Accounting Software For Bookkeepers

Imagine a cozy, sun-drenched office. The aroma of freshly brewed coffee fills the air as a bookkeeper, Sarah, diligently works through a stack of invoices. But instead of being buried under paperwork, she navigates seamlessly through her tasks, her fingers dancing across the keyboard, a serene smile gracing her face. This isn't a scene from a utopian dream; it's the reality for many bookkeepers empowered by the right accounting software.

The heart of the matter is this: accounting software has become an indispensable tool for bookkeepers, transforming their roles from number crunchers to strategic financial partners. This article explores the significance of accounting software for bookkeepers, examining its evolution, key benefits, and the impact it has on their efficiency and professional growth.

The Evolution of Accounting Practices

Traditionally, bookkeeping was a tedious, manual process. Large ledgers, handwritten entries, and countless hours spent reconciling accounts were the norm.

The advent of computers brought rudimentary spreadsheets, offering a marginal improvement.

However, the real game-changer was the introduction of dedicated accounting software.

Early Software Pioneers

Early software packages like QuickBooks and Sage revolutionized the field. They automated basic bookkeeping tasks such as recording transactions, generating reports, and managing payroll.

These platforms empowered bookkeepers to handle a larger volume of work with greater accuracy.

And they significantly reduced the risk of human error.

Cloud-Based Revolution

The shift to cloud-based accounting software has further transformed the industry. Platforms like Xero and newer versions of QuickBooks Online offer accessibility from anywhere with an internet connection.

This flexibility has been particularly beneficial for bookkeepers who work remotely or manage clients in various locations.

It also facilitates real-time collaboration between bookkeepers and their clients.

Key Benefits of Accounting Software

The advantages of using accounting software are multifaceted.

These tools streamline workflows, enhance accuracy, and provide valuable insights for both bookkeepers and their clients.

Increased Efficiency

Automation is a key feature. Accounting software automates repetitive tasks, freeing up bookkeepers to focus on more strategic activities.

Tasks like bank reconciliation, invoice generation, and expense tracking can be completed in a fraction of the time compared to manual methods.

This efficiency allows bookkeepers to manage more clients and increase their earning potential.

"By automating routine tasks, accounting software allows me to spend more time advising my clients on how to improve their financial performance." - Sarah Miller, Certified Bookkeeper

Improved Accuracy

Human error is inevitable with manual bookkeeping.

Accounting software minimizes this risk by automating calculations and providing built-in checks and balances. Features like double-entry bookkeeping ensure that every transaction is recorded accurately.

This accuracy builds trust with clients and reduces the likelihood of costly mistakes.

