Abbott Laboratories Investors 2018 Annual Report

Abbott Laboratories faced investor scrutiny following its 2018 Annual Report, released February 22, 2019, with concerns primarily focused on slower-than-expected growth in key segments and increased operational costs.

The report detailed the company's financial performance, highlighting revenue, expenses, and future outlook, which prompted immediate analysis and raised questions about Abbott's strategic direction. This analysis is crucial for investors to understand the potential impact on their investments.

Key Highlights from the 2018 Annual Report

Abbott reported worldwide sales of $30.6 billion for the full year 2018, reflecting reported growth of 11.5 percent and organic growth of 7.1 percent. This organic growth rate, while positive, fell slightly short of initial investor expectations set at the beginning of the year.

Adjusted diluted EPS increased to $2.88, reflecting growth of 19.4 percent. The company’s fourth-quarter sales grew 7.2 percent, however some analysts noted this growth was heavily reliant on international markets and new product launches.

The report highlighted strong performance in Established Pharmaceuticals and Medical Devices. However, challenges were apparent in other segments, leading to overall concerns about sustained growth momentum.

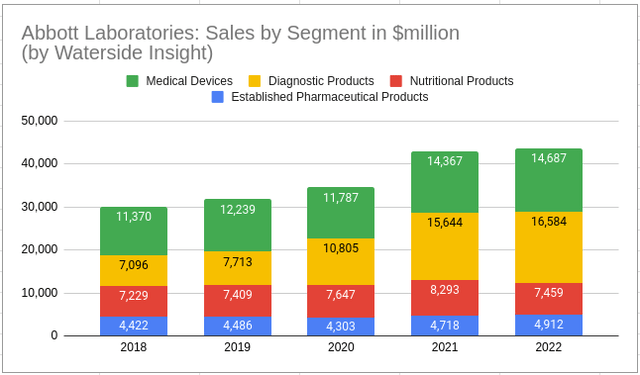

Segment Performance Breakdown

Nutrition sales were $7.1 billion in 2018, with reported growth of 3.9 percent and organic growth of 4.1 percent. Pediatric Nutrition experienced lower growth rates in certain emerging markets, affecting overall segment performance.

Diagnostics sales reached $7.7 billion in 2018, reflecting reported growth of 6.2 percent and organic growth of 6.7 percent. While the segment demonstrated solid growth, investors are seeking even higher returns from this key business unit.

The Medical Devices segment reported sales of $11.6 billion, with reported growth of 17.1 percent and organic growth of 7.8 percent. Despite strong growth, profitability in certain sub-segments remained a point of concern for investors.

Established Pharmaceuticals achieved sales of $4.2 billion in 2018, reflecting reported growth of 10.1 percent and organic growth of 10.5 percent. This segment’s performance was a positive aspect of the report, but concerns linger about its long-term sustainability.

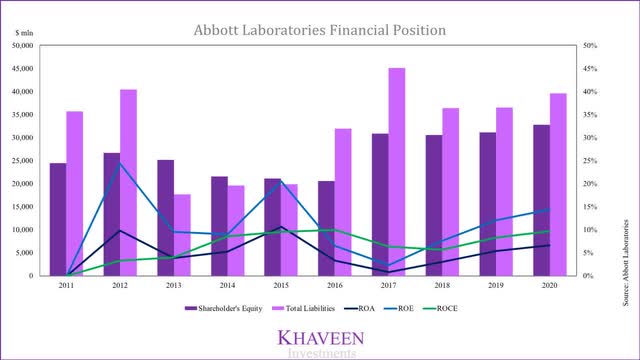

Operational Costs and Expenses

The report indicated an increase in selling, general, and administrative expenses, rising to $9.5 billion in 2018. Increased marketing and promotional spending in key markets contributed to this rise.

Research and development expenses also saw an increase, totaling $2.1 billion. This investment in innovation is viewed positively, but investors will closely monitor the returns on these investments.

These rising operational costs, combined with the slightly lower-than-anticipated organic growth, led to increased scrutiny from investors regarding Abbott's efficiency and cost-management strategies.

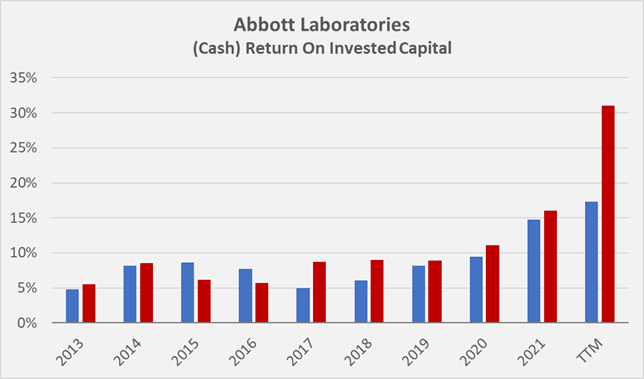

Investor Reaction and Market Response

Following the release of the 2018 Annual Report, Abbott's stock price experienced a period of volatility. Initial reactions were mixed, with some investors expressing disappointment over the growth figures.

Several analysts downgraded their ratings for Abbott, citing concerns about future growth prospects. However, other analysts maintained a positive outlook, emphasizing the company’s long-term potential and strategic acquisitions.

Investor confidence was further tested during subsequent earnings calls and investor conferences. Questions were raised regarding the company’s strategies for addressing the identified challenges.

Abbott's Response and Future Outlook

Abbott management addressed investor concerns through conference calls and public statements. The company emphasized its commitment to driving organic growth and improving operational efficiency.

Strategies included focusing on high-growth areas within their existing portfolio and optimizing supply chain operations. These initiatives are aimed at addressing concerns about profitability and sustained growth.

The company projected a positive outlook for 2019, forecasting organic sales growth of 6 to 7 percent. Achieving this target is crucial to regaining investor confidence and maintaining market position.

Specifically, Abbott plans to further leverage its investments in key areas such as Diabetes Care and Established Pharmaceuticals. These segments are expected to drive future growth and offset challenges in other areas.

Next Steps and Ongoing Developments

Investors will be closely monitoring Abbott's performance in the coming quarters. Key indicators will include organic growth rates, profitability margins, and the success of new product launches.

Ongoing developments include potential acquisitions and partnerships that could further enhance Abbott's market position. Any strategic moves will be carefully analyzed for their potential impact on shareholder value.

The next earnings report will provide further insight into Abbott's progress and the effectiveness of its strategies. Investors are urged to stay informed and assess the evolving situation diligently.