A Broker Dealer Is Permitted To Accept Payment

The regulatory landscape governing financial transactions in the securities industry has witnessed a significant shift, sparking both optimism and concern among market participants. A recent decision by the Securities and Exchange Commission (SEC) to permit a broker-dealer to accept payment for order flow (PFOF) under specific conditions has ignited a debate about the balance between innovation, competition, and investor protection.

This pivotal ruling challenges long-standing interpretations of existing regulations and raises critical questions about market transparency and potential conflicts of interest. The industry is now grappling with the implications of this decision, trying to understand its potential impact on retail investors, market makers, and the overall efficiency of the US equity market.

The Nut Graf: Understanding the SEC's Decision

The SEC's decision, detailed in a recent order, allows Virtu Financial, a major market maker and broker-dealer, to receive PFOF under specific, carefully defined circumstances. This authorization hinges on Virtu demonstrating that the arrangement results in best execution for its clients, ensuring that orders are executed at the most favorable terms reasonably available.

This includes price improvement and other factors beyond simply the displayed quote. The SEC emphasizes the importance of rigorous monitoring and compliance to prevent any potential disadvantages to retail investors.

Payment for Order Flow: A Primer

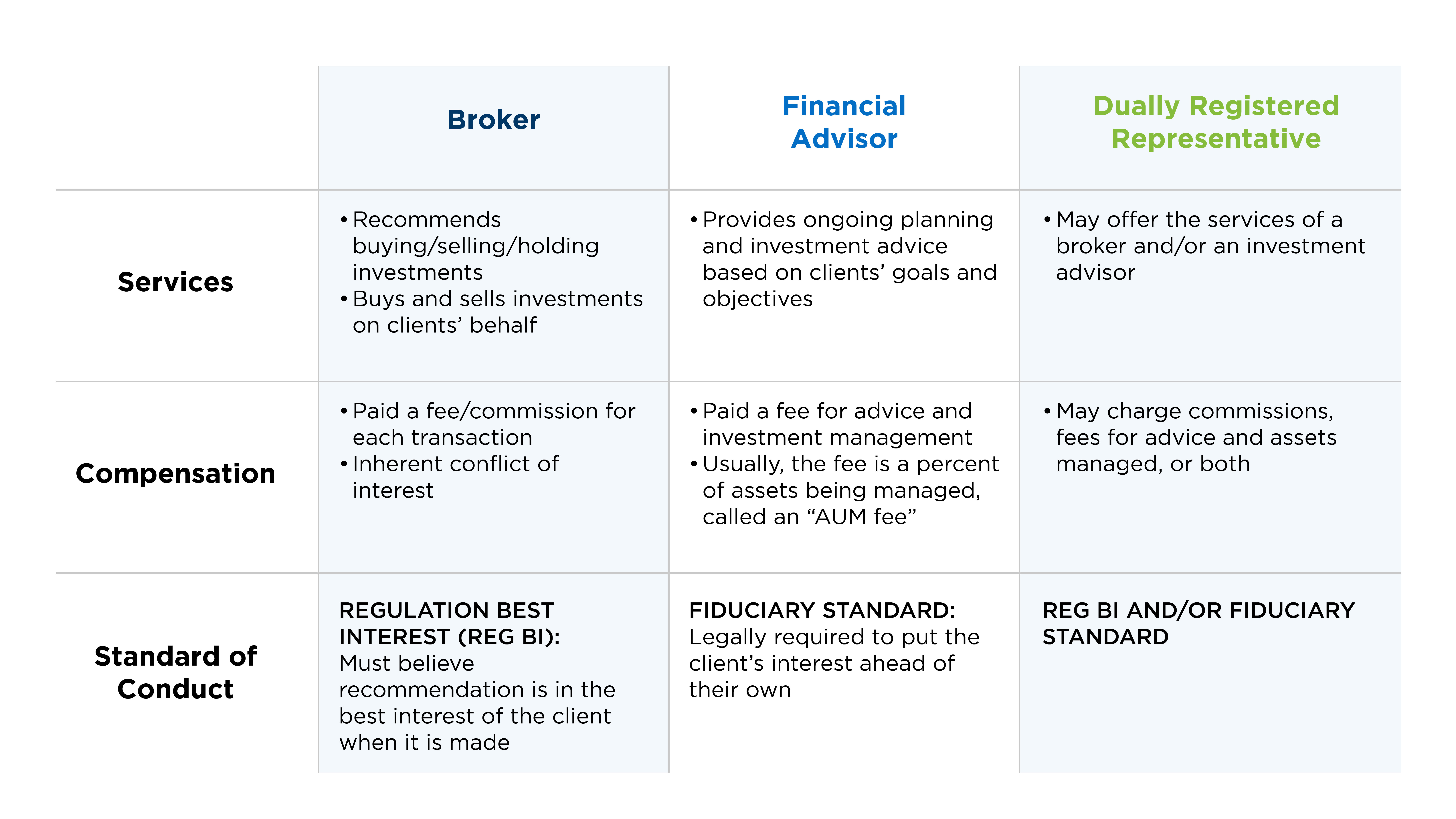

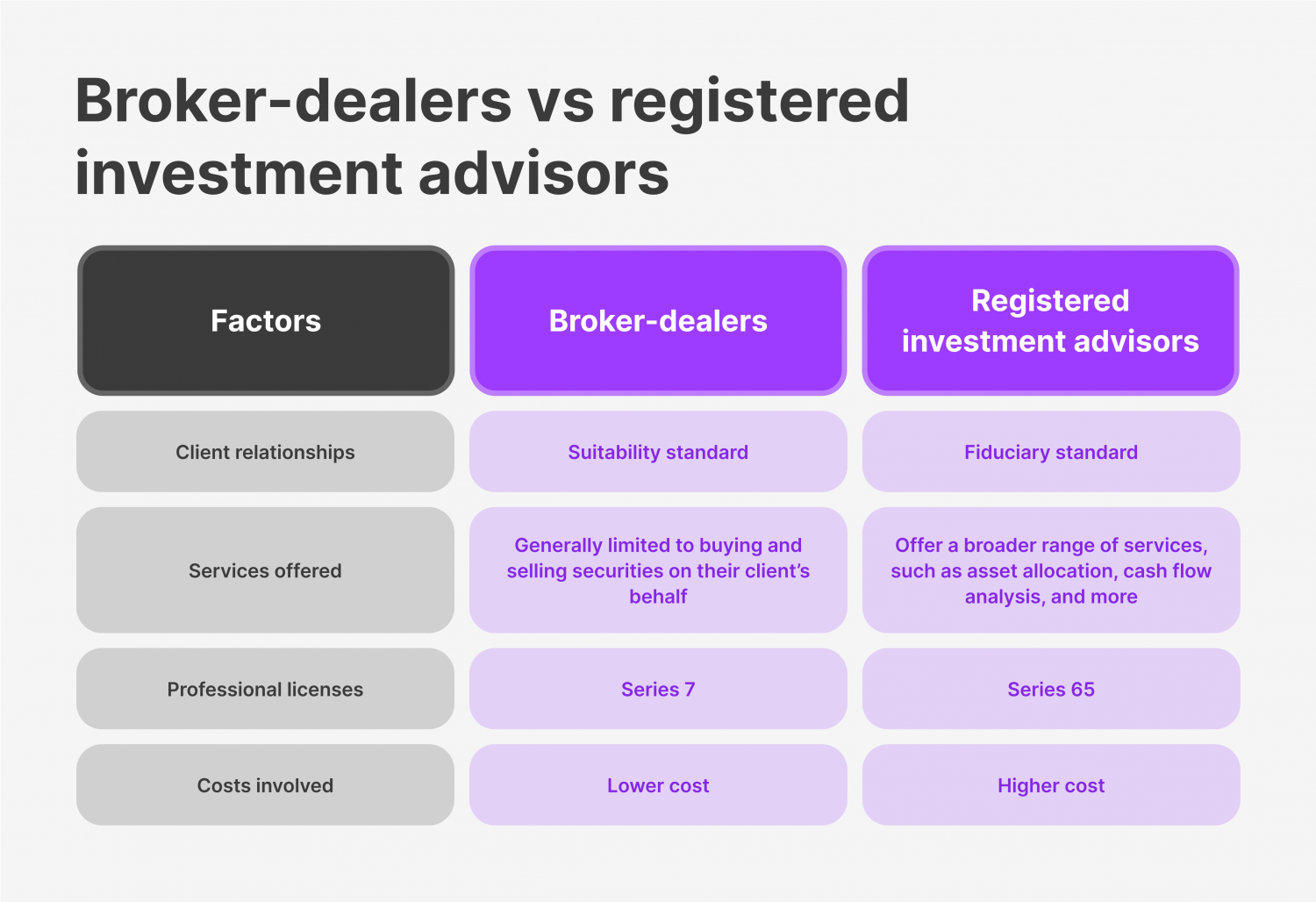

Payment for order flow is a common practice where broker-dealers receive compensation from market makers for routing customer orders to them for execution. Market makers, in turn, profit from the bid-ask spread and potential price movements.

