A Company Started The Year With 10 000 Of Inventory

The once-promising narrative of "Innovate Solutions Inc." faces a stark reality check as the fiscal year draws to a close. Starting with a seemingly healthy $10,000 inventory, the company now grapples with unforeseen market shifts and operational challenges. These issues have significantly impacted their bottom line and cast a shadow on their future prospects.

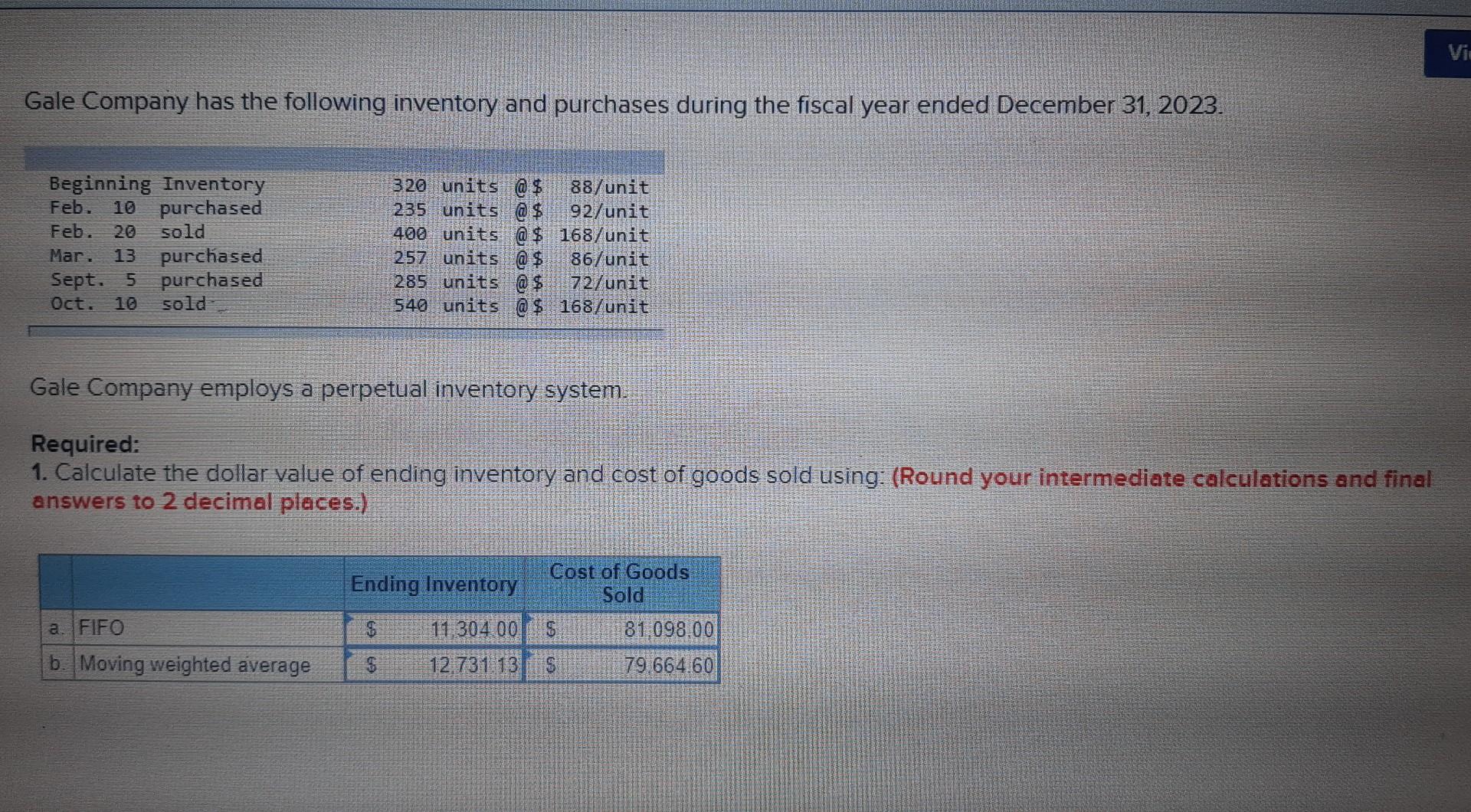

Innovate Solutions Inc., a tech startup specializing in sustainable energy solutions, has experienced a tumultuous year. Beginning with a $10,000 inventory, primarily consisting of solar panel components and battery storage units, the company projected substantial growth. However, a confluence of factors, including increased competition, supply chain disruptions, and fluctuating consumer demand, has led to a significant inventory surplus and financial strain.

