1099-k Reporting Requirements 2024 From Online Gambling Sites

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

The digital world of online gambling is facing a major shake-up in 2024 as new 1099-K reporting requirements loom large. What was once a relatively obscure tax detail is now set to impact millions of casual and professional gamblers alike, potentially altering their tax liabilities and forcing them to rethink their gaming strategies. The consequences could be profound, ranging from increased tax burdens to significant compliance hurdles for both individuals and online gambling platforms.

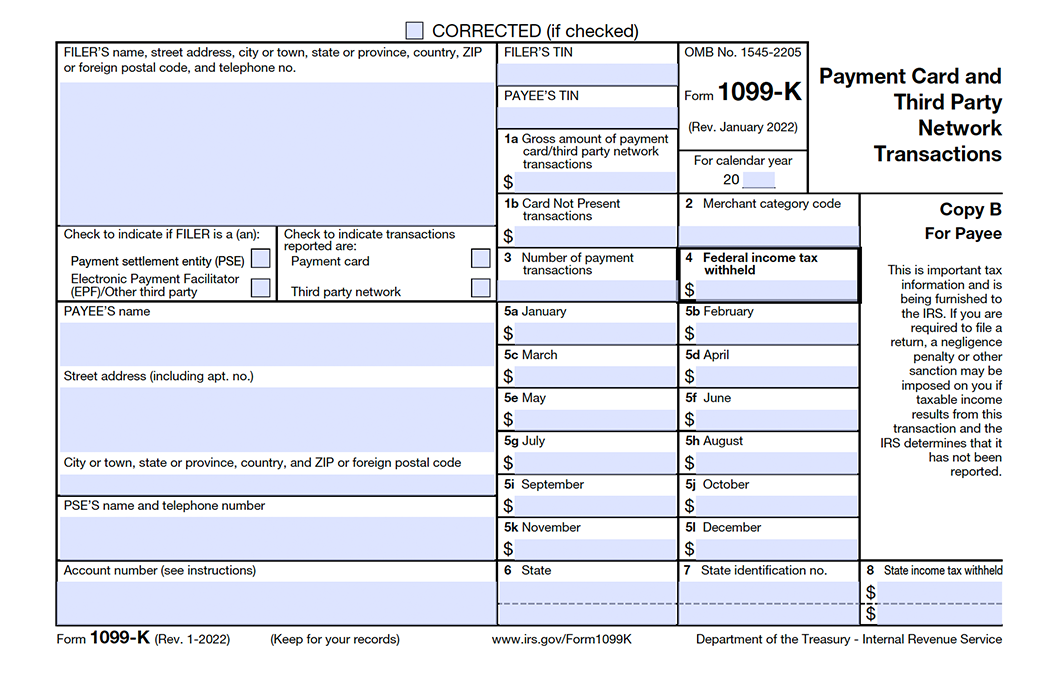

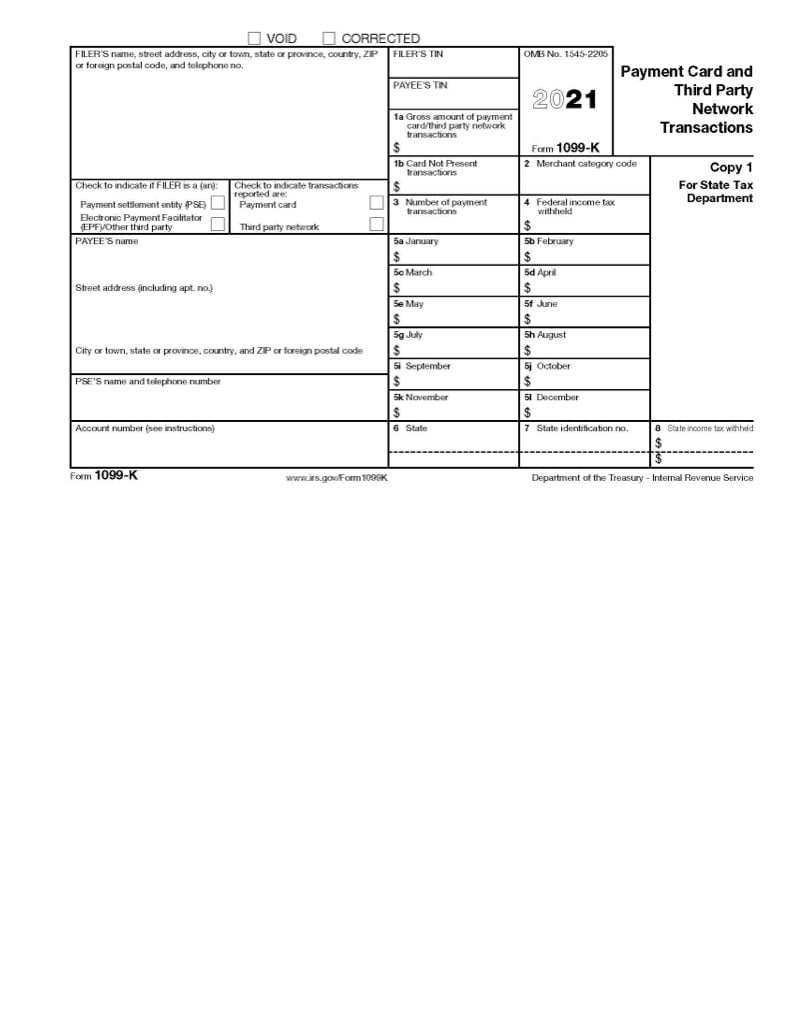

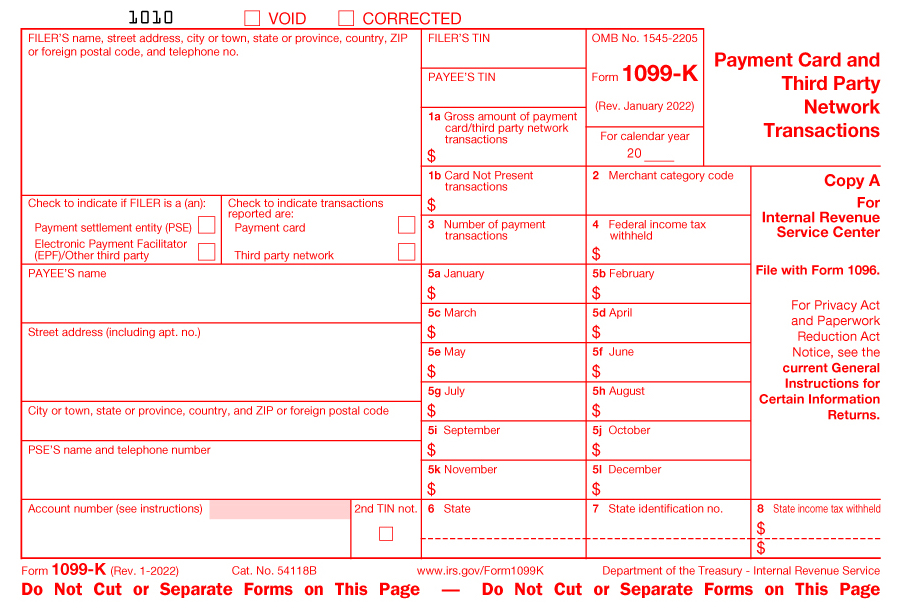

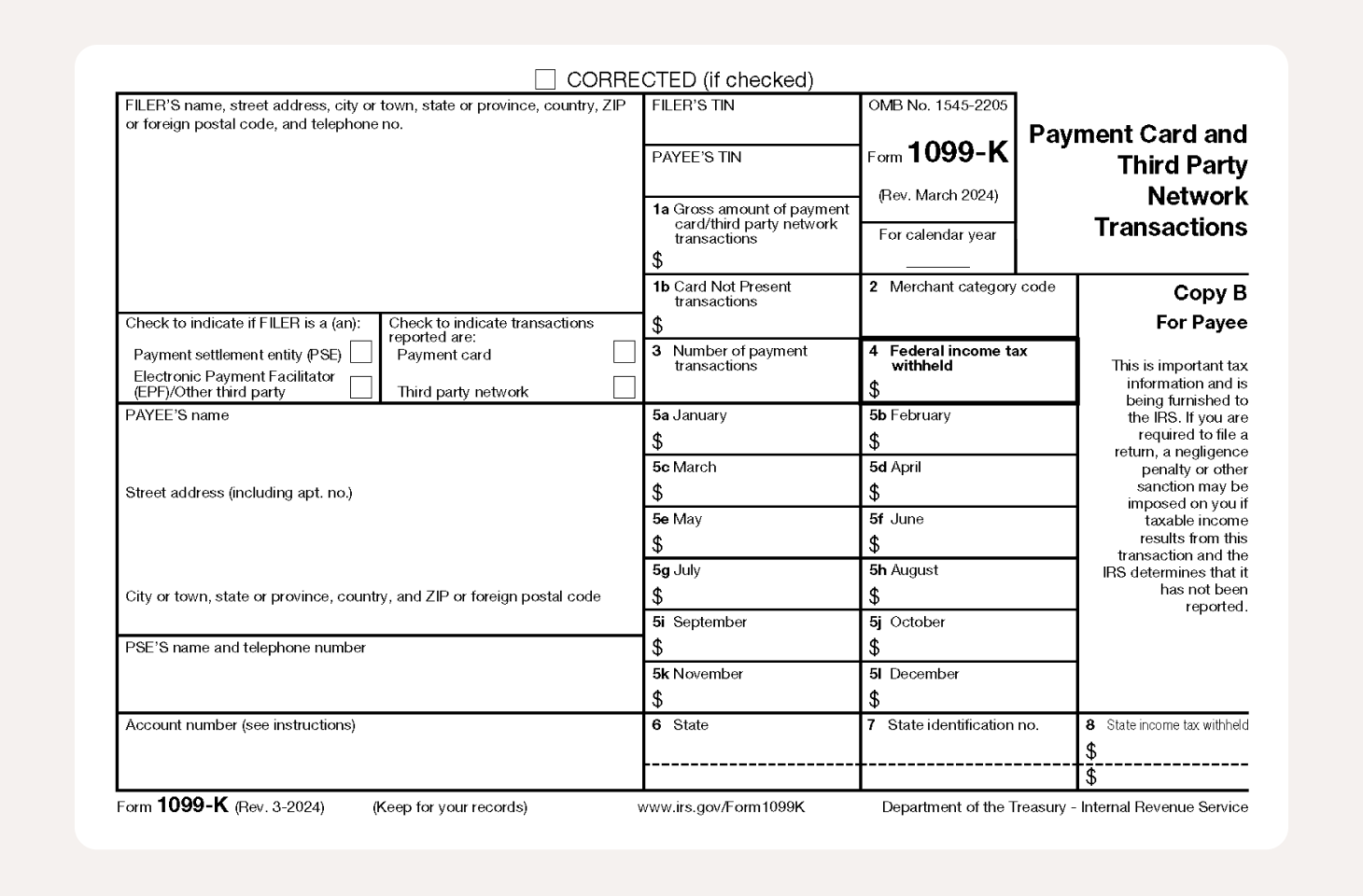

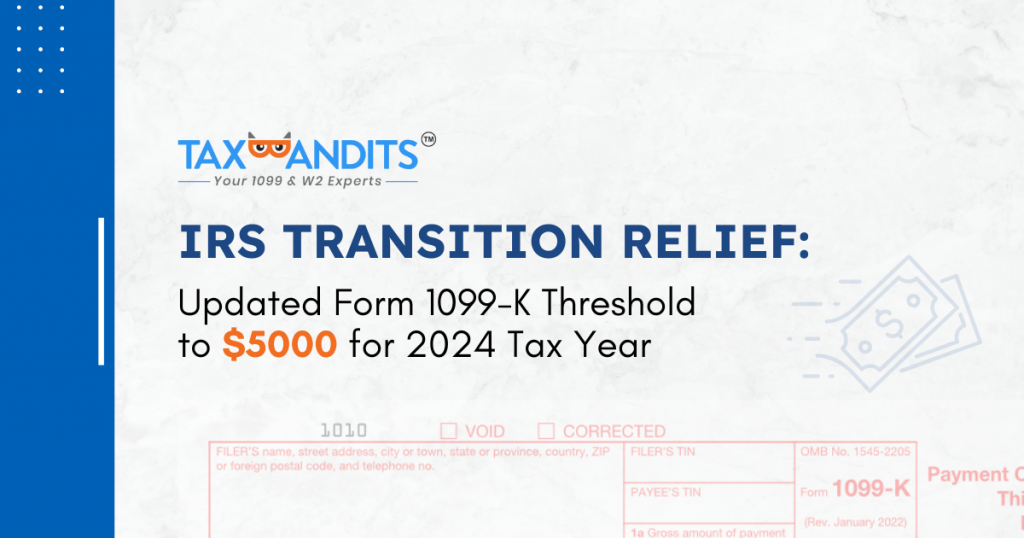

