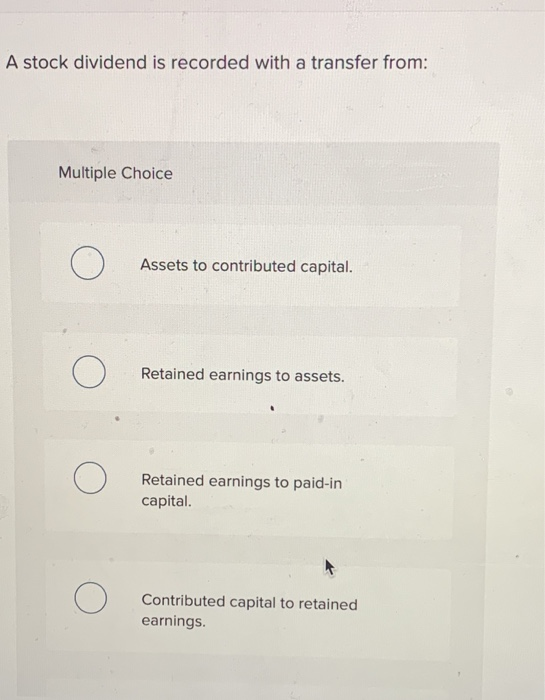

A Stock Dividend Is Recorded With A Transfer From

Imagine a quaint, sun-drenched garden, buzzing with the gentle murmur of bees flitting between vibrant blossoms. Each bloom represents a share of a thriving company, and the sweet nectar? That's the dividend, the reward for patiently nurturing that growth. Today, we're going to delve into a specific scenario in the world of finance – a stock dividend recorded with a transfer from another account – a process that, while seemingly complex, is fundamentally about sharing the fruits of a company's labor.

This article unpacks the intricacies of a stock dividend recorded with a transfer from another account, explaining what it means for both the company distributing the dividend and the investors receiving it. It will shed light on the accounting mechanics involved and the overall implications for shareholder equity and company valuation, providing a clear understanding of a common but often misunderstood corporate finance transaction. Essentially, we're demystifying how companies use existing resources to issue new shares to their loyal investors.

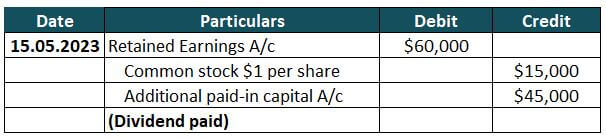

To fully grasp the concept, let's first revisit the basics of stock dividends. A stock dividend is a payment made to existing shareholders in the form of additional shares of the company's stock. Unlike cash dividends, which directly reduce a company's cash reserves, stock dividends involve the distribution of ownership, not liquid assets.

Companies typically issue stock dividends for several reasons. They may wish to conserve cash, signal confidence in future performance, or increase the number of outstanding shares to potentially improve liquidity. A stock dividend can also lower the per-share price, making the stock more accessible to smaller investors.

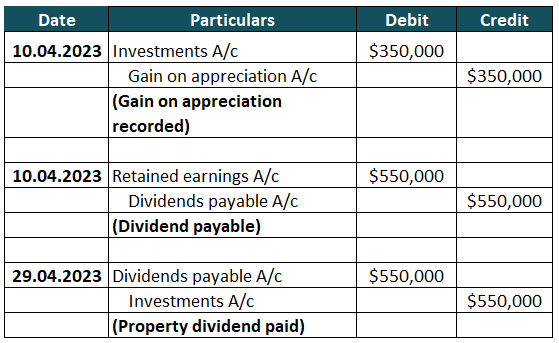

When a company declares a stock dividend, it doesn't magically create new value. Instead, it reallocates existing equity on the balance sheet. This reallocation typically involves transferring funds from retained earnings – the accumulated profits kept within the company – to other equity accounts.

The most common scenario is a transfer to the common stock account (representing the par value of the new shares issued) and the additional paid-in capital account (representing the amount received above the par value). This transfer essentially converts a portion of the company’s past profits into shareholders' capital.

