1 For 40 Reverse Stock Split

Shares of [Company Name], a [Company Industry] firm based in [Company Location], will soon trade on a split-adjusted basis following shareholder approval of a 1-for-40 reverse stock split. The decision, effective at the market open on [Date], aims to boost the company's share price and maintain its listing on the [Stock Exchange Name]. This strategic move comes as [Company Name] navigates a challenging market environment.

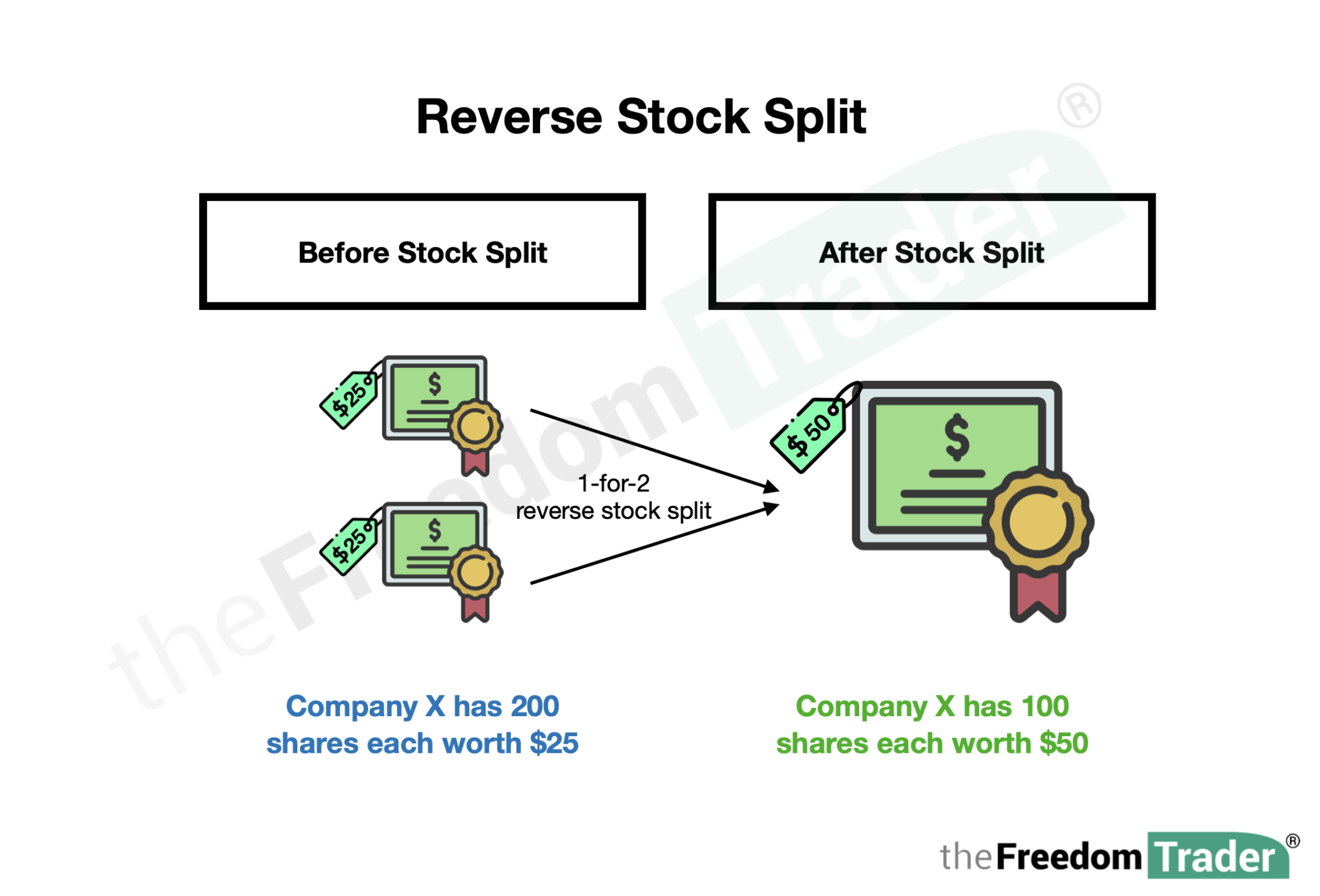

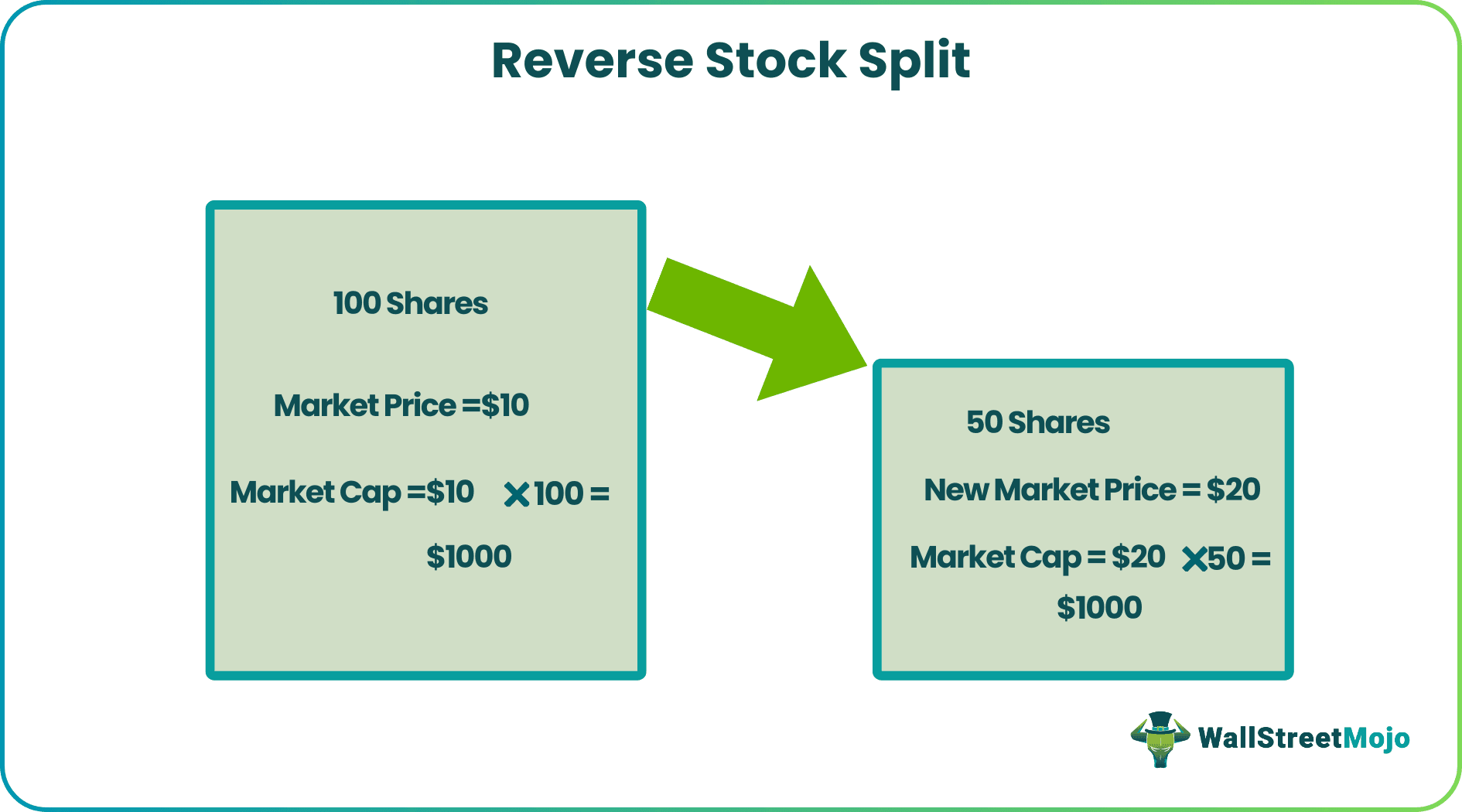

The reverse stock split consolidates every 40 existing shares of [Company Name] into one new share. This action proportionately reduces the number of outstanding shares while theoretically increasing the price of each remaining share by a factor of 40. The goal is to bring the share price into compliance with the minimum listing requirements of the [Stock Exchange Name], which requires a share price above $[Minimum Price].