Inventory Management Woes

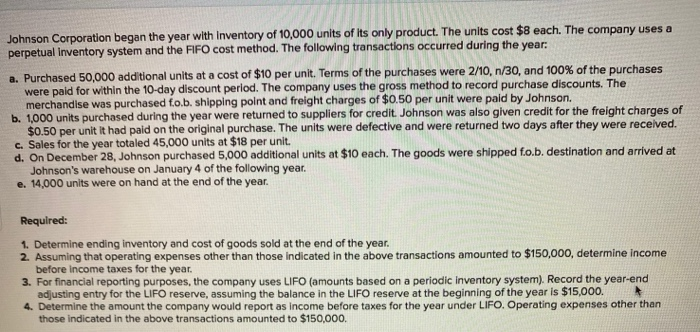

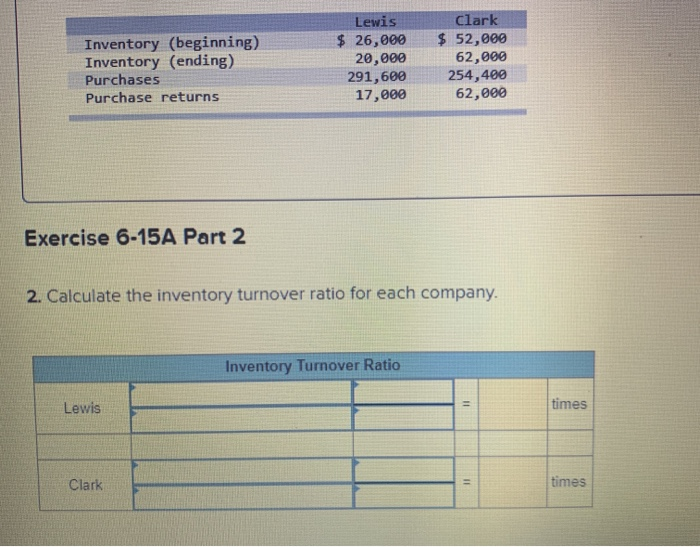

The company initially projected a 20% increase in sales, driven by growing environmental awareness and government incentives for renewable energy. However, unforeseen circumstances disrupted this optimistic forecast. The entrance of several new players into the market intensified competition, putting downward pressure on prices.

According to a recent report by the Renewable Energy Association, the market for solar panel components experienced a 30% increase in supply, leading to a corresponding decrease in prices. This price erosion directly impacted Innovate Solutions' profitability. Furthermore, global supply chain disruptions, exacerbated by geopolitical instability and logistical bottlenecks, led to delays in acquiring key components.

“We anticipated some market fluctuations, but the severity of the price erosion and supply chain disruptions caught us off guard,” stated CEO Amelia Stone in a recent press conference. She acknowledged the need for a more agile and responsive inventory management system. This statement reflects the challenges faced by many small businesses in navigating a rapidly evolving market landscape.

