1 For 30 Reverse Stock Split

The abrupt announcement of a 1-for-30 reverse stock split by [Hypothetical Company Name - HCN], a publicly traded entity in the [Industry Sector] sector, has sent ripples of concern and speculation through the investment community. Trading was temporarily halted on [Date] as the market digested the implications of this drastic measure. The move, effective [Effective Date], aims to artificially inflate the company’s share price, but analysts are divided on whether it represents a genuine attempt to bolster investor confidence or a desperate maneuver to avoid delisting.

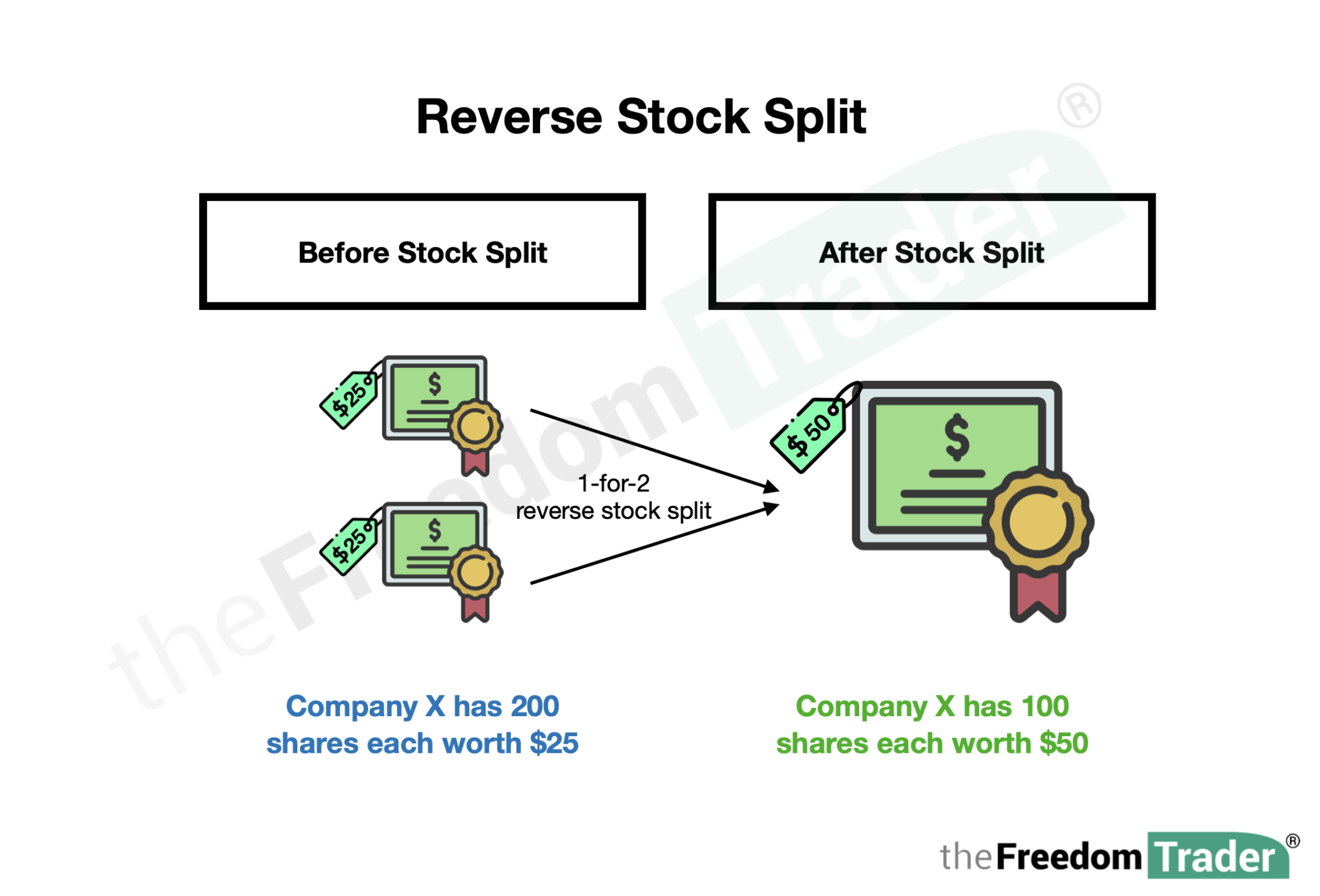