Enhanced Reporting and Analysis

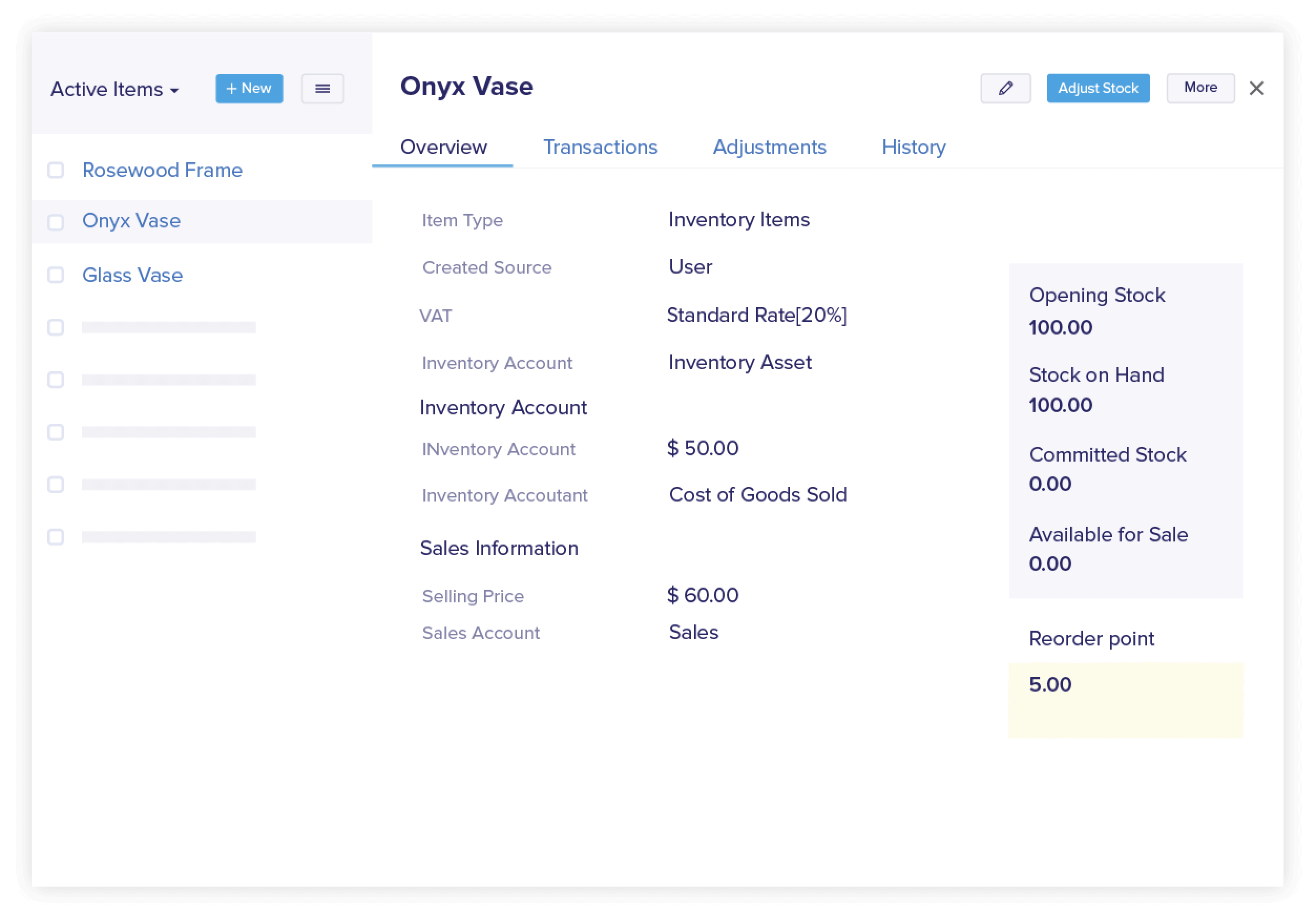

Modern accounting software offers robust reporting and analysis capabilities. Bookkeepers can generate a wide range of reports, including profit and loss statements, balance sheets, and cash flow statements, with just a few clicks.

These reports provide valuable insights into a client's financial performance, allowing bookkeepers to identify trends, spot potential problems, and offer data-driven advice.

Furthermore, many platforms offer customizable dashboards and visualizations that make it easy to understand complex financial data.

The Impact on Professional Growth

Accounting software not only improves efficiency and accuracy but also contributes to the professional growth of bookkeepers. By automating routine tasks, bookkeepers can focus on developing their skills in areas such as financial planning, tax preparation, and business consulting.

This shift towards advisory services makes them more valuable to their clients and opens up new career opportunities.

Continuing education and certifications related to specific software platforms are also becoming increasingly important for bookkeepers who want to stay competitive.

As technology continues to evolve, accounting software will undoubtedly become even more sophisticated, offering bookkeepers new tools and capabilities. The integration of artificial intelligence (AI) and machine learning (ML) is already beginning to automate more complex tasks, such as fraud detection and predictive analytics.

Bookkeepers who embrace these advancements and adapt their skills will be well-positioned to thrive in the future of accounting.

Ultimately, the power of accounting software lies in its ability to empower bookkeepers to become strategic financial partners, helping their clients achieve their business goals. It's a partnership forged in efficiency, accuracy, and a shared commitment to financial success.