$275 000 Mortgage Payment Calculator

A new online mortgage payment calculator, designed for loans up to $275,000, has launched, offering potential homebuyers and current homeowners a tool to estimate their monthly mortgage payments. The calculator aims to provide a clear picture of the costs associated with a mortgage, factoring in interest rates, loan terms, and property taxes.

The calculator serves as a vital resource for anyone navigating the complexities of the housing market. It provides an initial understanding of affordability and assists in financial planning. The tool's launch comes at a time of fluctuating interest rates and a competitive housing landscape, increasing the demand for accessible financial planning tools.

Key Features and Functionality

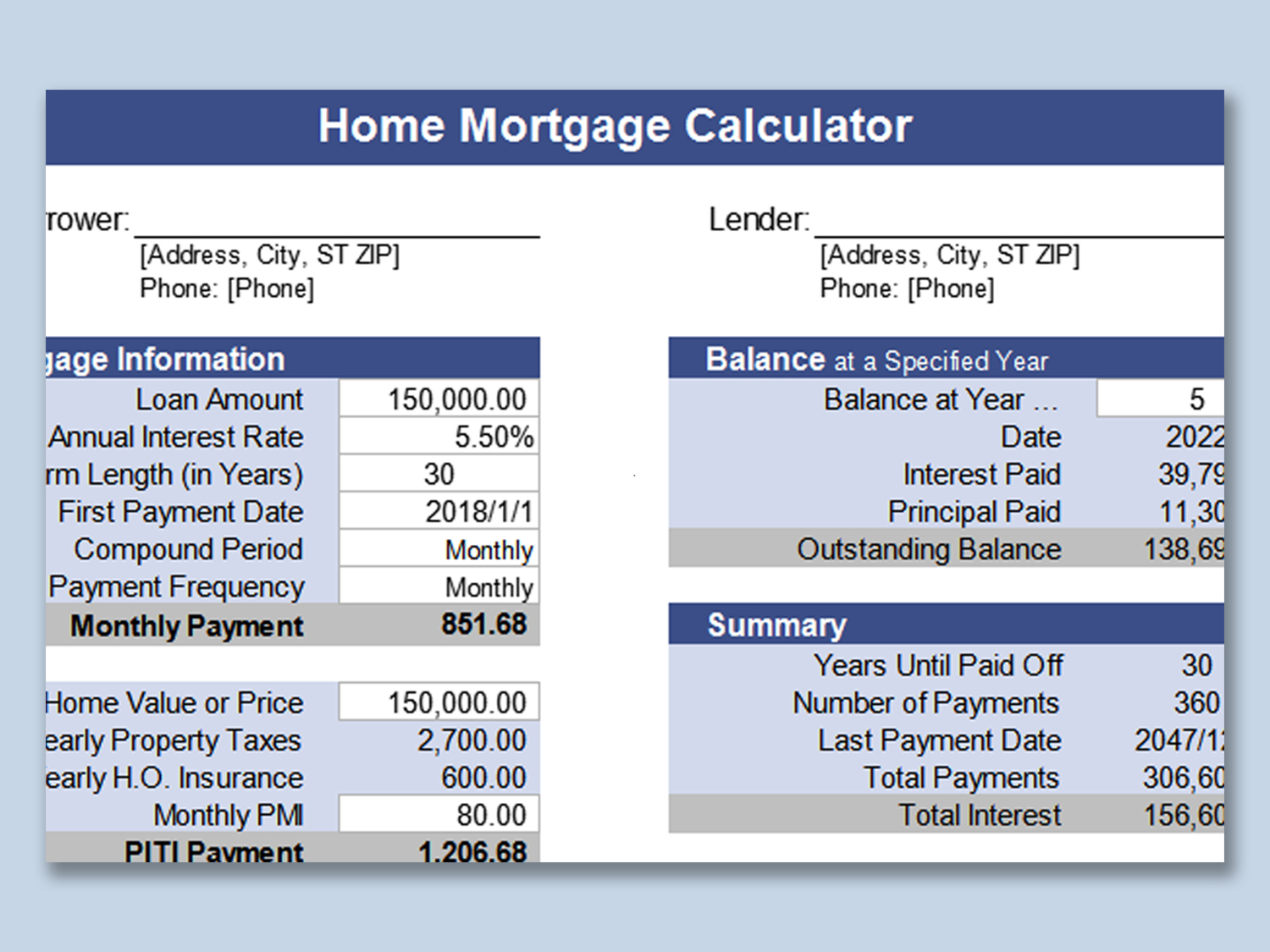

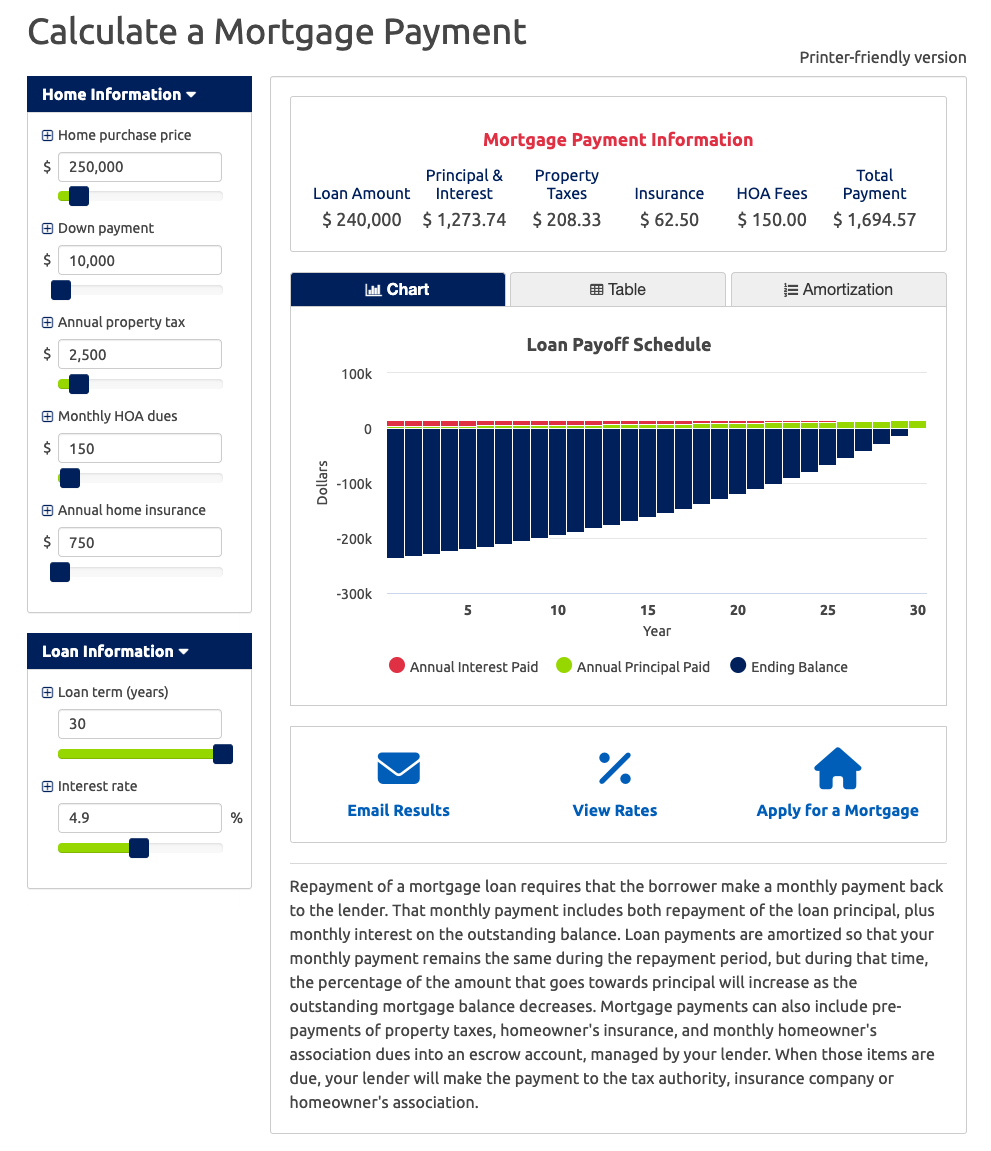

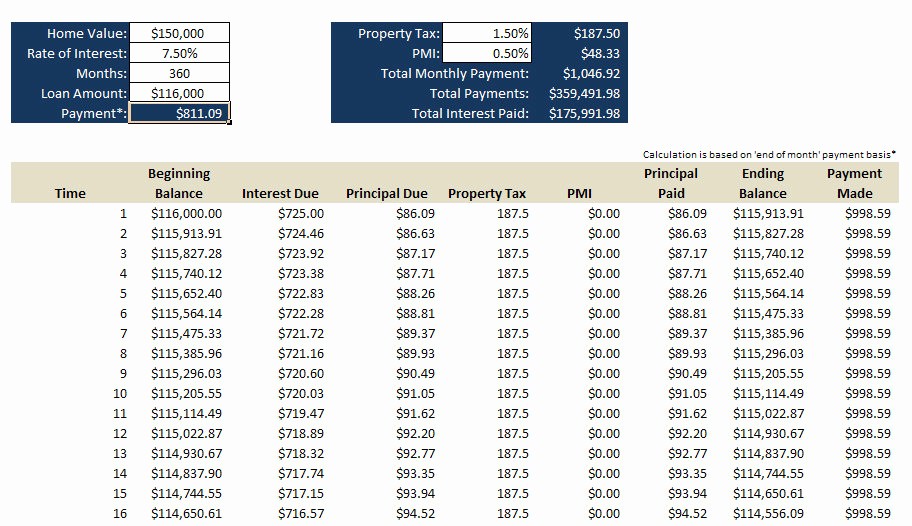

The $275,000 Mortgage Payment Calculator allows users to input various financial details to generate a personalized mortgage payment estimate. These details include the loan amount (up to $275,000), the interest rate, the loan term (in years), and any additional monthly expenses, such as property taxes and homeowner's insurance.

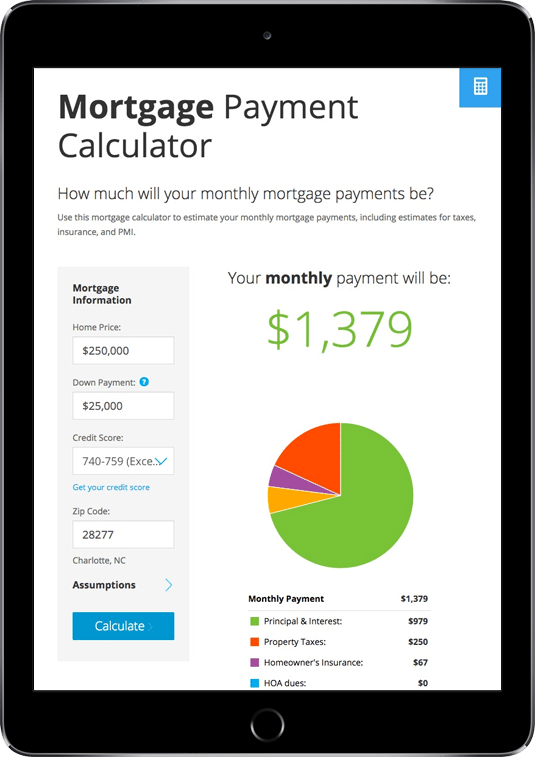