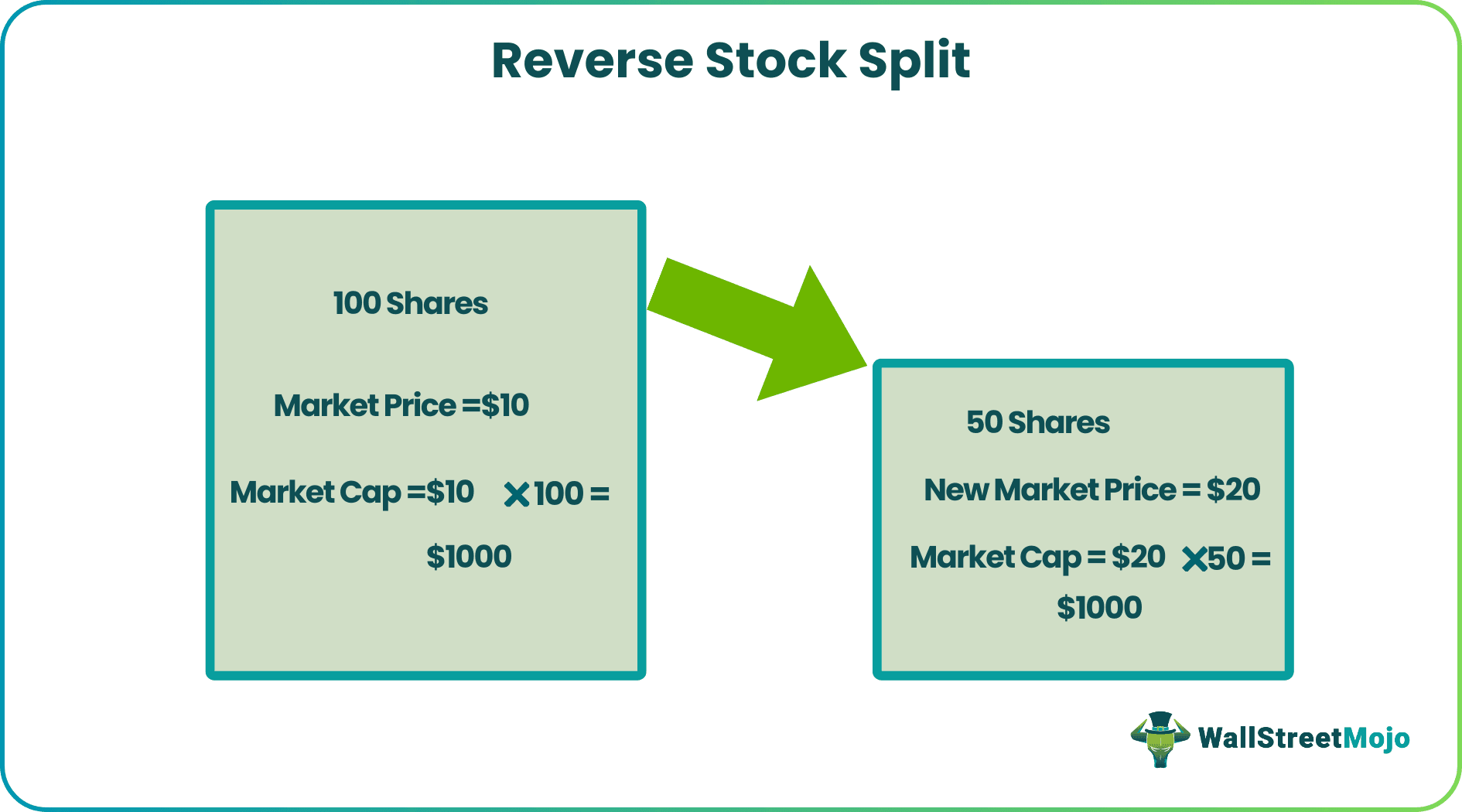

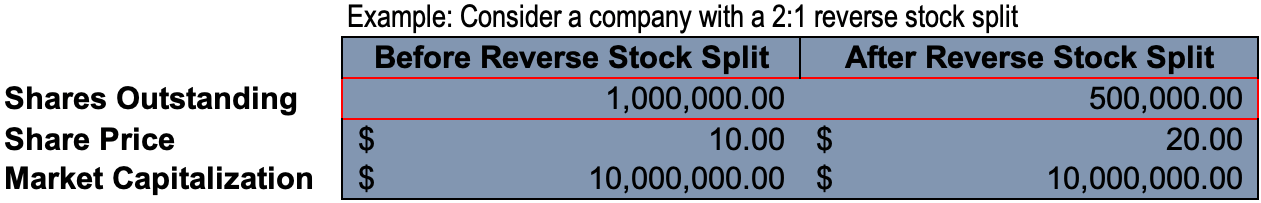

At its core, this reverse stock split reduces the number of outstanding shares by a factor of 30, meaning every 30 shares an investor held will now be consolidated into a single share. While the immediate impact is a higher share price, the underlying value of an investor's holdings remains unchanged. This maneuver by HCN begs the question: what strategic rationale underpins this decision, and what are the potential ramifications for both short-term and long-term investors? Understanding the motivations and potential consequences is crucial for investors navigating this turbulent period.

