Accounts Software For Small Business

Imagine Sarah, a passionate baker, her small cafe filled with the aroma of freshly baked bread and the happy chatter of customers. But behind the scenes, amidst the flour and sugar, Sarah was drowning in a sea of spreadsheets, struggling to keep track of her finances. Late nights were spent wrestling with invoices and expenses, leaving her little time for what she truly loved: creating delicious treats and connecting with her community.

This is a familiar story for many small business owners. The good news is that the rise of user-friendly accounts software is offering a lifeline, transforming financial management from a daunting chore into a manageable, even empowering, aspect of running a business.

The Rise of Accessible Accounting

For years, accounting software was perceived as complex and expensive, often requiring specialized training. That perception is rapidly changing. Cloud-based solutions have democratized access, putting powerful financial tools within reach of even the smallest enterprises.

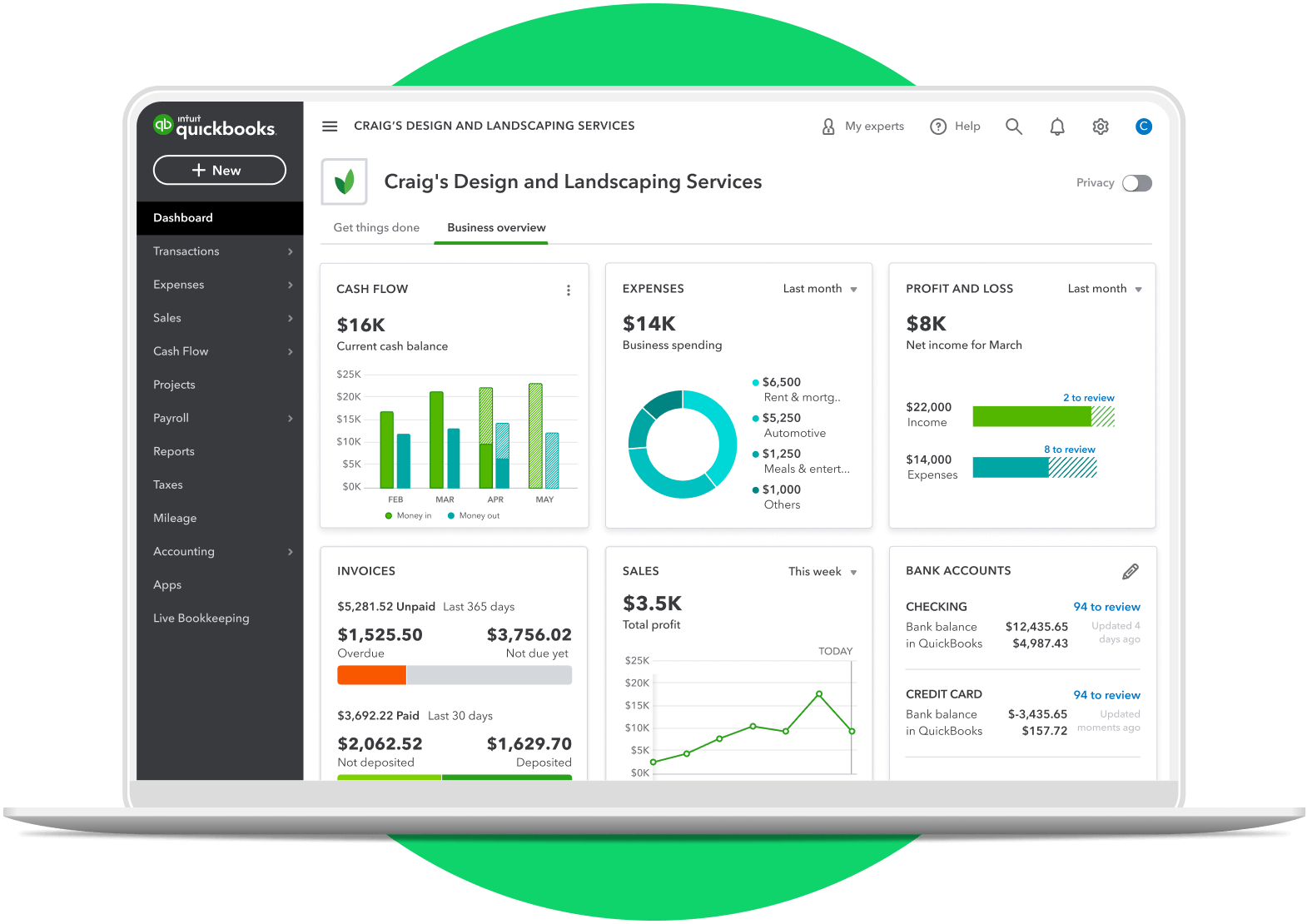

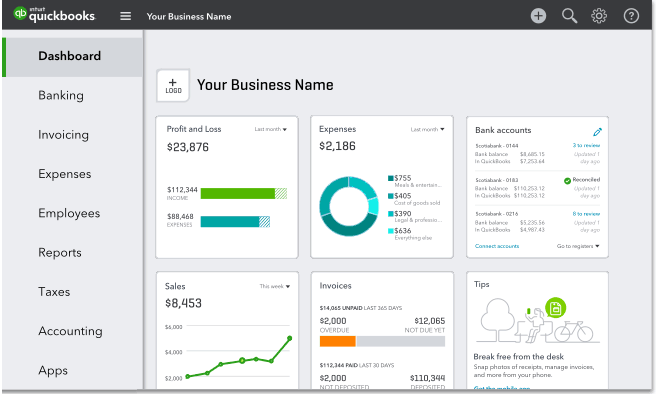

