260 An Hour Is How Much A Year

The question "What does $260 an hour translate to annually?" often arises for freelancers, contractors, and those considering hourly-to-salary negotiations. Understanding the yearly equivalent requires accounting for various factors beyond simply multiplying the hourly rate by a standard workweek.

Calculating the annual income derived from an hourly wage of $260 involves more than a simple multiplication. Factors like paid time off, holidays, potential unpaid leave, and the number of working hours per week all influence the final figure. The resulting annual salary can vary significantly depending on these assumptions.

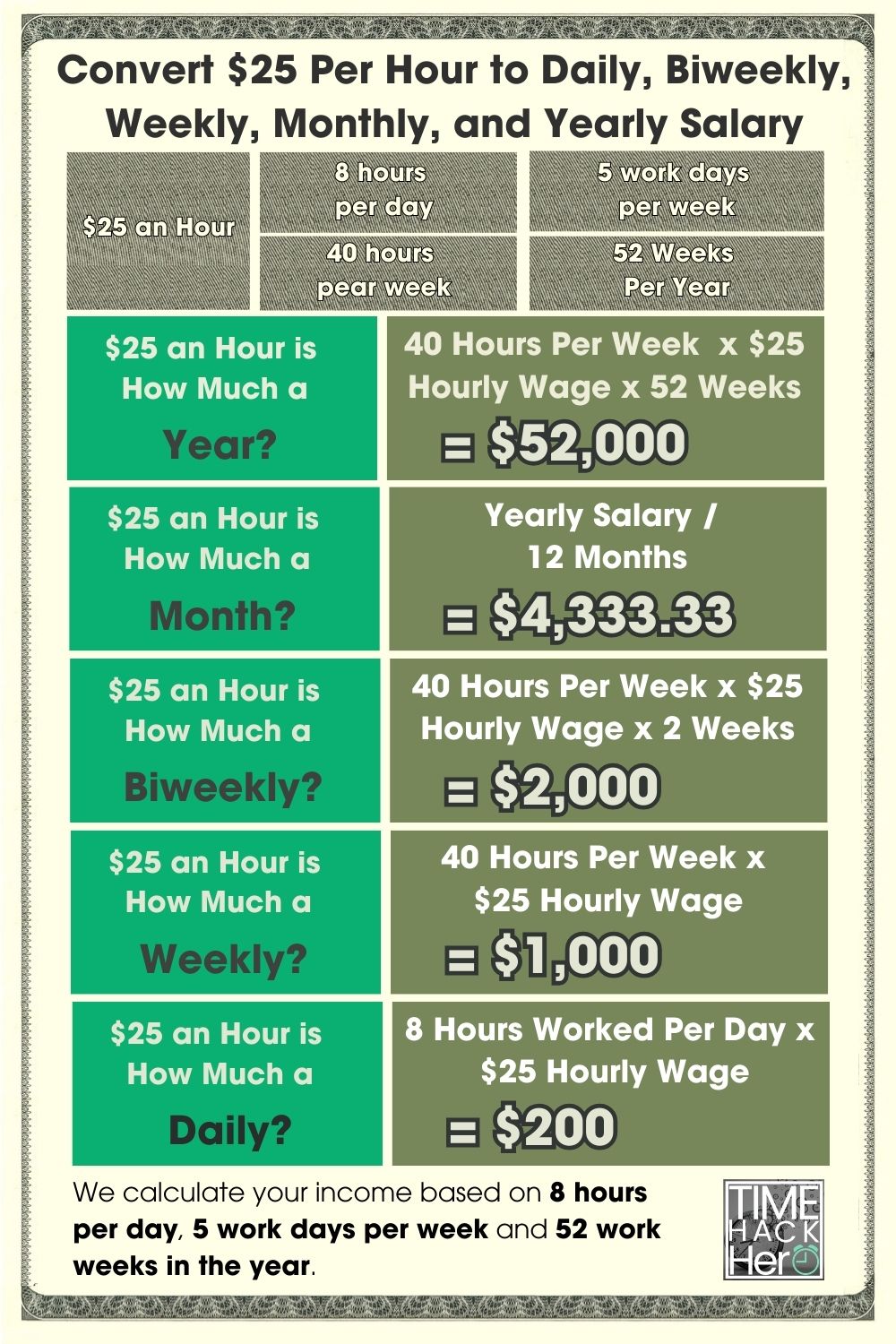

