A Company's Balance Sheet Has Total Assets Of

The financial health of Apex Industries is under scrutiny following the release of its latest balance sheet. While the company boasts a substantial total asset figure, questions are arising about the composition of those assets and the company's overall liquidity. This situation has sparked debate among analysts and investors alike, raising concerns about Apex Industries' future prospects amidst a volatile economic climate.

The core issue centers on Apex Industries' balance sheet, which reveals a significant total asset value. However, a deeper dive into the numbers exposes potential vulnerabilities related to the types of assets held and the level of debt financing used to acquire them. The implications of this financial structure could have far-reaching consequences for the company's ability to navigate upcoming economic challenges and maintain shareholder value.

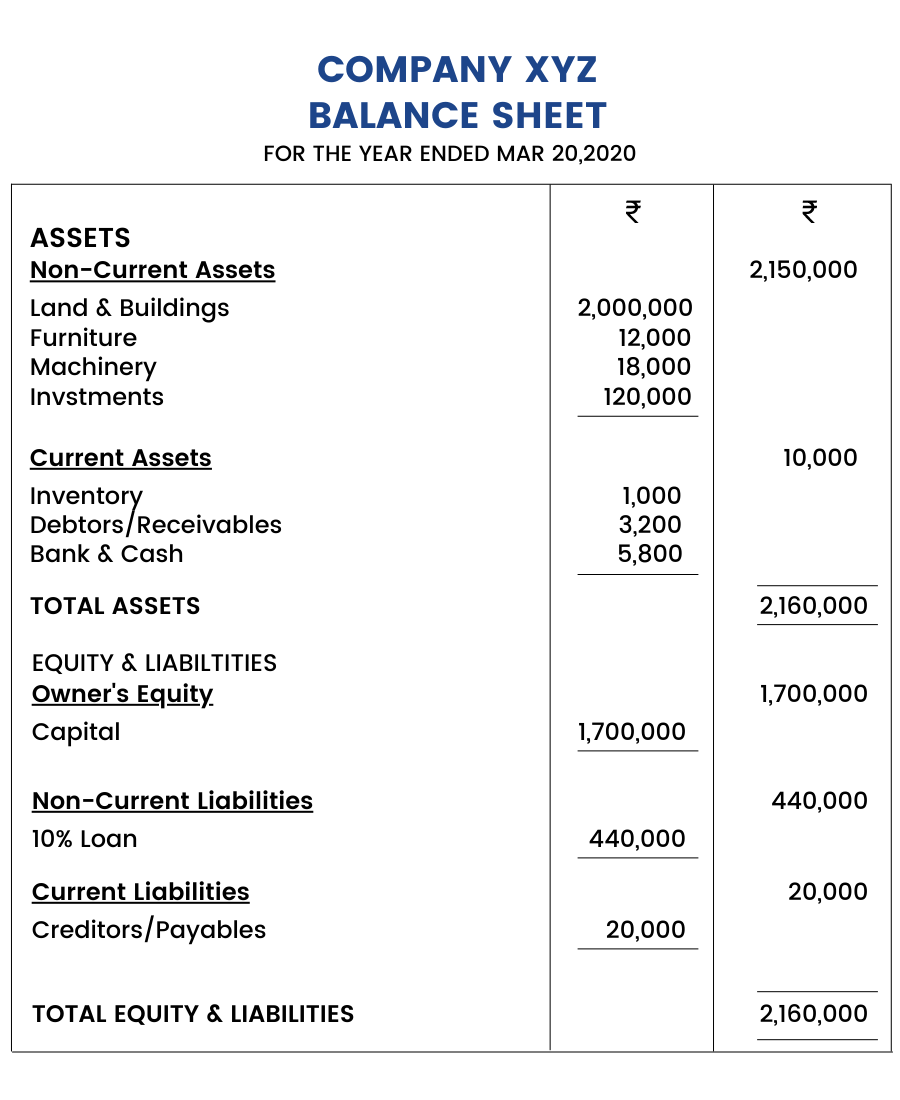

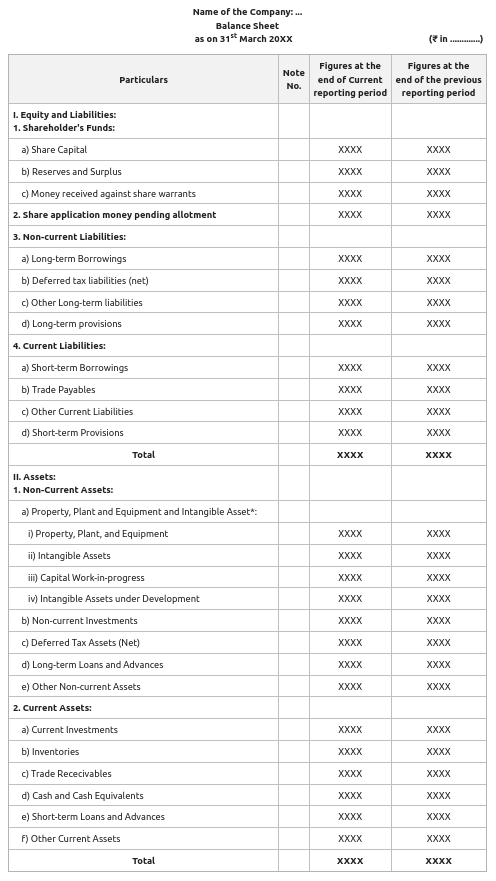

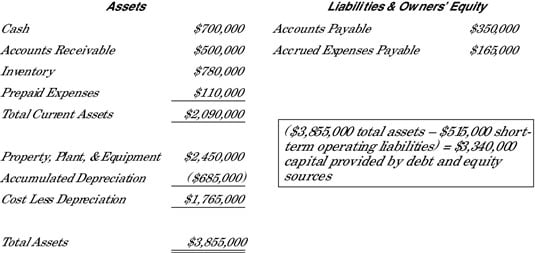

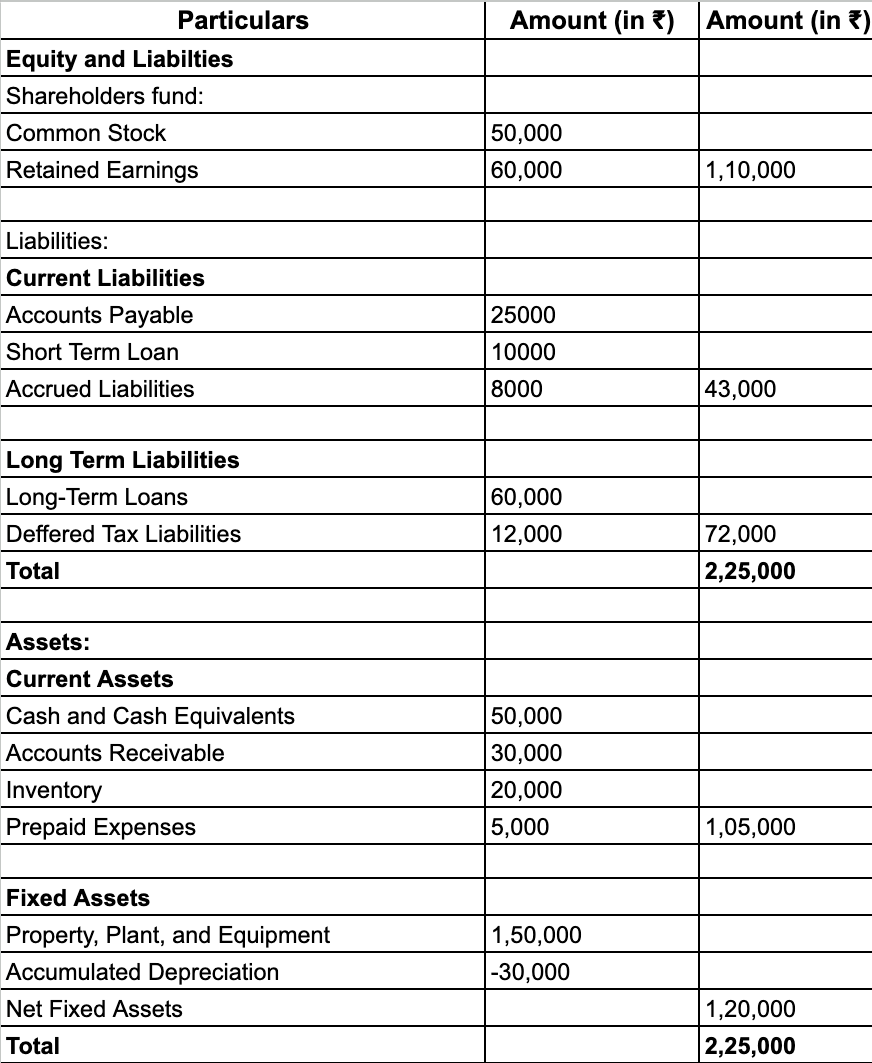

Apex Industries' Asset Breakdown

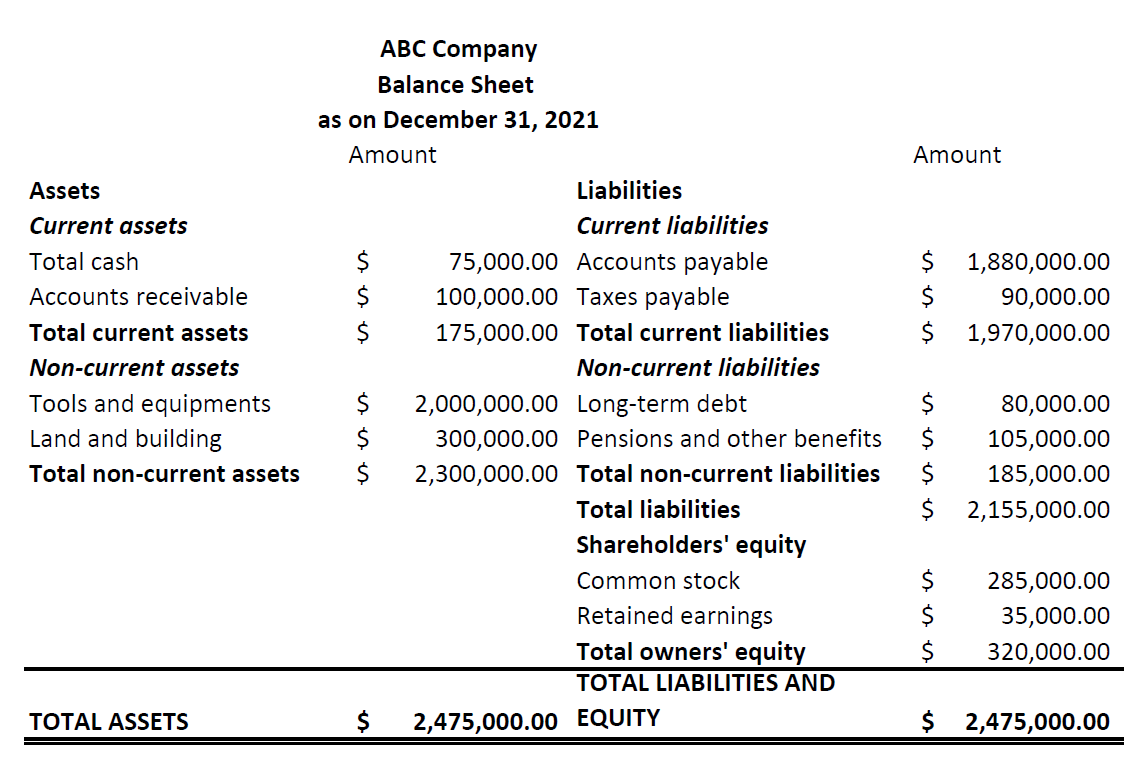

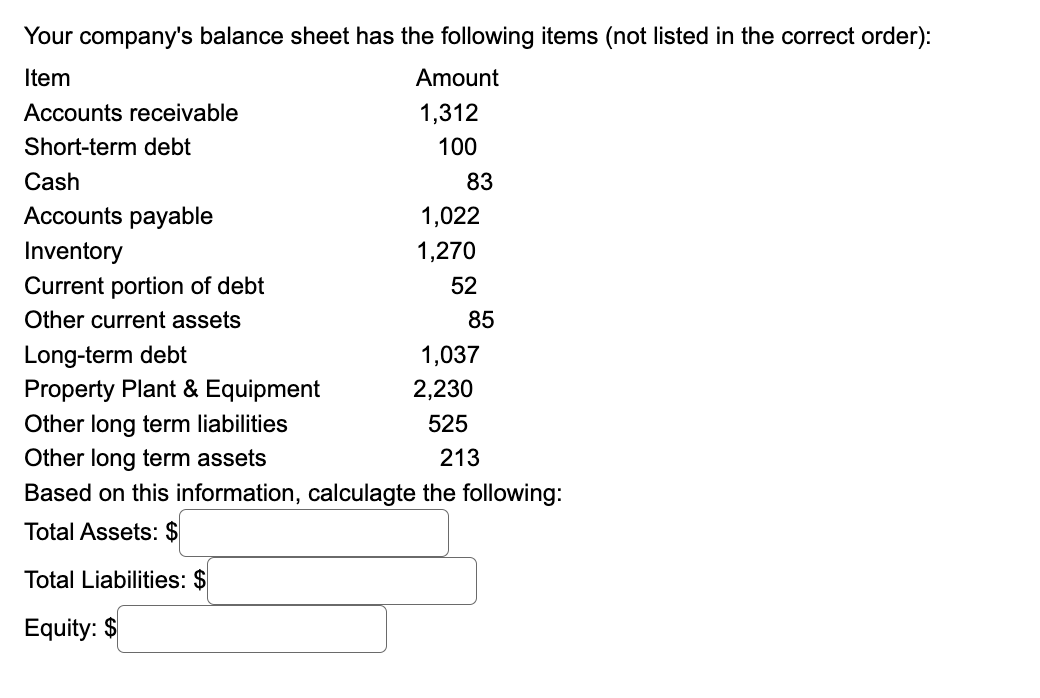

Apex Industries' balance sheet indicates a large total asset base. However, a closer inspection reveals that a substantial