Best Way To Get Capital For A Small Business

So, you've got the next big thing. A killer idea, a solid business plan, and the fire in your belly to make it happen. But there's one small, yet colossal, hurdle: capital. Securing funding for your small business can feel like navigating a labyrinth blindfolded. Don't worry, you're not alone, and this guide is your map.

This article is designed specifically for first-time business owners. We'll explore the most common and effective ways to get your venture off the ground. Forget the jargon; we're talking practical strategies and realistic expectations.

Why Funding Matters (And Where to Find It)

Capital isn't just about covering initial expenses. It's the fuel that keeps your engine running. It allows you to invest in marketing, hire the right team, and weather those inevitable early storms.

Think of it as the foundation upon which you'll build your empire. Without a solid foundation, the rest crumbles. We'll break down the most accessible and potentially lucrative funding options available to you.

The Top 5 Funding Options Compared

| Funding Source | Typical Funding Range | Interest Rate/Equity | Approval Difficulty | Repayment Terms |

|---|---|---|---|---|

| Small Business Loans | $5,000 - $500,000+ | Variable, typically 6-25% | Moderate to High | 1-25 years |

| Business Credit Cards | $500 - $50,000 | Variable, typically 15-30% | Low to Moderate | Revolving |

| Grants | $500 - $100,000+ | N/A (No repayment) | Very High | N/A |

| Angel Investors | $25,000 - $1,000,000+ | Equity stake (percentage of ownership) | High | N/A |

| Crowdfunding | $1,000 - $1,000,000+ | Rewards or equity (depending on platform) | Moderate | N/A |

Detailed Reviews of Each Funding Option

Small Business Loans: The Traditional Route

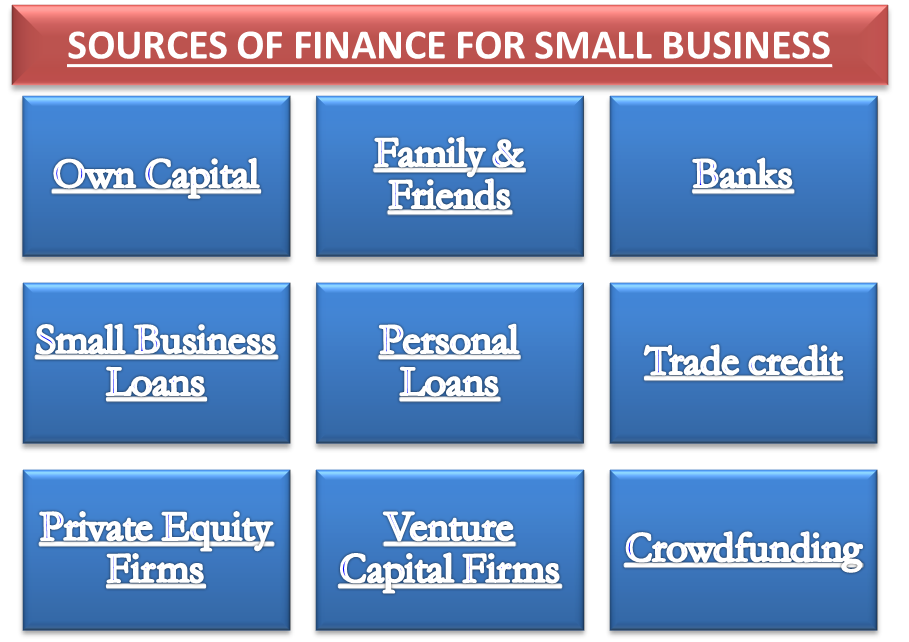

Small business loans are offered by banks, credit unions, and online lenders. They provide a lump sum of cash that you repay over a set period. Interest rates and terms vary depending on your creditworthiness and the lender.

Pros: Larger funding amounts available. Predictable repayment schedule.

Cons: Can be difficult to qualify for. Requires good credit and a solid business plan.