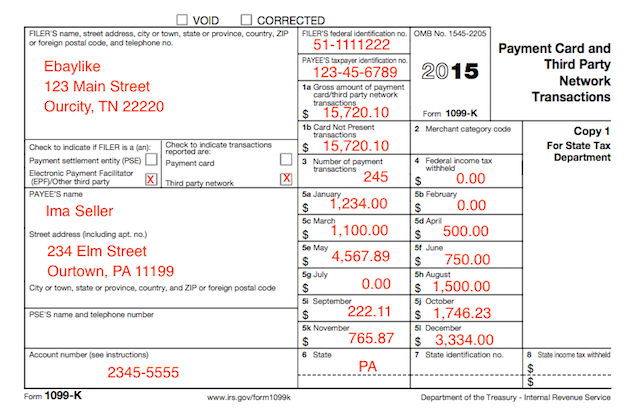

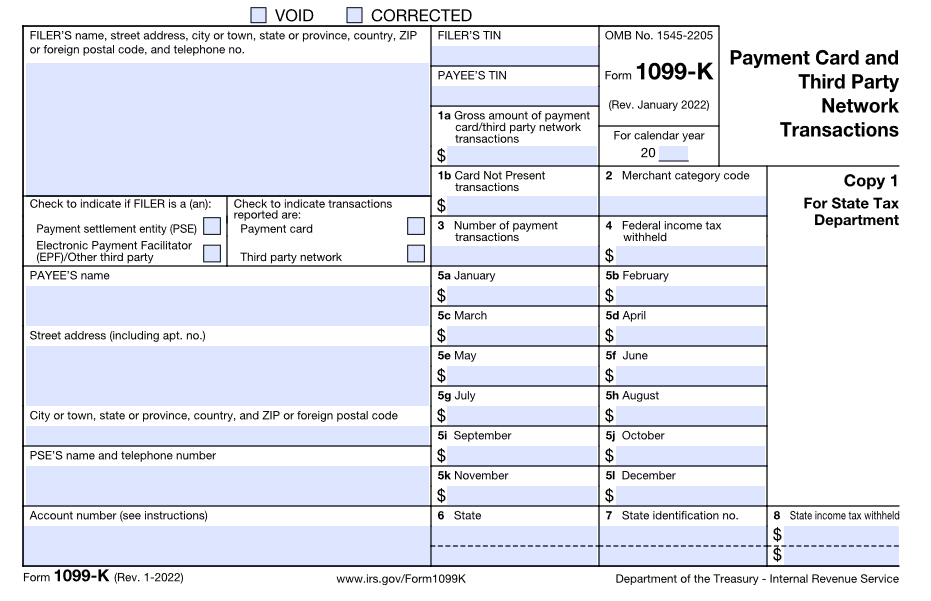

At the heart of this change is the revised IRS threshold for issuing Form 1099-K, which requires payment processors, including those used by online gambling sites, to report gross payment volumes exceeding a dramatically lowered threshold. While the implementation has been delayed in the past, the expectation is