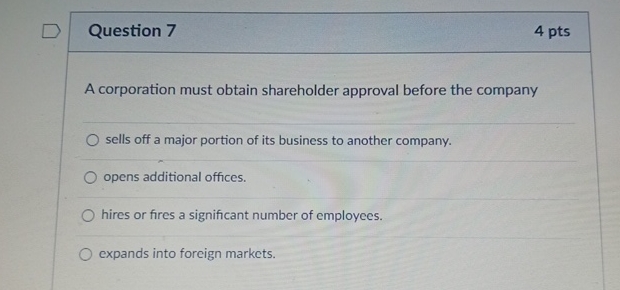

A Corporation Must Obtain Shareholder Approval Before The Company

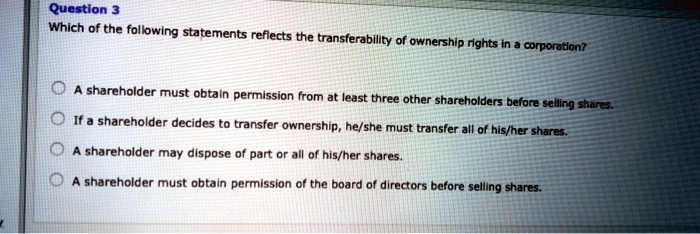

The landscape of corporate governance is facing a potential seismic shift. A growing movement is advocating for a fundamental change: requiring shareholder approval before a corporation can undertake any significant action. This push aims to realign corporate power, giving owners a more direct say in the direction of the companies they invest in.

At the heart of this debate is the question of accountability and the proper balance of power within a corporation. Proponents argue that requiring shareholder approval for major decisions would prevent corporate overreach and ensure that decisions align with the best interests of the owners, not just management. Critics, however, raise concerns about potential inefficiencies and the dampening effect such requirements could have on corporate agility and competitiveness.

The Core Argument for Shareholder Approval

The central argument boils down to the principle of ownership. Shareholders, as the owners of the company, should have a direct say in decisions that significantly impact the value of their investment, argues John Abrams, a leading advocate for corporate governance reform at the Shareholder Rights Coalition.

This stance stems from a belief that current corporate structures often prioritize management's interests over those of shareholders.

Abrams states, "When CEOs make decisions that drastically alter the course of a company without consulting the owners, they are effectively playing with someone else's money without their consent."

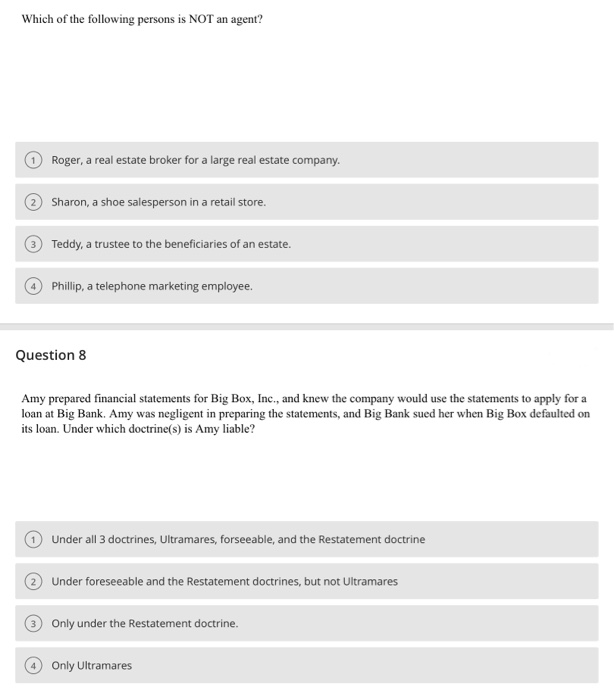

What Constitutes a Significant Action?