Critics argue that PFOF creates a conflict of interest, incentivizing brokers to route orders to market makers offering the highest payment, rather than those providing the best price for the customer. Proponents contend that PFOF allows brokers to offer commission-free trading, benefiting retail investors by lowering the barriers to entry into the market.

Conditions and Safeguards

The SEC's approval of Virtu's PFOF arrangement is subject to strict conditions designed to protect investors. Virtu must demonstrate that its routing practices consistently deliver best execution, as evaluated against industry benchmarks and internal performance metrics.

Regular audits and reporting are required to ensure compliance with these conditions. Furthermore, the SEC reserves the right to revoke the approval if it finds evidence of harm to investors or violations of securities laws.

Expert Perspectives: A Divided Opinion

The SEC's decision has elicited varied reactions from industry experts and advocacy groups. Some analysts believe that the ruling could pave the way for greater competition and innovation in the brokerage industry.

Others express concern that it could undermine investor protection and market integrity. Dennis Kelleher, President of Better Markets, a non-profit advocacy group, stated, "This decision raises serious questions about whether the SEC is prioritizing the interests of market makers over those of retail investors."

He added, "Robust oversight and enforcement will be critical to prevent abuses and ensure that investors receive fair treatment." James Angel, a finance professor at Georgetown University, offered a different perspective. He argued, "PFOF, when properly regulated, can benefit retail investors by lowering trading costs and increasing market liquidity."

He emphasized that the key is to ensure transparency and prevent brokers from sacrificing execution quality for higher payments.

Data and Evidence: Assessing the Impact