that the IRS will begin enforcing the new rules for the 2024 tax year. This means any individual receiving over $600 through online gambling platforms could face increased scrutiny and potentially higher tax bills. The impact of this change will affect players, gambling operators, and tax professionals alike.

The New 1099-K Threshold: A Game Changer

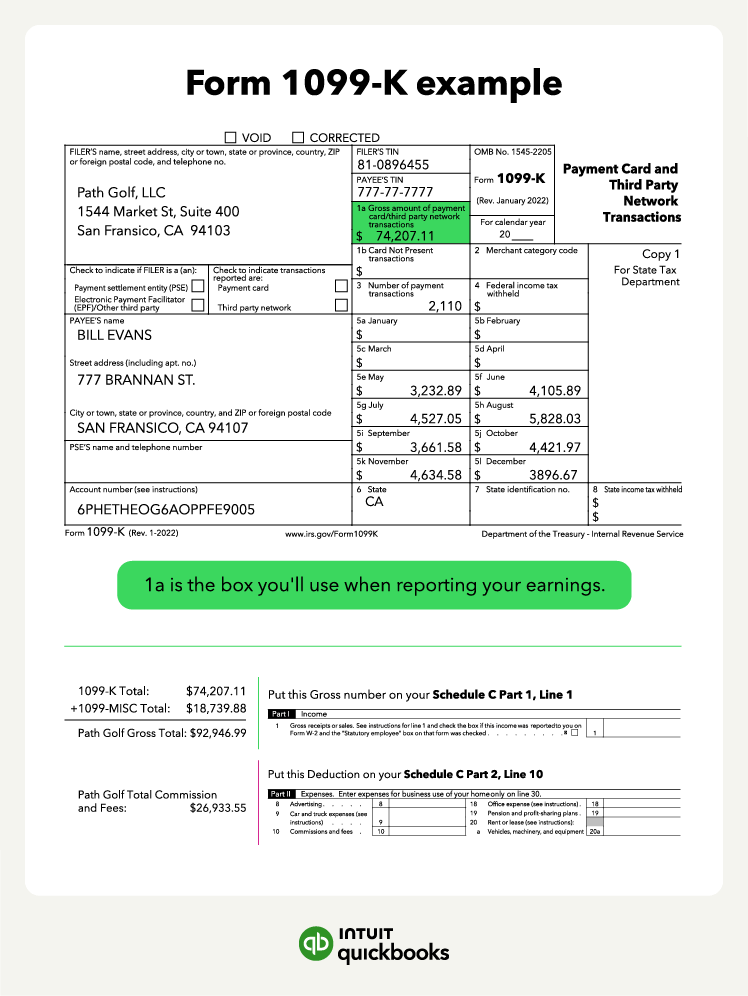

The former 1099-K reporting threshold, set at over $20,000 in gross payments and more than 200 transactions, allowed many casual gamblers to fly under the IRS radar. The new threshold of just $600, with no transaction minimum, represents a seismic shift. This means that even small winnings, when aggregated, could trigger a 1099-K form, regardless of whether the individual ultimately profited or lost money overall.

