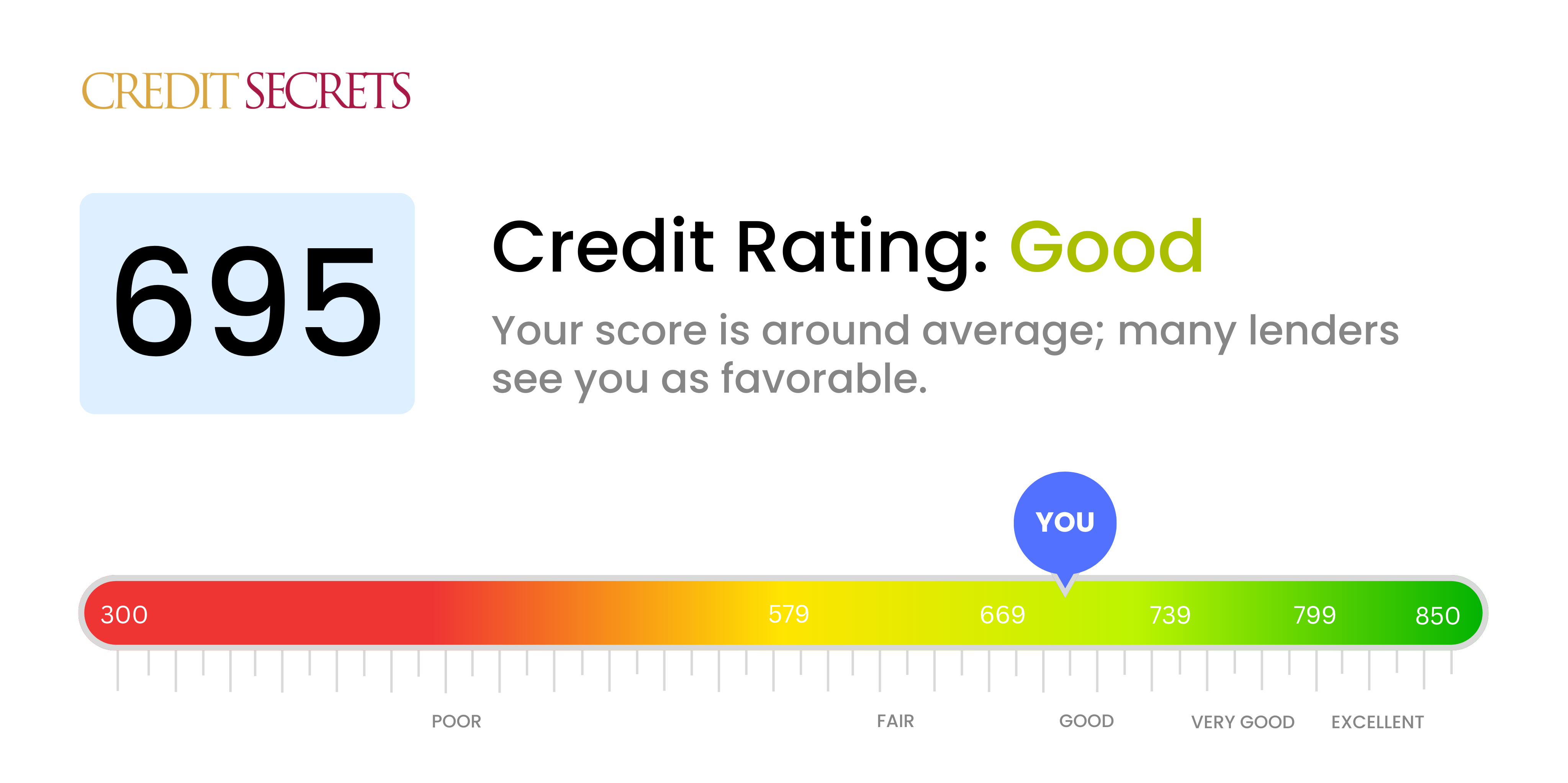

695 Credit Score Is That Good

Is your 695 credit score good enough? The answer is more nuanced than a simple yes or no, impacting everything from loan approvals to interest rates.

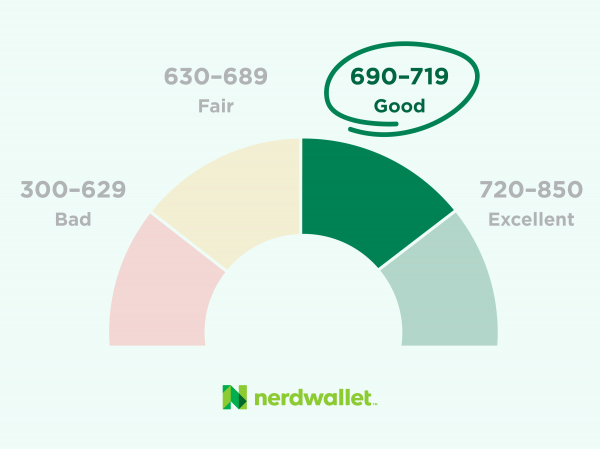

A 695 credit score typically falls within the "fair" range. This affects your financial opportunities and necessitates understanding its implications and how to improve it.

