Accounting Packages For Small Businesses

Imagine Sarah, a passionate baker, finally opening her dream bakery. The aroma of freshly baked bread fills the air, customers are lining up, and she's beaming with pride. But behind the scenes, a mountain of receipts and invoices threatens to overwhelm her, turning her sweet dream into a potential accounting nightmare.

For countless small business owners like Sarah, navigating the world of finances can be daunting. The good news is, a wide array of accounting software packages exists to simplify the process, providing essential tools for managing income, expenses, and everything in between. Choosing the right package can make all the difference between a business that thrives and one that struggles under the weight of financial mismanagement.

The Evolution of Small Business Accounting

Once upon a time, small business accounting meant manually tracking every transaction in hefty ledgers. These days are fast fading.

The rise of personal computers in the 1980s marked the beginning of digital accounting. Early software was often expensive and complex, accessible only to larger businesses.

As technology advanced, so did accounting software. The emergence of cloud-based solutions revolutionized the field, offering accessibility, affordability, and real-time collaboration.

According to a report by Statista, the global accounting software market is projected to reach $19.6 billion by 2027, highlighting its growing importance in the business landscape. This growth reflects the increasing reliance of small businesses on technology to streamline their financial operations.

Key Features to Look For

Choosing the right accounting package involves careful consideration of several key features. Every business has unique needs and capabilities.

Invoicing and Billing: A good package should allow you to create and send professional invoices, track payments, and automate reminders. This ensures timely payments and improves cash flow.

Expense Tracking: Efficiently tracking expenses is crucial for understanding profitability and claiming tax deductions. Look for features that allow you to categorize expenses, upload receipts, and generate reports.

Bank Reconciliation: Reconciling bank statements with your accounting records helps identify discrepancies and prevent errors. Automated bank feeds can streamline this process and save time.

Reporting: Comprehensive reporting tools provide valuable insights into your business performance. You should be able to generate reports on profit and loss, cash flow, and balance sheets.

Payroll Integration: If you have employees, seamless payroll integration is essential for managing salaries, taxes, and deductions. Some packages offer built-in payroll features, while others integrate with third-party payroll providers.

Popular Options for Small Businesses

Several accounting packages cater specifically to the needs of small businesses. Each has its own strengths and price points.