These platforms offer intuitive interfaces, automated features, and affordable subscription models, making financial management less intimidating and more efficient.

From Spreadsheets to Streamlined Solutions

The shift from manual spreadsheets to dedicated accounting software represents a significant leap forward for small businesses. Spreadsheets, while initially helpful, can quickly become unwieldy and prone to errors as a business grows.

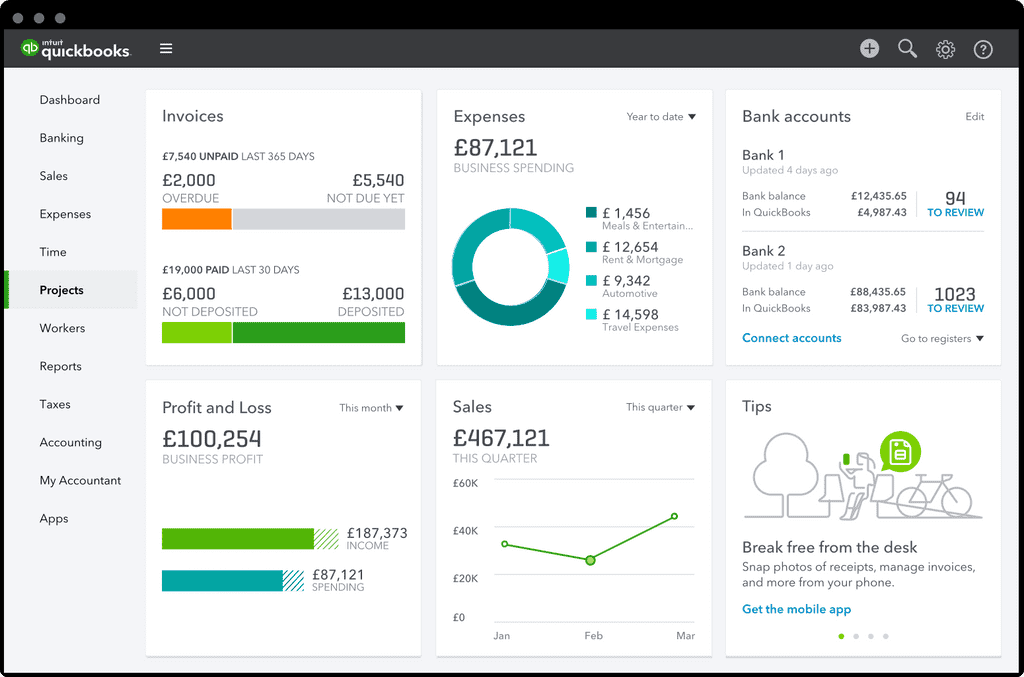

Accounts software automates tasks like invoicing, expense tracking, and bank reconciliation, significantly reducing the risk of mistakes and freeing up valuable time. According to a recent report by Intuit QuickBooks, businesses using accounting software spend up to 50% less time on bookkeeping tasks.

Key Benefits for Small Businesses

Beyond time savings, accounts software offers a multitude of benefits. It provides a clear and real-time view of a company's financial health, enabling owners to make informed decisions about pricing, investments, and growth strategies.

Accurate financial data is also crucial for securing funding from banks or investors. Accounts software simplifies tax preparation, ensuring compliance and minimizing the risk of penalties.

