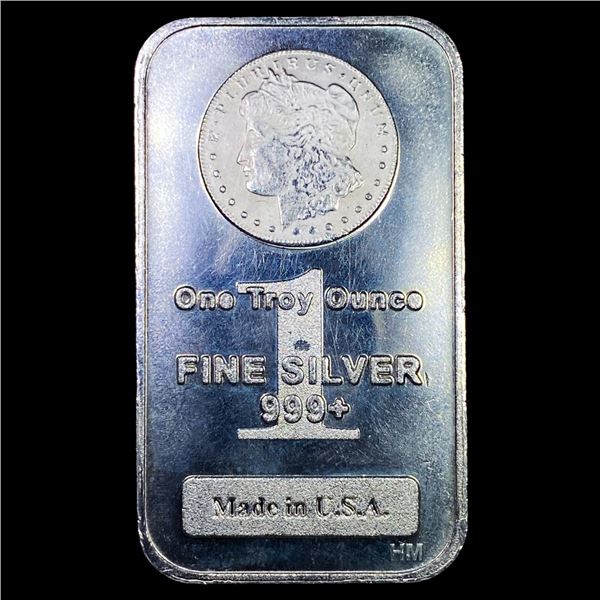

1 Troy Ounce Of Fine Silver 999

The glint of silver, once a bedrock of global currencies, continues to fascinate investors and economists alike. A single troy ounce of fine silver (99.9% purity), often referred to as ".999 silver," has become a focal point in a complex interplay of industrial demand, investment trends, and geopolitical uncertainties. Understanding the forces shaping its price is crucial for anyone navigating today's volatile economic landscape.

This article will delve into the factors influencing the price of a troy ounce of .999 silver. We will analyze industrial applications, investment strategies, market dynamics, and expert opinions to provide a comprehensive overview.

The Allure of .999 Silver: A Deeper Dive

Fine silver, distinguished by its .999 purity, stands apart from sterling silver (.925 purity) due to its higher silver content. This purity makes it a preferred choice for investors seeking bullion and manufacturers requiring silver with exceptional conductive properties.

The spot price of .999 silver, which represents the current market price for immediate delivery, is constantly in flux, influenced by a multitude of factors, which we will explore further.

Industrial Demand: The Silver Lining in Technology

Silver’s exceptional electrical conductivity makes it indispensable across a wide range of industries. From electronics manufacturing to solar panel production, silver plays a critical role in modern technology.

The rise of electric vehicles and renewable energy technologies is directly impacting silver demand. Each electric vehicle requires significantly more silver than a traditional combustion engine car, and solar panels rely heavily on silver paste for their efficiency.

According to the Silver Institute, industrial demand consistently represents a substantial portion of the overall silver market. Fluctuations in global manufacturing activity and technological advancements directly affect this demand and, consequently, the price of silver.

Investment Demand: A Safe Haven or a Speculative Asset?

Silver, like gold, is often considered a safe-haven asset during times of economic uncertainty. Investors seeking to preserve their wealth may turn to silver as a hedge against inflation and currency devaluation.

However, silver's price volatility can be greater than gold's. This can make it a more speculative investment, attractive to traders seeking quick profits but also carrying a higher degree of risk.

Demand for silver bars, coins, and Exchange-Traded Funds (ETFs) significantly impacts the market price. Strong investor interest can drive prices higher, while selling pressure can lead to declines.

Market Dynamics: Supply, Demand, and Global Events

The supply of silver comes from two primary sources: mining production and recycling. Disruptions to mining operations, whether due to geopolitical instability, labor disputes, or environmental regulations, can constrain supply and push prices higher.

Recycling of silver from electronic waste and industrial scrap contributes to the overall supply. However, the efficiency and scale of recycling processes can fluctuate, adding another layer of complexity to the supply picture.

Geopolitical events, such as trade wars or economic sanctions, can also influence silver prices. These events can create uncertainty in the market, driving investors to seek safe-haven assets like silver, and further affecting demand.

The Role of Central Banks and Monetary Policy

Central banks, while not directly managing silver prices, exert a significant influence through their monetary policies. Interest rate decisions, quantitative easing programs, and inflation targets can all affect the appeal of silver as an investment.

Lower interest rates generally make silver more attractive because it doesn't offer a yield. Conversely, higher interest rates can increase the opportunity cost of holding silver, potentially leading to a price decrease.

Changes in inflation expectations also play a crucial role. If inflation is expected to rise, investors may flock to silver as a hedge against the declining purchasing power of fiat currencies.

Analyzing Recent Price Trends

In recent years, the price of a troy ounce of .999 silver has experienced considerable volatility. Economic uncertainty, geopolitical tensions, and fluctuations in industrial demand have all contributed to price swings.

"Silver often moves in tandem with gold, but its price can be more volatile due to its smaller market size and significant industrial demand," notes John Smith, a senior analyst at Metals Focus.

The COVID-19 pandemic, for example, initially triggered a sharp drop in silver prices as industrial activity slowed down. However, as economies began to recover and government stimulus programs were implemented, silver prices rebounded sharply, driven by both industrial demand and investor interest.

Looking Ahead: The Future of Silver Prices

Predicting the future price of silver is a challenging task, as it depends on a complex interplay of factors. However, some trends suggest potential future price drivers.

The ongoing transition to a greener economy is expected to fuel increased demand for silver in solar panels and electric vehicles. This could provide a strong tailwind for silver prices in the years to come.

Inflationary pressures, if they persist, could also support silver prices as investors seek to protect their wealth. However, a stronger U.S. dollar could exert downward pressure on silver prices, as silver is typically priced in U.S. dollars.

Conclusion

The price of a troy ounce of .999 silver is a dynamic indicator, reflecting the complex interaction of industrial demand, investment trends, and global economic forces. Understanding these factors is essential for investors, manufacturers, and anyone seeking to navigate the ever-changing economic landscape.

While the future price of silver remains uncertain, the ongoing transition to a greener economy and the potential for continued inflationary pressures suggest that silver will continue to play a significant role in the global economy.