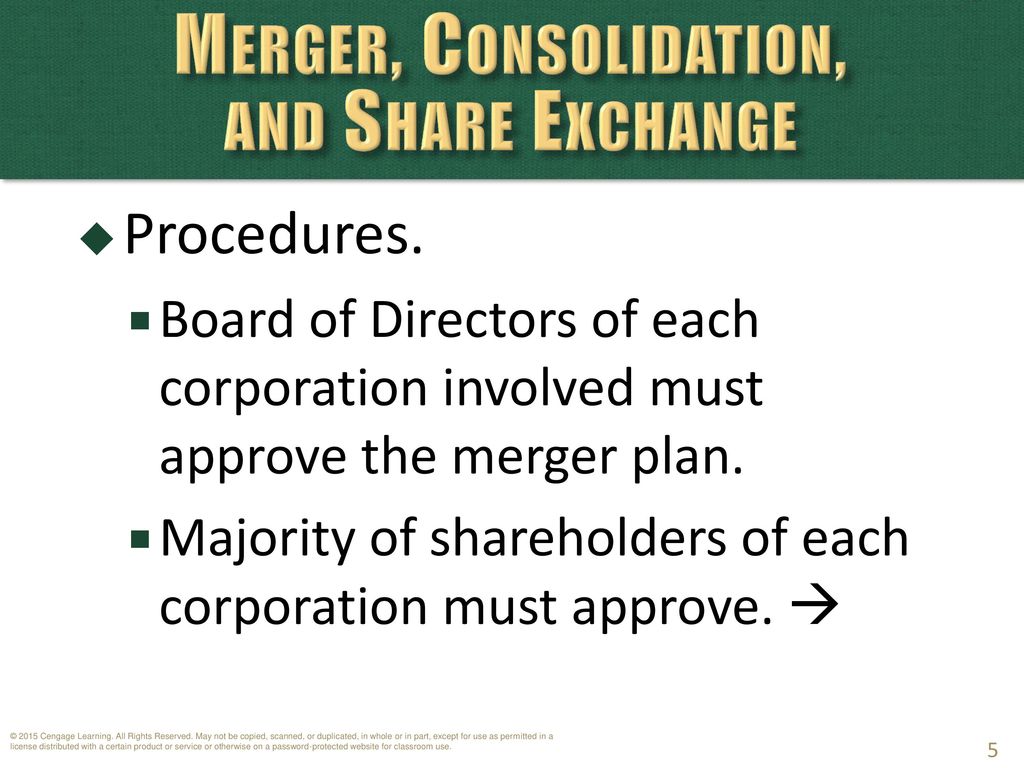

A key challenge lies in defining what constitutes a "significant action" that would trigger the need for shareholder approval. Proposed definitions often include mergers and acquisitions, large-scale asset sales, major restructurings, and significant changes to the company's charter.

The specifics, however, are a source of ongoing debate. "The threshold needs to be high enough to avoid bogging down management in endless votes," notes Dr. Emily Carter, a professor of corporate law at the University of California, Berkeley.

Yet, "it also needs to be low enough to actually protect shareholder interests from potentially damaging decisions," she adds.

Counterarguments and Potential Drawbacks

The proposal is not without its detractors. Opponents argue that requiring shareholder approval could slow down decision-making processes, making companies less competitive in a fast-paced global market. They also point to the potential for uninformed or short-sighted shareholders to make decisions that harm the long-term interests of the company.

Michael Davies, CEO of a Fortune 500 company, warns, "Imagine trying to quickly respond to a competitor's move or capitalize on a market opportunity when you have to wait weeks or months for a shareholder vote. It would be paralyzing."

He argues that boards of directors, elected by shareholders, are already responsible for overseeing management and making strategic decisions.

The Role of Institutional Investors

The views of institutional investors, such as pension funds and mutual funds, will be crucial in shaping the future of this debate. These large shareholders hold significant sway over corporate governance issues and their positions often influence the voting patterns of other shareholders.

Many institutional investors already engage in active dialogue with company management and exert pressure through their voting power on issues like executive compensation and environmental policies.

Whether they will support a move towards requiring shareholder approval for a broader range of decisions remains to be seen.

