Which Of These Factors Would An Insurer Consider When Determining

Insurers face a complex balancing act when determining premiums and coverage. Several key factors come into play, each weighted based on statistical analysis and risk modeling.

Understanding these factors is crucial not only for insurers but also for businesses seeking optimal insurance solutions.

The Evolving Landscape of Risk Assessment

The insurance industry is undergoing a significant transformation. The rise of data analytics and AI is reshaping how insurers assess risk.

This presents both opportunities and challenges. Traditional methods are being augmented by sophisticated algorithms.

However, ensuring fairness and transparency in these models is paramount.

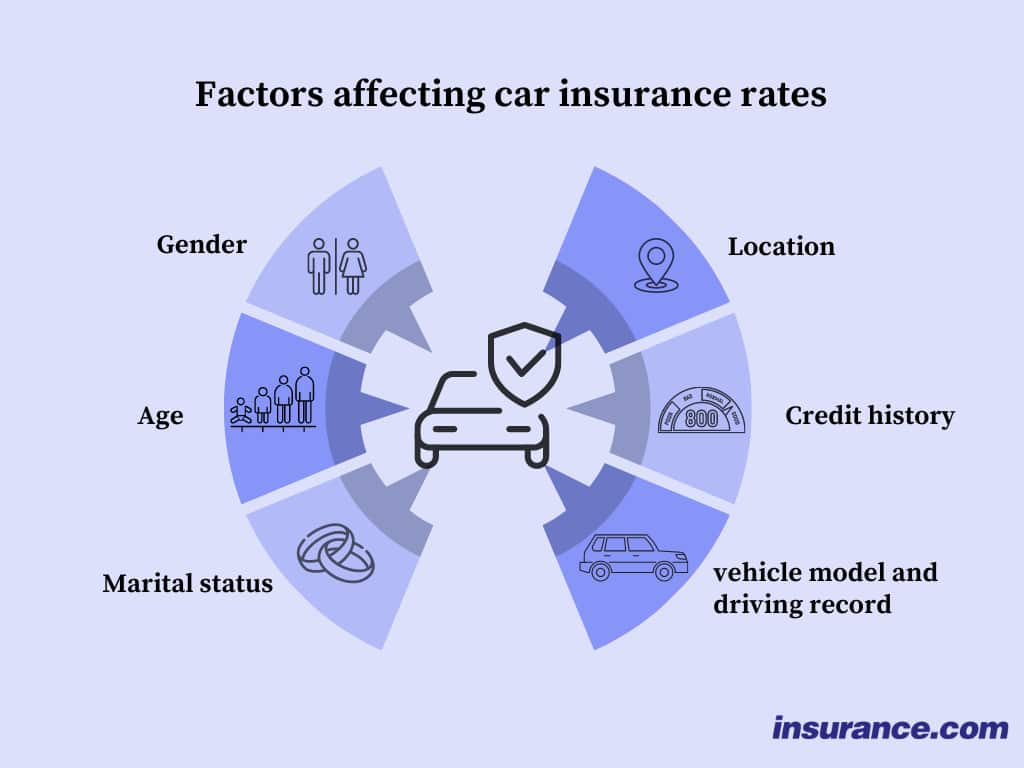

Financial Stability and Creditworthiness

A company's financial health is a primary indicator of its ability to manage risk and pay premiums. Insurers carefully scrutinize financial statements and credit ratings.

A strong financial profile translates to lower premiums. Weaknesses in financial performance can raise red flags.

Insurers may require higher premiums or collateral in such cases.

