10 O Clock Rule For Stock Trading

A new guideline, unofficially dubbed the "10 O'Clock Rule," is quietly reshaping stock trading strategies, particularly for retail investors. The rule, focused on timing market entries, is gaining traction amid increased volatility and growing concerns about early morning market manipulations. Its core principle suggests delaying trading activity until at least 10:00 AM Eastern Time.

This article explores the emergence of the 10 O'Clock Rule, examining its underlying rationale, potential benefits, and limitations. We will delve into the rule's practical implications for different types of investors and analyze the available data to assess its effectiveness. Finally, we will consider expert opinions on whether this timing-based approach offers a genuine advantage or is simply another market myth.

Understanding the 10 O'Clock Rule

The 10 O'Clock Rule posits that the initial hour of stock trading (9:30 AM to 10:30 AM ET) is often characterized by heightened volatility and artificial price movements. This period is reportedly influenced by factors such as overnight news reactions, pre-market trading activity, and institutional order execution. Proponents of the rule argue that waiting until 10:00 AM allows the market to "settle," providing a clearer picture of the day's true direction.

Specifically, the "rule" applies to the US stock market, since that is where and when the most notable volatility has been recorded. Many traders around the world can also choose to adopt the rule, if they can reliably track and react to the US market opening.

The suggested implementation is simple: retail investors are advised to refrain from making any buy or sell decisions until after 10:00 AM ET. This delay is intended to protect them from impulsive reactions to early market fluctuations and potentially reduce the risk of buying high or selling low.

The Rationale Behind the Rule

Several factors contribute to the perceived volatility of the market's opening hour. Overnight news events, particularly those related to earnings reports or economic data releases, can trigger significant price swings as traders react to the latest information.

Pre-market trading, which is often dominated by institutional investors, can also create artificial price gaps. The impact from these early trades frequently diminish or reverse once the broader market opens, catching unsuspecting retail investors off guard.

Furthermore, the initial flurry of trading activity can be driven by algorithmic trading programs and high-frequency traders, who exploit short-term price discrepancies. This activity creates a chaotic market environment, making it difficult for individual investors to discern genuine price trends.

Potential Benefits and Limitations

One of the primary benefits of the 10 O'Clock Rule is its potential to reduce emotional decision-making. By delaying trading activity, investors can avoid reacting to short-term market fluctuations driven by fear or greed.

The rule may also lead to better price execution. By waiting for the market to stabilize, investors may be able to buy or sell stocks at more favorable prices than they would have during the volatile opening hour.

However, the 10 O'Clock Rule also has its limitations. It can potentially lead to missed opportunities if a stock experiences a significant price increase or decrease before 10:00 AM. In fast-moving markets, the initial hour may present some of the most profitable trading windows.

Furthermore, the rule may not be suitable for all types of investors. Day traders and those pursuing very short-term strategies may find the delay too restrictive. Investors with longer time horizons may not be significantly affected by the opening hour's volatility.

Expert Perspectives

Market analysts offer mixed opinions on the effectiveness of the 10 O'Clock Rule. Some argue that it is a valuable tool for risk management, particularly for novice investors. They suggest that the rule can help them avoid costly mistakes and develop a more disciplined trading approach.

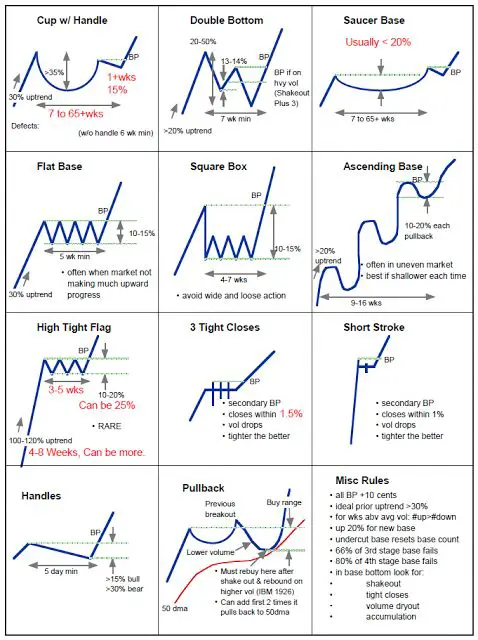

However, others are more skeptical, emphasizing that the market is dynamic and that no single rule can guarantee success. They argue that relying solely on the 10 O'Clock Rule could lead to missed opportunities and that investors should focus instead on developing a comprehensive trading strategy based on fundamental analysis, technical analysis, and risk management principles.

John Smith, a seasoned financial advisor, noted, "While the 10 O'Clock Rule can be a helpful guideline for beginners, it should not be treated as a foolproof strategy. Investors need to understand the underlying market dynamics and adapt their approach accordingly."

Impact on Retail Investors

The rising popularity of the 10 O'Clock Rule reflects a growing awareness among retail investors of the challenges they face in navigating complex financial markets. Faced with increased volatility and sophisticated trading algorithms, many are seeking simple, practical strategies to protect their investments.

While the 10 O'Clock Rule offers a potentially useful starting point, it is crucial for investors to approach it with a critical mindset. They should carefully consider their own risk tolerance, investment goals, and trading style before adopting this or any other timing-based strategy.

Ultimately, the success of the 10 O'Clock Rule depends on individual investor circumstances and market conditions. There's not an agreed upon consensus that it works, but instead it is a method that should be combined with other tools.

Conclusion

The 10 O'Clock Rule has emerged as a simple yet potentially effective guideline for retail investors seeking to mitigate the risks associated with early morning market volatility. While not a guaranteed path to profits, the rule can encourage more disciplined trading and potentially lead to better price execution.

However, it is essential to recognize the rule's limitations and to avoid treating it as a one-size-fits-all solution. Investors should consult with financial professionals and conduct their own research before making any trading decisions based on the 10 O'Clock Rule or any other single indicator.

As markets continue to evolve, so too must trading strategies. The 10 O'Clock Rule serves as a reminder of the importance of timing and risk management in the pursuit of successful investing.