2 10 Home Buyers Warranty Review

For many Americans, buying a home represents the pinnacle of the American dream, a symbol of stability and long-term security. However, the excitement of homeownership can quickly turn to frustration and financial strain when unexpected repairs arise. Home warranties, promising protection against these unforeseen expenses, offer a tempting solution. But are they truly a safety net, or just another layer of complexity and potential disappointment? This question is especially pertinent when considering 2-10 Home Buyers Warranty, one of the nation's largest home warranty providers.

This article delves into a comprehensive review of 2-10 Home Buyers Warranty, analyzing its coverage, customer service, pricing, and reputation. We'll examine its strengths and weaknesses to help homeowners make informed decisions about whether this warranty provider aligns with their individual needs and risk tolerance. By drawing on customer reviews, industry reports, and expert analysis, we aim to provide a balanced and objective assessment of 2-10 Home Buyers Warranty's value proposition in the competitive home warranty market.

Understanding 2-10 Home Buyers Warranty

2-10 Home Buyers Warranty, officially known as Residential Warranty Services, Inc., has been in operation for over 40 years. They offer a range of home warranty plans designed to cover the repair or replacement of major systems and appliances in a home. These plans are marketed to both homeowners and real estate professionals, often included as part of a home sale transaction.

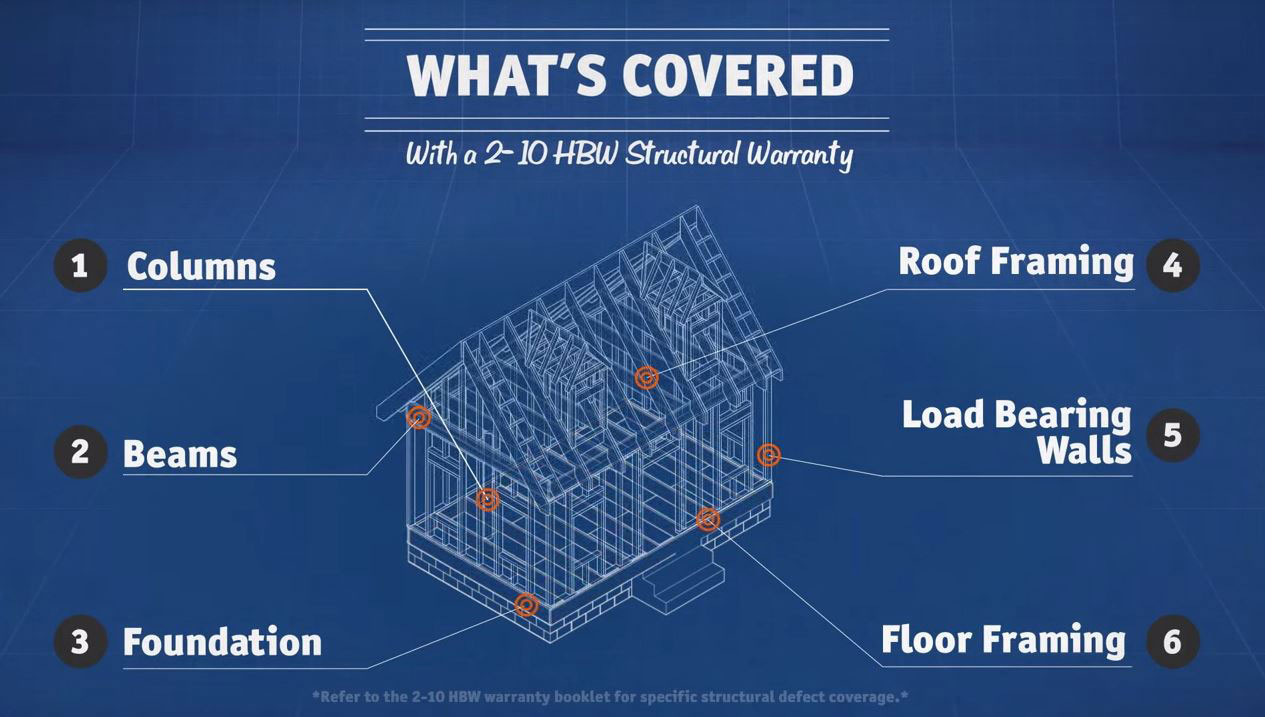

