42 500 A Year Is How Much An Hour

Imagine sipping your morning coffee, the sunlight streaming through the window, and the gentle hum of possibilities filling the air. The day stretches ahead, promising a blend of challenges and rewards. But what if, underlying every task and decision, was the comforting knowledge of financial stability – a paycheck that reflected your worth and offered a pathway to your dreams? It’s a scenario many aspire to, and understanding the nuts and bolts of earnings, like figuring out the hourly equivalent of an annual salary, is a crucial step towards achieving it.

This article breaks down what an annual salary of $42,500 translates to on an hourly basis. It considers standard work schedules and provides context on how this figure fits into the broader economic landscape. We aim to provide a clear and accessible understanding of personal finances.

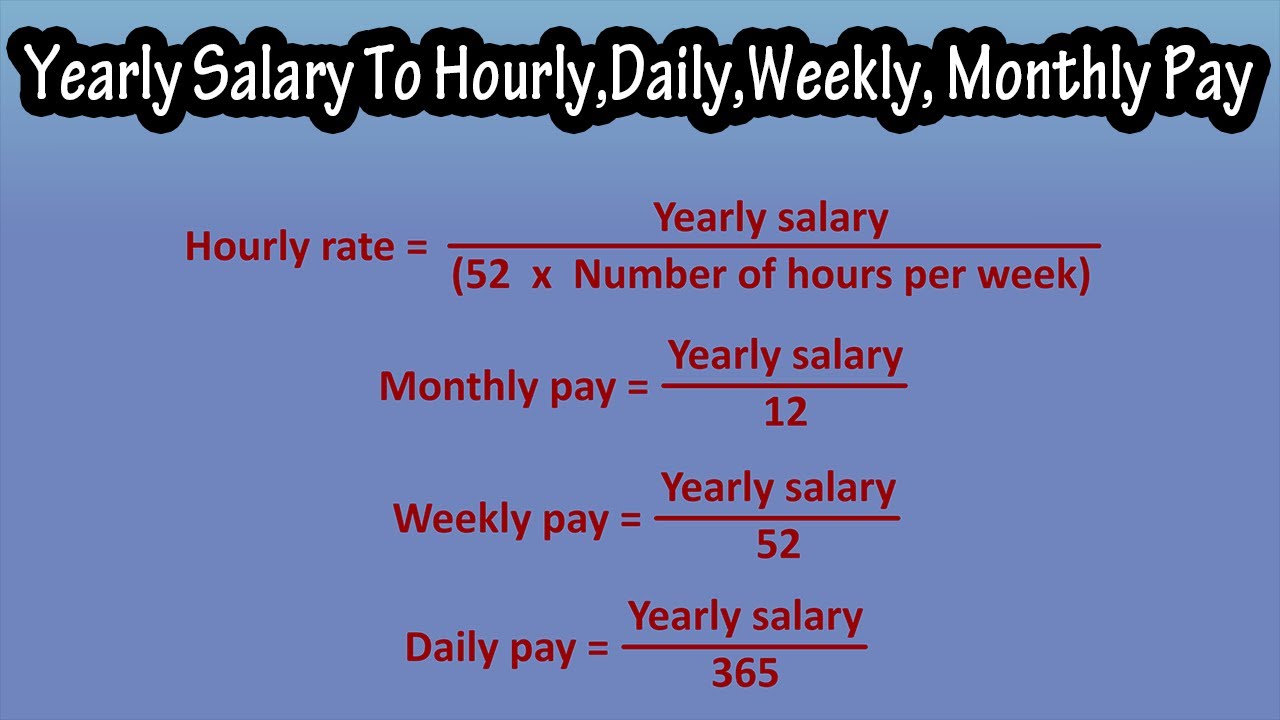

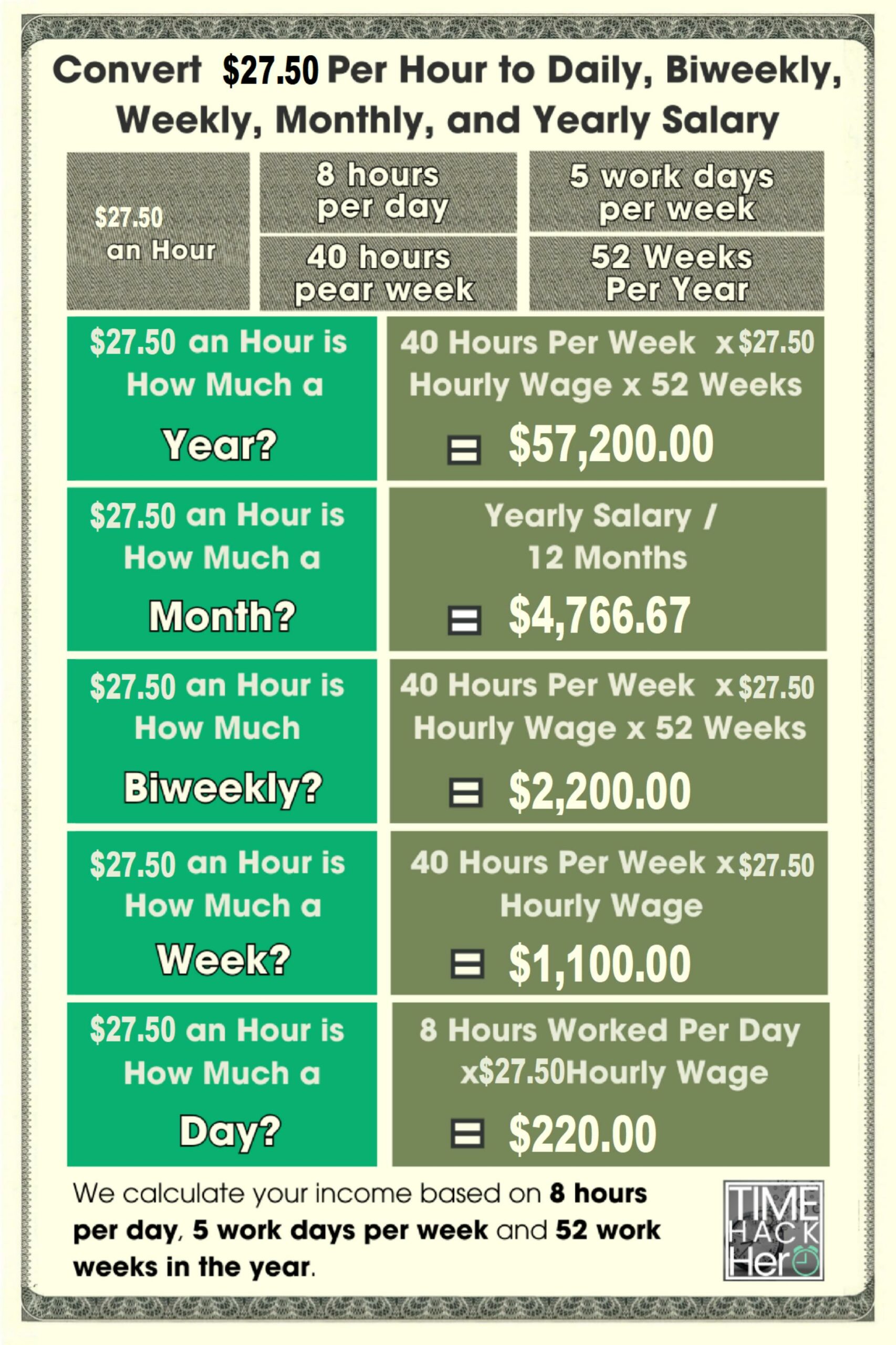

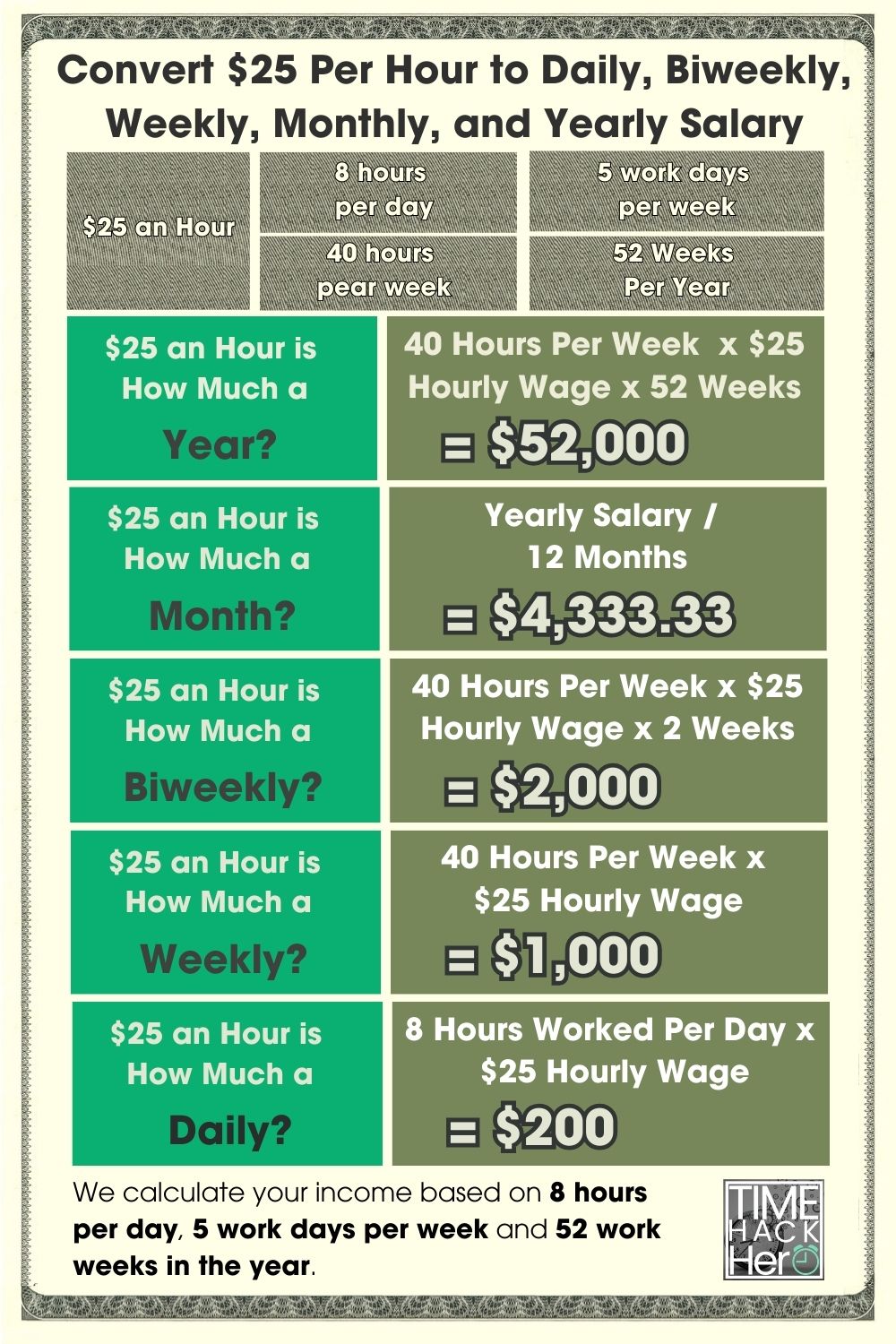

Understanding the Calculation

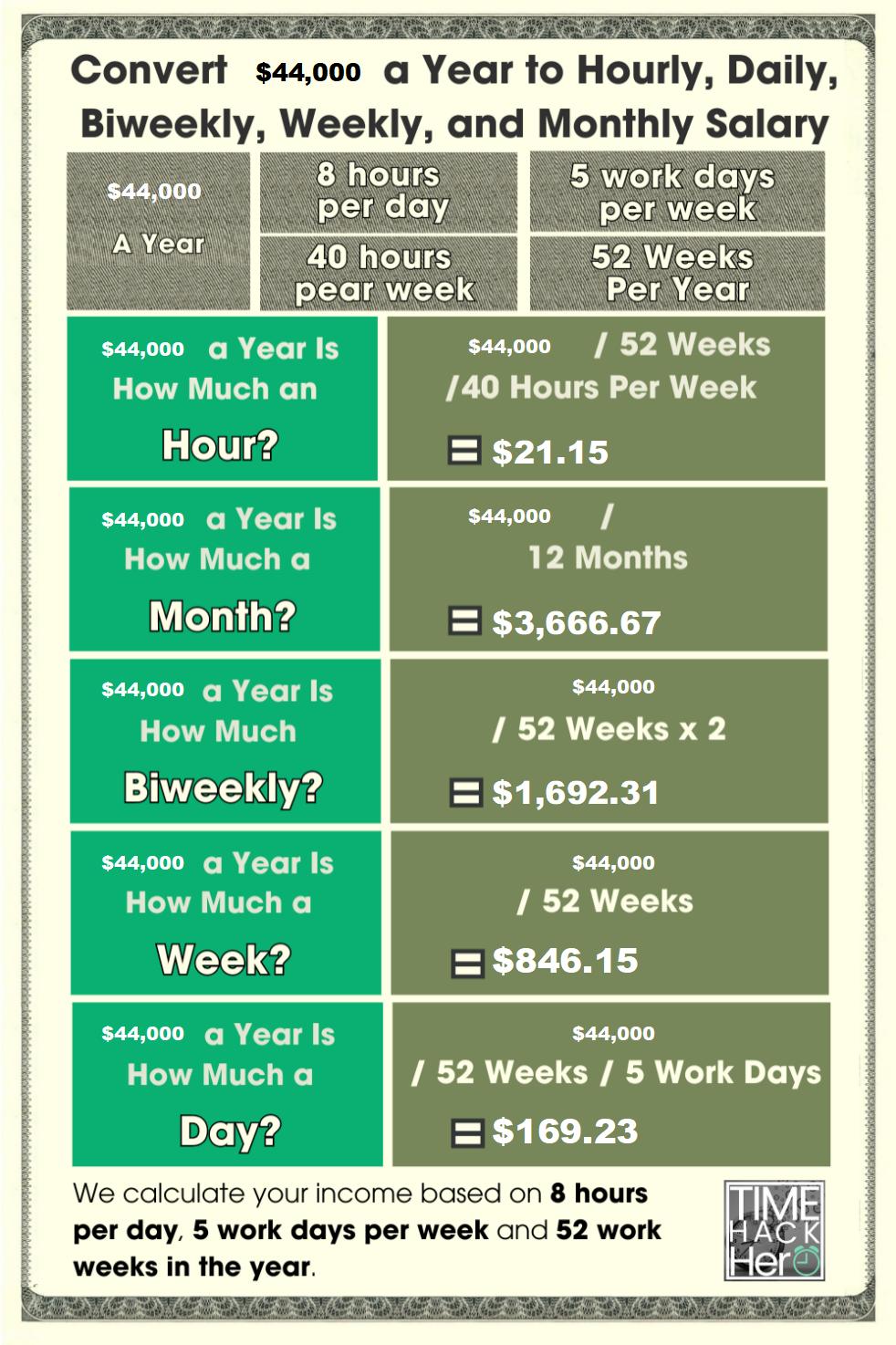

Calculating your hourly wage from an annual salary involves a simple mathematical formula. The standard approach assumes