A Health Insurance Policy Will Typically Cover

The rising cost of healthcare looms large in the minds of Americans, often overshadowing the fundamental question: What does my health insurance actually cover? Navigating the complexities of health insurance policies can feel like deciphering a foreign language, leaving many unsure about their financial responsibility when faced with medical bills. This uncertainty can lead to delayed care, increased stress, and potentially devastating financial burdens.

This article aims to demystify the typical coverage offered by health insurance policies, providing a comprehensive overview of common benefits, limitations, and considerations. Understanding these core aspects is crucial for making informed decisions about healthcare and managing costs effectively. We will explore the breadth of coverage, from preventative care to emergency services, and shed light on the factors that influence what is and isn't included in a standard policy.

Core Components of Health Insurance Coverage

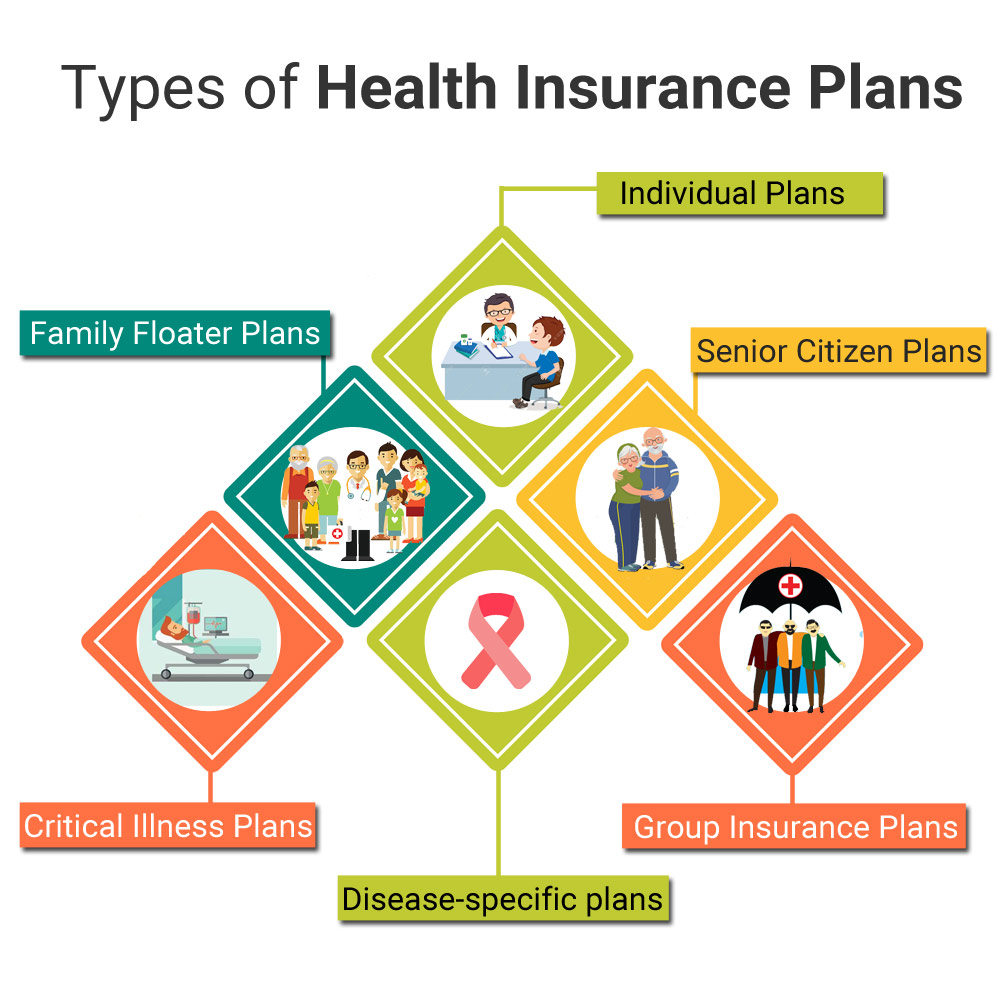

Most health insurance plans are designed to cover a wide range of medical services, although the specifics can vary significantly depending on the plan type (e.g., HMO, PPO, EPO) and the insurer. These services generally fall into several key categories, each playing a vital role in maintaining overall health and well-being.

