A Common Measure Of Long-term Solvency Is

Amidst growing economic uncertainty and fluctuating market conditions, understanding the financial health of companies is more critical than ever. Investors, creditors, and stakeholders alike are increasingly turning to key financial metrics to assess the long-term viability of businesses.

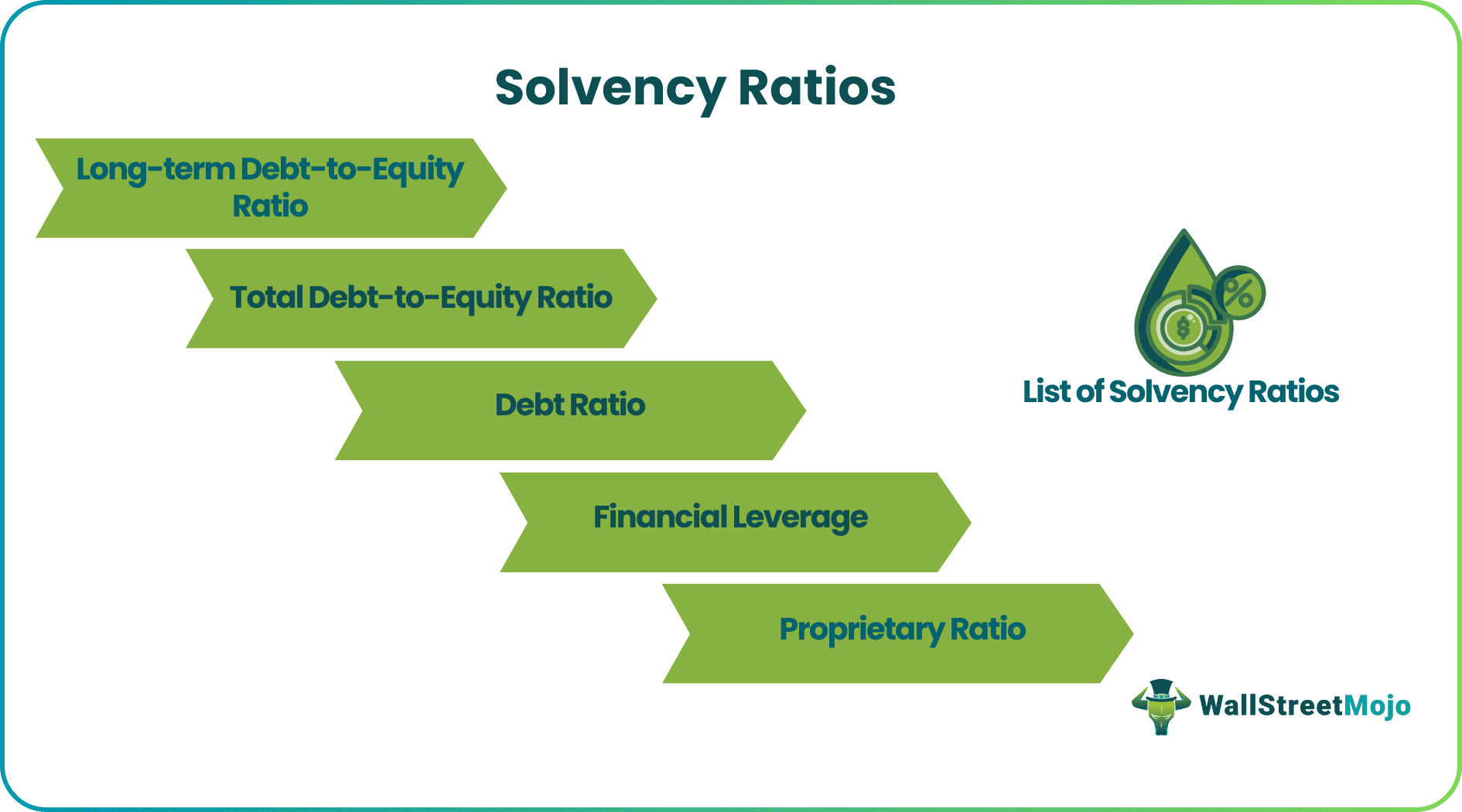

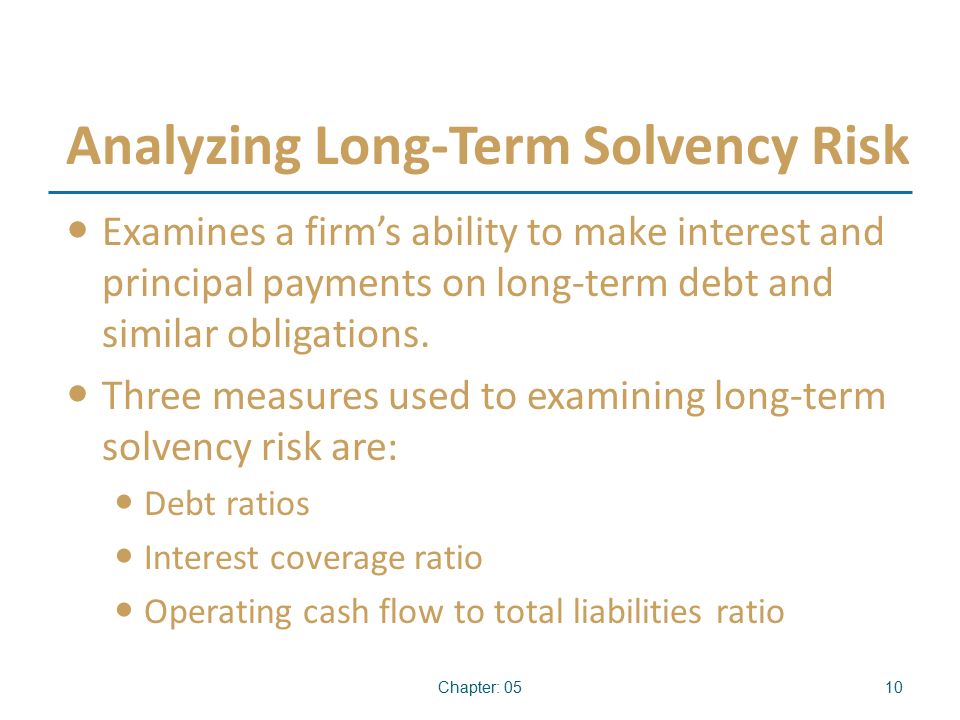

At the heart of this assessment lies the concept of solvency, a company's ability to meet its long-term financial obligations. One of the most commonly used measures for gauging this crucial aspect of financial stability is the Debt-to-Equity Ratio. This ratio offers a clear picture of a company's leverage and its reliance on debt versus equity financing.

What is the Debt-to-Equity Ratio?

