A Company's Cost Of Capital Refers To The

:max_bytes(150000):strip_icc()/COST-OF-CAPITAL-FINAL-HR-f3d41d21c66a494ea77eec360a6a3857.jpg)

The relentless pressure on corporate earnings is intensifying, forcing companies to scrutinize every line item on their financial statements. At the heart of this evaluation lies a crucial metric often shrouded in complexity: the cost of capital.

This deceptively simple phrase represents the minimum rate of return a company must earn on its investments to satisfy its investors. Miscalculating or ignoring this figure can lead to disastrous decisions, eroding shareholder value and jeopardizing long-term viability.

The cost of capital is a critical concept in finance, representing the rate of return a company must earn on its investments to satisfy its investors (both debt and equity holders). It essentially reflects the opportunity cost of investing in a specific company versus other opportunities with similar risk profiles. A company's cost of capital serves as a benchmark for evaluating potential projects and investments: if a project's expected return is lower than the cost of capital, it would destroy value and should not be pursued. Understanding and accurately calculating the cost of capital is paramount for sound financial decision-making, impacting everything from capital budgeting to valuation.

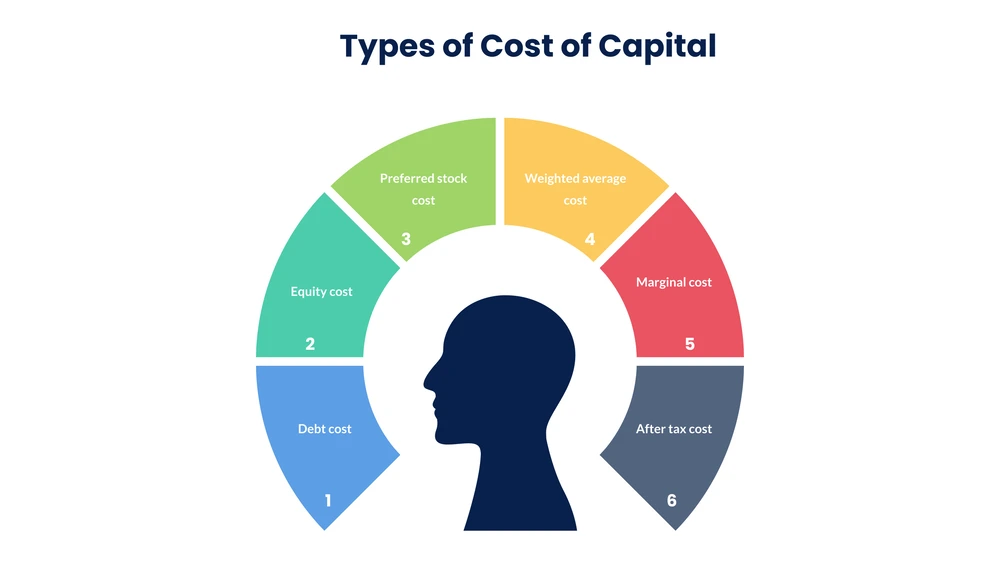

Understanding the Components

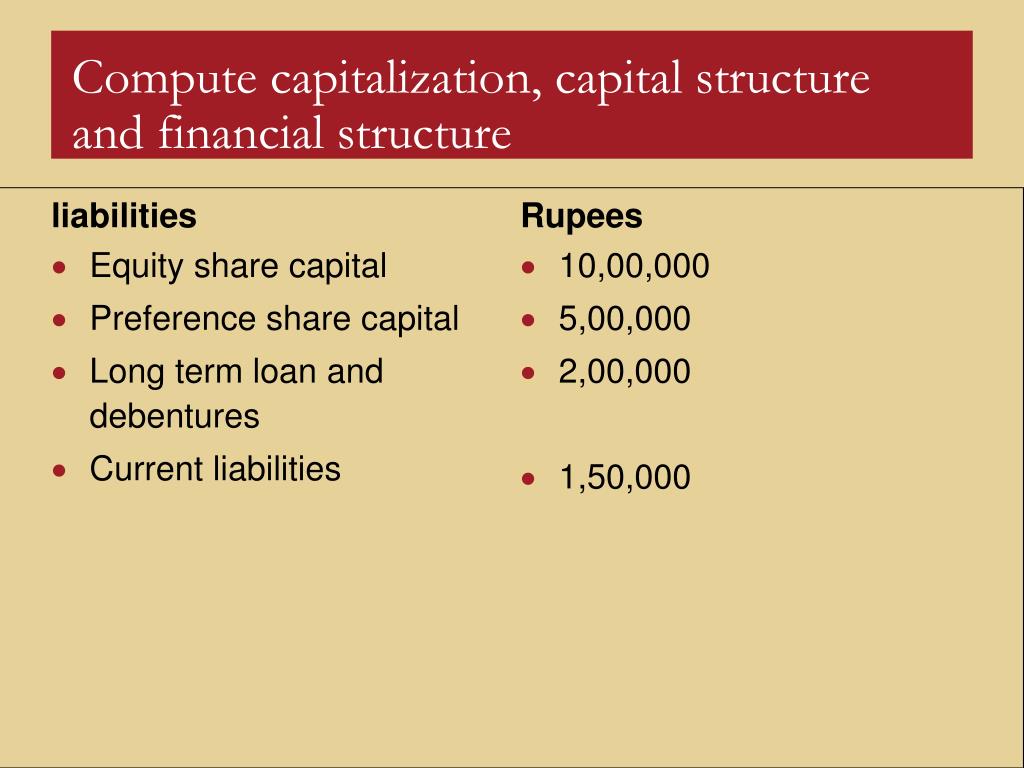

The cost of capital isn't a single, monolithic number. It's a weighted average of the costs of different sources of funding, primarily debt and equity.