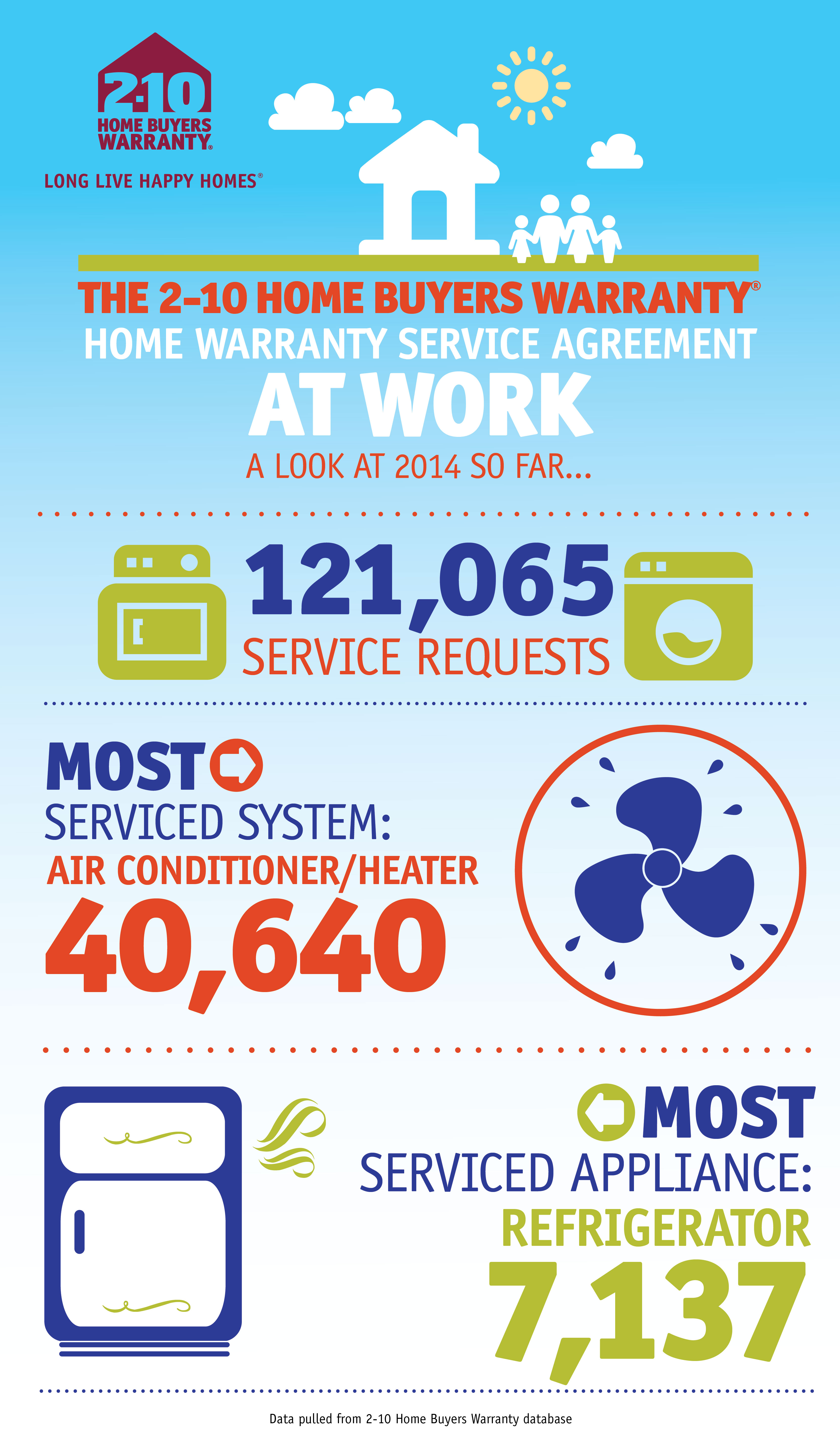

The company's core offering revolves around protecting homeowners from unexpected repair costs associated with items like HVAC systems, plumbing, electrical systems, and major appliances. Different plans offer varying levels of coverage, with options for add-ons to protect specific items or address unique homeowner needs.

Coverage Options and Plan Details

2-10 Home Buyers Warranty offers several tiers of coverage, each with different price points and inclusions. The most basic plans typically cover essential systems like heating, cooling, and plumbing. More comprehensive plans extend coverage to major appliances such as refrigerators, ovens, and dishwashers.

The specific covered items and limitations are detailed in the service agreement, a document that all customers should carefully review. Deductibles typically apply per service request, and there are caps on the amount the company will pay out for each covered item.

Customers should pay close attention to the exclusions within the agreement. Common exclusions include pre-existing conditions, cosmetic issues, and damage caused by improper maintenance or natural disasters. Understanding these limitations is crucial for setting realistic expectations about the scope of coverage.

Pricing and Fees

The cost of a 2-10 Home Buyers Warranty plan varies based on several factors, including the size and age of the home, the chosen coverage level, and the deductible amount. Quotes can be obtained online or through a sales representative. Homeowners should compare quotes from multiple providers to ensure they are receiving competitive pricing.