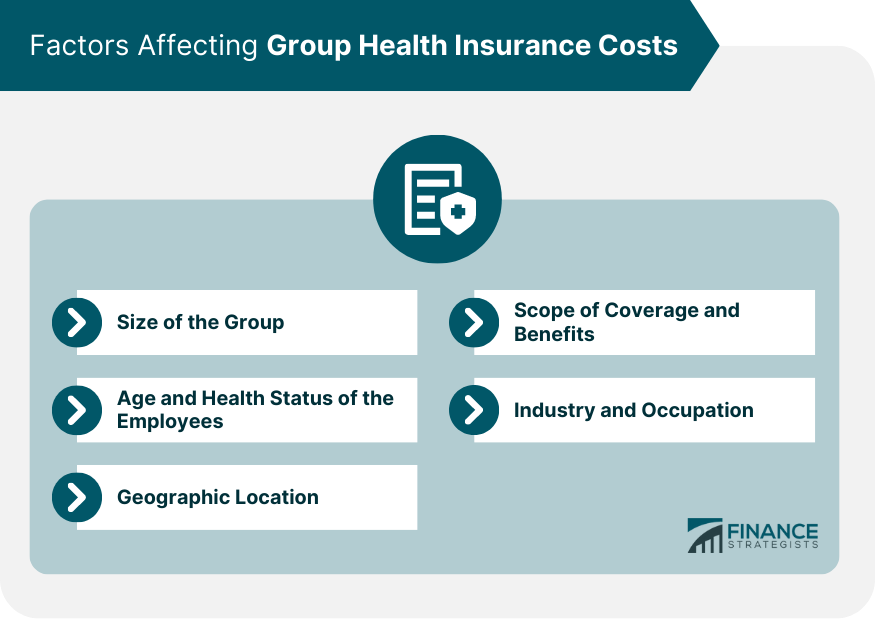

Industry and Operational Risk

The nature of a business and its operations significantly influences insurance costs. High-risk industries, such as construction or manufacturing, typically face higher premiums.

Specific operational risks, like hazardous materials or complex machinery, also impact the assessment.

Risk mitigation strategies implemented by the business can offset these higher risks.

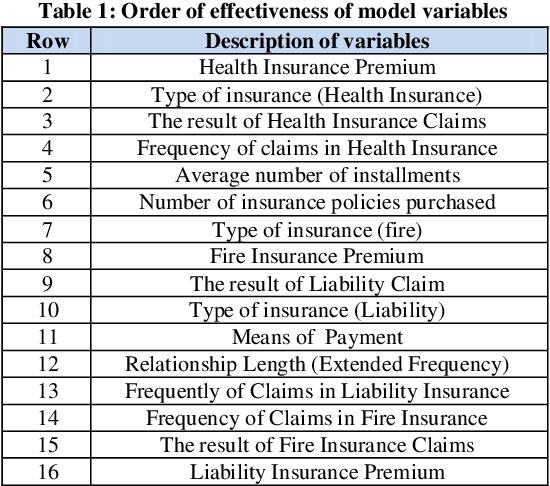

Claims History and Loss Prevention Measures

A company's past claims history is a strong predictor of future claims. Frequency and severity of past losses directly impact premium calculations.

However, insurers also consider proactive loss prevention measures. Investments in safety protocols and risk management can lead to premium discounts.

This highlights the importance of a robust risk management framework.

Geographic Location and Environmental Factors

The geographic location of a business exposes it to specific environmental risks. Businesses in areas prone to natural disasters face higher premiums for property and casualty insurance.

Climate change is further amplifying these risks. Insurers are increasingly incorporating climate-related factors into their underwriting models.

This includes evaluating risks from flooding, wildfires, and extreme weather events.

Regulatory Compliance and Legal Environment

Compliance with relevant regulations is essential for minimizing legal and operational risks. Insurers assess a company's adherence to industry-specific standards and environmental regulations.

Breaches of regulations can result in increased premiums or policy cancellation. A strong compliance program demonstrates a commitment to risk management.

This proactive approach can positively influence insurance rates.

Management Expertise and Governance

The quality of a company's management team and its governance structure play a crucial role. Insurers evaluate the experience and track record of key executives.

Strong leadership and sound corporate governance indicate a commitment to responsible risk management. Lack of transparency or ethical concerns can raise concerns and increase premiums.

Insurers seek assurance that the business is well-managed and accountable.

The Data-Driven Future of Insurance Underwriting

Artificial intelligence and machine learning are revolutionizing insurance underwriting. These technologies enable insurers to analyze vast amounts of data and identify subtle patterns.

Predictive analytics can help assess risk more accurately. This leads to more personalized and targeted insurance products.

However, ethical considerations are paramount when using AI in risk assessment.

Navigating the Insurance Landscape: A Strategic Approach

Businesses must adopt a proactive and strategic approach to insurance. Regularly reviewing coverage and risk management practices is essential.

Working closely with insurance brokers and risk consultants can help identify gaps in coverage and opportunities for improvement. Building a strong relationship with your insurer is crucial.

Transparency and open communication are key to securing the best possible terms.

Ultimately, understanding the factors that influence insurance decisions is crucial for effective risk management and long-term business success.

:max_bytes(150000):strip_icc()/7-factors-affect-your-life-insurance-quote.asp_V2-ba373e2794d94d97abd3e15cc60bed4e.png)