The cost of debt is relatively straightforward, reflecting the interest rate a company pays on its borrowings, adjusted for the tax deductibility of interest payments. The higher the interest rate a company is paying, the greater its cost of debt.

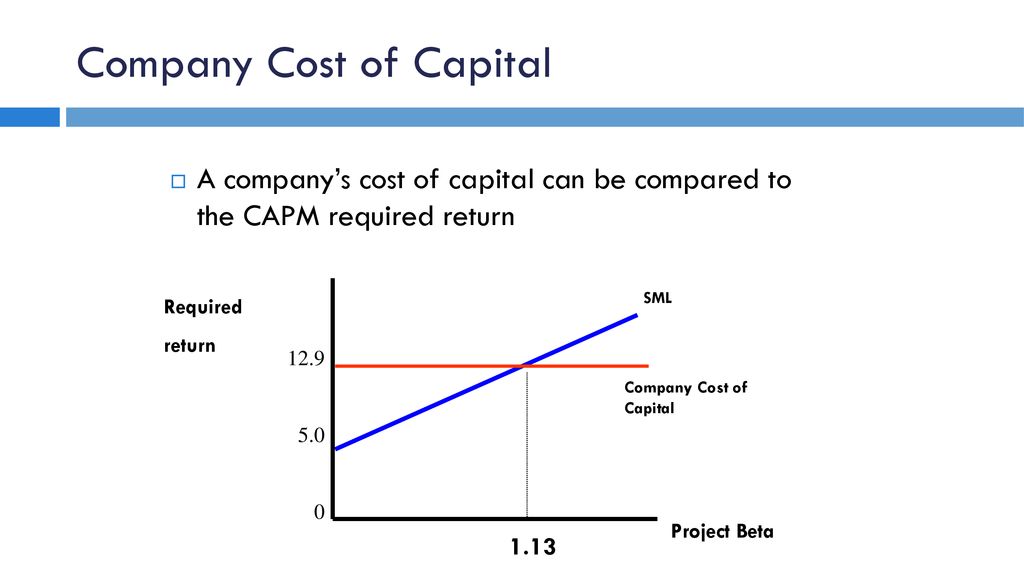

The cost of equity, however, is more complex. It represents the return required by equity investors, who bear more risk than debt holders. This can be determined using models like the Capital Asset Pricing Model (CAPM) or the Dividend Discount Model.

Calculating the Weighted Average

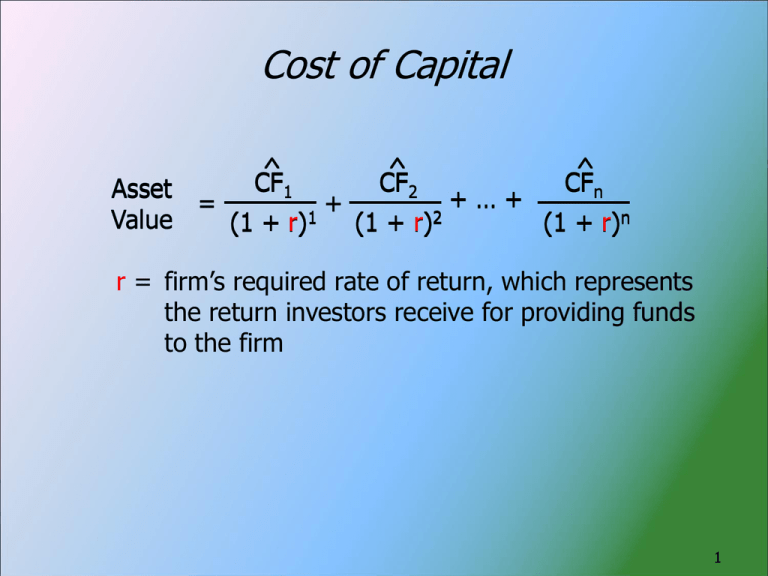

Once the costs of debt and equity are determined, they are weighted according to their proportion in the company's capital structure. This calculation results in the Weighted Average Cost of Capital (WACC), which represents the overall cost of capital for the company.

WACC is the discount rate used to calculate the net present value of future cash flows, serving as a crucial input for investment decisions. A lower WACC generally indicates a healthier financial position and allows for greater investment opportunities.

Factors Influencing the Cost of Capital

Numerous factors can influence a company's cost of capital, both internal and external. Interest rates, set by central banks, directly impact the cost of debt.

