250 Dollar Loan No Credit Check

The allure of quick cash, especially when facing unexpected expenses, has fueled the growth of short-term loan options. Among these, the "$250 loan no credit check" has gained considerable traction, particularly among individuals with limited or damaged credit histories. But what are these loans, and what should borrowers consider before taking one out?

This article aims to provide a comprehensive overview of the $250 no credit check loan, outlining its mechanics, potential benefits, associated risks, and alternatives available to consumers. Understanding these factors is crucial for making informed financial decisions and avoiding potentially harmful debt cycles.

What is a $250 No Credit Check Loan?

A "$250 loan no credit check" is a short-term, small-dollar loan marketed to individuals who need immediate funds and may not qualify for traditional loans due to poor or non-existent credit. The "no credit check" aspect is a key feature, meaning lenders typically don't perform a hard inquiry on the borrower's credit report with major credit bureaus. Instead, they may rely on alternative data sources to assess creditworthiness.

These lenders often focus on factors like income verification and employment history. They may also look at existing bank account information and transaction history.

The appeal lies in the perceived accessibility and speed. Borrowers can often apply online and receive funds within the same day or the next business day, making it an attractive option for urgent financial needs. However, this convenience often comes at a significant cost.

The Mechanics: Who, What, Where, When, and How

Who: These loans target individuals with poor or no credit history, often those struggling to access traditional financing options.

What: The loan is a small-dollar amount, typically $250, intended to cover immediate expenses like bills, groceries, or minor emergencies.