Consider a casual gambler who deposits $50 and places multiple small bets over the course of a year, eventually withdrawing $700. Under the new rules, the online gambling platform, or its payment processor, would be required to issue a 1099-K, reporting the $700 in gross payments, even though the individual's net winnings are a modest $650. This reporting requirement sets the stage for a complex and potentially burdensome tax situation.

Impact on Gamblers: A Closer Look

The primary impact on gamblers is the increased likelihood of receiving a 1099-K form. This form reports the gross amount of payments received, not the net profit. Consequently, individuals may need to carefully track their winnings and losses to accurately report their taxable gambling income and potentially offset winnings with deductible losses.

This could translate into a significant increase in record-keeping responsibilities. Gamblers will need to meticulously document their deposits, wagers, wins, and losses, potentially requiring the use of spreadsheets or specialized software. Without proper records, individuals may be unable to deduct their gambling losses, potentially leading to a higher tax liability. According to the IRS, gambling losses are deductible, but only up to the amount of gambling winnings.

Furthermore, the reporting requirements could incentivize gamblers to change their behavior. Some may choose to reduce their gambling activity to avoid triggering the 1099-K threshold. Others may seek alternative, less regulated platforms, potentially leading to a shift away from established and licensed online gambling sites.

Challenges for Online Gambling Platforms

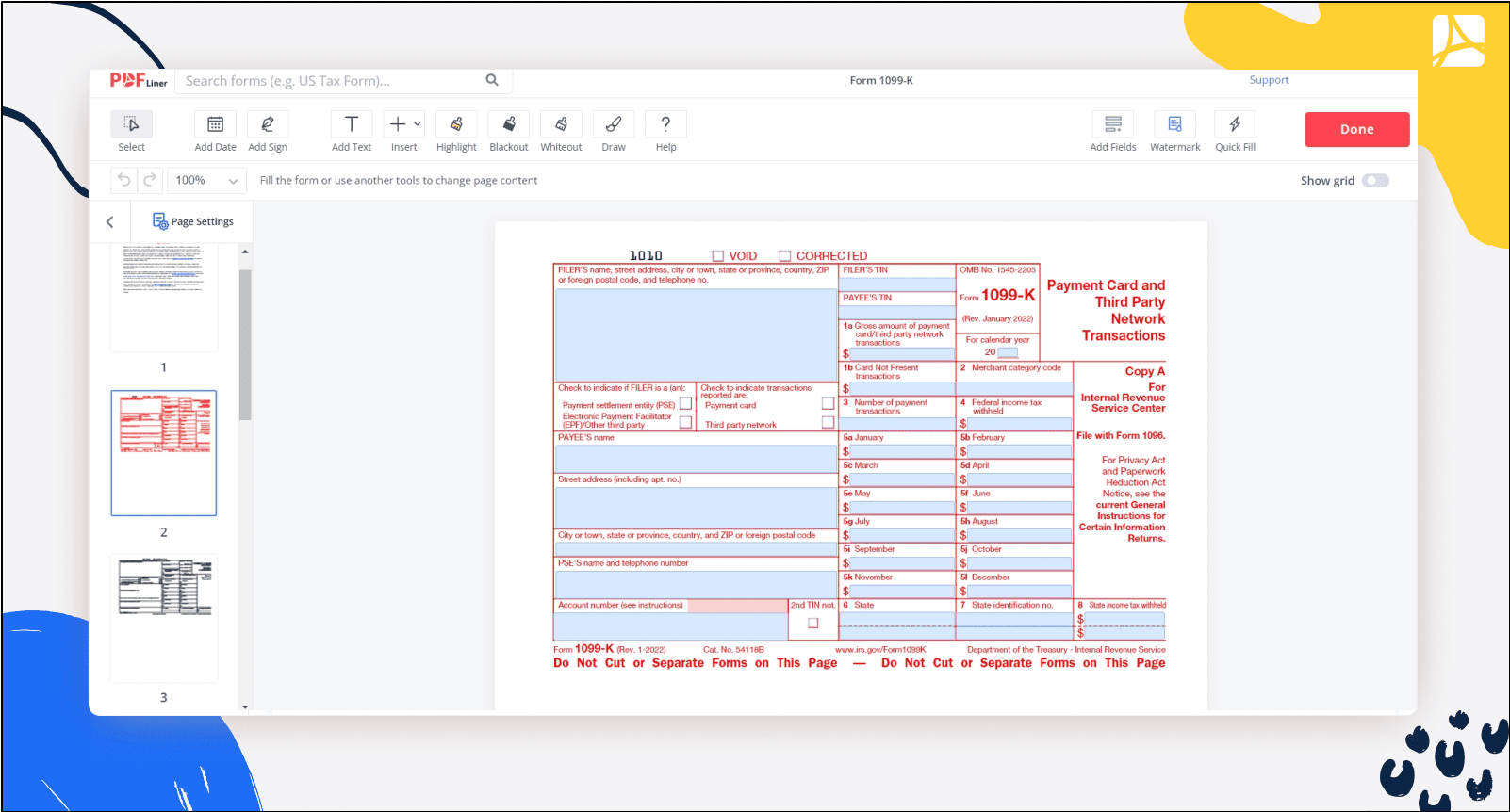

Online gambling platforms also face significant challenges. The new reporting requirements necessitate substantial investments in technology and compliance infrastructure. They must accurately track and report all payments exceeding the $600 threshold, a task that can be complex, especially for platforms with a high volume of transactions.

Moreover, platforms must communicate these changes to their users, educating them about the new reporting requirements and their potential tax obligations. This requires clear and transparent communication strategies to avoid confusion and maintain user trust. Failure to comply with the 1099-K reporting requirements can result in significant penalties for the online gambling platforms themselves.

