money through payment processing fees. This can be a good trade-off if you don't mind paying a small fee per transaction in exchange for free accounting software. However, the customer support options are more limited compared to paid solutions.

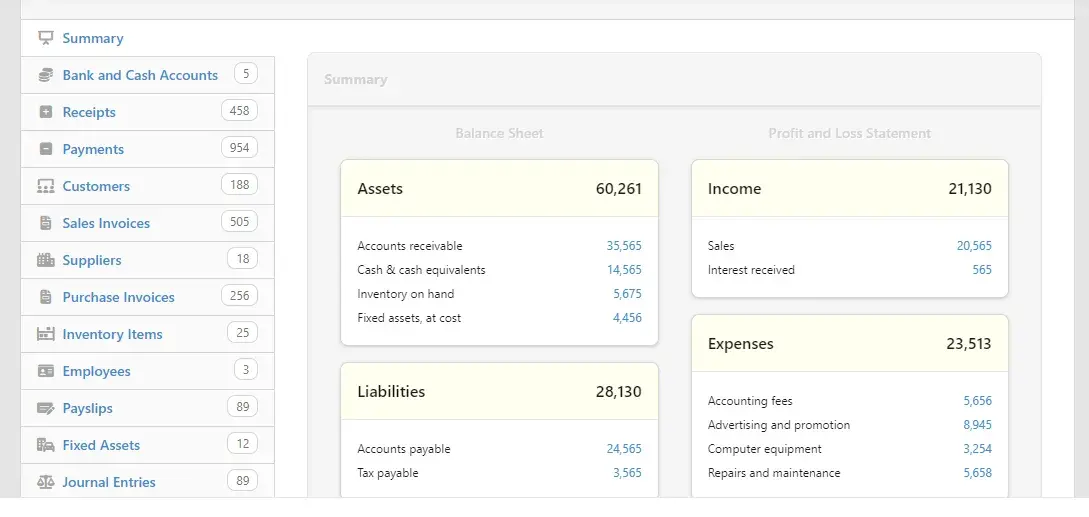

Xero

Xero is a powerful cloud-based accounting platform popular among larger small businesses. It offers robust features like bank reconciliation and detailed reporting. It is a more advanced option than other solutions listed here.

Its interface isn't quite as intuitive as FreshBooks or QuickBooks Self-Employed. However, with more features, it has a steeper learning curve. But, for businesses that need more advanced accounting capabilities, Xero is a worthy contender.

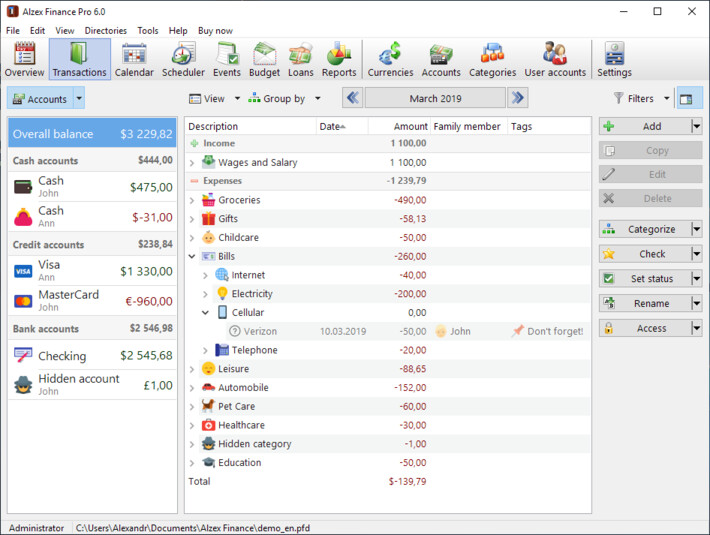

Used vs. New Accounting Software: What's the Difference?

Accounting software is generally purchased brand new. There is no "used" market. Because software is often subscription-based, and tied to specific business data and licensing agreements, buying a used version isn't a practical option.

The "used" option usually refers to opting for older versions of a software if possible. However, sticking with updated and supported version of accounting software is almost always the best course of action to make sure the software has the last security updates and is working as intended.

Reliability Ratings by Brand

Based on customer reviews and industry reports, here's a general assessment of reliability:

- QuickBooks: Generally high reliability, but occasional glitches reported.

- Zoho Books: Known for its stability and robust infrastructure.

- FreshBooks: Considered reliable with a strong focus on user experience.

- Wave Accounting: Mostly reliable, but occasional performance issues have been noted.

- Xero: Highly reliable with a focus on enterprise-grade performance.

Checklist: 5 Must-Check Features Before Buying

- Ease of Use: Can you navigate the software without constant help?

- Invoicing Capabilities: Can you create and send professional-looking invoices?

- Expense Tracking: Is it easy to record and categorize expenses?

- Reporting Features: Does it provide insightful reports on your business's financial health?

- Integration: Does it integrate with other tools you use, like your bank account or payment processor?

Key Takeaways

Choosing the right simple accounting software is crucial for managing your business finances effectively. We've explored five excellent options: Zoho Books, QuickBooks Self-Employed, FreshBooks, Wave Accounting, and Xero.

Consider the key factors that align with your business needs. Assess your budget, technical expertise, and specific requirements, such as invoicing, expense tracking, and reporting. Each platform has its strengths, from FreshBooks' user-friendliness to Wave Accounting's cost-effectiveness and Zoho Books's comprehensive free plan.

By carefully considering these aspects, you'll be well-equipped to make an informed decision that sets your business up for financial success.

Ready to Take Control of Your Finances?

Don't let accounting intimidate you. Take advantage of free trials offered by many of these providers. Test them out and see which one feels most intuitive and best suits your business's unique needs. With the right simple accounting software in place, you can focus on growing your business with confidence.

![Best Simple Accounting Software The 11 Best Accounting Software [Bookkeeping Software Review]](https://www.softwaretestinghelp.com/wp-content/qa/uploads/2020/09/10-Top-Accounting-Software.png)