A Potential Negative Outcome Of Budgeting Is That

.jpg)

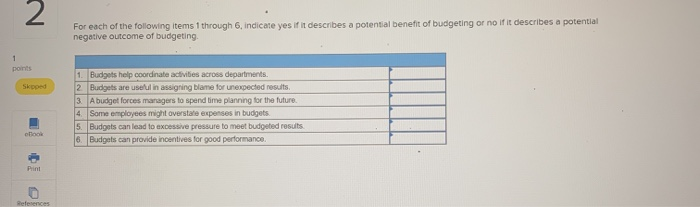

Budgeting, often lauded as a cornerstone of financial responsibility, can paradoxically lead to negative outcomes if not implemented and managed carefully. While intended to promote saving and control spending, rigid or poorly conceived budgets can create stress, limit opportunities, and even foster unhealthy financial behaviors.

This article examines the potential downsides of budgeting, exploring how restrictive financial plans can inadvertently undermine the very goals they aim to achieve. We will delve into the psychological, social, and economic repercussions of overzealous budgeting, drawing on expert opinions and real-world examples to illustrate the complexities involved.

The Perils of Over-Restriction

One of the primary pitfalls of budgeting is the temptation to create overly restrictive plans. Extreme budget cuts, especially when imposed suddenly, can trigger feelings of deprivation and resentment.

This can lead to a phenomenon known as "budget fatigue," where individuals become disillusioned with the process and abandon their financial goals altogether. According to a study by the Financial Therapy Association, overly restrictive budgets are a significant contributor to financial stress and anxiety.

Furthermore, excessively tight budgets can stifle opportunities for personal growth and development. Cutting back on educational courses, social activities, or even hobbies can limit access to new skills, experiences, and social connections.

These limitations can have long-term consequences, hindering career advancement and overall well-being. "It's crucial to strike a balance between saving and enjoying life," says Certified Financial Planner (CFP) Jane Doe. "A budget should be a tool for empowerment, not a source of constant stress."

The Impact on Relationships

Budgeting can also strain interpersonal relationships, particularly within households. Disagreements over spending priorities and budget enforcement are common sources of conflict among couples and families.

If one partner feels their needs or desires are consistently ignored, resentment can build up over time. In extreme cases, budget-related conflicts can even lead to separation or divorce, according to research from the American Psychological Association.

Even when disagreements don't escalate to that level, a constant focus on financial restrictions can create a tense and uncomfortable atmosphere within the home. Open communication and compromise are essential for navigating these challenges effectively.

