Top Accounting Software For Small Business

Running a small business is tough, and managing finances shouldn't add to the struggle. Choosing the right accounting software can streamline operations, save you time and money, and provide crucial insights into your company's financial health. This article is for value-conscious small business owners who need to make informed decisions about accounting software without breaking the bank.

Why Accounting Software Matters

Accounting software automates tasks like invoicing, expense tracking, and bank reconciliation. This reduces errors, saves time, and frees you up to focus on growing your business. It also provides real-time financial data, empowering you to make better decisions.

Shortlist of Top Accounting Software for Small Businesses

Here are a few options:

- Best Overall: Zoho Books - Excellent value and comprehensive features.

- Best for Simplicity: Xero - User-friendly interface.

- Best for Sole Proprietors: QuickBooks Self-Employed - Designed for freelancers and independent contractors.

- Best Free Option: Wave Accounting - Offers free core accounting features.

Detailed Reviews

Zoho Books

Zoho Books provides a complete suite of accounting tools suitable for most small businesses. It offers features like invoicing, expense tracking, inventory management, and reporting. Its strengths are its affordability and extensive features.

Xero

Xero is known for its intuitive interface and seamless integrations with other business apps. It excels in bank reconciliation and collaboration. However, it may be more expensive than other options.

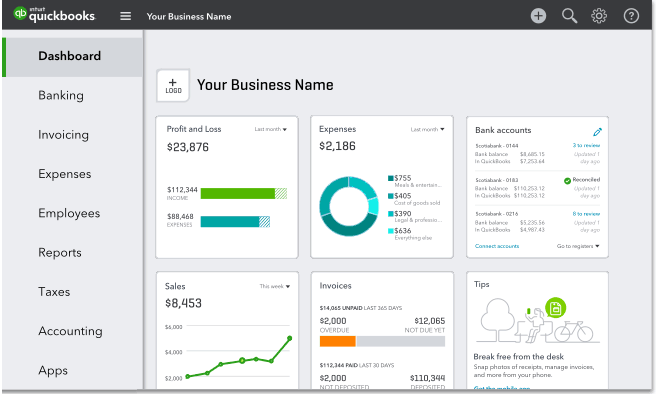

QuickBooks Self-Employed

QuickBooks Self-Employed is tailored for freelancers and independent contractors. It simplifies expense tracking, mileage tracking, and tax preparation. It integrates directly with TurboTax for easy tax filing.

Wave Accounting

Wave Accounting provides free core accounting features like invoicing, expense tracking, and basic reporting. It's a great option for businesses on a tight budget. Consider paid add-ons for payroll and payment processing.

Side-by-Side Specs Table

| Software | Price (Starting) | Ease of Use (1-5, 5=Easiest) | Features (1-5, 5=Most) | Customer Support (1-5, 5=Best) | Overall Score (1-5, 5=Highest) |

|---|---|---|---|---|---|

| Zoho Books | $0 - $24/month | 4 | 4 | 4 | 4.0 |

| Xero | $13/month | 5 | 4 | 3 | 4.0 |

| QuickBooks Self-Employed | $15/month | 4 | 3 | 3 | 3.3 |

| Wave Accounting | Free (fees apply for payroll & payments) | 3 | 3 | 2 | 2.7 |

Practical Considerations

Consider your business size, complexity, and future growth plans when selecting accounting software. Ensure the software integrates with your existing business tools. Check customer reviews and ratings to get an idea of user satisfaction.

Think about your budget and the features you actually need. Don't pay for features you won't use. Explore the possibility of free trials to test the software before committing.

Consider features like mobile access. If you plan to give access to an accountant you may consider accounting software that allows multiple users with different roles. Ensure that the software aligns with local tax regulations.

Key Takeaways

Choosing the right accounting software is crucial for efficient financial management. Zoho Books offers a balance of affordability and features. Xero stands out for its ease of use.

QuickBooks Self-Employed is ideal for freelancers, while Wave Accounting is a cost-effective option for budget-conscious businesses. Carefully evaluate your specific requirements and budget. Then, you can pick the right accounting software for your business.

Call to Action

Ready to simplify your accounting? Explore the free trials offered by Zoho Books, Xero, and QuickBooks Self-Employed. Start streamlining your finances and focus on growing your business today!

Frequently Asked Questions (FAQ)

Q: What is the most important feature in accounting software for a small business?

A: It depends on your business needs, but invoicing, expense tracking, and bank reconciliation are typically essential.

Q: Can I switch accounting software later if my needs change?

A: Yes, but it involves data migration, so plan carefully and choose software that can scale with your growth.

Q: Is cloud-based accounting software secure?

A: Reputable cloud-based software providers employ robust security measures. Make sure you follow strong password practices.

Q: Do I need an accountant if I use accounting software?

A: While software simplifies accounting, an accountant can offer valuable advice and ensure compliance with tax regulations.

Q: What are the benefits of integrating my accounting software with other business tools?

A: Integration streamlines workflows, reduces data entry errors, and provides a more complete view of your business operations.