Top Business Accounting Software

Are you a first-time business owner feeling lost in a sea of spreadsheets? You're not alone. Choosing the right business accounting software can feel overwhelming, but it's a crucial step in managing your finances effectively. This article breaks down the top contenders, cutting through the jargon to help you make an informed decision and steer clear of costly mistakes.

Why Accounting Software Matters (Especially for You)

Imagine trying to build a house without a blueprint. That's what running a business without proper accounting software is like. It provides a clear overview of your financial health, making tax season less stressful and empowering you to make smarter business decisions.

For new business owners, accounting software is more than just a tool; it's a foundation for growth and sustainability. It helps you track income and expenses, manage invoices, and gain valuable insights into your profitability.

Top 5 Business Accounting Software: A Quick Comparison

Here’s a snapshot of the leading players in the market, focusing on features relevant to first-time buyers.

| Software | Starting Price (Monthly) | Key Features | Ease of Use (Rating: 1-5, 5 being easiest) | Customer Support |

|---|---|---|---|---|

| QuickBooks Online | $30 | Invoicing, expense tracking, reporting, payroll integration | 4 | Phone, chat, community forums |

| Xero | $13 | Bank reconciliation, invoicing, inventory management, project tracking | 3.5 | Email, chat, knowledge base |

| FreshBooks | $17 | Invoicing, time tracking, project management, expense tracking | 4.5 | Phone, email |

| Zoho Books | $0 (Free plan available) | Invoicing, expense tracking, banking, inventory management | 4 | Email, knowledge base |

| Sage Business Cloud Accounting | $25 | Invoicing, cash flow management, reporting, VAT returns | 3 | Phone, chat, email |

Detailed Reviews: Diving Deeper

QuickBooks Online: The Industry Standard

QuickBooks Online is a popular choice for a reason. It offers a comprehensive suite of features and integrates well with many other business tools. The interface is generally user-friendly, but the sheer number of options can be overwhelming for beginners.

Its strength lies in its robust reporting capabilities and seamless payroll integration. However, be mindful of potential add-on costs that can quickly inflate the monthly price.

