A Company's Net Cash Flow Will Equal Its Net Income

Imagine a bustling marketplace, vendors hawking their wares, coins changing hands, a constant flow of transactions. Now, picture a business, a digital marketplace perhaps, where the money coming in neatly matches the profits reported on paper. It sounds almost utopian, a financial fairytale.

This isn't a fairytale for Everbright Innovations. In a rare and noteworthy feat, Everbright Innovations, a leading sustainable technology firm, is projecting its net cash flow to precisely mirror its net income for the upcoming fiscal year. This alignment, while seemingly simple, represents a significant achievement highlighting the company's efficient operations, robust financial management, and commitment to transparency.

A Deep Dive into Everbright Innovations

Everbright Innovations, founded in 2010, has quickly risen to prominence in the sustainable technology sector. They specialize in developing innovative solutions for renewable energy storage and smart grid technologies. The company’s mission is to create a cleaner, more sustainable future by providing cutting-edge energy solutions.

The company's projected financial performance for the next fiscal year is causing ripples of excitement among investors and analysts. Typically, net income and net cash flow, while related, rarely match perfectly. This difference arises from various accounting practices and operational realities.

Understanding the Nuances

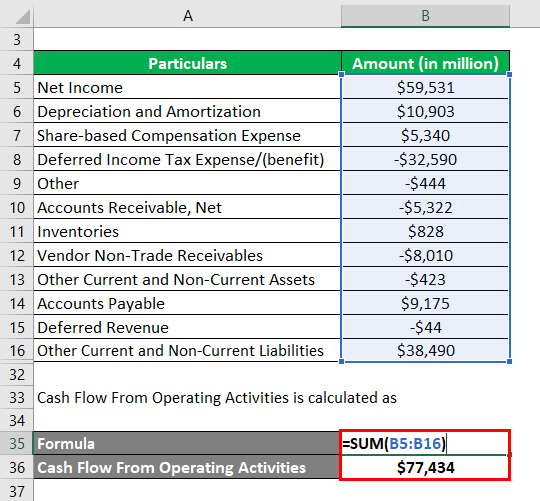