Business Credit Cards: Flexibility and Convenience

Business credit cards offer a revolving line of credit you can use for various expenses. They're often easier to obtain than loans. However, interest rates can be high if you carry a balance.

Pros: Easy access to funds. Rewards programs and cash back options.

Cons: High interest rates. Potential for debt accumulation.

Grants: Free Money (With Strings Attached)

Grants are essentially free money offered by government agencies, foundations, and corporations. They typically have specific requirements and a competitive application process.

Pros: No repayment required. Can boost your credibility.

Cons: Highly competitive. Often require detailed reporting.

Angel Investors: More Than Just Money

Angel investors are individuals who invest their own money in early-stage companies. They often provide mentorship and guidance in addition to capital.

Pros: Access to expertise and network. Potential for significant funding.

Cons: Giving up equity in your company. Can be difficult to find the right investor.

Crowdfunding: Leveraging the Power of the Crowd

Crowdfunding involves raising money from a large number of people online. There are two main types: reward-based and equity-based.

Pros: Can raise significant capital. Opportunity to build brand awareness.

Cons: Requires significant marketing effort. Success is not guaranteed.

"Used vs New" Analogy: Applying it to Funding

Think of "used" funding as bootstrapping or personal savings. It's readily available, but limited. "New" funding represents external sources like loans or investors, offering more resources but requiring more effort and commitment.

Bootstrapping (Used): Pros: Maintain full control. No debt or equity dilution. Cons: Limited resources. Slower growth potential.

External Funding (New): Pros: Access to significant capital. Faster growth potential. Cons: Giving up control or incurring debt. Increased pressure to perform.

Reliability Ratings by Funding Source (Subjective & Relative)

- Banks/Credit Unions (Small Business Loans): Generally High Reliability

- Established Online Lenders (e.g., Funding Circle, BlueVine): Moderate Reliability

- Business Credit Cards (Major Issuers): High Reliability

- Government Grants (SBA, State Agencies): High Reliability (if awarded)

- Angel Investors (Vetted Networks): Moderate Reliability (due diligence crucial)

- Crowdfunding Platforms (Kickstarter, Indiegogo): Platform Reliability High, Project Success Varies Greatly

Checklist: 5 Must-Check Features Before Committing to Funding

- Interest Rate/Equity Dilution: Understand the true cost of the funding. What percentage are you paying back in interest, or giving away in company ownership?

- Repayment Terms/Obligations: Know the repayment schedule and penalties for late payments. Are there any personal guarantees required?

- Eligibility Requirements: Ensure you meet all the lender's or investor's requirements. Don't waste time applying if you don't qualify.

- Hidden Fees: Read the fine print. Are there any origination fees, prepayment penalties, or other hidden costs?

- Long-Term Impact: How will this funding affect your company's long-term financial health and ownership structure?

Key Takeaways

Choosing the right funding option is a crucial decision for any small business. Consider your specific needs, financial situation, and risk tolerance. Weigh the pros and cons of each option carefully.

Don't be afraid to explore multiple avenues. A combination of funding sources may be the best approach. Thorough research and careful planning are essential for success.

Remember, capital is a tool. Use it wisely to build a sustainable and thriving business. Securing funding is just the first step.

Ready to Take the Next Step?

Now that you're armed with this knowledge, it's time to start exploring your options. Research different lenders, grants, and investors. Create a solid business plan and financial projections.

Don't be afraid to ask for help from mentors, advisors, and other entrepreneurs. Starting a business is challenging, but with the right funding and support, you can achieve your dreams.

Start today. Visit [Link to resource list for small business funding] to explore potential funding sources and access valuable resources. Your journey to success starts now.

:max_bytes(150000):strip_icc()/CapitalizationTable_updated-12aace0ed353491b888a2de732a82b66.png)

:max_bytes(150000):strip_icc()/WorkingCapitalLoan_Final-c8f87cd151e749fe9eee07612e799e15.png)