Impact on Shareholders

The immediate consequence for shareholders is a reduction in the number of shares owned. An investor who previously held 3,000 shares of HCN will now possess only 100 shares. It's important to underscore that, theoretically, the value of the holding should remain consistent; if the shares were trading at $0.50 before the split, the post-split price should be approximately $15.00.

However, this is where the theoretical ideal often diverges from the practical reality. Reverse stock splits are frequently viewed negatively by the market. They can trigger a sell-off as investors, particularly retail investors, become disillusioned or fear further decline.

Potential for Increased Volatility

Reverse stock splits often introduce heightened volatility. The perceived artificial inflation of the share price can attract short-sellers who believe the company's fundamentals do not justify the higher valuation. This can create a self-fulfilling prophecy of decline, as short-selling pressure drives the price down, further eroding investor confidence.

Furthermore, the smaller float (number of shares available for trading) post-split can exacerbate price swings. Even relatively small trading volumes can cause significant percentage changes in the share price, making it a more risky investment for some.

Motivations Behind the Reverse Split

Companies typically enact reverse stock splits for a few key reasons. One primary driver is to meet minimum listing requirements of major stock exchanges like the NYSE or Nasdaq. These exchanges generally require companies to maintain a minimum share price, often $1.00, to remain listed.

Failure to meet this threshold can lead to delisting, which significantly reduces a company's access to capital and often triggers a further decline in share price. Therefore, a reverse split can be seen as a preemptive measure to avoid this outcome.

Another potential motivation is to improve the company's image and appeal to a broader range of investors. Some institutional investors are restricted from purchasing shares of companies trading below a certain price. By artificially inflating the share price, HCN may hope to attract these larger investors.

Industry Expert Analysis

“Reverse stock splits are a double-edged sword,” explains Dr. Anya Sharma, a financial analyst at [Hypothetical Financial Institution]. “While they can temporarily boost a company’s share price and avoid delisting, they often signal underlying financial distress.” Sharma emphasizes that the long-term success of the strategy depends on the company's ability to improve its fundamental performance.

Another perspective comes from Mr. Ben Carter, a portfolio manager at [Hypothetical Investment Firm]. “We generally view reverse stock splits with caution. They rarely solve the underlying problems that led to the low share price in the first place.” Carter stresses the importance of due diligence and a thorough understanding of the company's financial health before investing after a reverse split.

HCN's Official Statement

In a press release, HCN stated that the reverse stock split is "intended to increase the per-share market price of its common stock and improve the marketability and liquidity of its common stock." The company's CEO, [Hypothetical CEO Name], added that they believe the higher share price will "broaden our appeal to institutional investors" and "provide greater flexibility in financing future growth opportunities."

However, the statement lacks concrete details on how HCN plans to improve its underlying business operations and generate sustainable growth. This omission has fueled skepticism among some analysts.

Potential Risks and Rewards

The potential rewards for investors are limited. While a higher share price *might* attract some institutional investors and improve market perception, these benefits are contingent on HCN's ability to deliver improved financial results.

The risks, however, are more pronounced. The potential for increased volatility, negative market sentiment, and the risk of further decline if the company fails to improve its fundamentals are all significant concerns.

Looking Ahead

The success of HCN's reverse stock split hinges on its ability to execute a clear and effective turnaround strategy. The company must demonstrate concrete improvements in its financial performance, product development, or market share to justify the higher share price.

Investors should closely monitor HCN's upcoming earnings reports, strategic announcements, and industry trends. A thorough understanding of the company's underlying fundamentals is crucial for making informed investment decisions.

Ultimately, the 1-for-30 reverse stock split is a high-stakes gamble. Whether it proves to be a successful lifeline or a temporary reprieve remains to be seen. Investors must tread carefully and assess the risks before committing capital to HCN.

:max_bytes(150000):strip_icc()/Term-r-reverse-stock-split-Final-d87a97b081a64a98aa6c2064cfac6e68.jpg)