1000 Dollar Loan No Credit Check

The promise of quick cash without credit checks is alluring, especially when faced with unexpected expenses. A $1,000 loan with no credit check sounds like a lifesaver, but beneath the surface lie potential pitfalls that borrowers must understand. These loans, often marketed to individuals with poor or limited credit history, come with high costs and risks.

This article delves into the world of $1,000 no-credit-check loans, examining their mechanics, associated dangers, and available alternatives. We'll analyze the typical terms and conditions, scrutinize the lenders offering these products, and explore the financial consequences for borrowers. The goal is to provide a comprehensive overview so readers can make informed decisions about their financial well-being.

Understanding No-Credit-Check Loans

No-credit-check loans, as the name suggests, don't rely on traditional credit reports from agencies like Experian, Equifax, and TransUnion. Lenders offering these loans often focus on other factors to assess a borrower's ability to repay.

These factors may include income verification, bank statements, and employment history. While this can be helpful for those with limited credit, it often translates into higher interest rates and fees.

Who Offers These Loans?

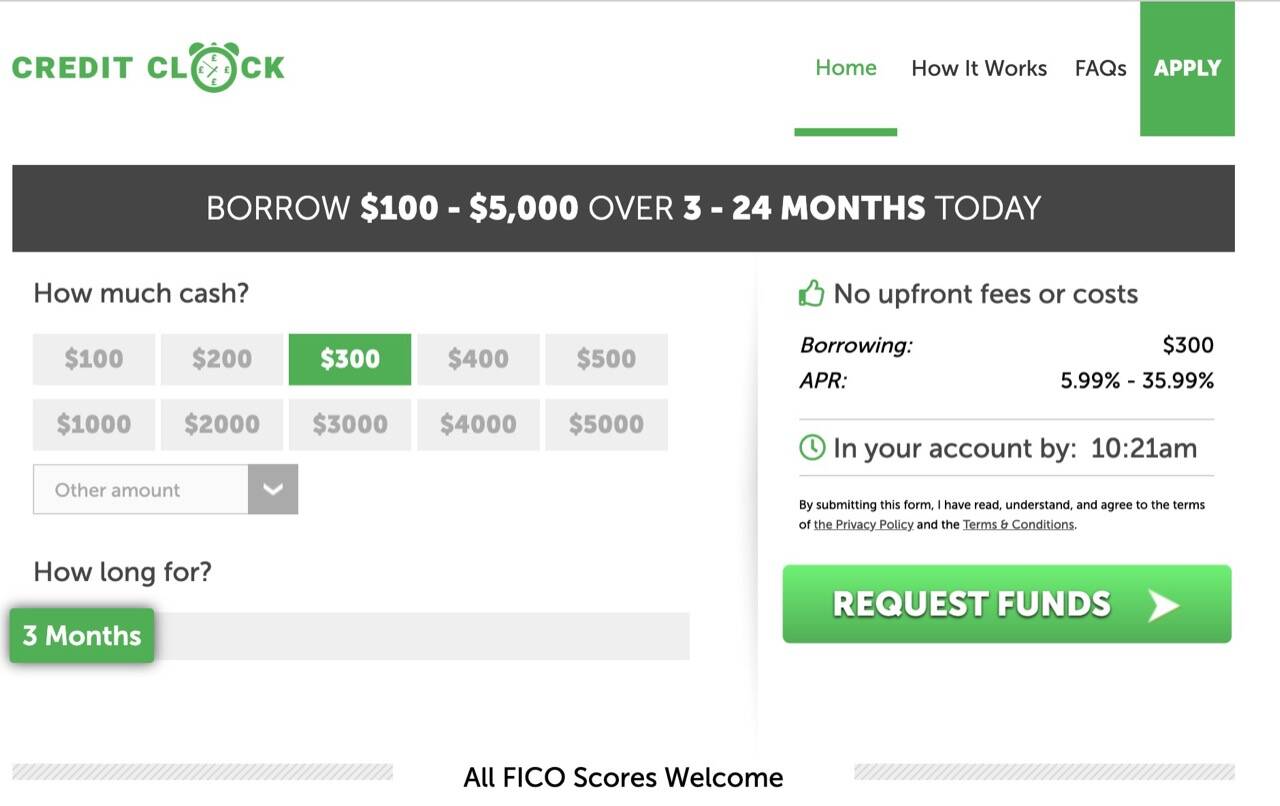

The market for no-credit-check loans is primarily populated by online lenders and payday loan companies. These institutions often target individuals who have been turned down by traditional banks and credit unions. It is crucial to research lenders thoroughly and check for any complaints or legal actions before applying for a loan.