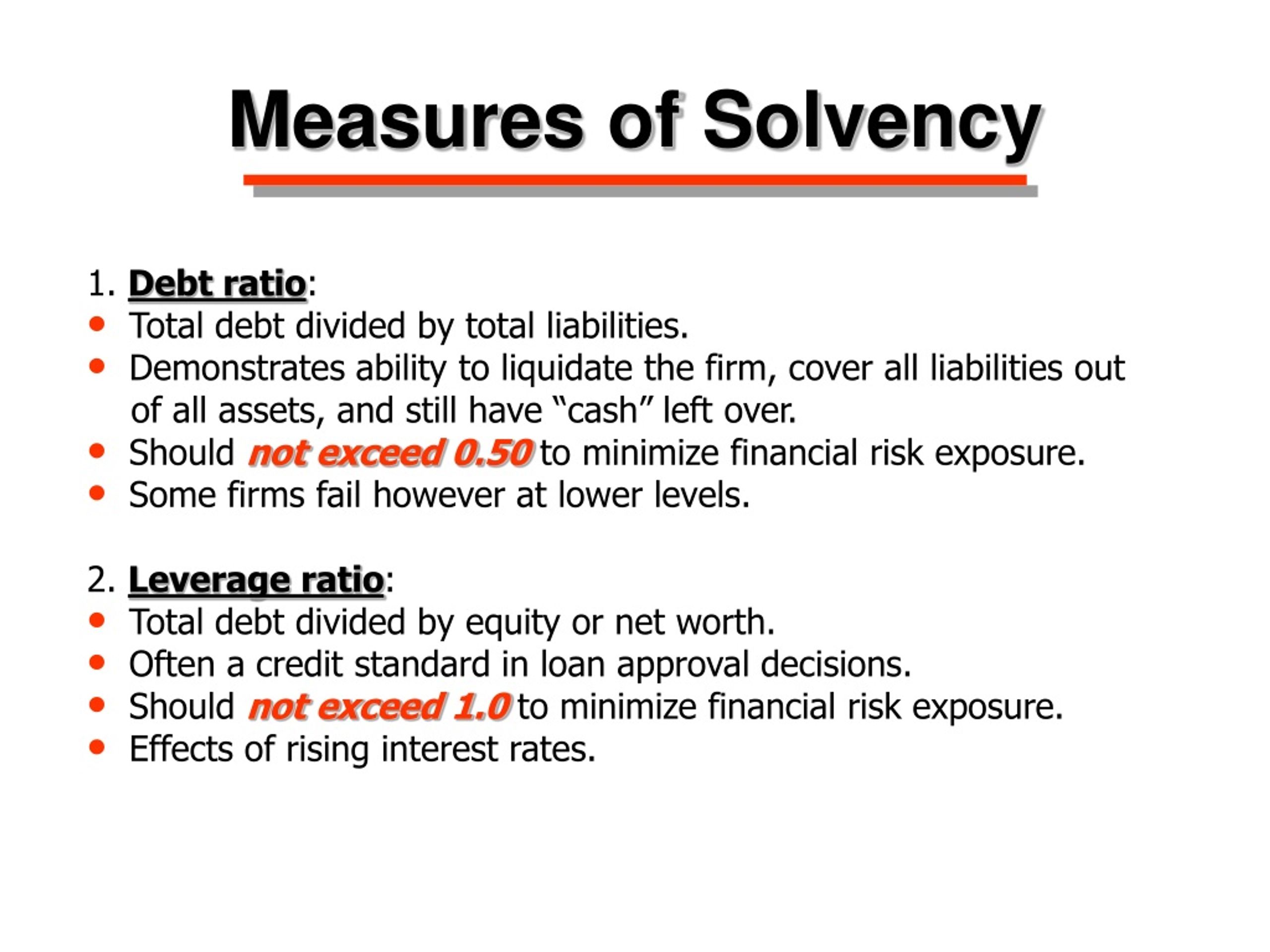

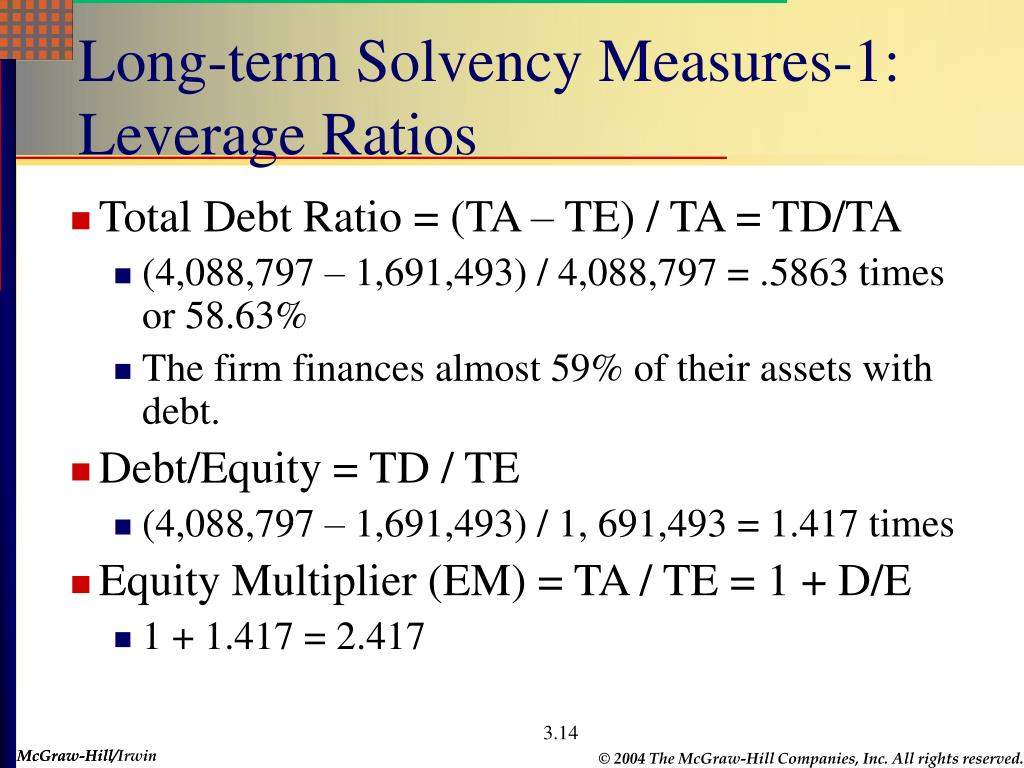

The Debt-to-Equity (D/E) ratio compares a company's total liabilities to its shareholders' equity. It essentially indicates the proportion of a company's financing that comes from debt compared to the proportion that comes from equity. A higher ratio generally suggests that a company relies more heavily on debt financing.