a 40-hour workweek. The yearly working hours are obtained by multiplying 40 hours by the number of working weeks in a year (52).

Therefore, 40 hours/week * 52 weeks/year = 2080 hours/year. To find the hourly wage, you divide the annual salary by the total number of working hours in a year.

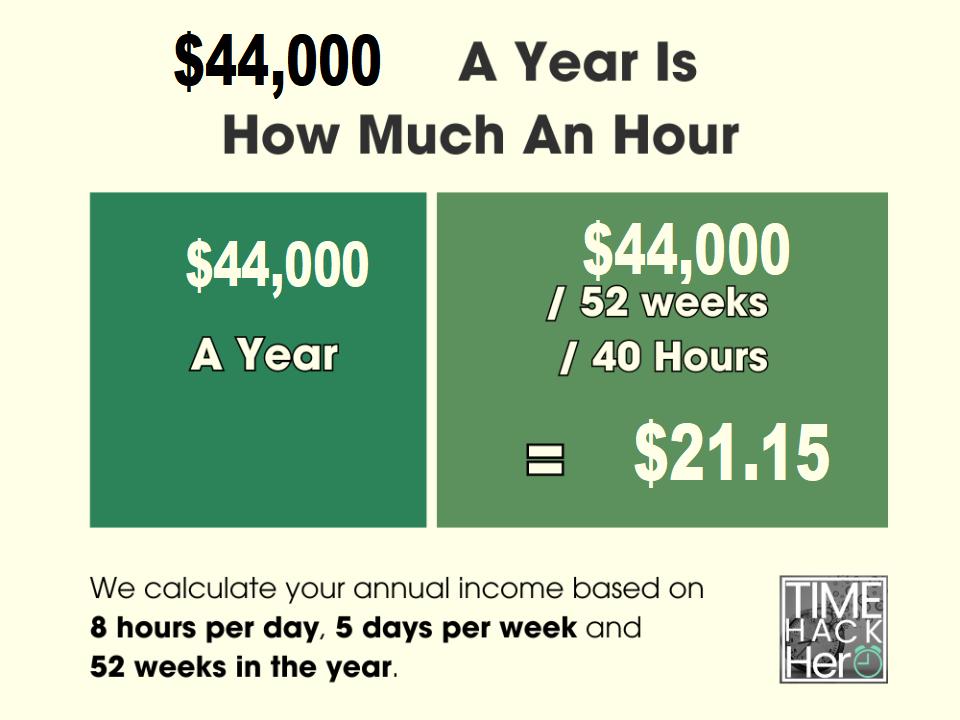

Calculation: $42,500 / 2080 hours = $20.43/hour (approximately).

