A Life Policy That Contains A Monthly Mortality Charge

Imagine sitting at your kitchen table, the aroma of freshly brewed coffee filling the air, as you sift through a stack of paperwork. Among the bills and circulars, a document catches your eye: your life insurance policy. You've always considered it a safety net, a promise of security for your loved ones, but something about the fine print now seems different, unfamiliar. It mentions something called a "monthly mortality charge," and a sense of unease begins to settle in.

This article delves into the intricacies of life insurance policies that incorporate a monthly mortality charge. We'll explore what this charge entails, how it impacts policyholders, and what to consider when choosing a life insurance plan to ensure peace of mind for yourself and your family.

Understanding the Monthly Mortality Charge

At its core, a monthly mortality charge (MMC) is the fee an insurance company levies to cover the cost of providing the death benefit associated with a life insurance policy. It's essentially the insurer's price for taking on the risk that the insured individual will die during the policy's term.

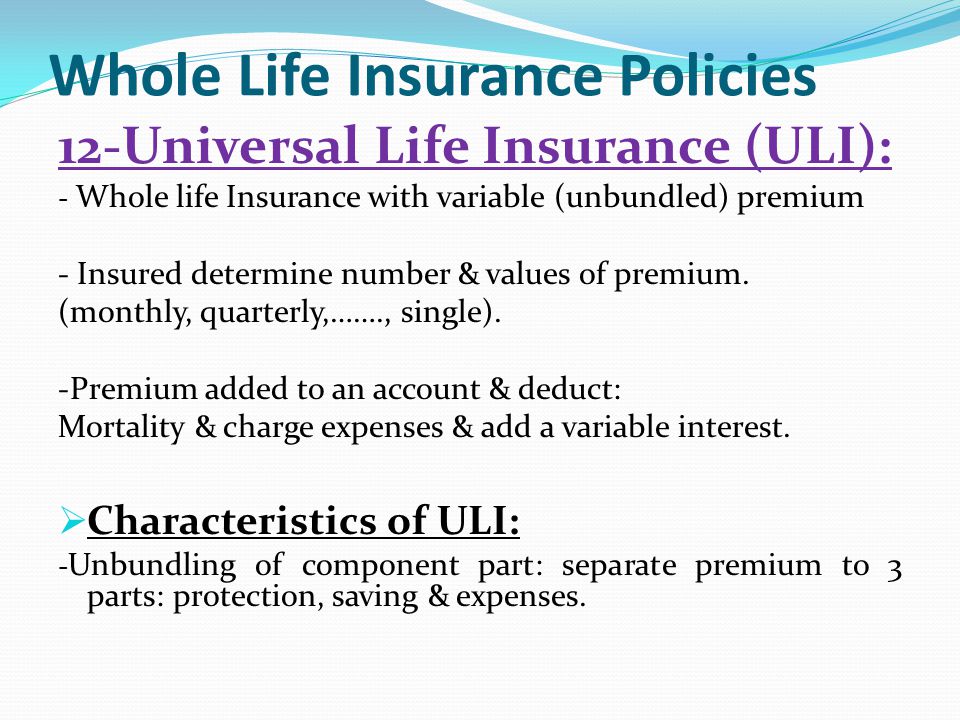

This charge is common in certain types of life insurance, particularly universal life and variable life policies, which offer a cash value component in addition to the death benefit. The MMC is deducted from the policy's cash value each month.