“The challenge for gambling operators is to balance compliance with providing a seamless user experience. Players may be deterred by intrusive reporting or KYC (Know Your Customer) requirements, leading them to seek less compliant operators,” said a tax expert from Deloitte in a recent industry conference.

Potential for Confusion and Misreporting

The complexity of the new rules creates a significant potential for confusion and misreporting. Many casual gamblers may be unaware of the new threshold and their reporting obligations. They may also struggle to accurately track their winnings and losses, especially if they engage in gambling across multiple platforms.

This confusion could lead to unintentional errors on tax returns, potentially triggering audits and penalties from the IRS. Tax professionals, in turn, will need to be well-versed in the new rules to accurately advise their clients and ensure compliance. The complexity of gambling income and losses can be challenging to navigate. The AICPA (American Institute of Certified Public Accountants) has issued guidance on reporting gambling income, but the low threshold increases complexity.

Furthermore, the reporting of gross payments, rather than net winnings, could create a misleading picture of an individual's income. An individual who receives a 1099-K for $1,000 in gross payments but ultimately loses $500 may appear to have a higher income than they actually do, potentially impacting eligibility for certain government benefits or loans.

Looking Ahead: The Future of Online Gambling and Taxation

The implementation of the new 1099-K reporting requirements is likely to have a lasting impact on the online gambling industry. It may lead to greater transparency and compliance but also create new challenges for both gamblers and platforms. The long-term effects will depend on how effectively the IRS enforces the rules and how well individuals and businesses adapt to the new landscape.

It is crucial for individuals to educate themselves about the new reporting requirements and to maintain accurate records of their gambling activity. Online gambling platforms must invest in robust compliance infrastructure and communicate clearly with their users. As the 2024 tax season approaches, expect that both gamblers and platforms will need to pay close attention to these rule changes.

The future of online gambling taxation hinges on a delicate balance between ensuring fair tax collection and avoiding undue burdens on individuals and businesses. It is a landscape that will continue to evolve, requiring ongoing attention and adaptation from all stakeholders.