The Risk of Neglecting Long-Term Goals

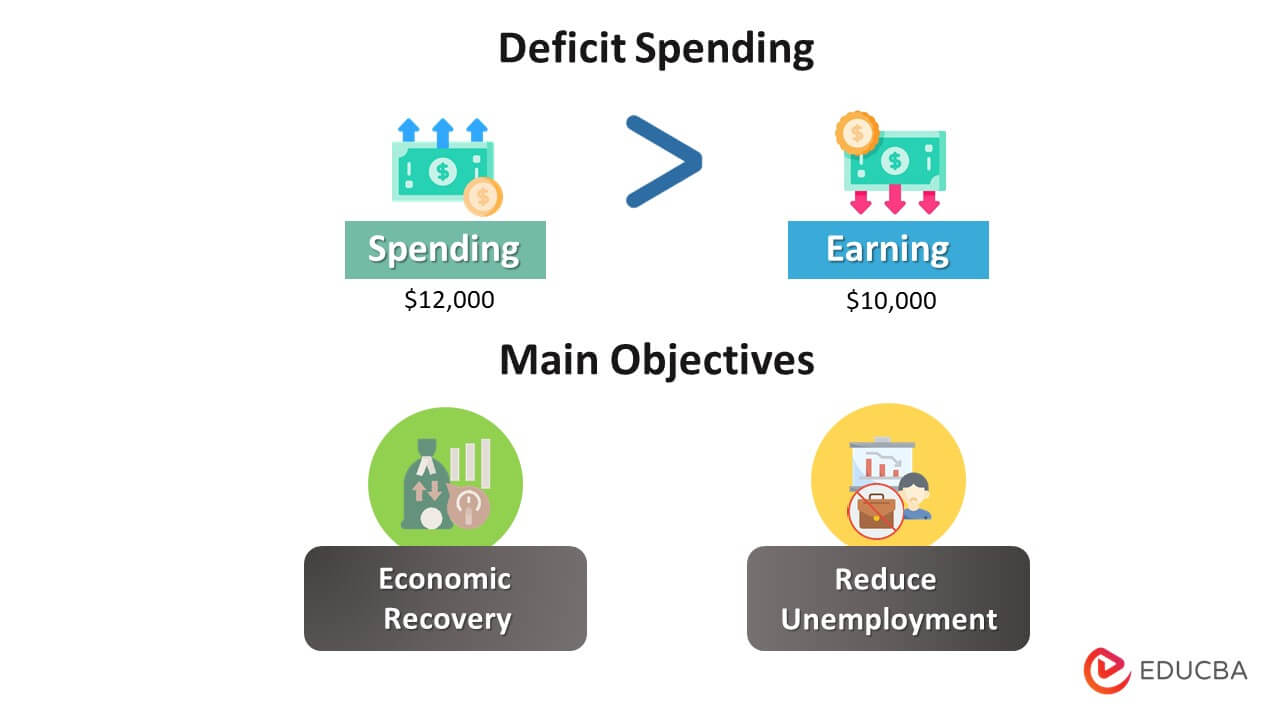

While budgeting often emphasizes short-term savings and expense tracking, it can sometimes lead to neglecting long-term financial goals. In an effort to cut costs immediately, individuals may postpone or avoid crucial investments in retirement, healthcare, or education.

This can have severe consequences in the future, particularly when unexpected emergencies arise. For instance, delaying preventative medical care to save money can result in more serious and expensive health problems down the line.

Similarly, foregoing retirement contributions in the short term can jeopardize financial security in old age. It's vital to ensure that budgeting strategies incorporate a long-term perspective and prioritize investments that will yield future benefits.

The Illusion of Control

Budgeting can sometimes create a false sense of control over one's financial situation. While it's undoubtedly helpful to track income and expenses, external factors beyond an individual's control can significantly impact financial stability. Economic downturns, job losses, or unexpected medical expenses can all disrupt even the most carefully crafted budget.

Relying solely on a budget as a buffer against financial adversity can be misleading and leave individuals vulnerable to unforeseen circumstances. It's important to supplement budgeting with other strategies, such as building an emergency fund and obtaining adequate insurance coverage.

Moreover, the focus on strict numbers can overshadow the importance of financial flexibility and adaptability. Life is unpredictable, and budgets should be designed to accommodate changes and unexpected events.

The Human-Interest Angle: A Cautionary Tale

Consider the story of Maria Rodriguez, a single mother who meticulously tracked every penny she spent. While her budgeting efforts initially helped her pay down debt, they also led to significant stress and social isolation.

Maria cut back on social activities and family outings to the point where her relationships suffered. She felt constantly anxious about exceeding her budget and became reluctant to spend money on anything that wasn't absolutely essential.

Eventually, Maria realized that her rigid budgeting was negatively impacting her quality of life. She adjusted her approach, allowing for more flexibility and incorporating "fun money" into her monthly plan. "Budgeting is a tool, but it shouldn't rule your life," she says.

Conclusion: Striking a Balance

Budgeting is a valuable tool for financial management, but it's essential to recognize its potential pitfalls. Overly restrictive budgets, strained relationships, neglected long-term goals, and a false sense of control are all potential negative outcomes.

By adopting a balanced and flexible approach, individuals can harness the benefits of budgeting without sacrificing their well-being or limiting their opportunities. Open communication, long-term planning, and a healthy perspective are crucial for successful and sustainable financial management.

Remember, a budget should serve as a guide, not a prison. Adjust it as needed and prioritize your overall well-being alongside your financial goals.

+Learning+Objective+C1:+Describe+the+benefits+of+budgeting+and+the+process+of+budget+administration..jpg)

+Motivates+employees+through+participation+in+the+budgeting+process+and+the+establishment+of+attainable+goals..jpg)