Financial Implications and Mitigation Strategies

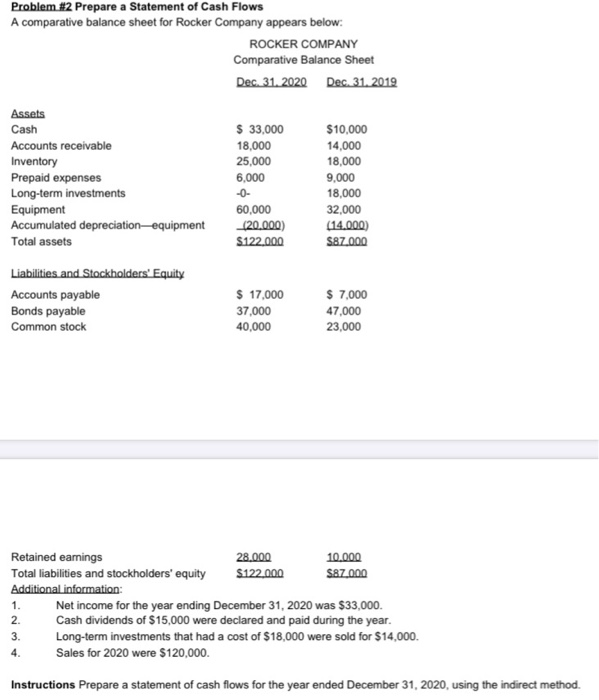

The excess inventory has tied up valuable capital, impacting the company's cash flow. The cost of storing and maintaining the unsold inventory has further strained their resources. This has also limited their ability to invest in research and development, a crucial area for a tech startup.

Innovate Solutions has implemented several strategies to mitigate the impact of the inventory surplus. These include aggressive discounting, participation in industry trade shows, and exploration of new distribution channels. They are also actively seeking partnerships with larger companies to expand their market reach.

“We are exploring all available options to optimize our inventory levels and improve our financial performance,” explained CFO David Lee. He highlighted the company's commitment to adapting to the changing market dynamics. The CFO mentioned the exploration of lean inventory principles.

Impact on Stakeholders

The company's struggles have had a ripple effect on its stakeholders. Employees have faced uncertainty regarding job security and potential salary reductions. Suppliers have experienced delays in payments, and investors have seen a decline in the value of their holdings.

“We understand the concerns of our employees and are committed to transparency throughout this challenging period,” assured HR Director Sarah Chen. She emphasized the company's efforts to maintain open communication and provide support to its workforce. However, morale remains a concern among some employees.

Several investors have expressed their disappointment with the company's performance. One major investor, Venture Capitalist John Smith, stated, “While we recognize the challenges faced by the company, we expect to see a significant turnaround in the coming quarters.” This puts further pressure on Innovate Solutions to deliver results.

Future Outlook and Industry Analysis

The future of Innovate Solutions remains uncertain. Their success hinges on their ability to effectively manage their inventory, adapt to changing market conditions, and secure additional funding. The company's leadership is actively exploring strategic partnerships and seeking expert advice on inventory management.

According to Market Insights Group, the renewable energy sector is projected to experience significant growth in the long term. However, short-term volatility and intense competition are expected to persist. Companies that can effectively manage their costs and differentiate their products will be best positioned to succeed.

Innovate Solutions is banking on its innovative technology and commitment to sustainability to differentiate itself from competitors. They are also actively pursuing government contracts and exploring opportunities in emerging markets. This could potentially offer a lifeline for the struggling company.

CEO Amelia Stone remains optimistic about the company's long-term prospects. "We believe in our technology and our team's ability to overcome these challenges," she stated. She emphasized the company's resilience and determination to emerge stronger from this difficult period.

The story of Innovate Solutions serves as a cautionary tale for startups navigating a volatile market. It underscores the importance of robust inventory management, adaptability, and a clear understanding of market dynamics. Whether they can turn the tide remains to be seen, but their journey highlights the complexities and challenges inherent in the rapidly evolving renewable energy sector.

Conclusion

As Innovate Solutions Inc. heads into the next fiscal year, the focus is on operational efficiency and strategic realignment. The company's ability to adapt to the changing market dynamics and secure additional funding will be critical determinants of its long-term survival. The lessons learned from this challenging year will undoubtedly shape the company's future strategy and risk management protocols.

![A Company Started The Year With 10 000 Of Inventory [Solved] The following transactions pertain to Yea | SolutionInn](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6661b4aa6b4d3_2746661b4aa0e533.jpg)