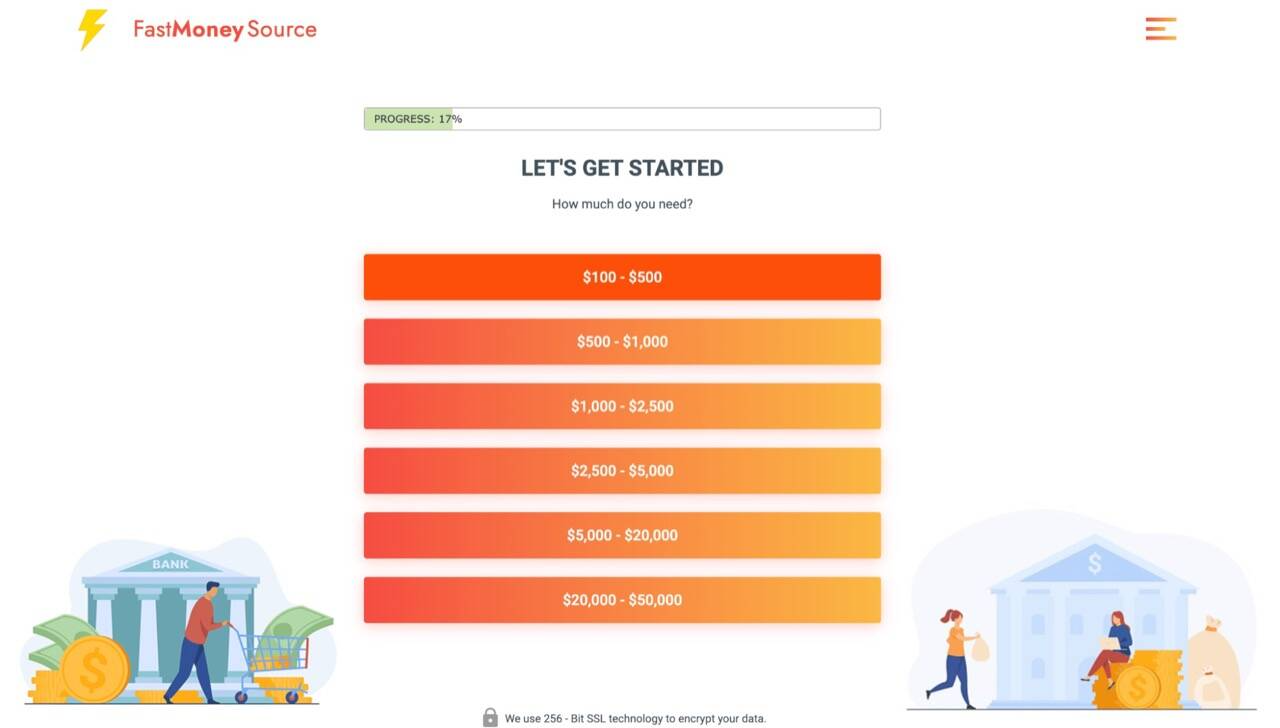

Where: These loans are predominantly offered by online lenders, storefront payday loan companies, and installment loan providers. Some lenders operate solely online, while others have a physical presence.

When: Borrowers typically seek these loans when faced with an unexpected financial shortfall and require immediate access to funds. The repayment period is short, often within a few weeks or a month.

How: The application process is generally straightforward, often conducted online. Borrowers provide personal information, proof of income, and bank account details. Upon approval, the funds are typically deposited directly into the borrower's bank account. Repayment is usually automated, with the lender withdrawing the amount due from the borrower's account on the agreed-upon date.

The High Cost of Convenience

The most significant drawback of these loans is their extremely high cost. While the initial $250 may seem manageable, the associated fees and interest rates can be exorbitant. These fees are often expressed as a dollar amount per $100 borrowed, or as an Annual Percentage Rate (APR) that can reach triple-digit figures.

For example, a $250 loan with a $30 fee and a two-week repayment period could translate to an APR of nearly 400%. This means the borrower could end up repaying significantly more than the initial $250 borrowed. This often traps borrowers in a cycle of debt.

According to the Consumer Financial Protection Bureau (CFPB), borrowers who take out payday loans are at high risk of reborrowing. Many borrowers end up taking out new loans to cover the initial loan, leading to a snowballing effect of debt. It is also important to note that lenders may engage in aggressive collection practices if borrowers default on their loans.

Potential Alternatives to $250 No Credit Check Loans

Before resorting to a $250 no credit check loan, it's crucial to explore alternative options that may be more affordable and sustainable. These alternatives include:

Personal Loans from Credit Unions or Banks

Credit unions and banks often offer small-dollar personal loans with more reasonable interest rates and repayment terms. Credit unions, in particular, may be more willing to work with individuals with limited credit history.

Credit Card Cash Advances

While cash advances on credit cards also come with fees and interest, the APR is often lower than that of a payday loan. However, this is only feasible if you have an available credit line.

Borrowing from Friends or Family

If possible, consider borrowing money from friends or family. You can agree to set up a reasonable repayment plan with low or no interest.

Negotiating with Creditors

If you're struggling to pay bills, contact your creditors and explain your situation. They may be willing to offer a payment plan or temporarily defer payments.

Seeking Assistance from Local Charities or Nonprofits

Many local charities and non-profit organizations offer financial assistance programs to individuals in need. These programs may provide grants, loans, or other forms of support.

The Impact on Society

The prevalence of "$250 loan no credit check" options and similar high-cost lending products raises concerns about their impact on vulnerable populations. These loans can exacerbate financial instability and contribute to cycles of debt, particularly among low-income individuals and communities.

Consumer advocacy groups and regulatory agencies like the CFPB continue to monitor the payday lending industry and advocate for stronger consumer protections. They also push for greater transparency and regulation to prevent predatory lending practices.

Conclusion: While $250 no credit check loans may seem like a quick fix for immediate financial needs, the associated risks and high costs often outweigh the benefits. Borrowers should carefully consider all available options and explore alternatives before resorting to these loans. It's crucial to understand the terms and conditions, including the APR, fees, and repayment schedule, to avoid falling into a debt trap. Seeking financial advice from a trusted advisor or non-profit organization can also provide valuable guidance.