Accounting For Small Business Software

For small business owners, juggling daily operations with financial management can feel like a high-wire act. Fortunately, the rise of accounting software offers a safety net, promising efficiency and accuracy in handling finances. But with a vast array of options available, choosing the right software and understanding its implications can be daunting.

This article explores the current landscape of accounting software for small businesses. It will delve into the key features, pricing models, and the potential impact of these tools on the success of small enterprises. Understanding these tools is crucial for making informed decisions in an increasingly digital business environment.

The Rise of Digital Accounting

Accounting software has evolved significantly from simple spreadsheets to sophisticated, cloud-based platforms. These platforms offer a range of features tailored to the specific needs of small businesses. This evolution reflects the growing demand for streamlined financial management tools.

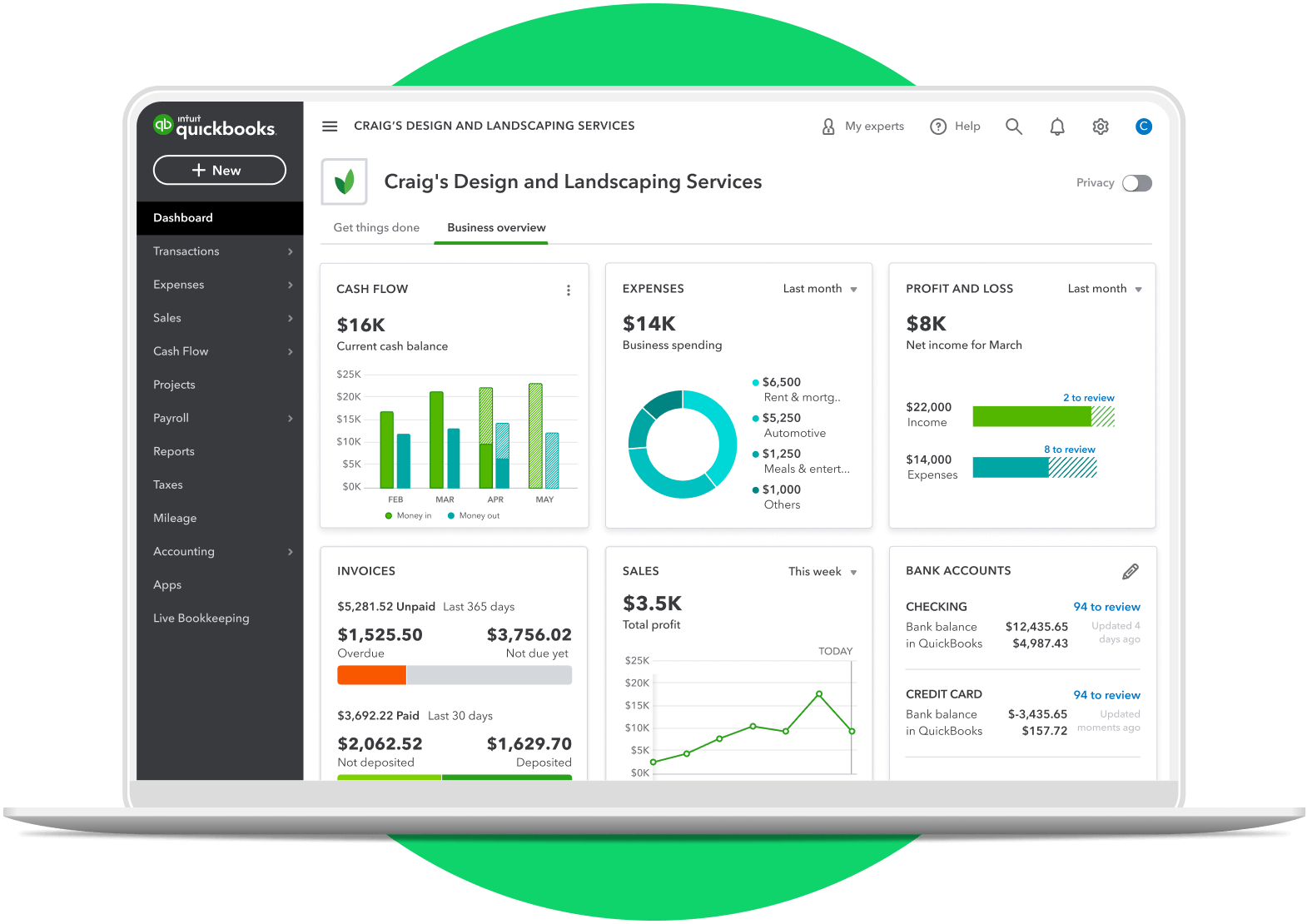

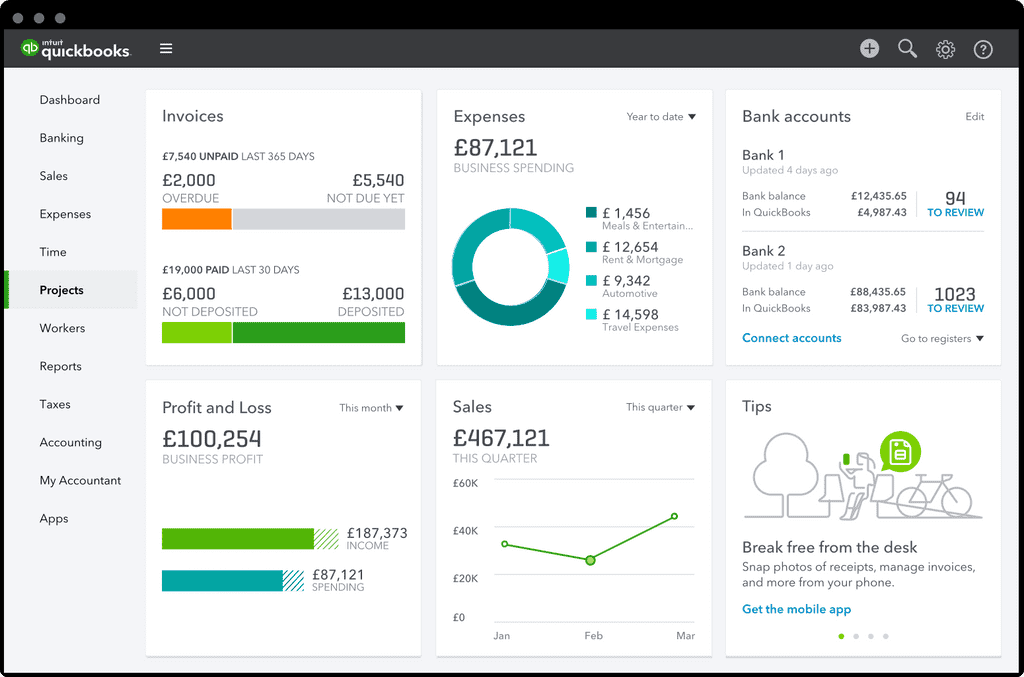

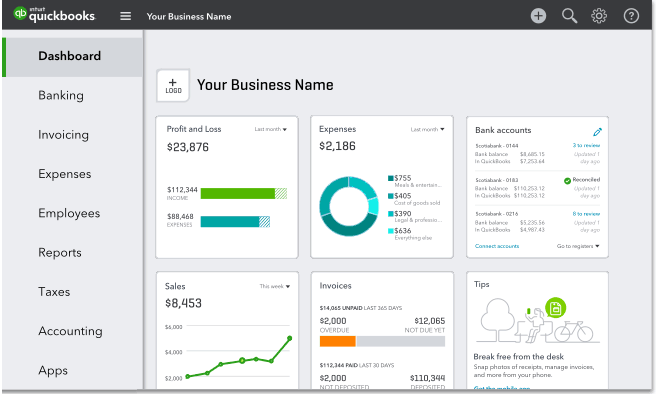

Key features often include invoicing, expense tracking, bank reconciliation, and financial reporting. Cloud-based solutions also offer accessibility from anywhere with an internet connection, facilitating collaboration and real-time insights.

Popular Software Options

Several players dominate the small business accounting software market. QuickBooks Online, Xero, and Zoho Books are among the most popular choices, each offering different strengths and pricing plans.

QuickBooks Online is known for its comprehensive feature set and integration with other Intuit products. Xero is praised for its user-friendly interface and strong mobile app. Zoho Books often appeals to businesses seeking a cost-effective solution within the Zoho ecosystem.

Pricing Models and Affordability

Accounting software typically operates on a subscription-based model. Prices vary depending on the features included and the number of users supported.

Entry-level plans can start as low as $15 per month, while more advanced plans with payroll and inventory management can cost upwards of $100 per month. Many vendors offer free trials or discounted introductory rates to attract new customers.

