A Company Has Satisfied Its Performance Obligation When The

+Each+Performance+Obligation+is+Satisfied.jpg)

Imagine a bustling marketplace, vendors hawking their wares, customers carefully inspecting each item. A farmer proudly presents a basket of ripe, red tomatoes, and a chef examines them with a discerning eye. The exchange – the farmer handing over the tomatoes, the chef paying the agreed price – signifies the completion of a deal, a promise fulfilled. This simple transaction, mirrored in countless ways across the global economy, illuminates the core of when a company has satisfied its performance obligation.

Understanding when a performance obligation is satisfied is crucial for accurate financial reporting and business decision-making. This determines when revenue can be recognized, impacting a company's reported profitability and ultimately, its perceived value. It's more than just a technical accounting rule; it reflects the culmination of effort and the fulfillment of a promise to a customer.

The Core of Performance Obligations

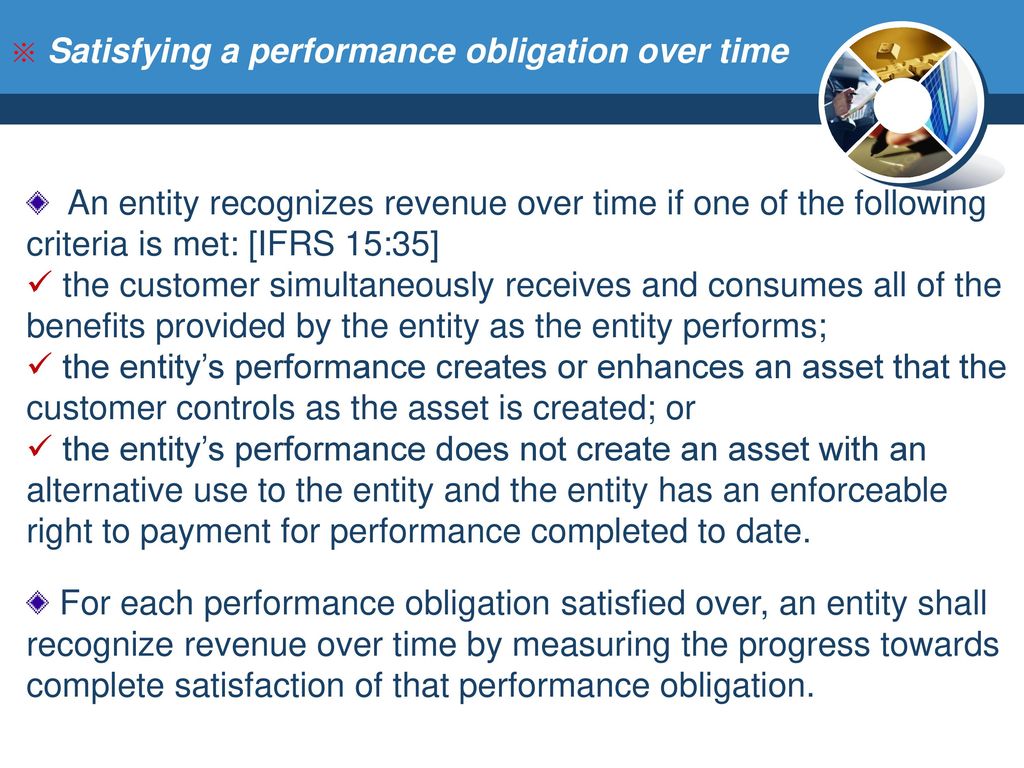

A performance obligation, as defined under accounting standards like IFRS 15 and ASC 606, is a promise in a contract with a customer to transfer a good or service. This good or service must be distinct, meaning the customer can benefit from it on its own or together with other resources readily available to them. Think of it as the specific thing the customer is paying for.