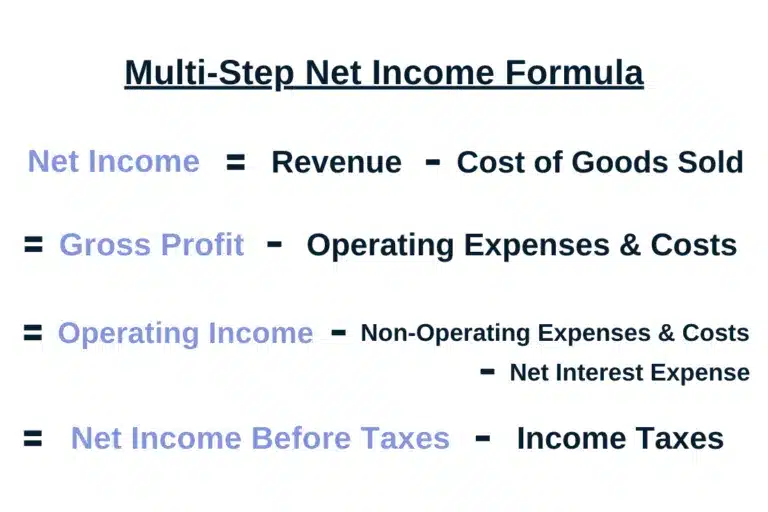

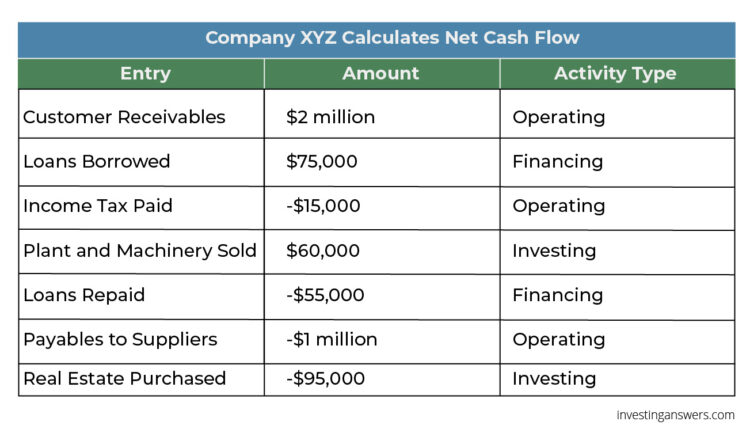

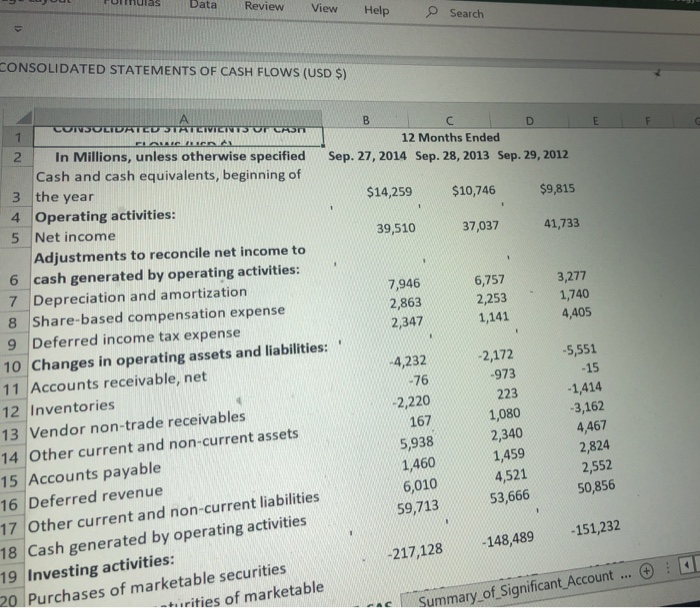

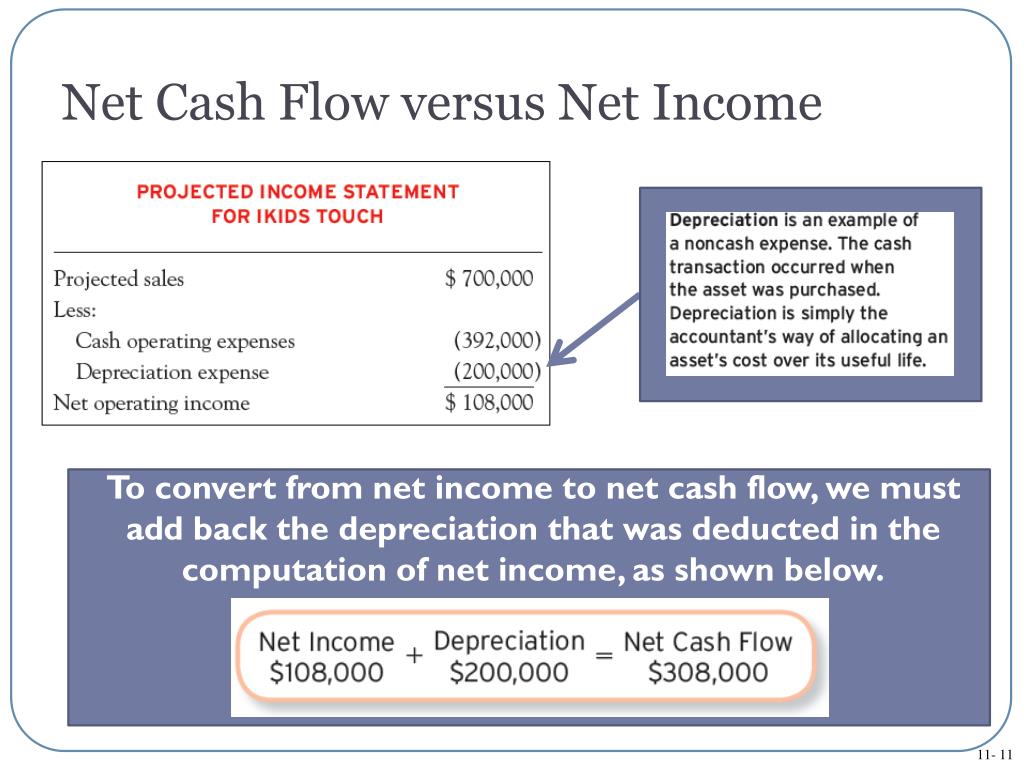

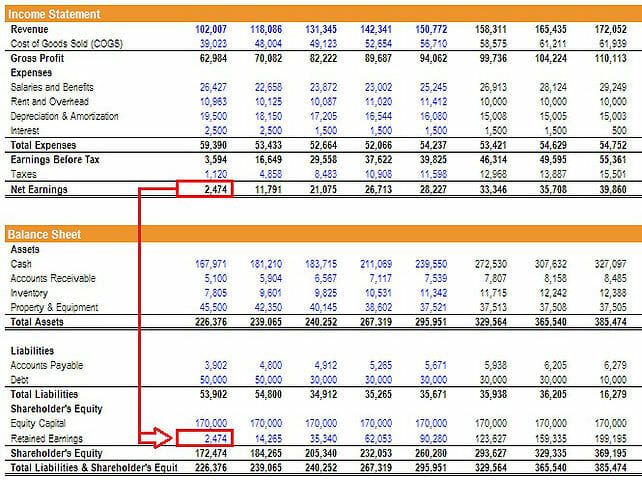

Net income, at its core, represents a company’s profit after all expenses, including taxes and depreciation, have been deducted from revenue. It’s a key indicator of a company’s profitability and is crucial for investors making informed decisions.

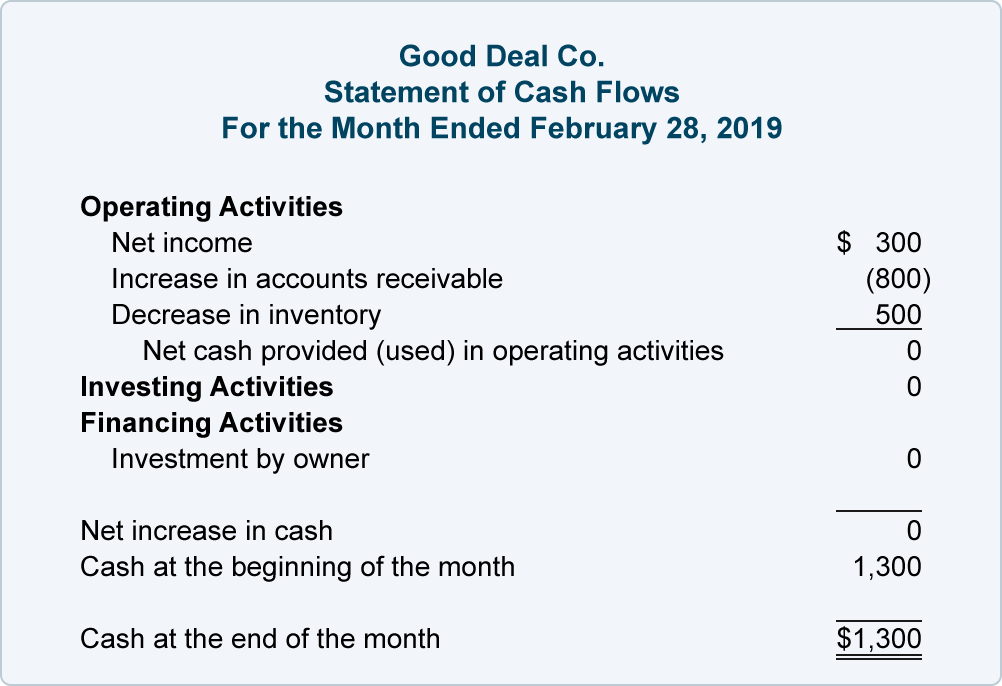

Net cash flow, on the other hand, reflects the actual cash a company generates from its operations. It's the real money coming in and going out of the business. Depreciation, for instance, is an expense that affects net income but doesn’t involve an actual outflow of cash.

