Accrued Market Discount On Treasury Notes

Treasury investors face a critical juncture as accrued market discount rules intensify scrutiny. Heightened awareness is paramount, as misunderstanding could trigger unforeseen tax implications.

This article dissects the complexities surrounding accrued market discount on Treasury notes, providing clarity for investors navigating these regulations.

Understanding Accrued Market Discount

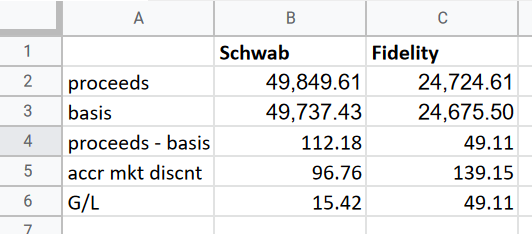

The accrued market discount arises when a Treasury note is purchased for less than its face value on the secondary market. This discount represents the difference between the purchase price and the note's par value at maturity.

However, the tax treatment of this discount can be intricate, often misunderstood by even seasoned investors.

Who is Affected?

Any investor purchasing Treasury notes at a discount on the secondary market is potentially affected. This includes individuals, corporations, and institutions.

The impact is most significant for those who hold these notes outside of tax-advantaged accounts like 401(k)s or IRAs.

Careful planning is essential to mitigate unforeseen tax burdens.

What is Accrued?

The accrued portion of the market discount refers to the amount that has accumulated over time. This represents the portion of the total discount that is considered earned but not yet realized.

Determining the accrued amount requires calculating the proportional amount of the total discount based on the holding period.

Different methods exist for calculating this accrual, adding another layer of complexity.

Where Does This Apply?

This regulation applies to all U.S. Treasury notes purchased at a discount on the secondary market, regardless of the location of the buyer.

It also applies to transactions executed through brokerage accounts, direct purchases from the Treasury, or any other method of acquisition.

No geographical exemptions exist for U.S. taxpayers.

When Does This Matter?

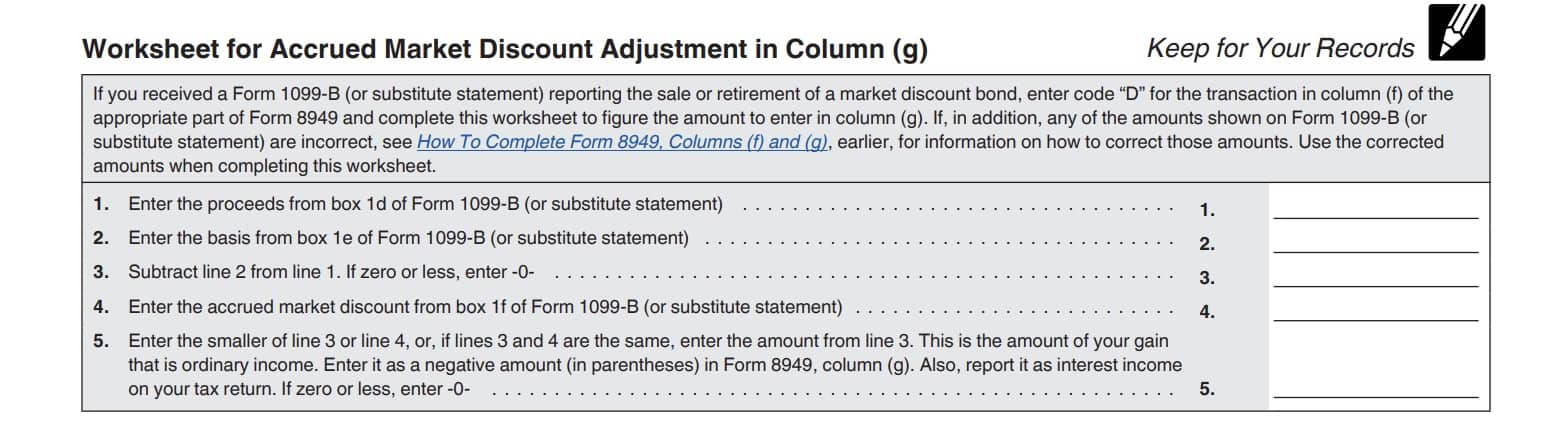

The tax implications become particularly relevant when the Treasury note is sold before maturity. The accrued market discount is then taxed as ordinary income at the time of sale.

This taxation can surprise investors who were expecting capital gains treatment.

Maturity of the bond also triggers a tax event.