In addition to the annual premium, homeowners are responsible for paying a service fee or deductible each time they request a repair. These fees can range from $75 to $125, depending on the plan. Consider the potential frequency of repairs and the cost of the service fee when evaluating the overall value of the warranty.

It's important to note that some plans may have additional fees for specific services, such as emergency repairs or weekend service calls. Thoroughly review the fee schedule before enrolling in a plan.

Customer Service and Claims Process

Customer service experiences are a crucial aspect of evaluating any home warranty provider. 2-10 Home Buyers Warranty offers a 24/7 claims hotline and an online portal for submitting service requests. The company aims to dispatch a qualified service technician to the home within a reasonable timeframe to diagnose and repair the issue.

However, customer reviews regarding the claims process are mixed. Some customers report positive experiences with prompt service and satisfactory repairs. Other customers describe frustrating encounters involving delays, denied claims, and disagreements over coverage. These discrepancies underscore the importance of reading the fine print and documenting all communication with the company.

A significant factor affecting customer satisfaction is the network of contractors that 2-10 Home Buyers Warranty uses. While the company vets its contractors, the quality of service can vary depending on the individual technician. Homeowners may have limited control over selecting their preferred contractor, which can be a source of dissatisfaction if they are unhappy with the assigned technician.

"Customer service experiences are a critical factor in determining the overall value of a home warranty. Be sure to read reviews and understand the company's dispute resolution process," advises consumer advocate, Jane Doe.

Analyzing Customer Reviews and Ratings

Online reviews and ratings provide valuable insights into the experiences of other 2-10 Home Buyers Warranty customers. Websites such as the Better Business Bureau (BBB), Trustpilot, and ConsumerAffairs host numerous reviews, both positive and negative. A thorough review of these sources can reveal patterns and potential red flags.

While individual experiences may vary, it's important to consider the overall trend in customer sentiment. Pay attention to common complaints, such as difficulty filing claims, long wait times for repairs, and disagreements over coverage. Also, look for positive feedback regarding prompt service, helpful customer service representatives, and satisfactory repairs.

Keep in mind that online reviews are subjective and may not always paint a complete picture. However, a large volume of consistently negative reviews should raise concerns and warrant further investigation. Always cross-reference information from multiple sources to form a well-rounded opinion.

Weighing the Pros and Cons

2-10 Home Buyers Warranty offers potential benefits for homeowners seeking to protect themselves from unexpected repair costs. The ability to budget for a fixed premium and deductible can provide peace of mind. A home warranty can be particularly appealing for those purchasing older homes with aging systems and appliances.

However, it's important to carefully weigh the potential drawbacks before enrolling in a plan. Coverage limitations, exclusions, and potential disputes over claims can lead to frustration and financial burden. The service fee per claim can also add up over time, potentially negating the value of the warranty.

Ultimately, the decision of whether to purchase a 2-10 Home Buyers Warranty depends on individual circumstances and risk tolerance. Consider the age and condition of your home, the potential cost of repairs, and your comfort level with managing these expenses yourself. Obtain and carefully review the service agreement before making a decision.

Alternatives to Home Warranties

Home warranties are not the only option for protecting yourself against unexpected repair costs. Building an emergency fund specifically earmarked for home repairs is an alternative. This provides greater flexibility and control over how the money is spent.

Another option is to obtain a home inspection before purchasing a property. This can identify potential problems upfront, allowing you to negotiate repairs with the seller or budget accordingly. Regular maintenance of your home's systems and appliances can also help prevent costly breakdowns.

Some homeowners may also find value in purchasing extended warranties for specific appliances. These warranties are typically offered by the manufacturer or retailer and may provide more comprehensive coverage than a general home warranty.

Conclusion: Making an Informed Decision

2-10 Home Buyers Warranty, like all home warranty providers, presents a mixed bag of potential benefits and drawbacks. While it can offer financial protection and peace of mind, coverage limitations, customer service inconsistencies, and potential disputes can lead to frustration. A thorough understanding of the coverage terms, pricing, and customer feedback is crucial for making an informed decision.

Ultimately, the value of a 2-10 Home Buyers Warranty depends on your individual circumstances, risk tolerance, and willingness to carefully manage the claims process. By weighing the pros and cons and comparing alternatives, homeowners can determine whether this warranty provider aligns with their needs and provides a worthwhile investment. Consider talking to a real estate professional to help you evaluate if a home warranty is right for your situation.

Moving forward, prospective buyers should prioritize thorough research and due diligence before purchasing any home warranty, including those offered by 2-10 Home Buyers Warranty. Carefully examining the service agreement, reading customer reviews, and comparing alternatives are essential steps in ensuring a satisfactory and financially sound decision.

:max_bytes(150000):strip_icc()/2_10_Recirc-9fae8fc133474a86a94c5130d0e6c9a1.jpg)

.20210923105346.jpg)