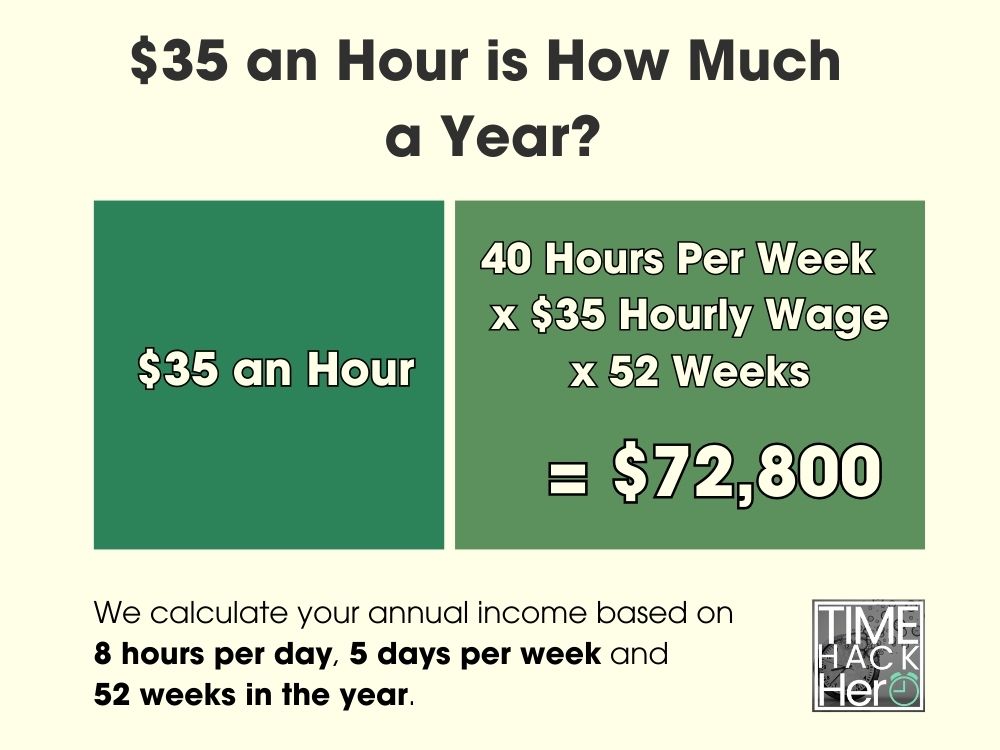

The Basic Calculation: $260 an Hour, 40 Hours a Week

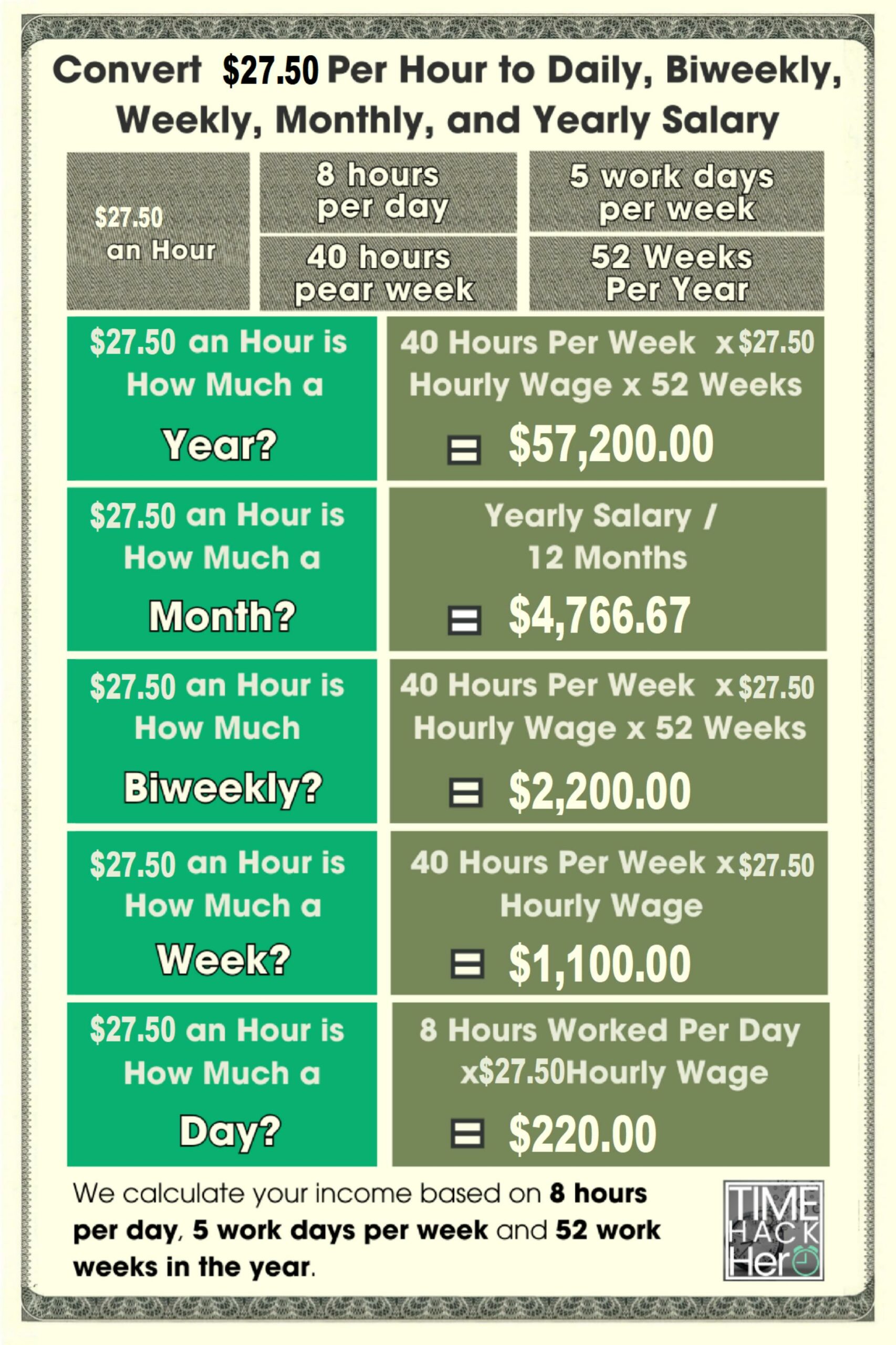

The most straightforward calculation assumes a standard 40-hour workweek. Multiplying $260 by 40 hours gives a weekly income of $10,400.

Then, multiplying the weekly income by 52 weeks yields a gross annual income of $540,800. This represents a base estimate, excluding any deductions or time off.

Accounting for Time Off: A More Realistic Estimate

Most full-time employees receive paid time off (PTO) for vacation, sick days, and holidays. Let's consider a scenario with two weeks of vacation and ten paid holidays, totaling approximately three weeks of non-working paid time.

Reducing the working weeks from 52 to 49 (52-3) gives a more accurate reflection of actual working time. Multiplying $10,400 (weekly income) by 49 weeks results in an annual income of $509,600.

Freelancers and Contractors: A Different Perspective

Freelancers and contractors often don't receive paid time off and may experience fluctuations in workload. They also bear the burden of self-employment taxes and benefits costs.

A freelancer charging $260 an hour needs to factor in time spent on administrative tasks, marketing, and client acquisition, which are often unpaid. This may significantly reduce their billable hours and, consequently, their actual annual income.