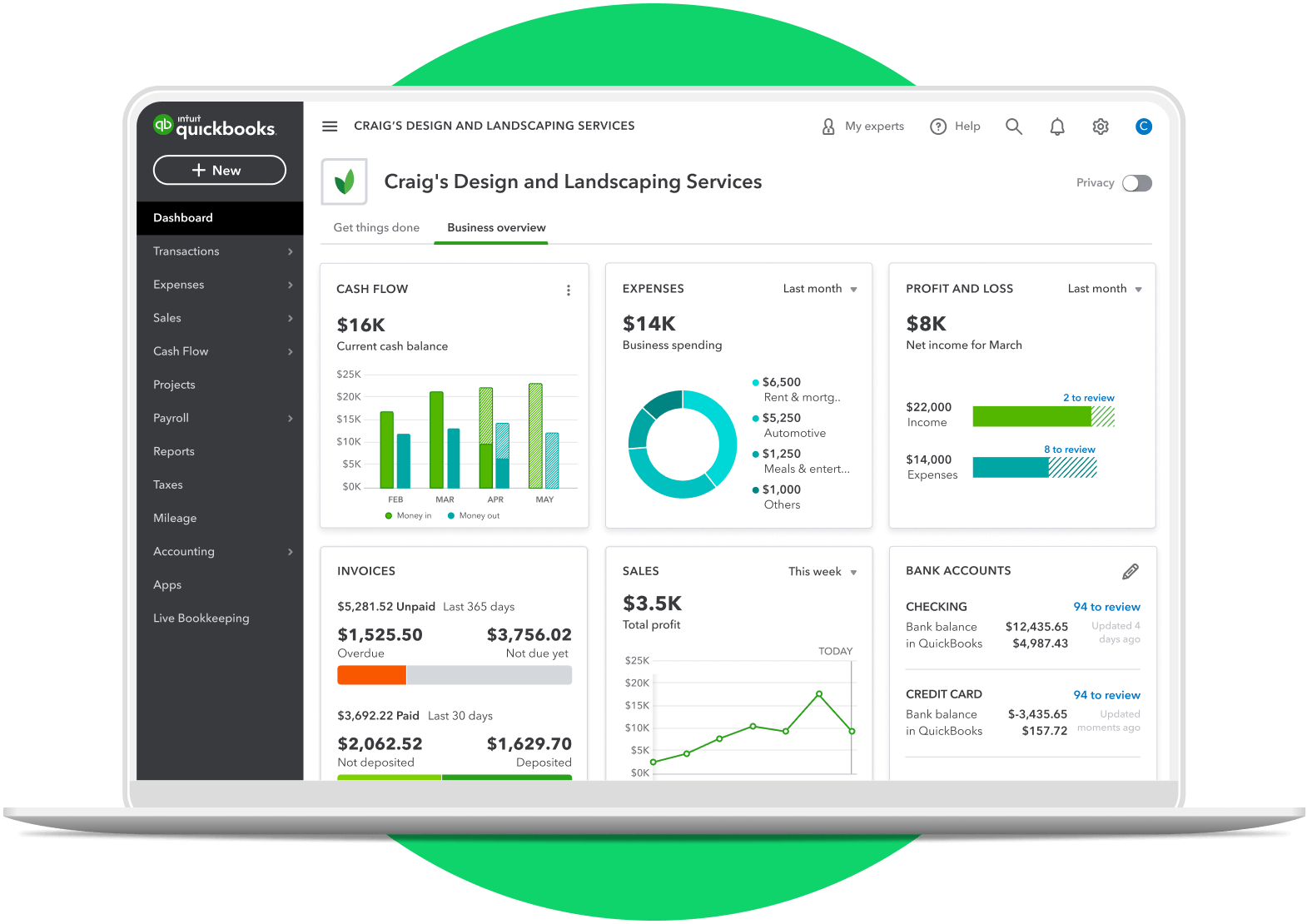

QuickBooks Online: One of the most popular options, QuickBooks Online offers a wide range of features, including invoicing, expense tracking, and payroll integration. It's known for its user-friendly interface and extensive online resources.

Xero: A cloud-based platform, Xero is another strong contender, offering similar features to QuickBooks Online. It's particularly praised for its sleek design and mobile app.

Zoho Books: As part of the Zoho suite of business applications, Zoho Books provides a comprehensive accounting solution with strong integration capabilities. It offers a free plan for very small businesses with limited features.

FreshBooks: Designed primarily for freelancers and service-based businesses, FreshBooks focuses on invoicing, time tracking, and project management. Its intuitive interface makes it easy to use.

When selecting an accounting package, consider your budget, the size and complexity of your business, and your level of accounting expertise. Free trials are often available, allowing you to test out different options before committing to a subscription.

Choosing an accounting package is a great start, but getting good advice is crucial. Consulting with an accountant can help you select the most appropriate software and set up your chart of accounts correctly.

The Path to Financial Clarity

The right accounting package can empower small business owners to take control of their finances and make informed decisions. No longer does Sarah the baker need to be bogged down by paperwork; she can now focus on what she loves: creating delicious treats and building her dream business.

With improved financial visibility, small businesses can identify areas for improvement, track their progress, and achieve their financial goals. It's about creating a sustainable future and achieving long-term success.

As the digital landscape continues to evolve, accounting software will undoubtedly become even more sophisticated, offering innovative solutions for managing finances. For small businesses, embracing these tools is no longer a luxury, but a necessity for survival and growth in today's competitive market.