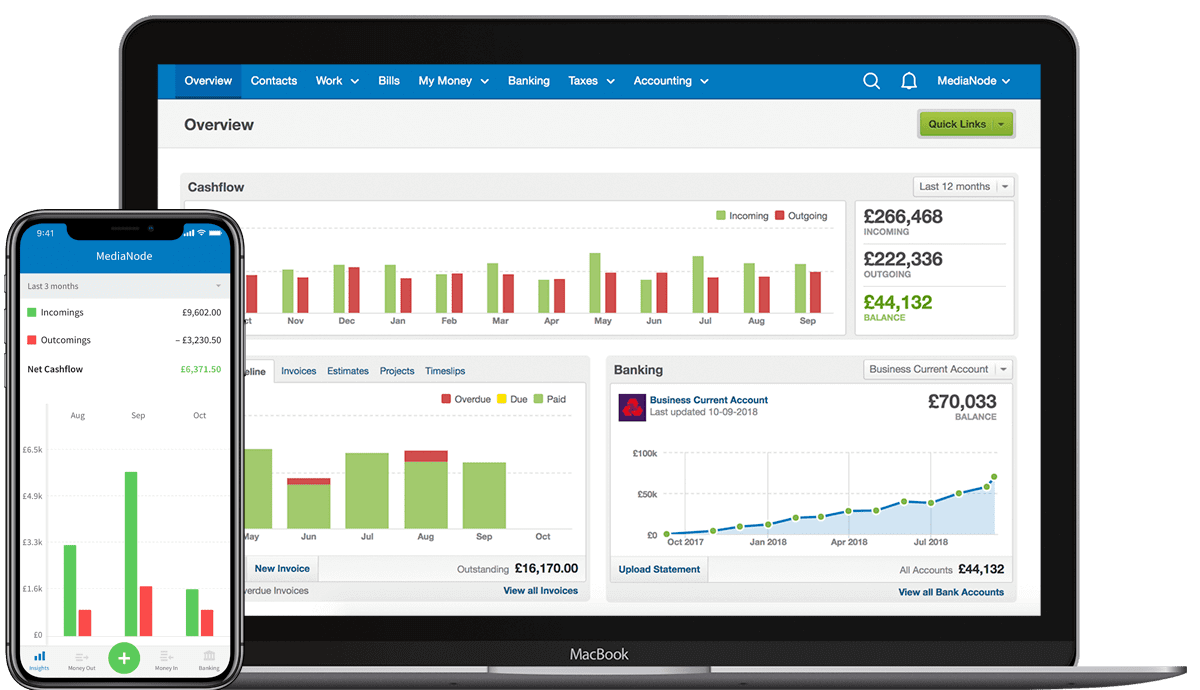

Xero: A Strong Contender

Xero distinguishes itself with its focus on bank reconciliation, making it easier to keep your accounts accurate and up-to-date. Its interface is clean and modern, but some users find it less intuitive than QuickBooks.

It excels in collaboration, allowing multiple users to access and work on the same accounts simultaneously. Its pricing structure might be more appealing to businesses with fluctuating revenue, as it offers different plans based on invoice volume.