Typical Terms and Conditions

The terms and conditions of $1,000 no-credit-check loans can vary significantly. However, some common characteristics include short repayment periods (often weeks or months), high APRs (Annual Percentage Rates), and potential for rollover fees. Rollover fees occur when borrowers cannot repay the loan on time and extend the loan term, incurring additional charges.

These loans often carry APRs ranging from 300% to over 600%, making them incredibly expensive compared to traditional loans. Failure to repay can lead to a debt cycle that's difficult to escape.

The Dangers of No-Credit-Check Loans

While the allure of quick cash is strong, the dangers associated with $1,000 no-credit-check loans are considerable. The high interest rates and fees can quickly make the loan unaffordable.

The short repayment periods can also put significant strain on a borrower's budget. Many borrowers end up taking out additional loans to cover the initial one, leading to a cycle of debt.

According to the Consumer Financial Protection Bureau (CFPB), payday loans, a common type of no-credit-check loan, can trap borrowers in long-term debt. The CFPB has issued warnings about the risks associated with these types of loans.

The Impact on Credit Scores

Ironically, while these loans don't rely on a credit check for approval, they can still negatively impact your credit score. If you fail to repay the loan, the lender may report the default to credit bureaus. This can significantly lower your credit score, making it harder to obtain loans, rent an apartment, or even get a job in the future.

Predatory Lending Practices

Some lenders offering no-credit-check loans engage in predatory lending practices. This includes charging exorbitant fees, misrepresenting loan terms, and harassing borrowers. It's essential to be wary of lenders who pressure you into taking out a loan or who are not transparent about the terms and conditions.

"Borrowers should always read the fine print and understand the true cost of the loan before signing anything," advises Sarah Miller, a financial advisor.

Alternatives to No-Credit-Check Loans

Before resorting to a $1,000 no-credit-check loan, explore alternative options that may be less risky and more affordable. These options may require more effort to secure, but they can save you money and protect your financial well-being in the long run.

Personal Loans from Credit Unions or Banks

Consider applying for a personal loan from a credit union or bank. These institutions often offer lower interest rates and more flexible repayment terms than payday lenders. Even if you have less-than-perfect credit, it's worth exploring this option.

Credit Card Cash Advances

If you have a credit card, a cash advance might be an option, although the interest rates are typically high. Carefully evaluate the terms before taking out a cash advance and make a plan to repay the balance quickly.

Borrowing from Friends or Family

If possible, consider borrowing money from friends or family. This can be a less expensive option than taking out a loan, but it's important to establish clear repayment terms to avoid damaging relationships.

Payment Plans and Negotiating with Creditors

If you're struggling to pay bills, contact your creditors and see if you can negotiate a payment plan. Many companies are willing to work with you to avoid late payments or defaults.

Emergency Assistance Programs

Explore local emergency assistance programs offered by charities, non-profits, or government agencies. These programs may provide grants or loans to help you cover unexpected expenses.

The Future of No-Credit-Check Lending

The demand for no-credit-check loans is likely to persist as long as there are individuals with limited access to traditional credit. However, increased regulatory scrutiny and consumer awareness could shape the future of this industry.

The CFPB and other regulatory agencies are working to protect consumers from predatory lending practices. New regulations may limit interest rates and fees, require lenders to assess a borrower's ability to repay, and increase transparency. Educating consumers about the risks associated with no-credit-check loans is essential.

By understanding the potential dangers and exploring alternative options, borrowers can make informed decisions about their financial well-being. Seeking advice from a financial advisor or credit counselor can also provide valuable guidance.