Best Software For Small Business Bookkeeping

Are you a small business owner drowning in spreadsheets and receipts? Effective bookkeeping is the backbone of any successful small business, but managing finances manually can be time-consuming and prone to errors.

Choosing the right bookkeeping software can automate tasks, provide valuable insights, and ultimately save you time and money. This review is tailored for value-conscious small business owners seeking the best bookkeeping software to streamline their finances without breaking the bank.

Why Bookkeeping Software Matters

Accurate bookkeeping provides a clear picture of your financial health, allowing you to make informed decisions about pricing, investments, and overall business strategy.

It simplifies tax preparation, helps you track expenses, and ensures compliance with financial regulations. Ultimately, good bookkeeping software empowers you to focus on growing your business, not just managing its finances.

Shortlist of Bookkeeping Software for Small Businesses

Here's a curated list of bookkeeping software catering to different needs and budgets:

- Best Overall: QuickBooks Online

- Best for Sole Proprietors: Zoho Books

- Best Free Option: Wave Accounting

- Best for E-commerce: Xero

- Best for Contractors: FreshBooks

Detailed Reviews

QuickBooks Online

QuickBooks Online is a comprehensive solution packed with features like invoicing, expense tracking, bank reconciliation, and reporting.

Its user-friendly interface and extensive integrations make it a popular choice for many small businesses. However, its pricing can be a barrier for some, especially as your business grows and requires more advanced features.

Zoho Books

Zoho Books is a strong contender offering a balance of features and affordability, particularly suitable for sole proprietors and small businesses with simple needs.

It includes invoicing, expense tracking, online payments, and basic reporting. While it may lack some of the advanced features of QuickBooks Online, it's a cost-effective and user-friendly alternative.

Wave Accounting

For businesses operating on a tight budget, Wave Accounting provides a completely free bookkeeping solution.

It covers essential features like invoicing, expense tracking, and bank reconciliation. However, be aware that payment processing and payroll are paid add-ons.