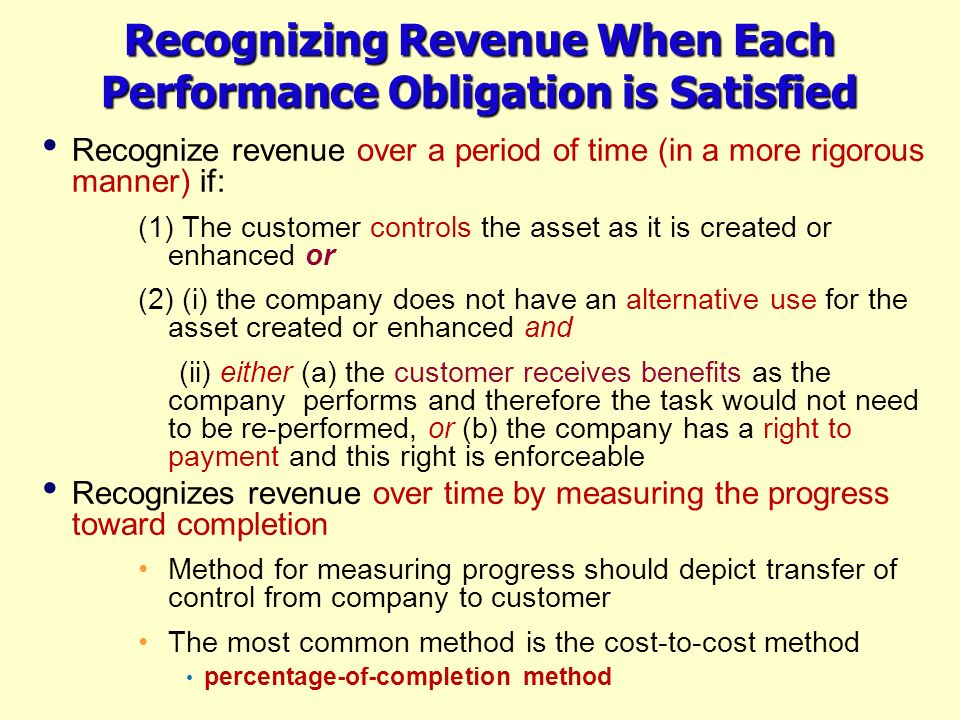

The satisfaction of a performance obligation occurs when the company transfers control of the good or service to the customer. This is the pivotal moment when the customer has the ability to direct the use of the asset and obtain substantially all of its remaining benefits. It's about more than just delivery; it's about the customer having the power to use and benefit from what they've purchased.

Defining "Control" in Practical Terms

But what does "control" actually mean? Several indicators are considered to determine if control has transferred to the customer. These include the customer's legal title to the asset, physical possession, acceptance of the asset, and the risks and rewards of ownership. No single indicator is necessarily decisive; rather, a holistic assessment is needed.

For instance, if a construction company builds a bridge according to a contract, control typically transfers to the customer (e.g., a municipality) as the bridge is being built, if the municipality has continuous access to and control over the work in progress. The company recognizes revenue over time, reflecting the gradual transfer of control. Conversely, for a standard product sold in a retail store, control usually transfers at a single point in time – when the customer walks out with the item.

Examples Across Industries

Let's look at some concrete examples. A software company selling a perpetual license satisfies its performance obligation when the customer can access and use the software. This is typically upon delivery of the license key and provision of necessary installation instructions. Microsoft, for example, recognizes revenue from software licenses when these conditions are met.

For a subscription service like Netflix, the performance obligation is satisfied continuously over the subscription period. Netflix provides ongoing access to its streaming content, and revenue is recognized ratably over the month or year. This reflects the ongoing transfer of value to the customer.

In the case of consulting services provided by a firm like McKinsey, the performance obligation is often satisfied over time as the consulting work is performed. This involves assessing milestones and progress towards the agreed-upon deliverables. The company recognizes revenue based on the stage of completion of the project.

The Significance of Accurate Recognition

Accurate revenue recognition is paramount for a company's financial health and its relationship with investors. It ensures that financial statements reflect a true and fair view of the company's performance. This is especially important for companies seeking investment or loans, as lenders and investors rely on accurate financial data to make informed decisions.

Improper revenue recognition can lead to misstated earnings, potentially misleading investors and resulting in legal and reputational damage. Companies must have robust internal controls and processes in place to ensure compliance with accounting standards. This includes carefully reviewing contracts, identifying performance obligations, and determining when control transfers to the customer.

Challenges and Considerations

While the principles are clear, applying them in practice can be complex. Some contracts involve multiple performance obligations, requiring careful allocation of the transaction price to each obligation. This can be particularly challenging in bundled sales or service arrangements. The ASC 606 and IFRS 15 standards provide detailed guidance, but professional judgment is often required.

Changes in contracts after they are initially agreed upon can also create complexities. Modifications to the scope of work or the price may require reassessment of the performance obligations and their timing of satisfaction. Staying updated on the latest accounting interpretations and pronouncements is crucial for finance professionals.

Looking Ahead: The Future of Revenue Recognition

As businesses become more complex and globalized, the importance of accurate and transparent revenue recognition will only increase. Technological advancements such as automation and AI are playing a growing role in assisting companies with revenue recognition processes. These technologies can help streamline data collection, improve accuracy, and enhance compliance.

The principles underlying performance obligation satisfaction are fundamental to sound financial reporting. By diligently applying these principles and continuously improving their processes, companies can ensure that their financial statements reflect a true and fair view of their performance, fostering trust and confidence among stakeholders.

In the end, it comes back to that bustling marketplace – the farmer delivering the tomatoes, the chef accepting them, and the exchange signifying a promise kept. The satisfaction of a performance obligation is more than just an accounting entry; it's the tangible result of a company delivering value to its customers, one transaction at a time.

+Each.jpg)

+Each.jpg)

+Each+Performance+Obligation+is+Satisfied.jpg)