Assessing the true impact of PFOF requires careful analysis of trading data and execution quality metrics. Studies on the effects of PFOF have yielded mixed results, with some showing that it leads to slightly better execution prices for retail investors, while others find no significant difference or even slightly worse prices in some cases.

A report by the Financial Industry Regulatory Authority (FINRA) highlighted the importance of broker-dealers conducting thorough reviews of their routing practices to ensure best execution. The report emphasized that price improvement alone is not sufficient and that brokers must consider other factors such as speed of execution and order fill rates.

The Broader Regulatory Context

The SEC's decision on Virtu's PFOF arrangement comes amid ongoing debates about the regulation of market structure and trading practices. The rise of commission-free trading has fueled the growth of PFOF, leading to calls for greater transparency and oversight.

Some lawmakers have proposed banning PFOF altogether, arguing that it inherently creates a conflict of interest. Others favor stricter regulation and increased disclosure requirements.

Looking Ahead: The Future of PFOF

The SEC's decision on Virtu's PFOF arrangement could set a precedent for other broker-dealers seeking to engage in similar practices. It remains to be seen how the industry will respond and whether other firms will seek similar exemptions.

The SEC is expected to closely monitor the implementation of this arrangement and will likely use its findings to inform future policy decisions on PFOF and related issues. The debate surrounding PFOF is likely to continue as regulators, industry participants, and advocacy groups grapple with the challenges of balancing innovation, competition, and investor protection in the evolving financial landscape.

:max_bytes(150000):strip_icc()/broker-dealer.asp-Final-cd1a92eeadf84c5b9f13bce3e44d8d99.jpg)