"Having a clear understanding of your finances is no longer a luxury, it's a necessity for survival and growth," says John Smith, a small business consultant. "The right accounts software can provide that clarity, empowering owners to take control of their financial destiny."

Choosing the Right Software

With numerous options available, selecting the right accounts software can feel overwhelming. Key considerations include the size and complexity of the business, the specific features needed, and the level of technical expertise of the user.

Many platforms offer free trials or demos, allowing potential users to test the software before committing. Reading reviews and seeking recommendations from other small business owners can also be helpful.

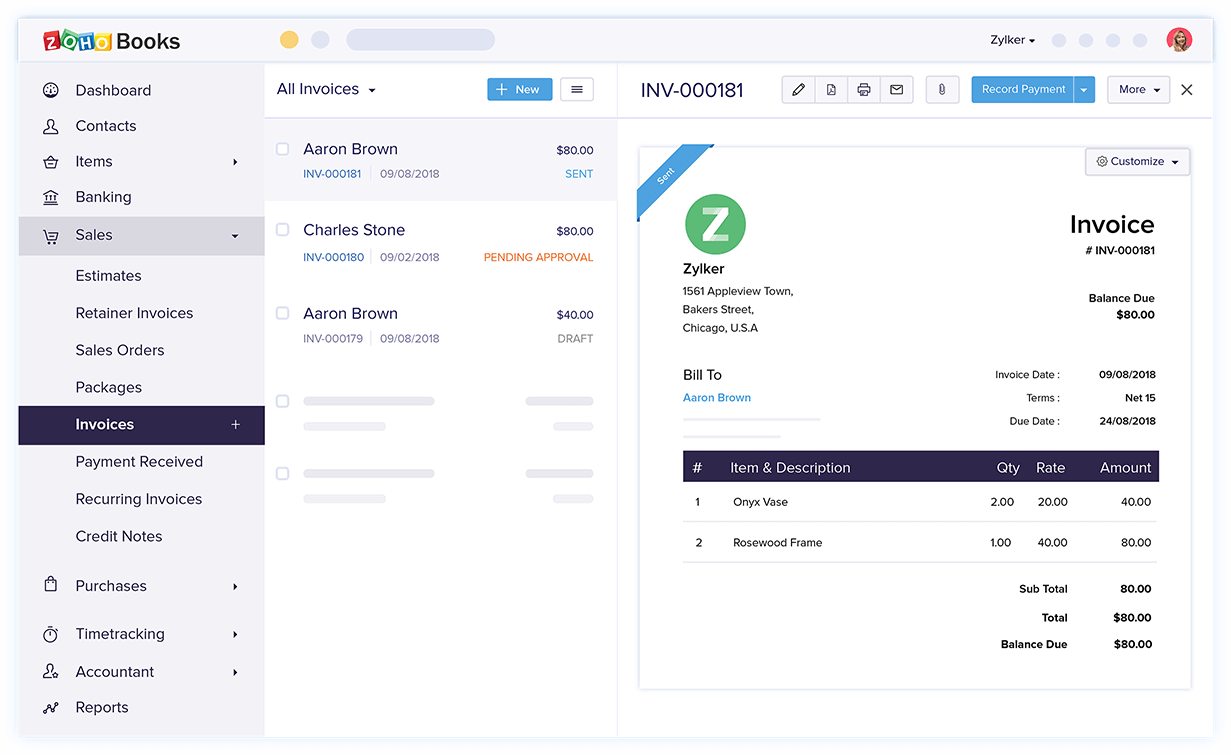

It is also important to consider integrations with other software that a business might already be using, such as CRM or e-commerce platforms. Some popular solutions include Xero, Sage, and Zoho Books, each offering a unique set of features and pricing plans.

Beyond the Numbers: Empowerment and Growth

Ultimately, the adoption of accounts software is about more than just streamlining financial processes. It's about empowering small business owners to take control of their finances, make informed decisions, and focus on what they do best: growing their businesses and serving their customers.

For Sarah, the baker, implementing accounting software meant fewer late nights wrestling with spreadsheets and more time experimenting with new recipes and connecting with her community. It allowed her to shift her focus from administrative tasks to her passion, ultimately leading to a more successful and fulfilling business.

As the landscape of small business continues to evolve, accounts software is poised to play an increasingly critical role, enabling entrepreneurs to thrive in a competitive market. It is a tool that not only manages finances but also unlocks potential and fuels growth.