portion of these assets are tied up in long-term, illiquid investments. This concentration in illiquid assets raises concerns about the company's ability to quickly convert these holdings into cash to meet short-term obligations.

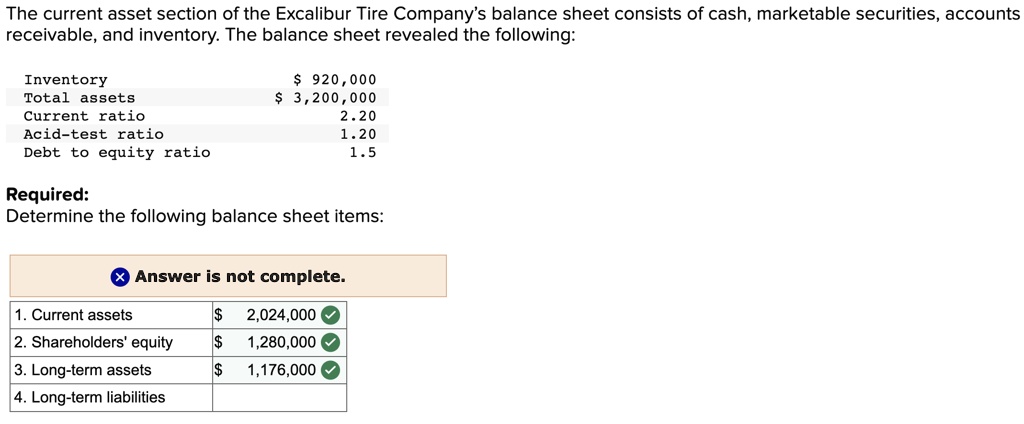

Analyzing Current Assets

Current assets, which include cash, accounts receivable, and inventory, are essential for day-to-day operations. While Apex Industries does hold current assets, their proportion relative to total assets appears relatively low compared to industry averages. This potentially weakens the company's ability to cover immediate liabilities.

Insufficient current assets may require the company to rely heavily on short-term borrowing to finance its operations. This dependence on short-term debt can increase financial risk, especially in periods of rising interest rates.

Fixed Assets and Intangibles

A significant portion of Apex Industries' assets are categorized as fixed assets, such as property, plant, and equipment (PP&E). These assets, while valuable, are not easily converted into cash.

Furthermore, the balance sheet includes a notable amount of intangible assets, like goodwill and patents. The valuation of these assets can be subjective, and their real value may fluctuate with market conditions and technological advancements.