Market conditions, including investor sentiment and economic outlook, influence the cost of equity. A volatile market may cause investors to require a higher return for their investment.

Company-specific factors, such as credit rating, capital structure, and business risk, also play a significant role. A company with a strong credit rating generally has a lower cost of debt.

Impact on Corporate Decisions

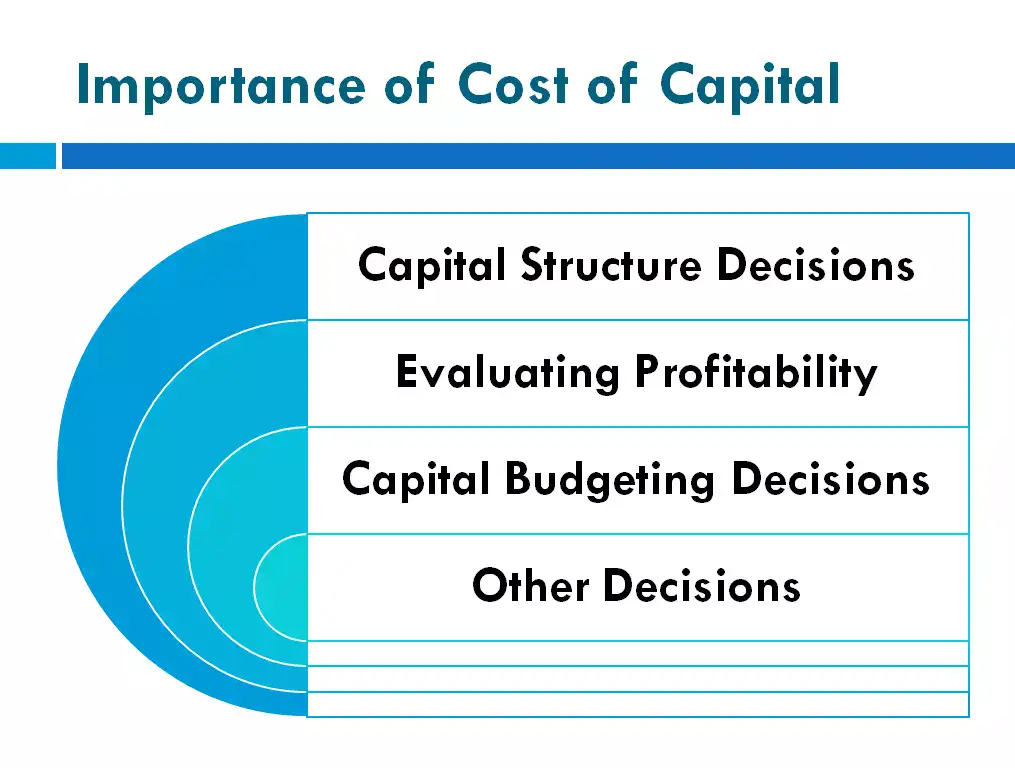

The cost of capital plays a pivotal role in a wide range of corporate decisions. It is a key input in capital budgeting, determining which projects are worth undertaking.

If a project's expected return is below the cost of capital, it would destroy value and should be rejected. It also influences decisions related to mergers and acquisitions, as well as stock valuations.

Accurately assessing the cost of capital is therefore critical for maximizing shareholder value and ensuring long-term financial stability.

Real-World Examples and Implications

Consider two companies: one, a stable utility with a predictable cash flow and strong credit rating; the other, a high-growth technology startup with volatile earnings. The utility will likely have a lower cost of capital due to its lower risk profile, allowing it to pursue projects with lower expected returns.

The startup, on the other hand, will need to generate higher returns to compensate investors for the increased risk. According to data from Damodaran Online, the average cost of equity for publicly traded companies varies significantly across industries, reflecting differences in risk and growth potential.

Companies that fail to accurately estimate their cost of capital may make poor investment decisions, leading to financial distress.

"A company's cost of capital is not just an accounting number," says Professor Johnathan Miles of the Wharton School of Business, "it is a strategic tool that should be used to guide all major financial decisions."

The Future of Cost of Capital Analysis

As financial markets become increasingly complex, so too will the analysis of the cost of capital. Sophisticated models and data analytics are being used to refine these calculations.

Furthermore, companies are increasingly incorporating environmental, social, and governance (ESG) factors into their cost of capital assessments. Companies with strong ESG profiles may be able to attract investors with lower return requirements, thus reducing their overall cost of capital.

The cost of capital will remain a critical metric for corporate finance, influencing investment decisions, valuations, and overall financial performance.

Conclusion

The relentless quest for maximizing shareholder value hinges on a deep understanding and accurate application of the cost of capital. This seemingly simple metric, comprising the cost of debt and equity, interwoven into the WACC, serves as the bedrock for informed decision-making.

As the financial landscape evolves, so too must the methods used to analyze and interpret the cost of capital, adapting to new factors and challenges. Ultimately, a well-managed cost of capital empowers companies to make strategic investments, navigate market volatility, and secure a sustainable path to long-term success.