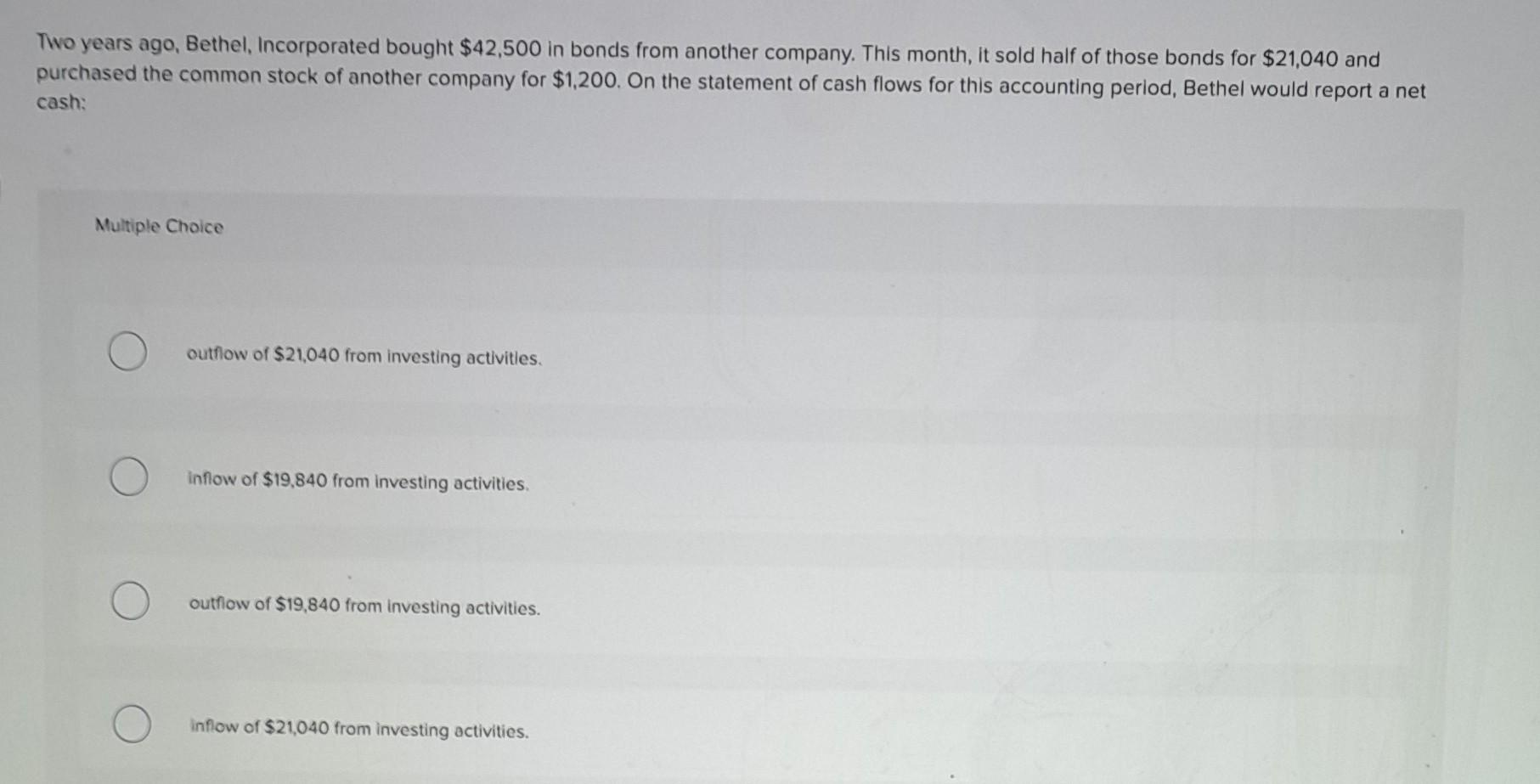

However, the scenario we're focusing on involves a "transfer from another account." This implies that the funding for the stock dividend isn't solely derived from retained earnings. It signifies a more strategic approach to leveraging internal resources.

What "another account" refers to can vary depending on the specific circumstances of the company and its accounting practices. It may involve a transfer from a treasury stock account (shares repurchased by the company), a revaluation surplus account (arising from the upward revaluation of assets), or, less commonly, from a dedicated capital surplus account.

Let's consider the treasury stock account. If a company has previously repurchased its own shares, those shares are held in treasury. Instead of reissuing these shares to the open market, the company can use them to fund a stock dividend. This is an advantageous route in times of economic uncertainty.

In this case, the accounting entry would involve a decrease in the treasury stock account, offset by an increase in the common stock and additional paid-in capital accounts, mirroring the issuance of new shares. The company avoids any substantial cash outflow, simply reallocating ownership from the treasury to existing shareholders.