How It Works

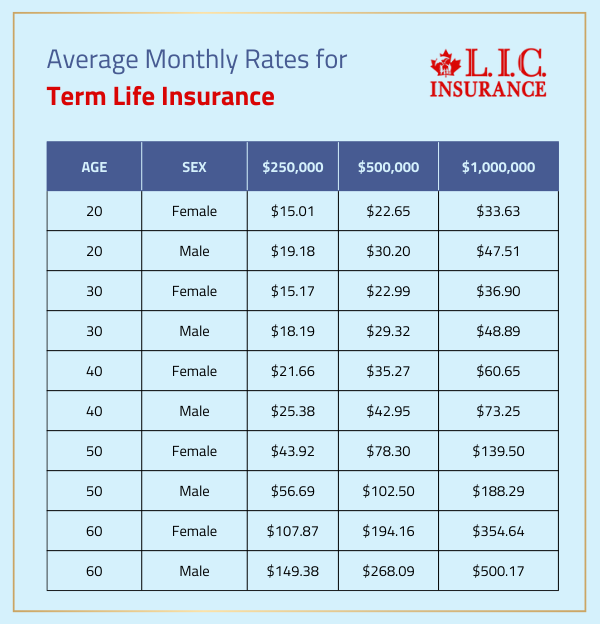

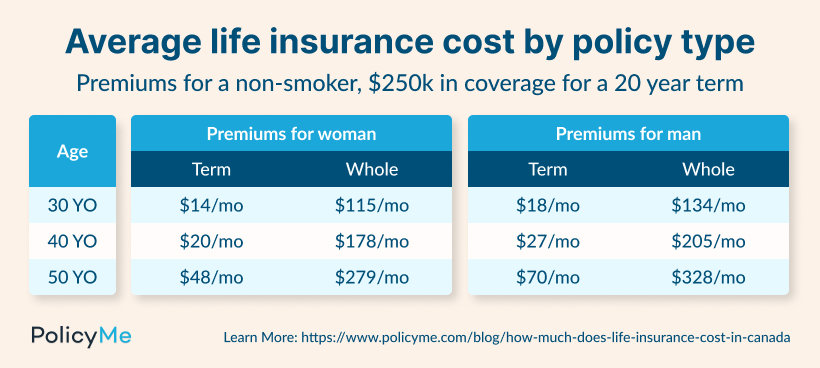

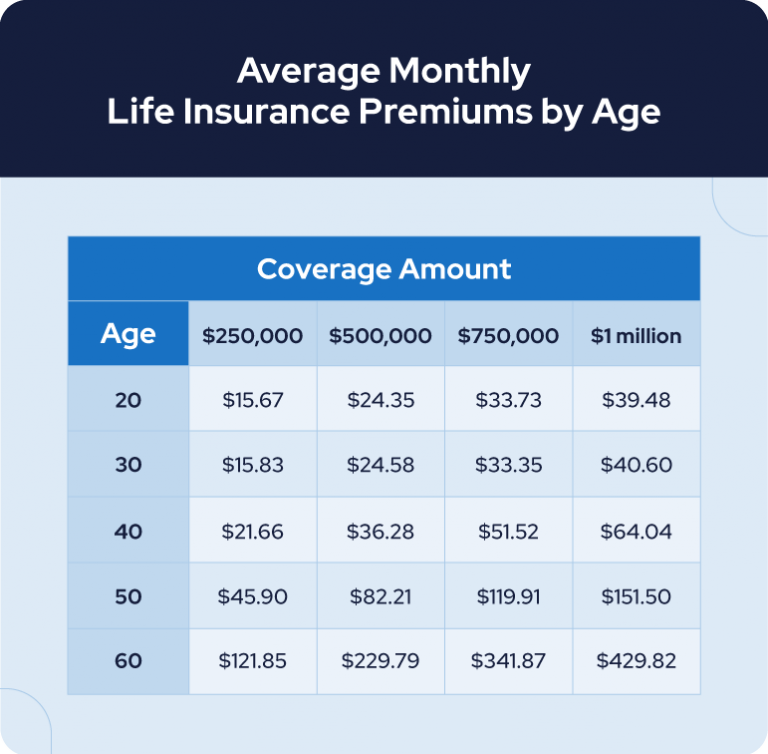

The MMC is calculated based on several factors, primarily the insured individual's age, gender, health status, and the amount of the death benefit. As the insured person ages, the risk of mortality increases, and consequently, the MMC also tends to rise.