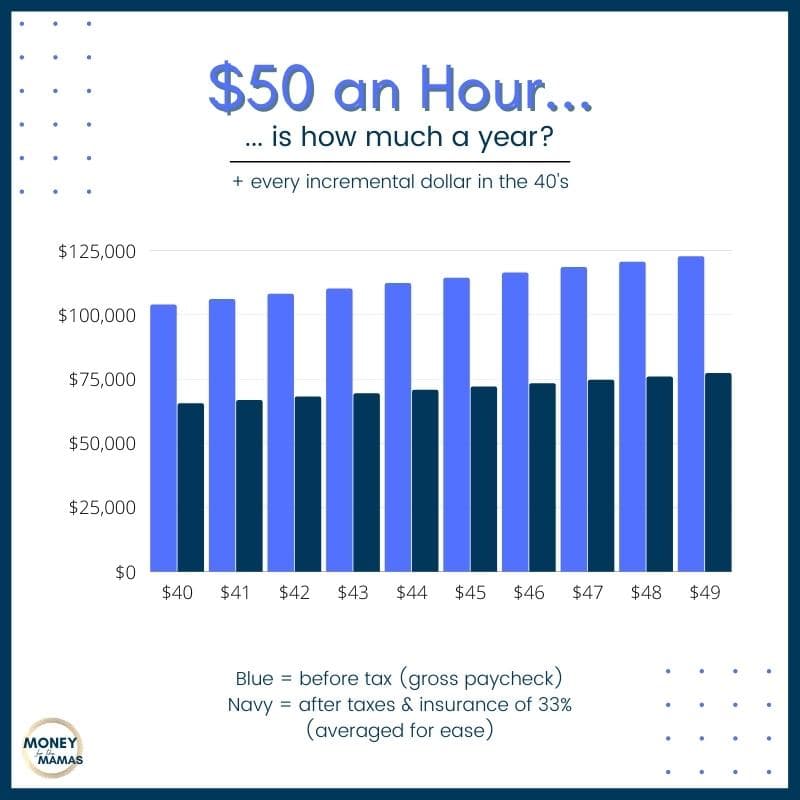

The Impact of Taxes and Benefits

It's crucial to remember that the figures calculated are gross annual income, before taxes. Federal, state, and local taxes will significantly reduce the net income.

Furthermore, employees often receive benefits like health insurance, retirement contributions, and paid leave, which have a monetary value. Contractors and freelancers usually need to purchase these benefits themselves, further impacting their take-home pay.

Benchmarking Against Salary Data

To put $260 an hour into perspective, it's helpful to compare it against average salary data for various professions. According to the Bureau of Labor Statistics (BLS), the median annual wage for all occupations in May 2023 was $48,060.

Specific professions requiring specialized skills and experience may command higher hourly rates. However, $260 an hour is significantly above the national average, suggesting a highly specialized or in-demand skillset.

The Significance of High Hourly Rates

An hourly rate of $260 often indicates expertise in a specialized field. It could represent the compensation for experienced consultants, highly skilled technical professionals, or executives with significant responsibilities.

Such rates reflect the value these individuals bring to their organizations or clients. The ability to command a high hourly rate often stems from years of experience, specialized training, and a proven track record of success.

Potential Impact on Individuals and Society

Earning a high hourly rate can significantly improve an individual's financial security and quality of life. It allows for greater savings, investments, and access to opportunities.

However, it's important to consider the potential drawbacks, such as increased stress, longer working hours, and higher tax burdens. Managing wealth effectively becomes crucial at this income level.

From a societal perspective, high earners contribute significantly to the economy through taxes and spending. Their expertise and innovation can also drive economic growth and create new opportunities.

Real-World Examples and Considerations

Consider a software engineer working as a consultant at $260 an hour. They might work on projects for multiple clients, requiring meticulous time management and invoicing.

Alternatively, a corporate lawyer billing at this rate could be providing specialized legal advice to large corporations. Their income would depend on the billable hours they log each year.

Conclusion

While a simple calculation suggests that $260 an hour translates to over $540,000 annually, this figure requires careful consideration. Accounting for time off, taxes, benefits, and the specific work arrangement is crucial.

The actual take-home pay and overall financial situation can vary significantly depending on these factors. Understanding the nuances of hourly versus salary compensation is essential for both employers and employees.

Ultimately, whether working as a freelancer, contractor, or employee, effectively managing finances and planning for the future are crucial for maximizing the benefits of a high hourly rate like $260.