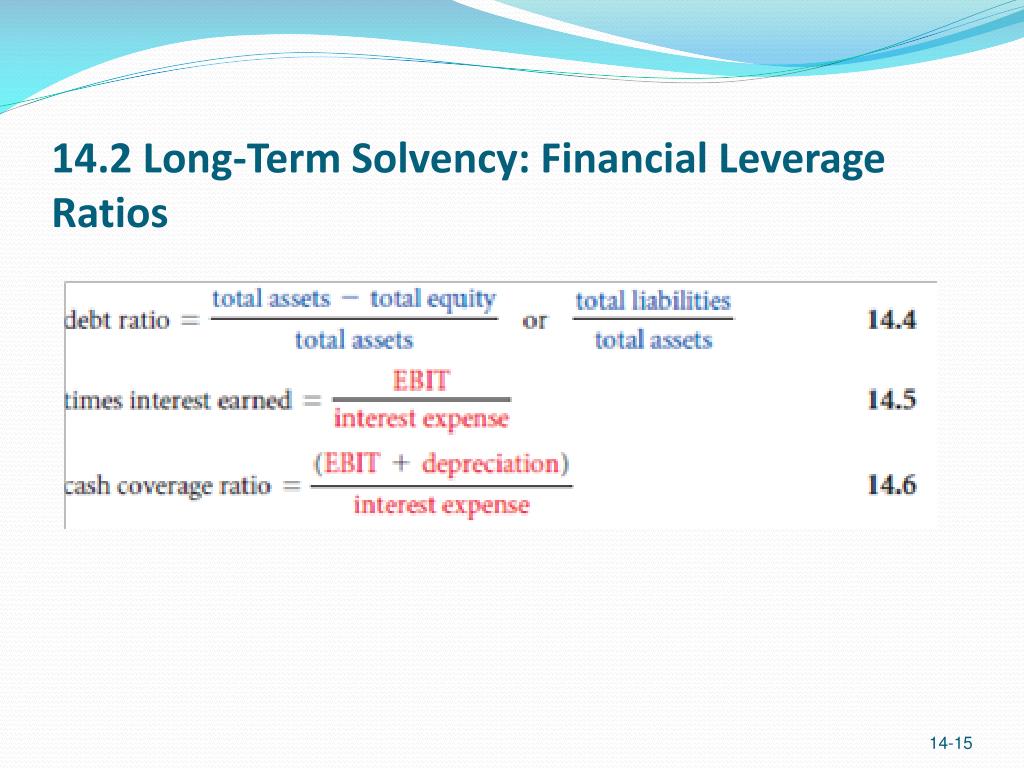

The formula for calculating the Debt-to-Equity Ratio is simple: Total Liabilities / Shareholders' Equity. Both figures can be readily found on a company's balance sheet, a standard financial statement.

How is the D/E Ratio Interpreted?

Interpreting the Debt-to-Equity Ratio requires considering industry-specific benchmarks and the company's overall financial strategy. A high ratio can signal increased financial risk, as a greater proportion of earnings may be needed to service debt.

However, a high ratio isn't always negative. Some industries, such as utilities or real estate, often have higher D/E ratios due to the capital-intensive nature of their operations.

Conversely, a low Debt-to-Equity Ratio may indicate a more conservative financial approach. It can also suggest that a company might not be taking full advantage of potential leverage to boost returns.

Factors Affecting the D/E Ratio

Several factors can influence a company's Debt-to-Equity Ratio. Economic conditions, for instance, can impact a company's ability to generate revenue and manage its debt burden. Interest rate fluctuations play a significant role, as higher rates increase the cost of borrowing and can impact profitability.

Additionally, a company's own investment decisions and capital structure choices directly affect its D/E ratio. Strategic acquisitions, stock buybacks, and dividend policies all contribute to the balance between debt and equity.

The Significance of the D/E Ratio

The Debt-to-Equity Ratio is a valuable tool for multiple stakeholders. Investors can use it to assess the risk associated with investing in a particular company.

Creditors rely on the D/E ratio to evaluate a company's creditworthiness before extending loans. A high ratio may raise concerns about the company's ability to repay its obligations.

Management uses the D/E ratio to monitor the company's financial health and make informed decisions about capital structure. It allows them to optimize the use of debt and equity to maximize shareholder value.

Limitations of the D/E Ratio

While the Debt-to-Equity Ratio is a widely used indicator of solvency, it has limitations. It's essential to compare companies within the same industry, as acceptable ratios vary significantly across sectors.

Off-balance sheet financing and lease obligations may not always be fully captured in the ratio, potentially understating a company's true debt levels. Accounting practices can also influence the reported values, making it crucial to analyze the underlying financial statements.

Real-World Example

Consider two companies in different industries: TechCo, a technology company, and BuildCorp, a construction company. TechCo might have a lower D/E ratio due to its reliance on equity financing and internally generated cash flow.

BuildCorp, on the other hand, could have a higher D/E ratio reflecting its need to finance large projects with debt. Without understanding these context, it is hard to compare the financial health of these two companies.

Looking Ahead

The Debt-to-Equity Ratio remains a fundamental measure of long-term solvency. However, it should be used in conjunction with other financial metrics and qualitative factors for a comprehensive assessment.

In an ever-changing economic landscape, a thorough understanding of financial ratios is essential for informed decision-making. By understanding and utilizing the D/E ratio effectively, all parties can gain valuable insights into the financial health and future prospects of businesses.

.jpg)