Insurance companies use actuarial tables, which are statistical tables showing the probability of death at each age, to determine these charges. These tables are based on population-wide mortality data.

The specific formula for calculating the MMC can be complex and varies among insurance companies. However, it generally involves multiplying a mortality rate (derived from the actuarial tables) by the amount of the death benefit at risk.

The Impact on Policyholders

The presence of a monthly mortality charge directly affects the growth of the policy's cash value. Since the MMC is deducted monthly, it reduces the amount available for investment and subsequent growth.

In the early years of a policy, a significant portion of the premiums may go towards covering the MMC and other policy expenses, which can slow down the accumulation of cash value. This is particularly true for policies with larger death benefits.

It’s vital for policyholders to understand how the MMC can fluctuate over time. A rising MMC can put a strain on the policy's cash value, potentially leading to reduced returns or even policy lapse if the cash value is insufficient to cover the charges.

Transparency and Disclosure

Transparency regarding the MMC is crucial for policyholders to make informed decisions. Reputable insurance companies are obligated to disclose the existence of the MMC and provide clear explanations of how it is calculated.

Policy illustrations, which are projections of future policy performance, should include information about the MMC and its potential impact on cash value growth. However, it's important to remember that these illustrations are not guarantees and actual results may vary.

Potential policyholders should carefully review the policy documents, ask questions, and seek clarification from the insurance agent or company representative regarding the MMC and any other fees or charges associated with the policy.

Choosing the Right Policy

Selecting the right life insurance policy requires careful consideration of individual needs and financial goals. Understanding the different types of policies and their associated charges is paramount.

For those primarily seeking death benefit protection without the emphasis on cash value accumulation, term life insurance may be a more suitable option. Term life policies typically do not have a cash value component and, therefore, do not involve a monthly mortality charge.

If a cash value component is desired, it’s wise to compare different universal life or variable life policies from various insurers. Pay close attention to the MMC, as well as other fees, such as administrative charges and surrender charges.

Factors to Consider

When comparing policies, it’s essential to consider the long-term implications of the MMC. A policy with a lower initial premium may have a higher MMC, which could erode the cash value over time.

Review the policy's guarantees and limitations regarding the MMC. Some policies may guarantee a maximum MMC rate, while others may allow the insurer to adjust the rate based on market conditions.

Consult with a qualified financial advisor to assess your individual needs and receive personalized recommendations. A financial advisor can help you understand the complexities of life insurance and choose a policy that aligns with your financial goals.

Expert Perspectives

Financial experts often emphasize the importance of understanding the underlying costs associated with life insurance policies. “It's crucial to look beyond the initial premium and carefully evaluate all fees and charges, including the monthly mortality charge,” says Jane Doe, a certified financial planner. "A seemingly affordable policy could end up costing more in the long run if the MMC is excessively high."

According to the Insurance Information Institute, consumers should ask for detailed explanations of all fees and charges before purchasing a life insurance policy. “Transparency is key to ensuring that policyholders are making informed decisions and are not caught off guard by unexpected costs,” they state.

Independent consumer advocacy groups often advise comparing quotes from multiple insurers and thoroughly reviewing policy illustrations before making a purchase. This helps consumers identify policies with the most favorable terms and conditions.

A Path Forward

The presence of a monthly mortality charge in certain life insurance policies is not inherently negative. It's a necessary component of these policies, reflecting the insurer's cost of providing death benefit protection and managing the associated risks.

However, it's crucial for policyholders to be fully aware of the MMC and its potential impact on their policy's performance. Open communication with insurers and a proactive approach to understanding policy details are essential.

By taking the time to educate themselves and seek professional advice, individuals can make informed decisions about life insurance and ensure that they have the right coverage to protect their loved ones and achieve their financial goals. Ultimately, the goal is to secure a future where financial anxieties are replaced with the reassurance of a well-considered safety net.

.jpg)

+Table+of+Mortality%2C+Male+Lives+(selected+ages).jpg)