Understanding the 695 Credit Score

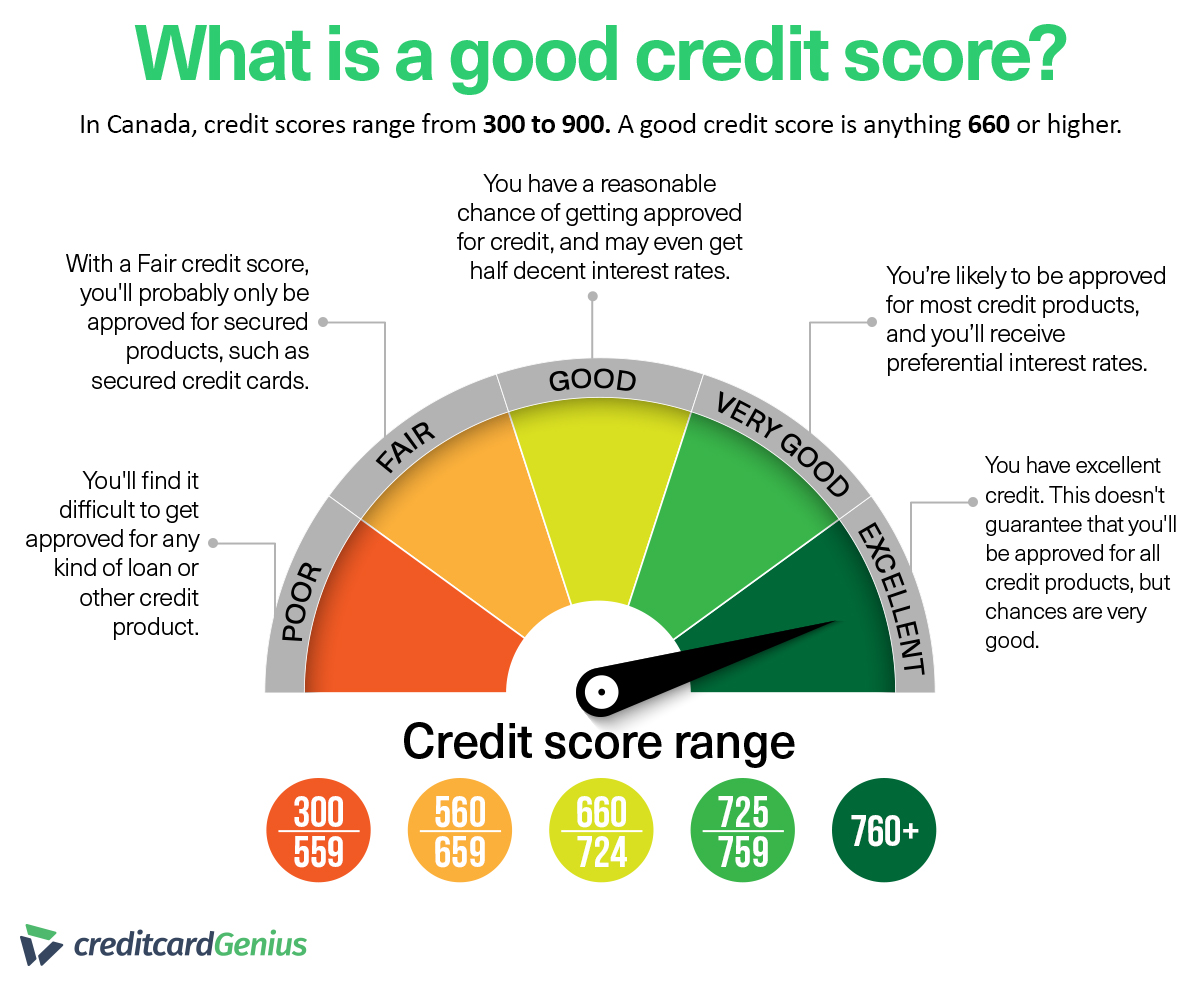

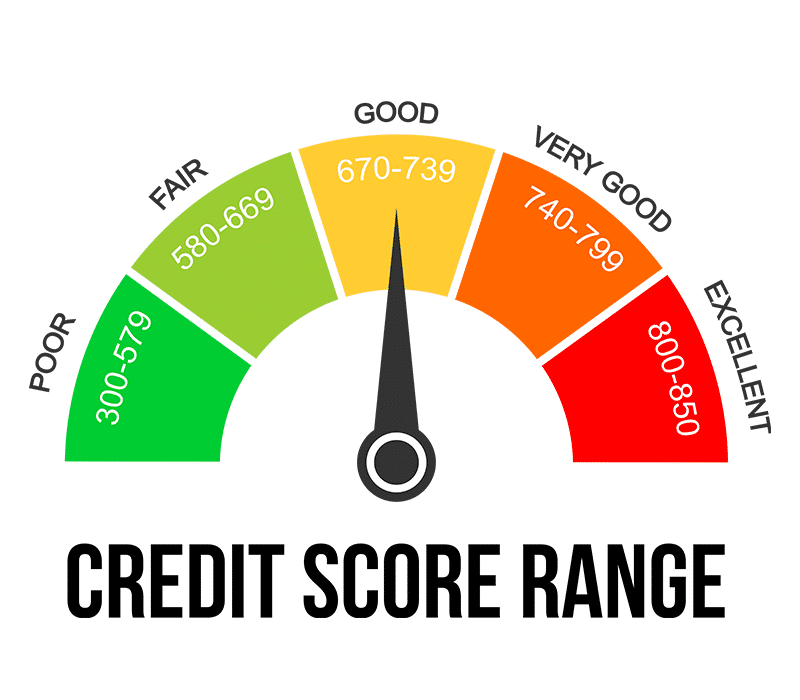

Credit scores, ranging from 300 to 850, are calculated by credit bureaus like Equifax, Experian, and TransUnion. These scores reflect your creditworthiness based on factors such as payment history, amounts owed, length of credit history, credit mix, and new credit.

A 695 score usually means that while you're not considered a high-risk borrower, you also don't qualify for the best interest rates or loan terms.

What a 695 Score Means for You

Loan Approvals: Getting approved for loans is possible, but expect higher interest rates compared to someone with a "good" (670-739) or "excellent" (740-850) score. This includes mortgages, auto loans, and personal loans.

Interest Rates: According to recent data from MyFICO, a 695 score could translate to paying significantly more in interest over the life of a loan. For example, a difference of even a few points can add up to thousands of dollars on a mortgage.

Credit Cards: While some credit cards might be available, the rewards programs and perks might not be as attractive as those offered to individuals with higher scores.

Other Implications: Landlords, employers, and insurance companies may also check your credit report. A 695 score may not disqualify you outright, but it could influence their decision or lead to higher premiums.

Why Your Score Matters

A lower credit score directly impacts your financial health. Higher interest rates mean more money spent on debt, limiting your ability to save and invest.

Data shows a strong correlation between credit scores and financial stability. People with lower scores often struggle with debt management and face more financial challenges.

