What Type Of Life Insurance Policy Generates Immediate Cash Value

Did you know a life insurance policy can offer more than just a death benefit? Some policies can be powerful tools for building immediate cash value.

Understanding which types of life insurance policies offer immediate cash value is crucial for business owners and managers seeking flexible financial planning options.

Why is Cash Value Life Insurance Important?

Life insurance isn't just about protecting your loved ones after you're gone. It can also provide a source of liquid assets while you're still alive.

This is particularly important for businesses needing quick access to funds for opportunities or unexpected expenses. Cash value life insurance offers a way to potentially grow wealth and have a safety net simultaneously.

It can be used for anything from funding a new project to covering short-term operational costs.

Understanding Cash Value Accumulation

Cash value life insurance policies grow in value over time on a tax-deferred basis. This means you don't pay taxes on the growth until you withdraw the money.

The cash value grows based on the policy's underlying investment performance or guaranteed interest rate, depending on the policy type.

This accumulated cash can then be accessed through policy loans or withdrawals.

Which Policy Types Offer Immediate Cash Value?

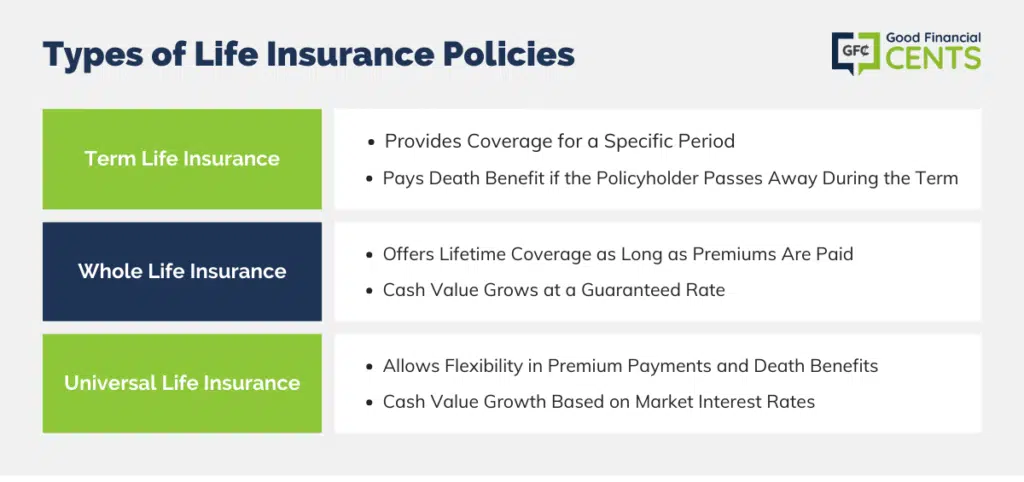

While term life insurance focuses solely on the death benefit and offers no cash value, certain permanent life insurance policies excel at building it.