Understanding the Reverse Stock Split

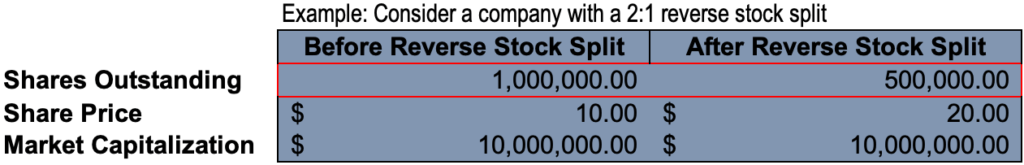

A reverse stock split is a corporate action that reduces the number of outstanding shares of a company. It is different from a regular stock split, where the number of shares increases and the price decreases proportionately. Reverse splits are often used by companies whose stock price has fallen significantly.

In the case of [Company Name], the reverse split will reduce the outstanding shares from approximately [Number] to roughly [Number divided by 40]. The new shares will trade under the same ticker symbol, [Stock Ticker Symbol], but will be accompanied by a notification to inform investors of the reverse split.

Fractional shares resulting from the reverse split will be handled by [Company Name]'s transfer agent, [Transfer Agent Name]. Shareholders entitled to fractional shares will receive cash payments in lieu of those shares, based on the closing price of [Stock Ticker Symbol] on [Date].