Impact on Small Businesses

Implementing accounting software can have a profound impact on small businesses. It automates many time-consuming tasks, freeing up owners to focus on other aspects of their business.

The automation reduces the risk of errors associated with manual data entry and calculations. It also provides real-time financial data, enabling better decision-making.

"The right accounting software can be a game-changer for small businesses, providing the financial clarity and control they need to thrive," says Sarah Johnson, a CPA specializing in small business accounting.

Beyond efficiency, these tools often provide insights into profitability, cash flow, and other key performance indicators. This allows business owners to identify trends, spot potential problems, and make informed strategic decisions.

Challenges and Considerations

Despite the benefits, adopting accounting software isn't without its challenges. The initial setup and learning curve can be time-consuming, requiring a commitment to training and implementation.

Data migration from existing systems can also be complex. Choosing the right software requires careful consideration of the business's specific needs and budget.

Security is another critical consideration, especially for cloud-based solutions. Businesses should ensure that their chosen software provider has robust security measures in place to protect sensitive financial data.

Looking Ahead

The future of accounting software for small businesses is likely to be shaped by artificial intelligence (AI) and machine learning (ML). These technologies can automate tasks such as invoice processing and fraud detection.

Furthermore, integration with other business applications, such as customer relationship management (CRM) and e-commerce platforms, will become increasingly seamless. This will provide a more holistic view of business operations.

For small business owners seeking to streamline their finances and gain a competitive edge, understanding and leveraging accounting software is more important than ever. The key is to research options thoroughly and choose a solution that aligns with their specific needs and long-term goals.