The who affected are consumers looking for credit, the what is the impact of a 695 credit score, the where is the financial marketplace, the when is ongoing, and the why is due to credit risk assessment.

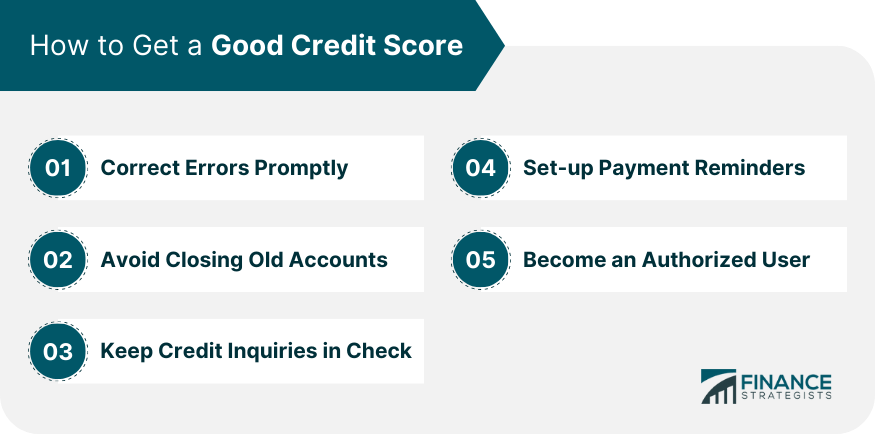

How to Improve Your Credit Score

Payment History: Make all payments on time. Late payments are a major factor in lowering your score.

Credit Utilization: Keep your credit card balances low. Experts recommend using no more than 30% of your available credit.

Credit Report Review: Regularly check your credit reports for errors and dispute any inaccuracies with the credit bureaus.

Avoid Opening Too Many Accounts: Opening multiple credit accounts in a short period can negatively impact your score.

Become an Authorized User: Ask a trusted friend or family member with good credit to add you as an authorized user on their credit card.

Expert Advice

“Building a strong credit score is a marathon, not a sprint,” says John Ulzheimer, a credit expert formerly with FICO and Equifax. “Focus on consistent, responsible credit management to see gradual improvements.”

According to the Consumer Financial Protection Bureau (CFPB), understanding your credit report is the first step towards building better credit. They offer resources and tools to help consumers manage their credit.

Next Steps

If you have a 695 credit score, take immediate action to improve it. Start by pulling your credit reports from all three bureaus and addressing any errors.

Consider setting up payment reminders to avoid late payments. Explore options for debt consolidation or balance transfers to lower your credit utilization.

Ongoing monitoring of your credit score and report is crucial to maintaining and improving your financial health. Stay informed and take proactive steps to manage your credit responsibly.