Xero

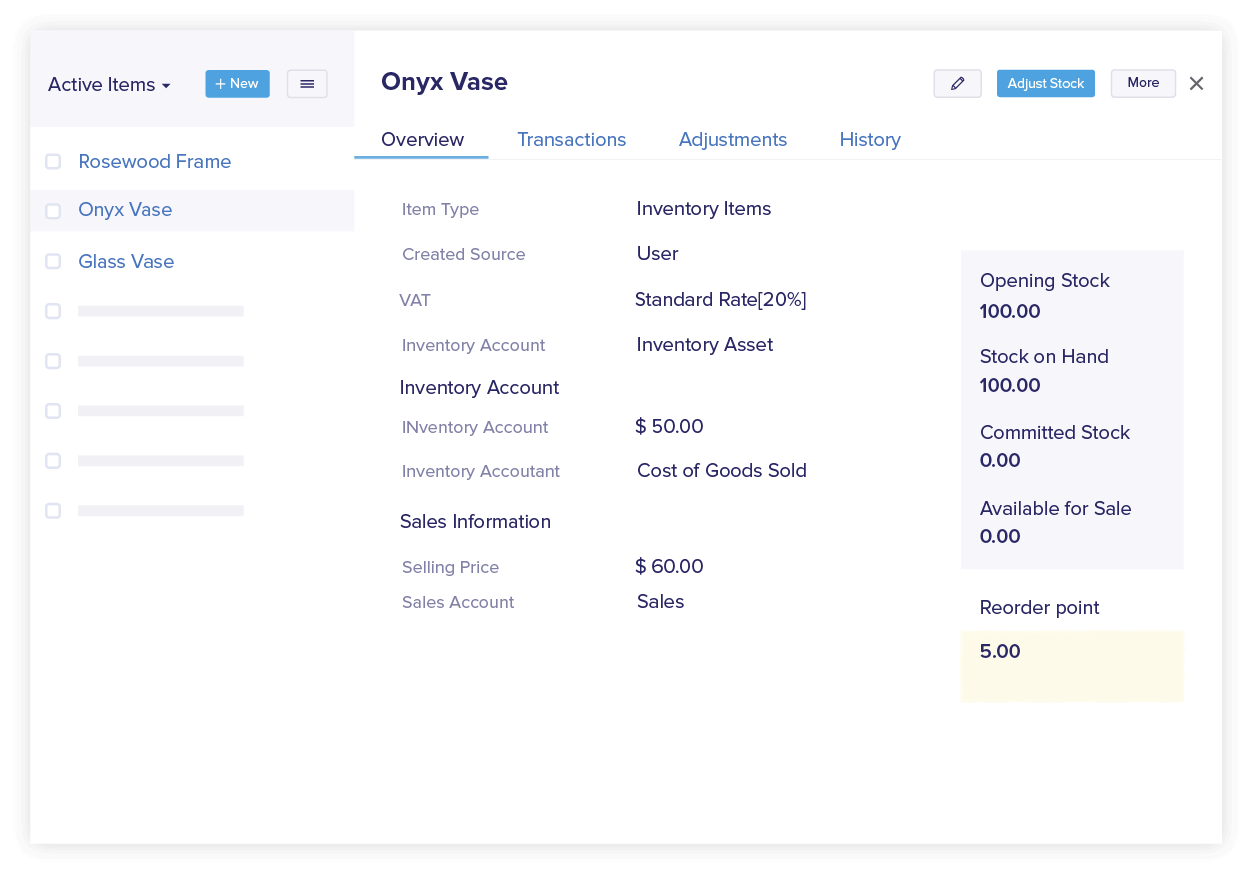

Xero is a powerful bookkeeping platform particularly well-suited for e-commerce businesses due to its robust inventory management and integrations with popular e-commerce platforms.

It offers comprehensive features like invoicing, bank reconciliation, expense tracking, and detailed reporting. While Xero's pricing is competitive, its interface can be less intuitive than some other options.

FreshBooks

FreshBooks is tailored towards freelancers and contractors, with a focus on time tracking, invoicing, and project management.

It provides features like automated late payment reminders and easy-to-use invoicing templates. While it offers some bookkeeping features, it may not be the best choice for businesses requiring advanced accounting functionalities.

Side-by-Side Specs Table

| Software | Pricing | Ease of Use | Key Features | Scalability | Overall Score (out of 5) |

|---|---|---|---|---|---|

| QuickBooks Online | $$$ | 4/5 | Comprehensive features, extensive integrations | High | 4.5/5 |

| Zoho Books | $$ | 4.5/5 | Invoicing, expense tracking, online payments | Medium | 4/5 |

| Wave Accounting | Free (paid add-ons) | 4/5 | Invoicing, expense tracking, bank reconciliation | Low | 3.5/5 |

| Xero | $$$ | 3.5/5 | Inventory management, e-commerce integrations | High | 4/5 |

| FreshBooks | $$ | 4.5/5 | Time tracking, invoicing, project management | Low | 4/5 |

Pricing: $ (Free - $15/month), $$ ($15 - $40/month), $$$ (Over $40/month)

Practical Considerations

Before committing to a bookkeeping software, consider these crucial factors.

Your Business Needs: Evaluate your current bookkeeping needs and anticipate future growth. Do you need inventory management, payroll processing, or advanced reporting features?

Budget: Determine how much you're willing to spend on bookkeeping software monthly or annually. Free options exist, but often have limitations.

Ease of Use: Choose software with a user-friendly interface and adequate support resources. Opt for a free trial to test the software before subscribing.

Integrations: Ensure the software integrates seamlessly with your existing tools, such as your bank accounts, payment processors, and CRM.

Scalability: Select a platform that can grow with your business and accommodate increasing complexity.

Summary

Choosing the right bookkeeping software is a critical decision for small businesses. QuickBooks Online offers a comprehensive solution, while Zoho Books provides a balance of features and affordability.

Wave Accounting is a viable free option, Xero is ideal for e-commerce, and FreshBooks caters to freelancers and contractors.

Consider your specific needs, budget, and long-term growth plans before making a final decision. By carefully evaluating the factors discussed, you can select the bookkeeping software that best empowers your business for financial success.

Call to Action

Ready to streamline your bookkeeping and take control of your finances? Start a free trial with one of the recommended software options today! Take advantage of trial periods to determine which platform best suits your needs.

Frequently Asked Questions (FAQ)

Q: Can I switch bookkeeping software later if I'm not satisfied?

A: Yes, you can typically switch bookkeeping software, but it requires careful planning and data migration to avoid errors. Consider consulting with a bookkeeper or accountant for assistance.

Q: Do I need to be an accountant to use bookkeeping software?

A: No, most bookkeeping software is designed to be user-friendly for non-accountants. However, understanding basic accounting principles can be beneficial. Consider online courses or tutorials to improve your bookkeeping skills.

Q: Is my financial data secure with online bookkeeping software?

A: Reputable bookkeeping software providers implement robust security measures to protect your financial data. Look for features like data encryption, two-factor authentication, and regular security audits. Also, familiarize yourself with the provider's privacy policy.

Q: How long does it take to learn how to use bookkeeping software?

A: The learning curve varies depending on the complexity of the software and your prior accounting experience. Most platforms offer tutorials, webinars, and support resources to help you get started. Plan to dedicate a few hours or days to familiarize yourself with the software.