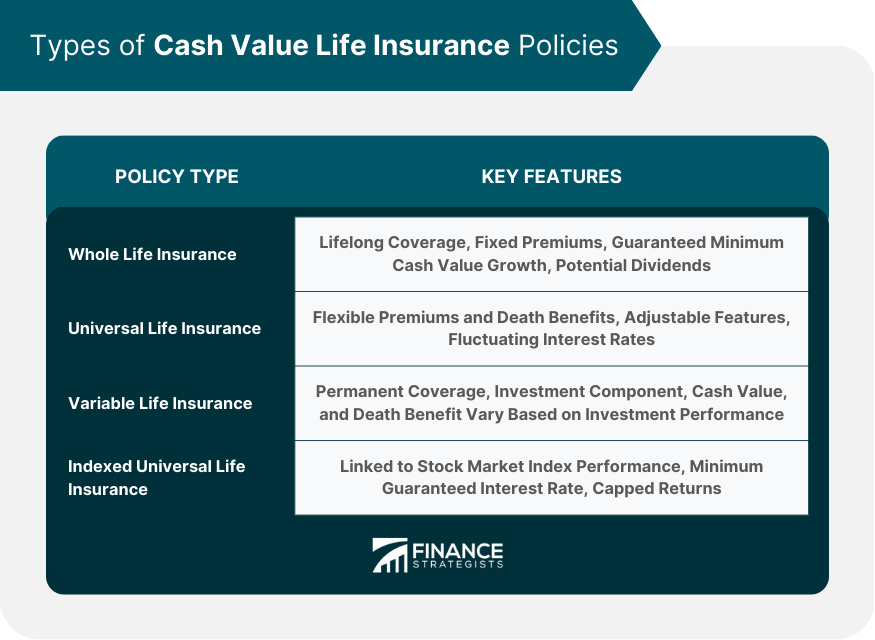

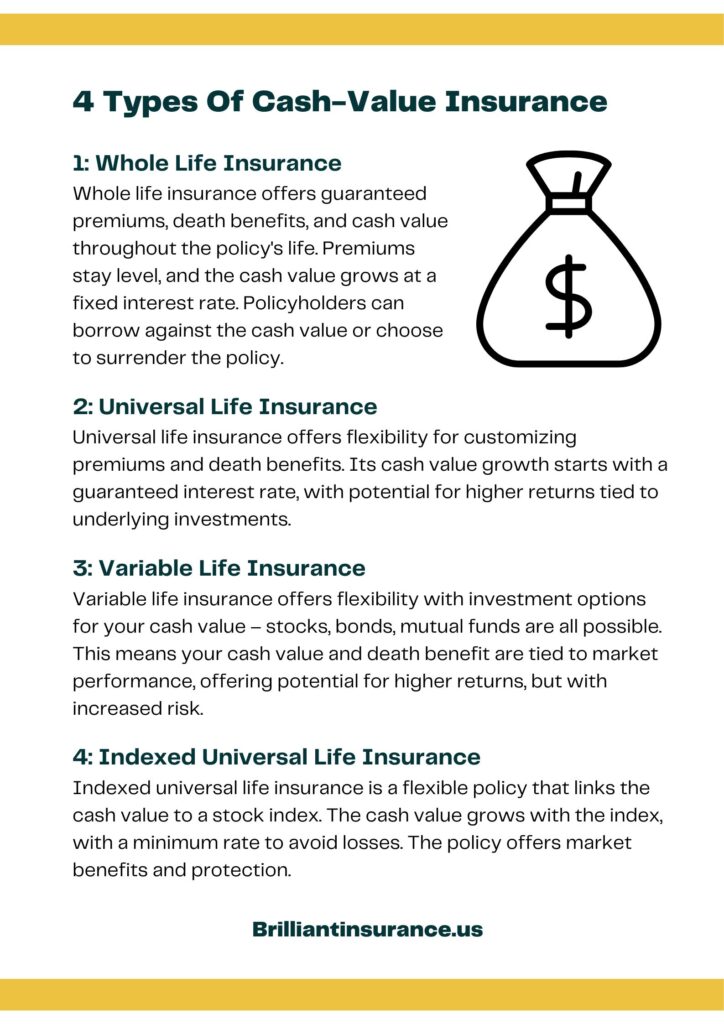

Whole Life Insurance

Whole life insurance provides lifelong coverage with a guaranteed death benefit and a guaranteed rate of return on the cash value.

A portion of each premium payment goes towards building the cash value, which grows at a predetermined rate.

While the growth is steady, the initial cash value accumulation might be slower compared to other options because a larger portion of the initial premiums covers policy expenses.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life insurance.

It allows you to adjust your premium payments and death benefit within certain limits, offering greater control over your policy.

The cash value growth is tied to current interest rates, which can fluctuate, but often offers the potential for faster initial growth than whole life.

Variable Life Insurance

Variable life insurance provides the most investment options, allowing you to allocate your cash value among various sub-accounts, similar to mutual funds.

This can lead to potentially higher returns, but it also comes with higher risk since the cash value is tied to the performance of the chosen investments.

While the potential for high returns exists, it's generally not considered the *best* for generating *immediate* cash value due to market volatility and investment risk.

Indexed Universal Life Insurance (IUL)

Indexed Universal Life (IUL) offers a balance between fixed and variable policies.

The cash value growth is linked to the performance of a specific market index, like the S&P 500, but with a cap on the potential gains and downside protection.

IUL policies can build cash value relatively quickly, offering potential for higher returns than whole life while limiting downside risk.

The Policy Best Suited for Immediate Cash Value

Generally, universal life insurance and indexed universal life insurance policies tend to offer the most potential for immediate cash value growth.

This is because they often have lower fees than whole life policies in the early years and are tied to market performance (with varying levels of risk and protection).

However, it's crucial to compare policies and consider your specific financial goals and risk tolerance. As an example, one might consider a universal life policy with a higher initial premium to quickly build cash value, understanding the associated fees and risks.

Key Considerations

Before purchasing a cash value life insurance policy, carefully consider these points.

Fees and expenses can impact cash value growth. Understand the policy's charges, including administrative fees, surrender charges, and mortality expenses.

Tax implications of withdrawals and loans from the policy should be evaluated. Generally, loans are not taxable as long as the policy remains in force, but withdrawals might be subject to income tax.

Policy loan interest rates should be examined. Rates can vary, impacting the overall cost of borrowing against your cash value.

Consult a Financial Advisor

Choosing the right life insurance policy requires careful consideration and professional advice. A qualified financial advisor can help you assess your needs, compare policies, and select the best option for your specific circumstances.

Don't hesitate to seek personalized guidance to ensure you make an informed decision. Remember, understanding the intricacies of each policy type is paramount to building a secure financial future for your business.

Fact: According to LIMRA, 41% of Americans have no life insurance coverage, potentially missing out on both death benefit protection and cash value accumulation. Source: LIMRA Facts About Life 2023.