Accounting Software Small Businesses

The financial backbone of the American economy, small businesses, are facing increasing pressure to streamline operations and enhance efficiency in an increasingly competitive landscape. A critical tool in this endeavor is accounting software, yet adoption and effective utilization remain a challenge for many. This article explores the evolving role of accounting software in the small business sector, examining the benefits, hurdles, and future trends shaping its implementation.

Accounting software has transitioned from a luxury to a necessity for small businesses striving for sustainable growth. This software offers a comprehensive solution for managing finances, tracking expenses, and ensuring compliance. However, despite the potential benefits, many small businesses struggle with choosing, implementing, and effectively using these tools, hindering their ability to leverage the full power of automation and data-driven decision-making.

Benefits of Accounting Software for Small Businesses

The primary advantage of accounting software lies in its ability to automate tasks. This automation drastically reduces the time spent on manual data entry and reconciliation. Consequently, businesses can focus on core operations like product development and customer engagement.

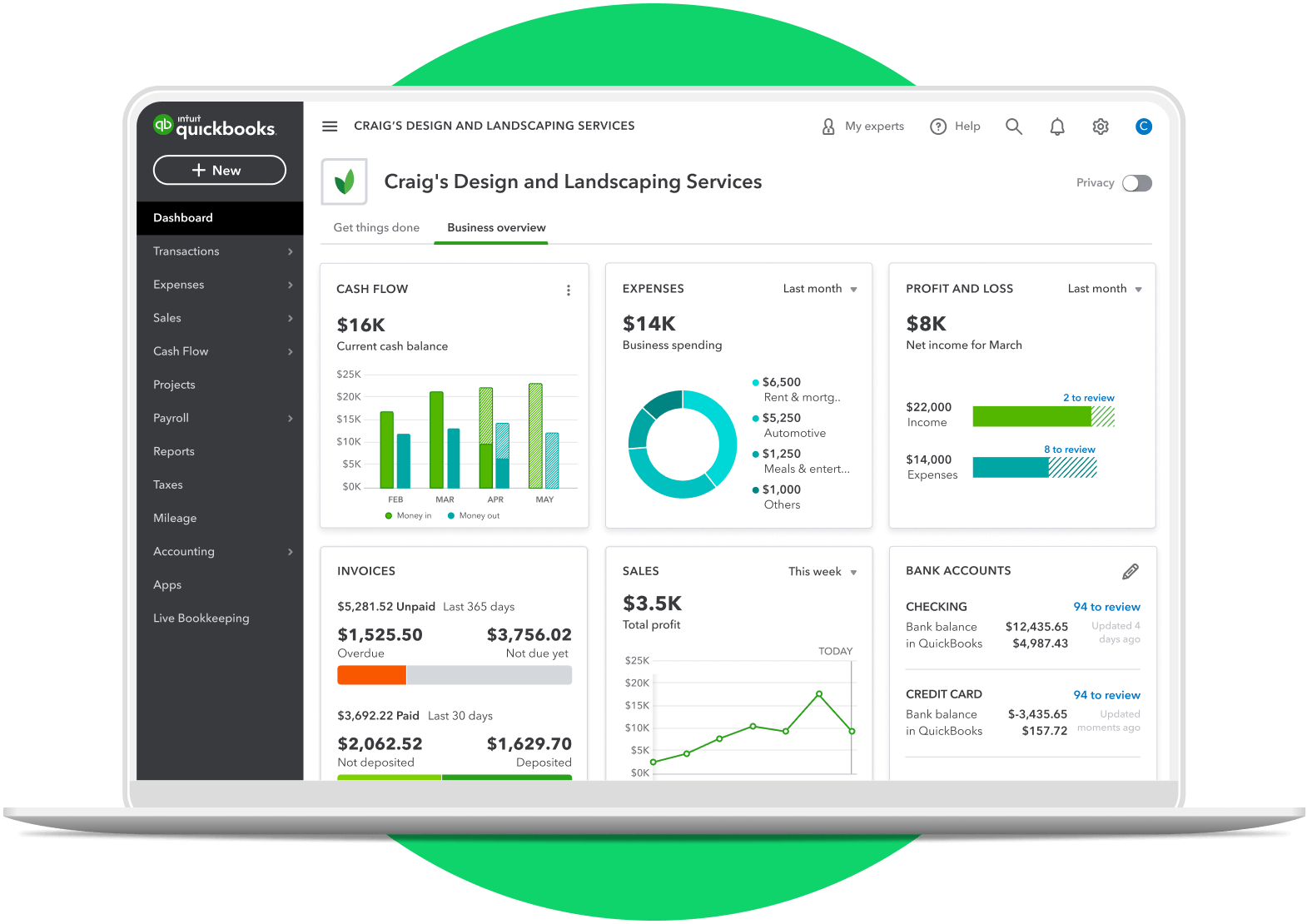

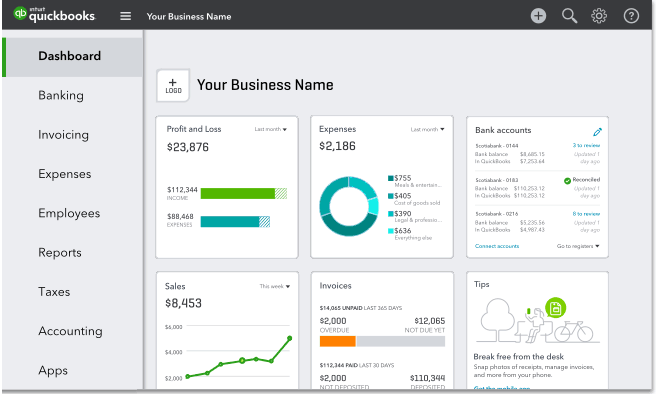

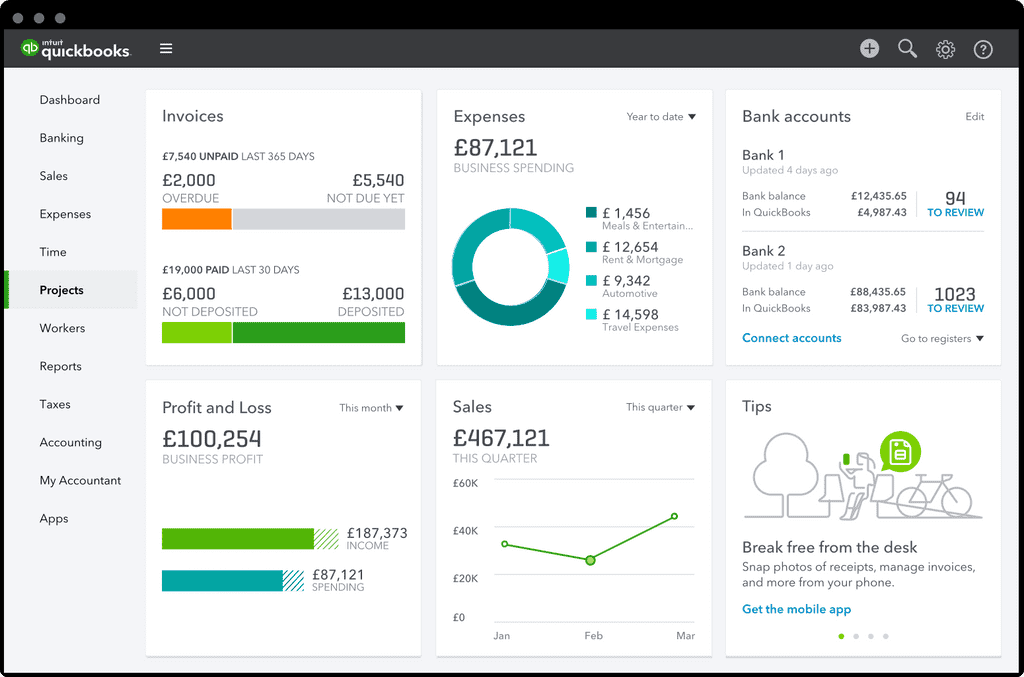

Beyond automation, accounting software offers real-time financial insights. These insights allow business owners to track key performance indicators (KPIs). This information empowers them to make informed decisions about pricing, inventory management, and investment strategies.

Furthermore, robust accounting software solutions enhance accuracy and compliance. They minimize the risk of errors associated with manual accounting. This leads to better financial reporting and reduces the likelihood of penalties from tax authorities like the IRS.

Challenges in Adoption and Implementation

Despite the clear benefits, many small businesses face significant challenges in adopting and implementing accounting software. Cost is a major deterrent, particularly for startups and businesses operating on tight budgets. Subscription fees, implementation costs, and training expenses can quickly add up.

Another hurdle is the complexity of some accounting software packages. Many small business owners lack the accounting expertise to fully utilize the software's capabilities. This lack of technical proficiency can lead to frustration and underutilization of the software's features.

Data migration from existing systems is another common pain point. Ensuring accurate and seamless transfer of financial data can be a time-consuming and complex process. Errors during data migration can have serious consequences for financial reporting and decision-making.

The Rise of Cloud-Based Accounting Solutions