The complexities of accounting often create a divergence between these two figures. Timing differences in revenue recognition, accounts receivable, and accounts payable also play a significant role.

The Factors Contributing to this Alignment

Several key factors contribute to Everbright Innovations' unique projection. The company has meticulously streamlined its operations to minimize discrepancies between reported earnings and actual cash generated.

“Our focus has always been on sustainable growth and responsible financial management,” stated CEO Amelia Hayes in a recent press release. “We believe that aligning our net cash flow with our net income is a testament to our commitment to transparency and operational excellence.”

One crucial element is their stringent inventory management system. They employ a just-in-time approach. This drastically reduces the need for extensive stockpiles and minimizes the risk of write-offs that could skew the numbers.

Another factor is the company's proactive approach to managing accounts receivable. Everbright Innovations has implemented efficient collection strategies. These strategies ensure that payments are received promptly, directly impacting the cash flow.

Furthermore, Everbright Innovations maintains conservative accounting practices. These practices minimize the use of aggressive revenue recognition strategies. This ensures that the reported income closely reflects the actual cash generated.

The Significance of this Achievement

The alignment of net income and net cash flow carries significant weight for several reasons. It instills greater confidence in investors. They can trust that the company's reported earnings accurately reflect its financial performance.

This alignment also simplifies financial analysis. Analysts can more easily assess the company’s financial health without having to reconcile significant differences between the two metrics. This leads to more accurate valuations and investment decisions.

Moreover, it signals strong operational efficiency. It demonstrates that the company can effectively convert its sales into cash, highlighting its ability to manage its working capital effectively. This is a positive sign for long-term sustainability.

Industry Reaction and Expert Commentary

Industry experts are praising Everbright Innovations for its remarkable achievement. Dr. Eleanor Vance, a renowned finance professor at the University of Cambridge, commented, "This alignment is exceptionally rare and indicative of superior financial discipline. It reflects a company that is truly in control of its finances."

Financial analysts at Goldman Sachs released a research note stating that Everbright Innovations' financial performance has significantly enhanced its creditworthiness. "The company's ability to consistently generate cash flow that mirrors its net income strengthens its balance sheet and reduces its reliance on external financing," the note stated.

Competitors are also taking notice. Several other companies in the sustainable technology sector are reportedly reviewing their own financial management practices. They are seeking to emulate Everbright Innovations' success.

Looking Ahead

Everbright Innovations plans to maintain its focus on sustainable growth and transparent financial reporting. The company will continue to invest in research and development. This will fuel innovation and expand its product offerings.

CEO Amelia Hayes emphasized the company’s long-term vision. “We are committed to building a company that not only delivers exceptional financial results but also makes a positive impact on the world.”

Everbright Innovations' journey serves as an inspiring example for other businesses. Their commitment to operational excellence and transparent financial management has set a new standard in the industry.

Conclusion

In a world often clouded by complex financial jargon and intricate accounting practices, Everbright Innovations' achievement shines as a beacon of clarity. Their projected alignment of net cash flow and net income isn’t just a financial milestone. It’s a reflection of a deeper commitment to integrity and responsible business practices.

It reminds us that true success lies not only in generating profits but also in managing resources wisely and building trust with stakeholders. As Everbright Innovations continues to innovate and grow, it serves as a powerful reminder that transparency and efficiency can indeed go hand in hand, creating a sustainable and prosperous future for all.

![A Company's Net Cash Flow Will Equal Its Net Income [Solved] Determining Net Income from Net Cash Flow | SolutionInn](https://s3.amazonaws.com/si.experts.images/answers/2024/05/665503710e315_4736655037108c97.jpg)