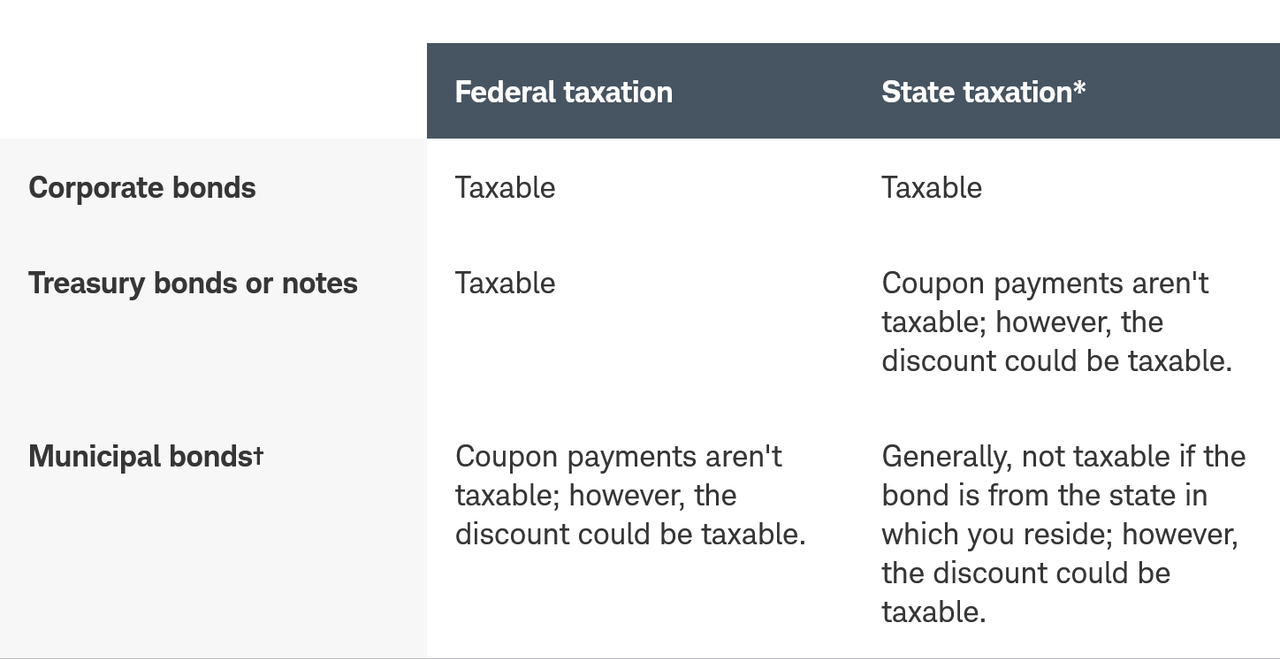

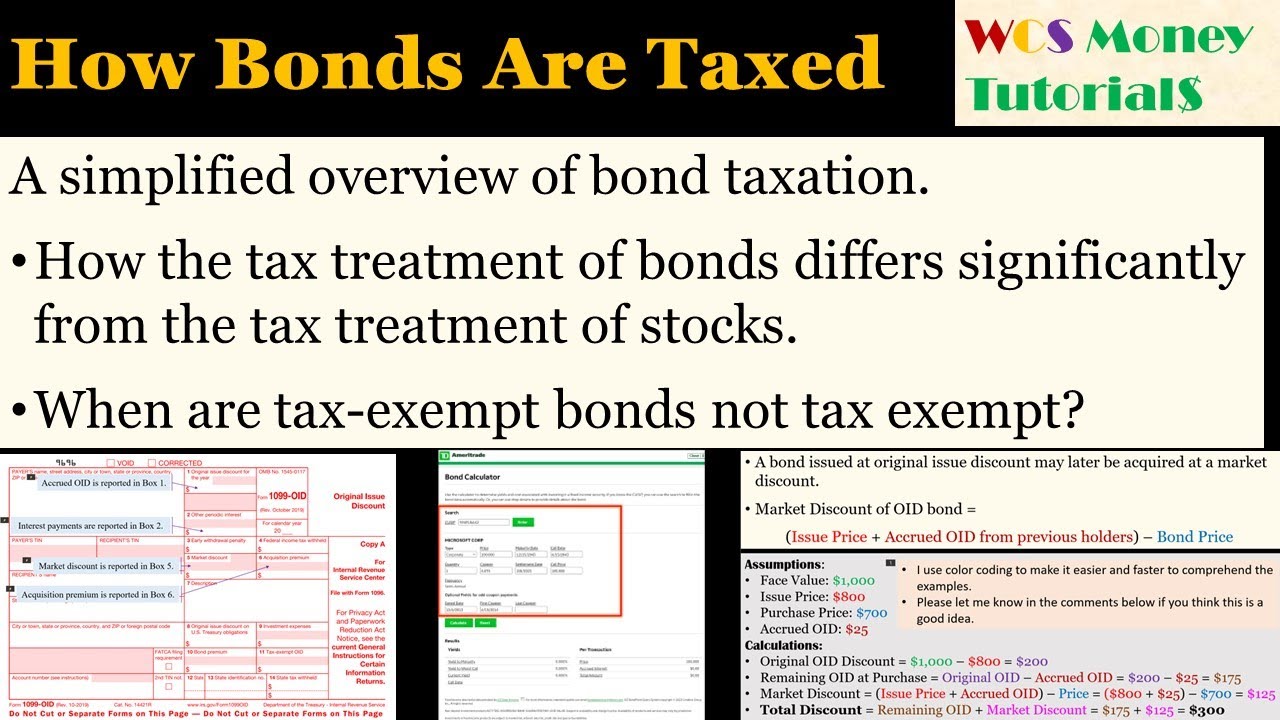

How is it Taxed?

The Internal Revenue Service (IRS) treats the accrued market discount as ordinary income, not as a capital gain. This distinction is crucial.

Ordinary income tax rates are generally higher than capital gains rates, potentially leading to a larger tax liability.

Investors should consult with tax professionals to understand their specific obligations.

Critical Considerations and Recent Updates

Tax Planning is Paramount: Investors must proactively factor in the potential tax liability associated with accrued market discount when making investment decisions.

Consulting a qualified tax advisor is essential to ensure compliance and optimize tax strategies.

Ignoring these rules can result in penalties and interest charges from the IRS.

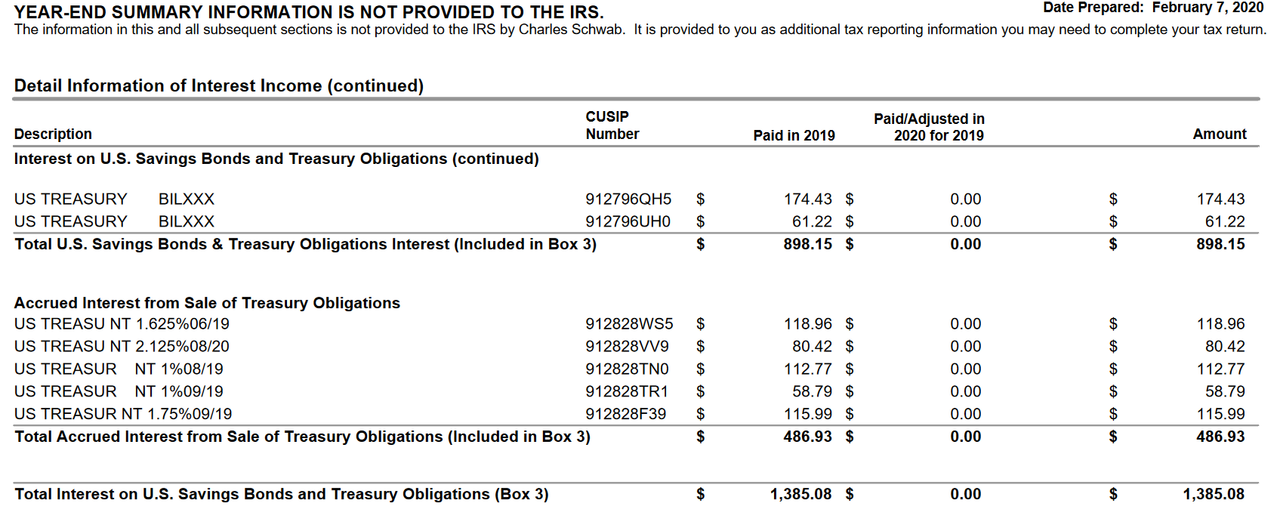

Reporting Obligations: Accurate reporting of accrued market discount on tax returns is mandatory. Failure to do so can trigger audits and further scrutiny.

Form 1099-B, provided by brokerage firms, should reflect the market discount. Investors must verify the accuracy of this information.

Discrepancies should be promptly addressed with the brokerage firm.

IRS Guidance: The IRS provides guidance on the treatment of market discount in publications and rulings. Investors should familiarize themselves with these resources.

Staying informed about changes in tax law is crucial for effective tax planning.

Resources like IRS Publication 550 offer detailed explanations.

Next Steps and Ongoing Developments

Investors holding Treasury notes purchased at a discount should immediately review their holdings and consult with a tax professional.

Monitor updates from the Treasury Department and the IRS regarding any potential changes to the regulations.

Continued vigilance is key to navigating the complexities of accrued market discount on Treasury notes effectively.

Brokerage firms and financial institutions are increasingly providing more detailed information on market discount to assist investors.

This increased transparency should aid in more accurate tax reporting.

However, the ultimate responsibility for compliance rests with the individual investor.

.jpg)