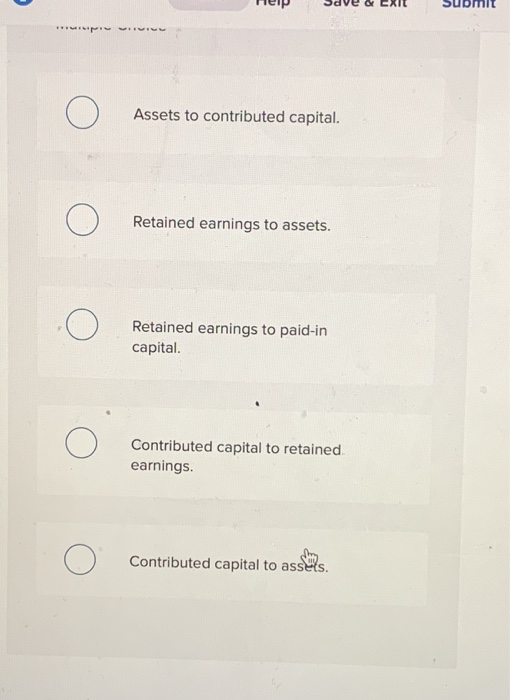

A revaluation surplus account arises when a company revalues its assets upwards, typically due to market appreciation. While less frequently used for stock dividends, these funds can be transferred and employed for the issue.

When using a revaluation surplus, the transaction could suggest that the company views its assets as undervalued, using the increased valuation to justify a more generous return to shareholders. This kind of stock dividend is especially useful when the company does not have adequate retained earnings.