Preventative Care

Preventative care is a cornerstone of modern health insurance. The Affordable Care Act (ACA) mandates that most health plans cover a range of preventative services without cost-sharing (i.e., no copay, coinsurance, or deductible). This includes annual physicals, vaccinations, screenings for common diseases (like cancer and diabetes), and well-woman visits.

By emphasizing early detection and prevention, insurance companies aim to reduce the incidence of serious illnesses and the associated long-term costs. The U.S. Preventive Services Task Force provides recommendations for the specific screenings and services that should be covered.

Doctor's Visits and Specialist Consultations

Coverage for doctor's visits is a fundamental aspect of health insurance. This includes visits to primary care physicians (PCPs) for routine checkups, sick visits, and management of chronic conditions. Specialist consultations, such as visits to cardiologists, dermatologists, or orthopedists, are also typically covered, often requiring a referral from the PCP, depending on the plan.

The cost-sharing for these visits can vary depending on the plan's copay, deductible, and coinsurance structure. Some plans may require a copay at the time of the visit, while others may require the deductible to be met before coverage kicks in.

Emergency Services

Health insurance provides crucial protection in the event of a medical emergency. Emergency room visits, ambulance services, and urgent care centers are generally covered. The "prudent layperson" standard often applies, meaning that coverage is determined by what a reasonable person would consider an emergency based on the symptoms presented.

The ACA prohibits insurance companies from charging higher cost-sharing for out-of-network emergency services. However, patients may still be responsible for balance billing if the provider charges more than the insurance company is willing to pay.

Hospitalization

Hospitalization can be one of the most expensive healthcare services. Health insurance policies typically cover a significant portion of the costs associated with hospital stays, including room and board, nursing care, and necessary medical procedures.

However, it is important to understand the plan's deductible, coinsurance, and out-of-pocket maximum, as these can significantly impact the overall cost of hospitalization. Pre-authorization may be required for certain hospital procedures.

Prescription Drugs

Prescription drug coverage is a standard feature of most health insurance plans. Policies usually have a formulary, which is a list of covered medications categorized into tiers. Each tier has a different cost-sharing level, with generic drugs typically having the lowest copay and brand-name drugs having higher costs.

Some plans may require prior authorization for certain medications, particularly those that are expensive or have potential for misuse. Mail-order pharmacies can offer cost savings for long-term prescriptions.

Mental Health and Substance Abuse Services

The Mental Health Parity and Addiction Equity Act (MHPAEA) requires most health insurance plans to cover mental health and substance abuse services at the same level as medical and surgical benefits. This includes therapy, counseling, inpatient and outpatient treatment programs.

Despite the parity law, access to mental health services can still be challenging due to factors such as limited provider networks and high demand. Many insurance companies offer telehealth options for mental health services to improve access.

Limitations and Exclusions

While health insurance offers broad coverage, it is crucial to be aware of the limitations and exclusions. Cosmetic surgery, experimental treatments, and alternative therapies are often not covered. Pre-existing conditions are now generally covered under the ACA.

However, specific plans may have waiting periods or limitations on coverage for certain conditions. It's imperative to carefully review the policy's exclusions and limitations to understand what is not covered.

Factors Influencing Coverage

The extent of coverage can vary based on several factors. The type of health insurance plan (HMO, PPO, EPO, HDHP) significantly impacts the level of coverage and the cost-sharing requirements. HMOs typically require members to choose a primary care physician and obtain referrals for specialists. PPOs offer more flexibility in choosing providers but may have higher out-of-pocket costs.