Rationale Behind the Decision

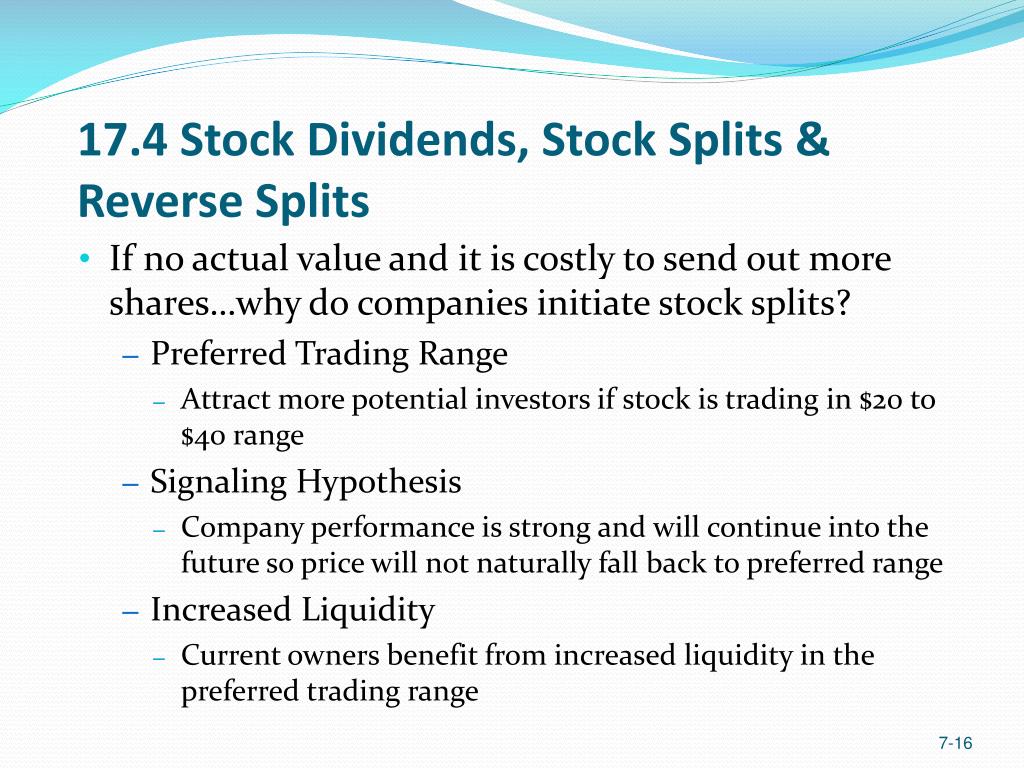

The primary reason for implementing the reverse stock split is to maintain compliance with the listing requirements of the [Stock Exchange Name]. Failure to meet these requirements could lead to delisting, which would negatively impact the company's stock and investor confidence. Maintaining the listing is critical for [Company Name] to attract institutional investors and access capital markets.

[Quote from Company CEO or CFO regarding the rationale behind the reverse split, preferably focusing on maintaining listing compliance and long-term value creation]. The quote must be from a credible source.

Beyond compliance, [Company Name] hopes the higher share price will improve the stock's perceived value and attract a broader range of investors. Many institutional investors have policies that prevent them from investing in stocks trading below a certain price threshold.

Potential Impact on Shareholders

The immediate impact of the reverse stock split will be a higher share price. However, the total value of an investor's holdings should remain roughly the same immediately after the split. It's important to remember that a reverse split doesn't fundamentally change the company's financial health or business prospects.

Some analysts express concern that reverse stock splits can signal underlying problems within a company. While the higher share price may provide a temporary boost, the company's long-term success depends on its ability to improve its financial performance. [Include a quote from an analyst about the potential risks or benefits of the reverse split].

For individual investors, it is important to consult with a financial advisor to understand the implications of the reverse stock split for their specific investment portfolio. They should also carefully monitor the company's performance in the coming quarters to assess its long-term prospects.

A Human Angle

[Optional paragraph with a brief anecdote or quote from a small shareholder, expressing their concerns or hopes about the reverse split. This would need to be ethically sourced and permission obtained.] The inclusion of a small shareholder's perspective could add a relatable element to the story.

Looking Ahead

The success of the reverse stock split ultimately depends on [Company Name]'s ability to execute its business strategy and improve its financial performance. While the higher share price may provide a temporary reprieve, the company must demonstrate its long-term value to investors.

[Company Name]'s future hinges on [mention key company initiatives or products]. The coming quarters will be crucial in determining whether the reverse stock split achieves its intended goals.

Investors will be closely watching [Company Name]'s financial results and strategic decisions to assess the long-term impact of the reverse stock split. The company is scheduled to report its next quarterly earnings on [Date], which will provide further insight into its performance and future outlook.

:max_bytes(150000):strip_icc()/Term-r-reverse-stock-split-Final-d87a97b081a64a98aa6c2064cfac6e68.jpg)