Top Free Personal Finance Software Unlock Your Financial Potential

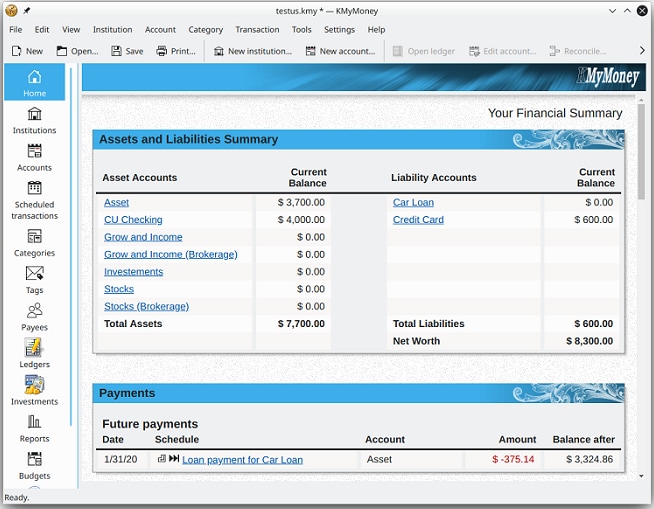

The rise of AI-powered financial tools is reshaping personal finance management in 2025. Free software is no longer just about tracking expenses; it's about proactive financial planning. This shift presents both opportunities and challenges for users and developers alike.

The Democratization of Financial Advice

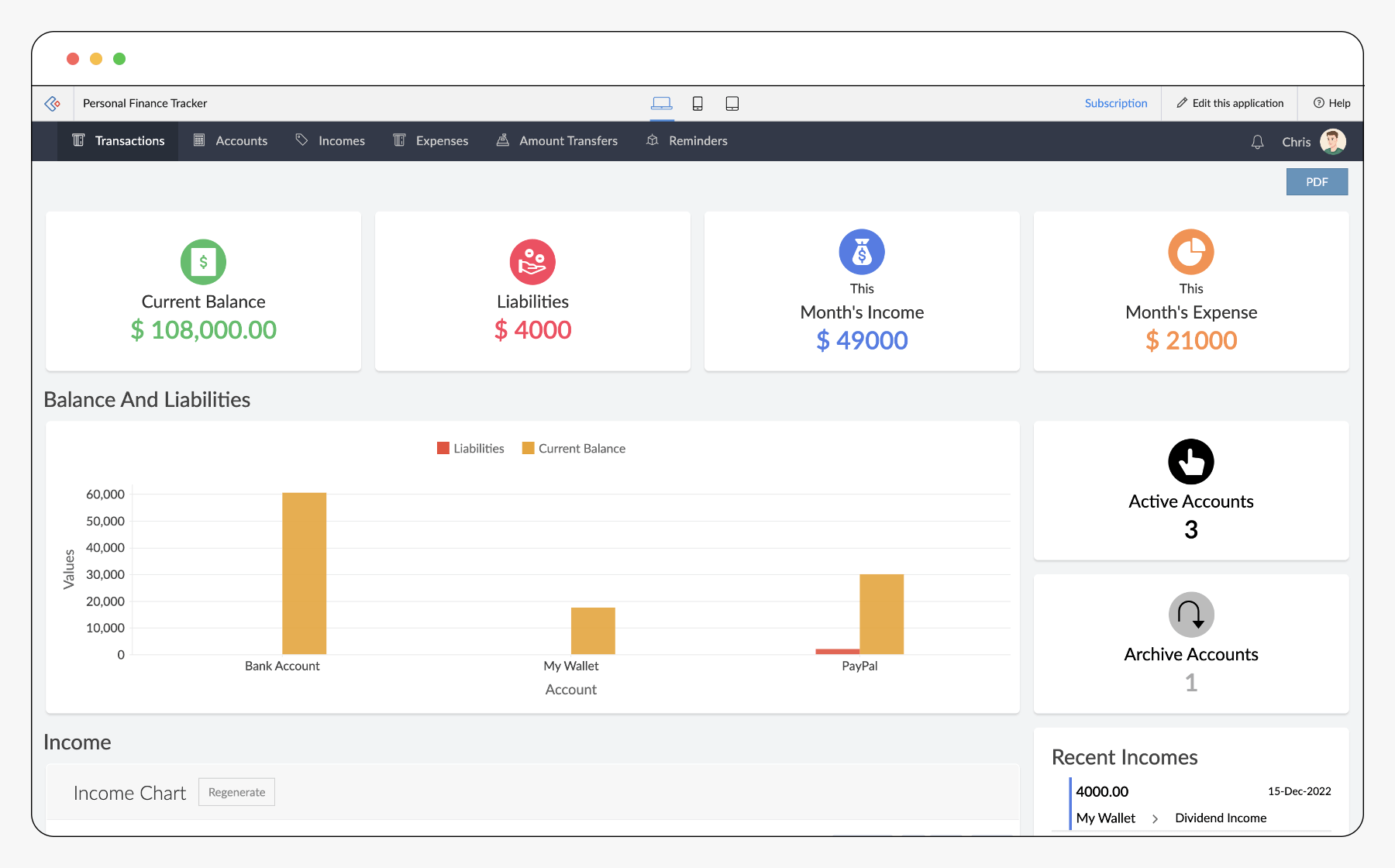

Previously, sophisticated financial advice was primarily available to high-net-worth individuals. Now, free personal finance software is leveling the playing field.