The calculator then computes the estimated monthly principal and interest payment. It also provides a breakdown of the total cost of the loan over its lifetime, illustrating the impact of interest accumulation.

The online tool is user-friendly and accessible on multiple devices, including desktops, tablets, and smartphones. This accessibility ensures that individuals can easily use the calculator regardless of their location or device preference.

Impact on Homebuyers

For prospective homebuyers, this calculator can play a significant role in determining affordability. Understanding the estimated monthly payments helps buyers establish a realistic budget and make informed decisions. The National Association of Realtors suggests using such tools early in the home-buying process.

The calculator can also help buyers compare different mortgage options. By adjusting the interest rate and loan term, users can see how these factors affect their monthly payments and the total cost of the loan. This allows for comparison between various loan offerings.

The tool can be particularly useful for first-time homebuyers who may not be familiar with all the costs associated with owning a home. It provides a clear and concise overview of these expenses, empowering them to make confident and informed decisions.

Impact on Current Homeowners

Existing homeowners can use the calculator to evaluate refinancing opportunities. By inputting their current loan details and comparing them with prevailing interest rates, homeowners can determine if refinancing is a worthwhile option.

The calculator also assists homeowners in assessing the impact of making extra mortgage payments. By simulating different payment scenarios, homeowners can see how much they could save in interest and how quickly they could pay off their mortgage.

This can be particularly useful in times of financial uncertainty. By understanding the options, homeowners can adapt and mitigate potential risks.

Expert Opinions

“Tools like this $275,000 Mortgage Payment Calculator are essential for consumers,” said Sarah Johnson, a financial advisor with Bright Future Financial Planning. "They empower individuals to take control of their finances and make informed decisions about their largest investments.”

According to HousingWire, a leading source of housing market news, online mortgage calculators are increasingly popular. More and more people turn to these resources as they research homeownership. Such tools offer a readily accessible way to estimate costs.

The launch of the $275,000 Mortgage Payment Calculator reflects a broader trend toward financial literacy and empowerment. The tool provides individuals with valuable information to navigate the complexities of the housing market. The goal is to make sound financial decisions.