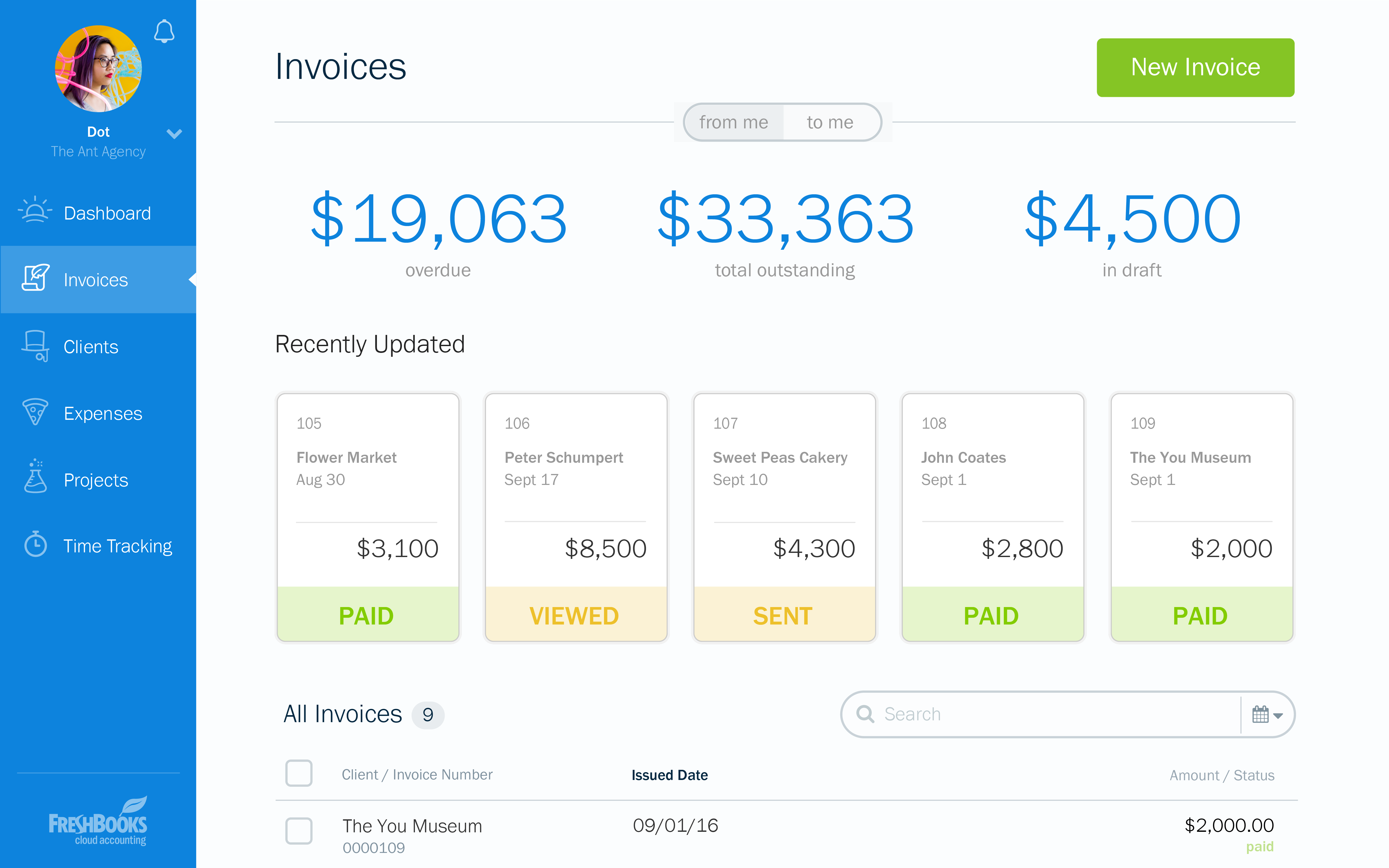

FreshBooks: Designed for Service-Based Businesses

FreshBooks is tailored for freelancers and service-based businesses. It emphasizes invoicing and time tracking, making it ideal for managing projects and client billing. Its user interface is incredibly intuitive, making it a breeze to learn and use.

While it's excellent for invoicing and project management, it might lack some of the more advanced accounting features offered by QuickBooks or Xero. Consider your business model carefully when evaluating FreshBooks.

Zoho Books: The Budget-Friendly Option

Zoho Books offers a compelling value proposition with its free plan and affordable paid options. It's part of the larger Zoho ecosystem, which includes CRM, marketing, and project management tools. It can be integrated with other Zoho products.

While the free plan is limited, it's a great way to get started and test the waters. The paid plans offer a comprehensive set of features at a competitive price. Its biggest advantage is its wide range of free or cheap integrations with other Zoho tools.

Sage Business Cloud Accounting: A Traditional Choice

Sage Business Cloud Accounting is a well-established player in the accounting software market. It offers a solid set of features, including invoicing, cash flow management, and VAT returns.

Its interface is less modern than some of its competitors, and it might have a steeper learning curve for beginners. However, it's a reliable option with a long history of serving businesses of all sizes.

Used vs. New: Is There a Secondhand Market for Accounting Software?

Unlike physical products, there isn't really a "used" market for accounting software. These platforms are typically subscription-based and tied to specific accounts. Always purchase directly from the software provider or an authorized reseller.

Attempting to use a "used" or pirated version could expose you to security risks and legal trouble. It's simply not worth the risk.

Reliability Ratings by Brand

Here's a general overview of the reliability and customer satisfaction ratings for each brand, based on user reviews and industry reports:

- QuickBooks Online: Generally reliable, but some users report occasional performance issues and customer support delays.

- Xero: Known for its stable platform and responsive customer support.

- FreshBooks: Praised for its ease of use and reliable performance.

- Zoho Books: A solid performer, but some users report occasional glitches and limited customer support options.

- Sage Business Cloud Accounting: A reliable option, but its older interface can sometimes feel clunky.

Checklist: 5 Must-Check Features Before Buying

Before you commit to any accounting software, make sure it ticks these boxes:

- Ease of Use: Can you navigate the software without getting lost in a maze of menus?

- Essential Features: Does it cover the basics you need, like invoicing, expense tracking, and reporting?

- Integration: Does it integrate with other tools you use, such as your bank account and payment processor?

- Scalability: Can it grow with your business as your needs evolve?

- Customer Support: Does it offer reliable customer support in case you run into trouble?

Summary: Making the Right Choice

Choosing the right business accounting software is a critical decision for any new business owner. Consider your specific needs, budget, and technical skills when evaluating different options. Don't be afraid to take advantage of free trials to test out different platforms before making a commitment.

Remember to prioritize ease of use, essential features, and reliable customer support. By carefully considering all the factors mentioned in this article, you can make an informed decision and set your business up for financial success.

Each solution has its strengths and weaknesses, and the best choice for you will depend on your specific business needs and priorities.

Ready to Take Control of Your Finances?

Explore the free trials offered by each software provider mentioned above. Take the time to compare features and find the platform that best suits your business. Don't delay, get started today and start building a solid financial foundation for your business!