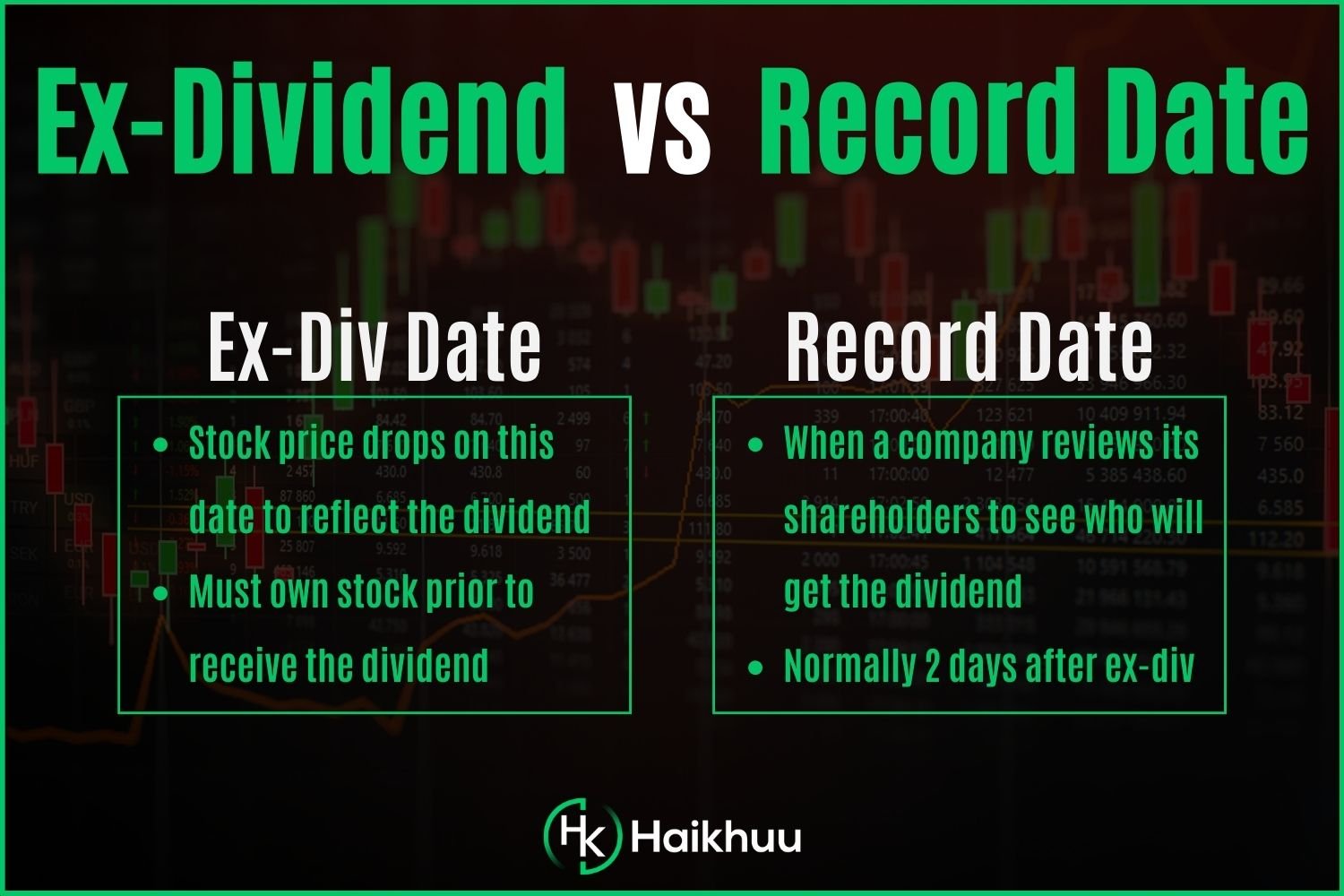

The impact of a stock dividend on shareholders is multifaceted. Firstly, shareholders receive more shares, increasing their proportional ownership in the company. However, because the total equity remains the same, the value of each individual share usually decreases proportionally.

For example, if a shareholder owns 100 shares of a company trading at $50 per share and receives a 10% stock dividend, they will now own 110 shares, but the share price will likely adjust to around $45.45 ($5000 / 110 shares), keeping the total value of their holding consistent.

While the immediate monetary value remains unchanged, a stock dividend can be beneficial for shareholders in the long run. A lower per-share price can attract new investors, potentially driving up demand and ultimately leading to higher share prices.

Furthermore, many investors perceive stock dividends as a positive signal from management, indicating confidence in the company's future prospects. The act of issuing new shares, even without a cash outlay, can boost investor sentiment and brand confidence.

From a company's perspective, the benefits of issuing stock dividends with a transfer from another account are significant. Most importantly, it conserves cash, allowing the company to reinvest in growth opportunities, reduce debt, or weather economic downturns. According to PwC's latest report on dividend trends, more companies are exploring stock dividends to retain cash during periods of uncertainty.

Additionally, a stock dividend can enhance a company's stock liquidity. By increasing the number of outstanding shares, the company may see improved trading volumes and reduced price volatility, making the stock more attractive to institutional investors.

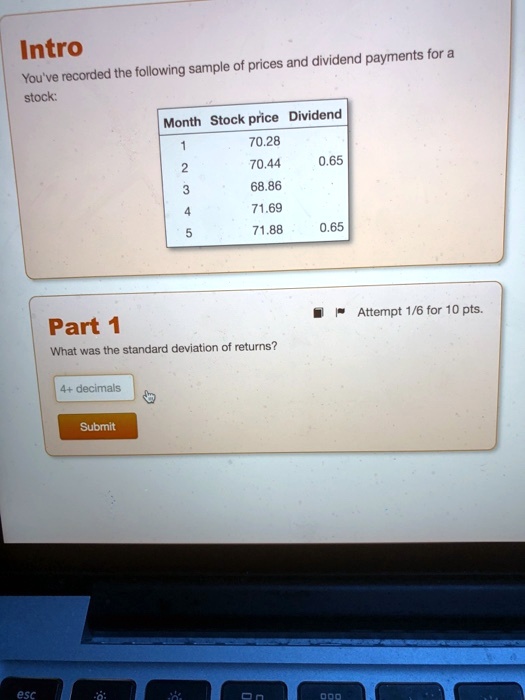

The accounting treatment for a stock dividend recorded with a transfer from another account is fairly straightforward. The key steps involve debiting the account from which the funds are transferred (e.g., treasury stock, revaluation surplus) and crediting the common stock and additional paid-in capital accounts.

The specific journal entries will depend on the type of account used for the transfer and the par value of the newly issued shares. It is important to comply with accounting standards and local regulations, and ensure that all documentation is properly maintained.

For example, if a company transfers $1 million from its treasury stock account to fund a stock dividend, the journal entry would debit treasury stock by $1 million and credit common stock and additional paid-in capital accordingly, based on the par value and market price of the shares.

In conclusion, a stock dividend recorded with a transfer from another account is a strategic financial maneuver that allows companies to reward shareholders without depleting their cash reserves. By carefully managing existing equity accounts, companies can boost investor confidence, improve stock liquidity, and position themselves for future growth.

This approach can be particularly advantageous in situations where a company has substantial treasury stock or a revaluation surplus, providing a flexible and efficient way to distribute value to shareholders. This is especially important given a recent Deloitte study highlighting increased shareholder demands for returns in the face of volatile market conditions.

Ultimately, understanding the nuances of these financial transactions empowers both investors and companies to make informed decisions, fostering a more transparent and efficient capital market. It demonstrates that financial health can be maintained even as companies seek innovative ways to share their prosperity.

.jpg)

.jpg)