AI algorithms analyze user data to provide personalized insights, such as optimal debt repayment strategies and investment recommendations. This makes financial literacy more accessible.

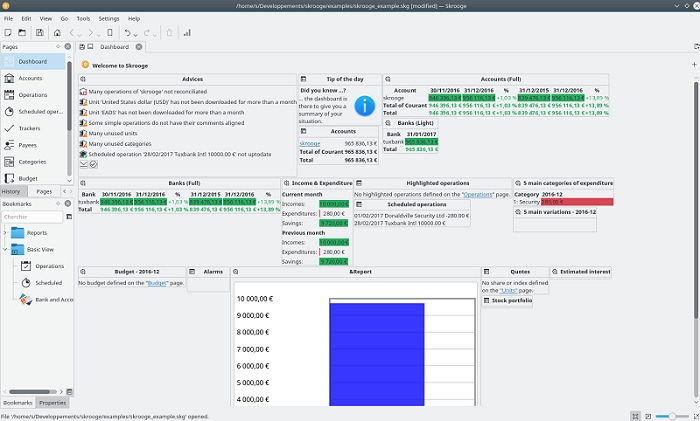

AI-Driven Budgeting and Forecasting

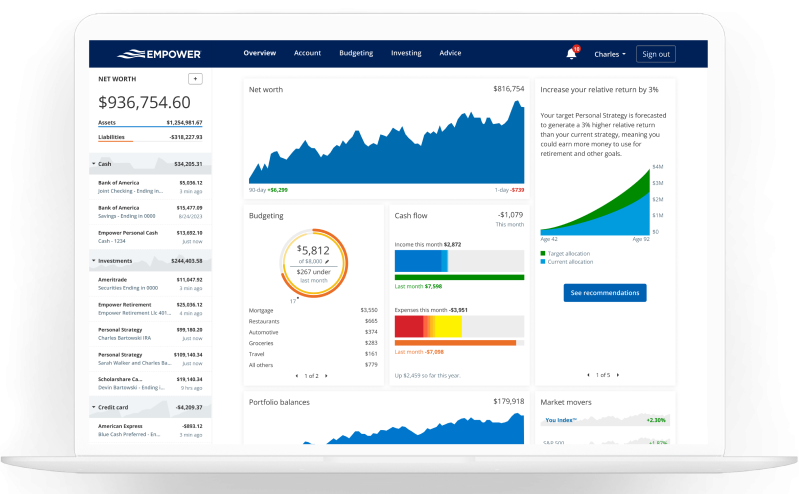

Traditional budgeting relied on manual data entry and backward-looking analysis. AI enhances this by predicting future cash flow based on historical spending patterns and external market data.

Users can now simulate different financial scenarios, like job loss or a major purchase, to assess their impact on their overall financial health. This allows for proactive adjustments and informed decision-making.

Personalized Investment Recommendations

Many free platforms now offer AI-powered investment recommendations tailored to individual risk tolerance and financial goals. These recommendations consider factors like age, income, and investment horizon.

Robo-advisors within these platforms automate investment management, rebalancing portfolios and optimizing asset allocation. This makes investing more accessible for beginners and those who lack the time or expertise for active management.

The Challenge of Data Privacy and Security

The increased reliance on AI in personal finance software raises significant data privacy and security concerns. Users are entrusting these platforms with sensitive financial information.

Data breaches and unauthorized access can have severe consequences, including identity theft and financial loss. Robust security measures and transparent data usage policies are crucial to maintain user trust.

Evolving Regulatory Landscape

Regulators worldwide are grappling with how to govern the use of AI in financial services. The lack of clear guidelines creates uncertainty for both developers and users.

Compliance with data privacy regulations like GDPR and CCPA is essential. Software providers must prioritize data security and transparency to avoid legal and reputational risks.

Combating Algorithmic Bias

AI algorithms can inadvertently perpetuate existing biases if trained on skewed or incomplete data. This can lead to discriminatory financial advice, disproportionately impacting certain demographics.

Developers must actively address algorithmic bias by ensuring data diversity and implementing fairness metrics. Regular audits and transparency in algorithm design are critical.

Opportunities for Innovation and Growth

The demand for free, AI-powered personal finance software presents significant opportunities for innovation and growth. Companies that prioritize user experience, security, and ethical AI practices are poised to thrive.

Integrating with other financial services, such as banking apps and credit card providers, can enhance the user experience. This creates a seamless and comprehensive financial management ecosystem.

Financial Wellness Programs

Businesses are increasingly recognizing the importance of employee financial wellness. Offering access to free personal finance software as a benefit can improve employee morale and productivity.

These programs can also help employees reduce financial stress, improve their savings habits, and plan for retirement. This benefits both the individual and the organization.

Hyper-Personalization through Advanced Analytics

The future of free personal finance software lies in hyper-personalization. By leveraging advanced analytics and machine learning, platforms can deliver tailored insights and recommendations at a granular level.

This includes personalized budgeting tips, investment strategies, and debt management plans. The goal is to empower users to make informed financial decisions that align with their unique circumstances and goals.

Ultimately, the ongoing evolution of free personal finance software is about more than just tracking expenses. It's about empowering individuals to take control of their financial futures. But ethical considerations and data security must remain paramount.