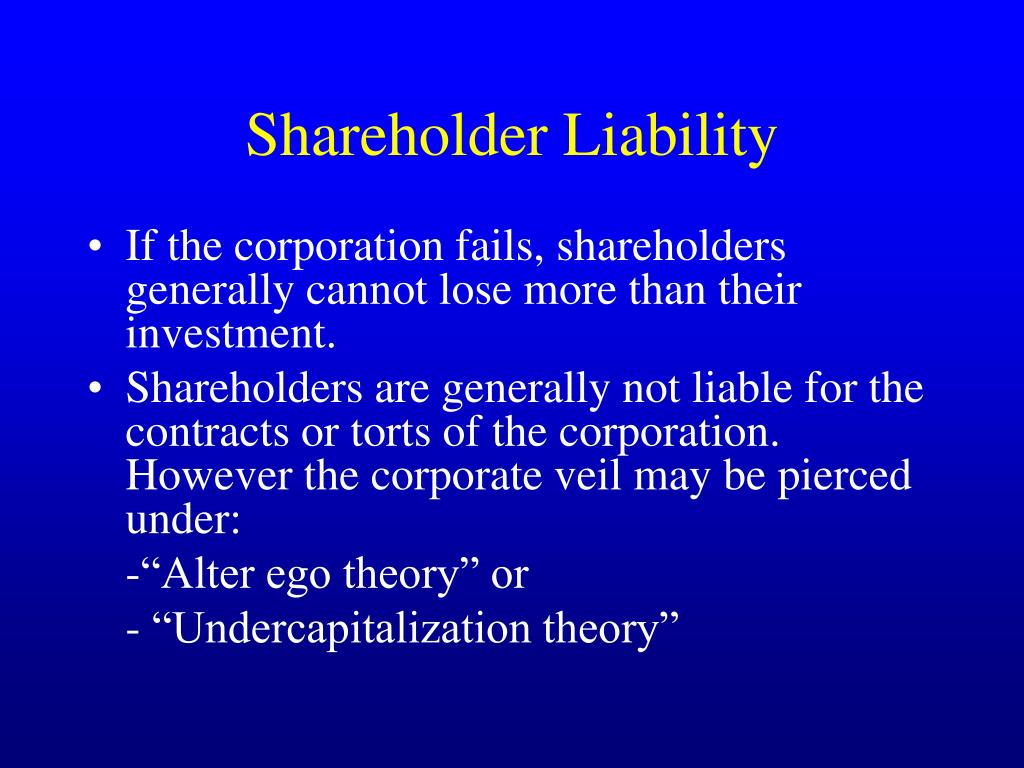

Existing Regulations and Precedents

Currently, shareholder approval is already required for certain corporate actions, such as mergers and acquisitions that involve issuing new shares, and amendments to the company's charter.

These existing regulations provide a baseline, but the proposed changes would significantly expand the scope of shareholder input. The Sarbanes-Oxley Act, passed in the wake of corporate scandals in the early 2000s, already mandates certain levels of corporate governance and accountability.

However, the proposed changes go further in empowering shareholders.

The Legal and Regulatory Challenges

Implementing a system requiring shareholder approval would also present significant legal and regulatory challenges. States have different laws governing corporate governance, and a federal mandate could face legal challenges based on states' rights.

The Securities and Exchange Commission (SEC) would likely play a key role in developing and enforcing any new regulations.

The SEC's current stance on the issue is neutral, but they are actively monitoring the debate and considering potential implications.

The Potential Impact on Corporate Innovation

One concern is the effect on corporate innovation. Some fear that increased shareholder involvement could lead to a more risk-averse corporate culture. Companies may be less willing to invest in risky but potentially game-changing projects if they need to convince a broad base of shareholders.

"Innovation often requires bold bets and a willingness to fail," says Dr. Sarah Lee, an expert on corporate innovation at Stanford University. "Shareholder approval could stifle that entrepreneurial spirit."

Others argue that aligning management's interests more closely with those of shareholders could actually lead to more sustainable innovation, focusing on long-term value creation rather than short-term gains.

Looking Ahead: The Future of Corporate Governance

The debate over requiring shareholder approval for significant corporate actions is likely to intensify in the coming years. As shareholder activism continues to grow, and concerns about corporate accountability remain salient, pressure will mount on lawmakers and regulators to consider reforms.

The outcome of this debate will have profound implications for the future of corporate governance, the balance of power within corporations, and the overall health of the economy. The discussion highlights a fundamental tension between the desire for greater accountability and the need for corporate flexibility and efficiency, a tension that will continue to shape the future of business.

Ultimately, finding a balance that protects shareholder interests without stifling corporate growth and innovation will be the key to a successful outcome.