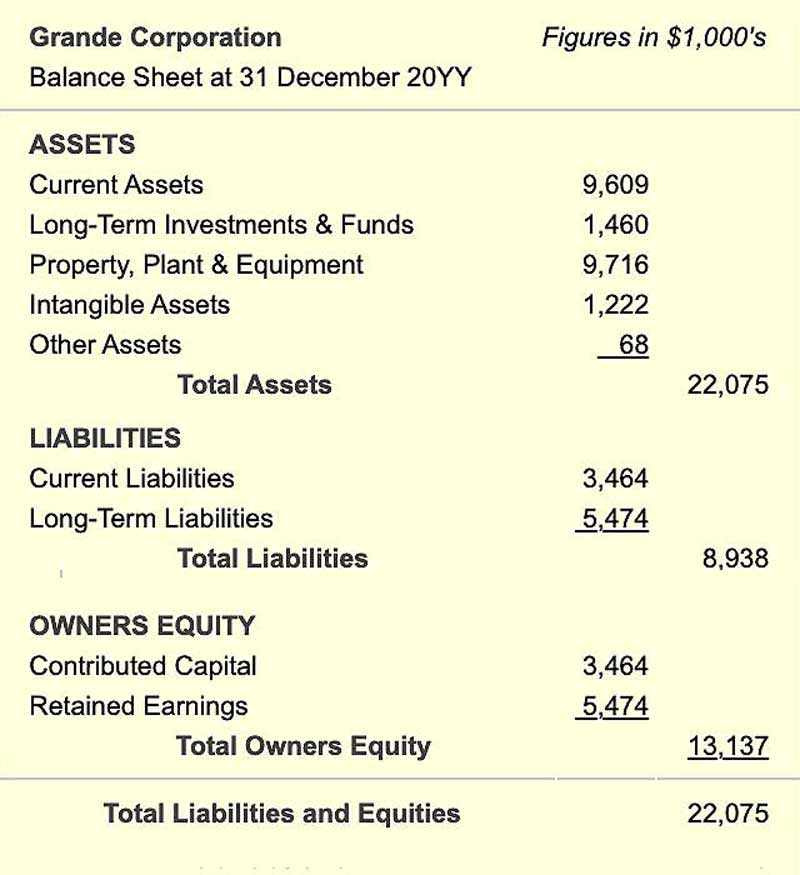

Debt and Equity Considerations

Apex Industries' balance sheet also sheds light on the company's capital structure, revealing a significant level of debt financing. While debt can be a useful tool for growth, excessive leverage can increase financial risk.

A high debt-to-equity ratio can make it more difficult for the company to secure financing in the future. It can also increase the risk of financial distress if the company experiences a downturn in its earnings.