Cloud-based accounting software has emerged as a game-changer for small businesses. It offers several advantages over traditional desktop software, including accessibility, scalability, and cost-effectiveness. According to a report by Gartner, cloud-based solutions are projected to account for a significant portion of the accounting software market in the coming years.

Accessibility is a key benefit. Cloud-based software allows business owners to access their financial data from anywhere with an internet connection. This flexibility is particularly valuable for businesses with remote employees or those operating in multiple locations.

Scalability is another major advantage. Cloud-based solutions can easily scale up or down to meet the changing needs of a growing business. This eliminates the need for costly hardware upgrades or software licenses as the business expands.

Choosing the Right Accounting Software

Selecting the right accounting software requires careful consideration of several factors. Business owners should assess their specific needs and requirements, including the size and complexity of their operations. They should also consider their budget and technical expertise.

It's essential to research different software options and compare their features, pricing, and user reviews. Many software vendors offer free trials or demos to allow businesses to test the software before committing to a purchase. Consulting with an accounting professional can also provide valuable insights.

Intuit's QuickBooks and Sage's Sage Intacct are popular choices among small businesses. Both offer a range of features and integrations to streamline accounting processes. However, other options, such as Xero, are also gaining traction in the market.

The Future of Accounting Software for Small Businesses

The future of accounting software for small businesses is likely to be shaped by several emerging trends. Artificial intelligence (AI) and machine learning (ML) are poised to play a bigger role in automating tasks. This includes fraud detection and predictive analytics.

Integration with other business applications, such as customer relationship management (CRM) and e-commerce platforms, will become increasingly important. This will provide a more holistic view of business operations and improve data-driven decision-making. According to a Forrester report, integrated business systems are crucial for long-term growth.

The increasing adoption of mobile devices will drive demand for mobile-friendly accounting software. Business owners will expect to be able to manage their finances and access real-time data from their smartphones and tablets, enabling greater agility and responsiveness.

Ultimately, the effective adoption and utilization of accounting software is crucial for the survival and success of small businesses. By embracing these tools and adapting to evolving trends, small businesses can streamline operations, improve financial management, and position themselves for sustainable growth in an increasingly competitive marketplace.