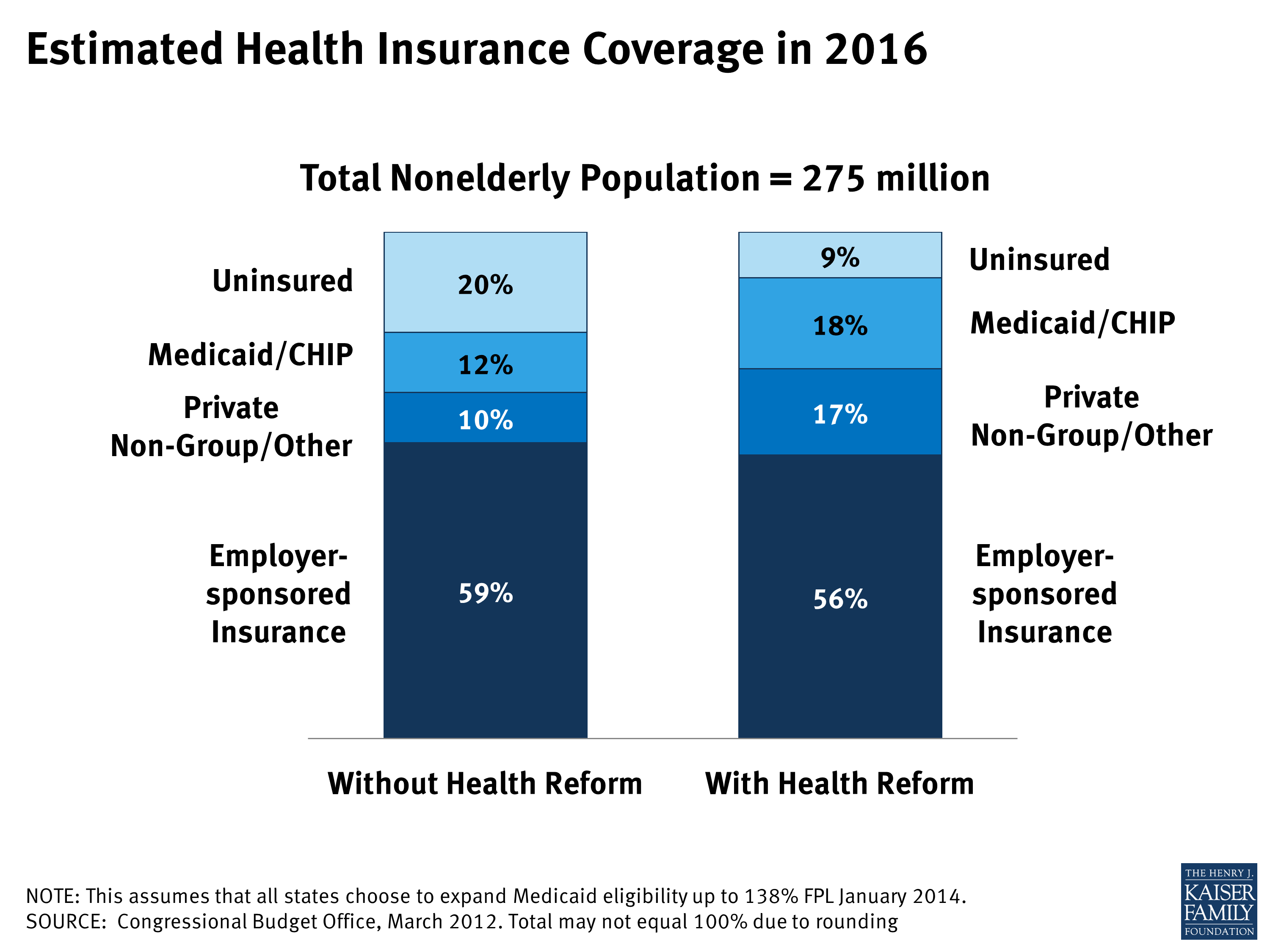

The specific insurance company and the policy's premium level also play a role. Higher premium plans generally offer richer coverage and lower cost-sharing. Employer-sponsored plans may have different coverage options compared to individual or marketplace plans.

Looking Ahead

The landscape of health insurance is constantly evolving. Emerging technologies, changes in healthcare regulations, and shifting consumer preferences are all shaping the future of coverage. Telehealth is becoming increasingly prevalent, expanding access to care and potentially lowering costs.

As healthcare costs continue to rise, it is more important than ever for consumers to understand their health insurance coverage and advocate for their needs. By staying informed and actively engaging with their insurance providers, individuals can navigate the complexities of the healthcare system and ensure they receive the care they need. Proactive engagement can also protect themselves from unexpected medical bills.