The $20.43 per Hour Reality

So, a $42,500 annual salary equates to approximately $20.43 per hour. This calculation is based on the typical 40-hour workweek. It's important to remember that this is a pre-tax figure.

This number serves as a baseline. Individual circumstances, deductions, and additional income can influence your actual take-home pay.

Factors Affecting Your Take-Home Pay

The $20.43 hourly wage derived earlier is a gross figure. Your actual take-home pay will be less due to various deductions.

These deductions typically include federal income tax, state income tax (where applicable), Social Security taxes, and Medicare taxes. Health insurance premiums, retirement contributions, and other voluntary deductions will also impact the final amount.

Taxes can vary significantly based on your filing status (single, married, etc.) and the number of dependents you claim. Using online tax calculators or consulting a tax professional can provide a more accurate estimate of your net pay.

$42,500 in the Context of Living Expenses

The purchasing power of $42,500 annually, or $20.43 per hour, varies greatly depending on geographic location. What constitutes a comfortable living in a rural area may be significantly different from a metropolitan city.

Consider housing costs, transportation expenses, food prices, and entertainment costs. These all contribute to the overall cost of living in a specific area.

According to the MIT Living Wage Calculator, a single adult in many parts of the United States may find $42,500 adequate to cover basic needs. However, in high-cost areas, it may require careful budgeting or supplemental income.

Comparing to Minimum Wage and Average Earnings

The federal minimum wage in the United States is $7.25 per hour. Many states and localities have established higher minimum wage rates.

Earning $20.43 per hour places an individual significantly above the federal minimum wage. The Bureau of Labor Statistics (BLS) provides data on average earnings across various occupations and industries.

Comparing your hourly wage to these averages can provide a benchmark. It helps you understand where you stand in relation to others in similar roles or industries.

Industries and Occupations Earning Around $42,500

Many different industries and occupations offer salaries in the vicinity of $42,500. These roles often require a mix of education, skills, and experience.

Some examples may include entry-level positions in fields like customer service, administrative support, retail management, and some skilled trades. Specific job titles could include customer service representatives, office assistants, retail supervisors, and entry-level technicians.

The career website Indeed and the BLS Occupational Outlook Handbook are valuable resources for researching specific occupations and their associated salary ranges.

Strategies for Increasing Your Earning Potential

If you're aiming to increase your earning potential beyond $42,500, there are several strategies to consider. These may involve investing in education, acquiring new skills, or seeking opportunities for advancement.

Pursuing higher education, such as a bachelor's or master's degree, can often lead to higher-paying positions. Learning in-demand skills through vocational training, certifications, or online courses can also make you a more competitive candidate.

Networking within your industry, seeking mentorship, and actively pursuing promotions or lateral moves to higher-paying roles are essential. Don't underestimate the importance of negotiating your salary during job offers or performance reviews.

The Psychological Impact of Financial Awareness

Understanding your hourly wage and its implications can have a positive psychological impact. It empowers you to make informed financial decisions.

Knowing how much you earn per hour can help you prioritize spending. It allows you to set realistic financial goals, and track your progress towards those goals.

This awareness can reduce financial stress. It promotes a sense of control over your finances and contribute to overall well-being. Remember that knowledge is power when it comes to managing your money.

Beyond the Numbers: Finding Value in Your Work

While financial compensation is undoubtedly important, it's crucial to remember that work offers more than just a paycheck. Feeling valued and appreciated in your role can significantly impact your job satisfaction and overall quality of life.

Consider factors such as the work environment, the opportunities for growth and development, and the sense of purpose or contribution you derive from your work. A job that aligns with your values and passions can be more rewarding than a higher-paying job that leaves you feeling unfulfilled.

Ultimately, finding a balance between financial stability and personal fulfillment is key. Understand the value you bring to the table, and how that translates into your hourly rate.

Looking Ahead

Understanding the hourly equivalent of an annual salary is a simple but powerful step towards financial literacy. In this article, we've explored how to calculate the hourly rate of $42,500 per year.

We also discussed factors that influence take-home pay. Furthermore, we examined its implications for living expenses and explored strategies for increasing your earning potential.

Equipped with this knowledge, you are better prepared to navigate your financial journey with confidence and clarity. Remember, financial awareness is a continuous process.