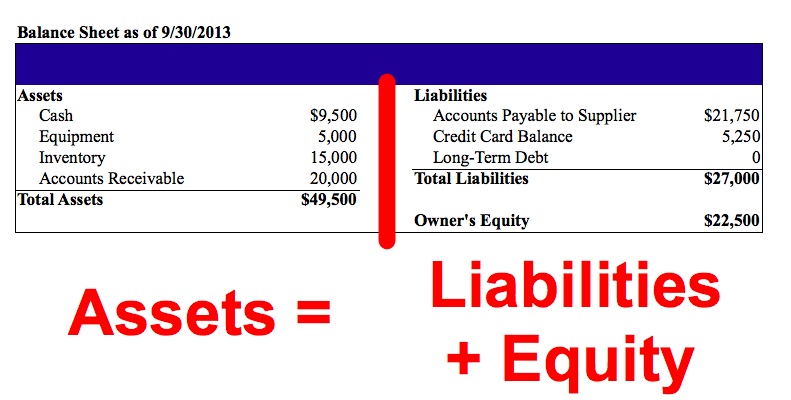

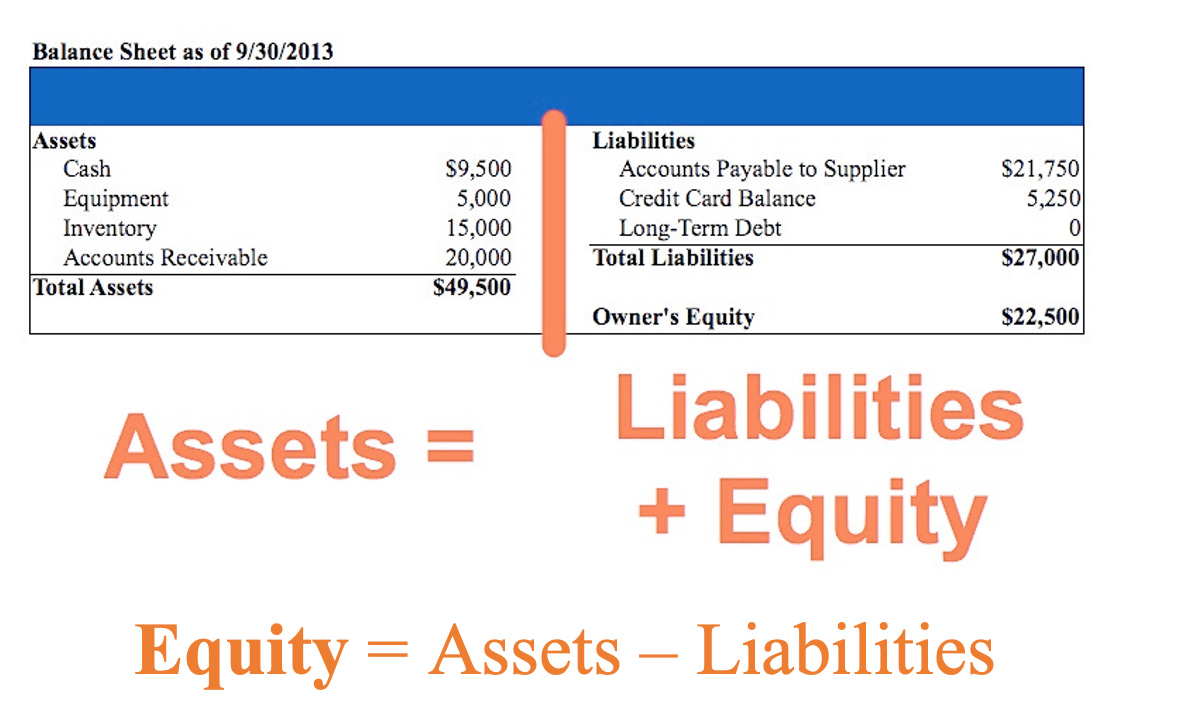

Impact on Liquidity Ratios

Financial analysts closely monitor key liquidity ratios, such as the current ratio and quick ratio, to assess a company's ability to meet its short-term obligations. Based on Apex Industries' balance sheet data, these ratios raise concerns about the company's immediate solvency.

A low current ratio suggests that the company may struggle to pay its current liabilities with its current assets. Similarly, a low quick ratio indicates a limited ability to meet obligations without relying on inventory sales.

Expert Opinions and Market Reactions

Financial analysts have expressed mixed opinions regarding Apex Industries' financial position. Some argue that the company's strong brand and market position provide a solid foundation for future growth, despite the current asset structure.

Others are more cautious, citing the company's high debt levels and reliance on illiquid assets as potential warning signs. "While Apex Industries has demonstrated impressive growth in the past, its current financial structure leaves it vulnerable to unforeseen economic shocks," stated John Miller, Senior Analyst at *Capital Research Group*.

The market has reacted to the release of the balance sheet with moderate uncertainty. Apex Industries' stock price has experienced some volatility, reflecting investor concerns about the company's liquidity and debt burden.

Potential Strategies for Improvement

To address the concerns raised by its balance sheet, Apex Industries may need to consider several strategic options. These include divesting some of its illiquid assets, reducing its debt load, and improving its working capital management.

Divesting non-core assets could generate much-needed cash to improve liquidity. Furthermore, the company could focus on streamlining its operations and improving its cash flow from operations.

Restructuring Debt Obligations

Refinancing existing debt or negotiating more favorable terms with lenders could also alleviate financial pressure. This could involve extending the maturity dates of debt obligations or securing lower interest rates.

However, these strategies require careful planning and execution. The company must also consider the potential impact on its long-term growth prospects.

Conclusion and Future Outlook

Apex Industries' balance sheet presents a complex picture of financial health. While the company's substantial total assets are noteworthy, concerns remain regarding the composition of those assets and the level of debt financing.

The company's future success will depend on its ability to address these challenges and implement strategies to improve its liquidity and reduce its financial risk. Investors will be closely monitoring the company's actions in the coming quarters.

Going forward, Apex Industries will need to demonstrate a commitment to sound financial management and a willingness to adapt to changing market conditions. Only then can it reassure investors and secure its long-term prosperity.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)