Accrued Revenues Would Appear On The Balance Sheet As

The complexities of financial accounting can often seem like a dense fog, obscuring the true financial picture of a company. Among the many concepts that require careful understanding, accrued revenues and their placement on the balance sheet are crucial for accurate financial reporting. Misunderstanding this aspect can lead to skewed financial analyses and potentially flawed business decisions.

This article delves into the nature of accrued revenues, explaining why they appear as an asset on the balance sheet. We will explore the accounting principles that govern their treatment, the implications for financial statement analysis, and practical examples to illustrate the concept. This information is vital for investors, creditors, and anyone seeking a clear understanding of a company’s financial health.

Understanding Accrued Revenues

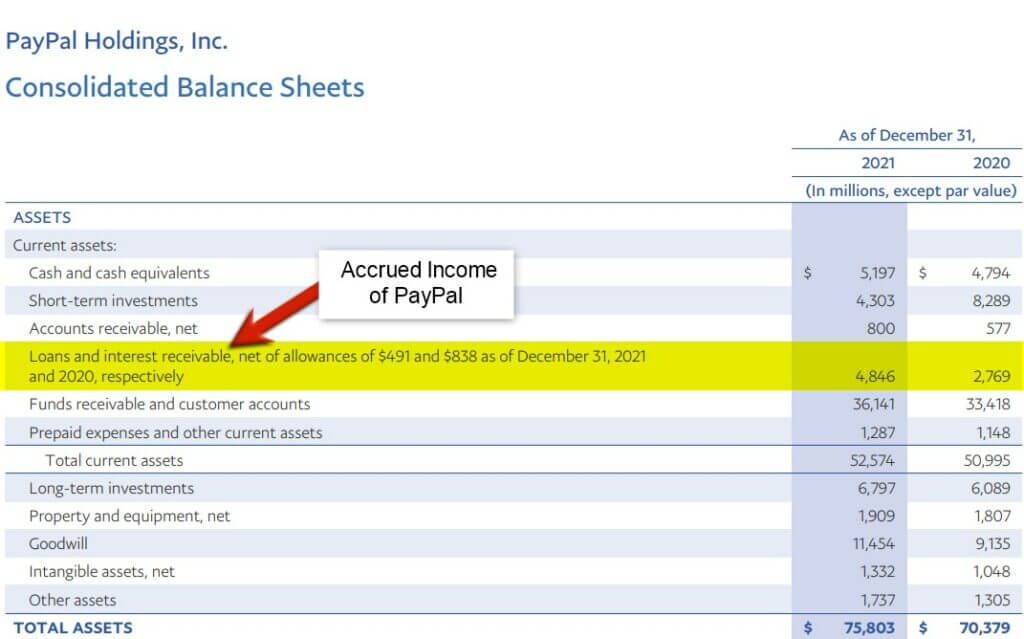

Accrued revenues, also known as accrued receivables, represent revenue that a company has earned but has not yet received payment for. This typically occurs when goods have been delivered or services have been rendered, but the customer has not yet been invoiced. In essence, the company has a right to receive future payment for work already completed.

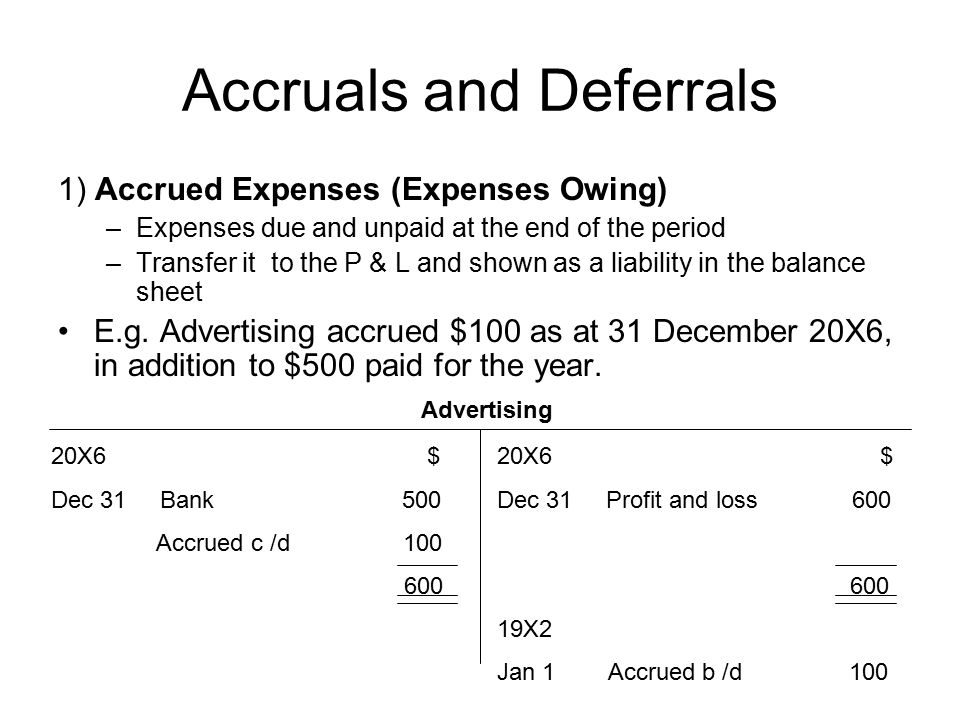

The concept of accrual accounting, which dictates that revenues and expenses are recognized when they are earned or incurred regardless of when cash changes hands, underpins the treatment of accrued revenues. This is in contrast to cash accounting, where transactions are recorded only when cash is received or paid out.

According to Generally Accepted Accounting Principles (GAAP), accrual accounting provides a more accurate reflection of a company's financial performance over a specific period. It paints a more complete and relevant picture than cash accounting alone.

Accrued Revenues on the Balance Sheet: An Asset

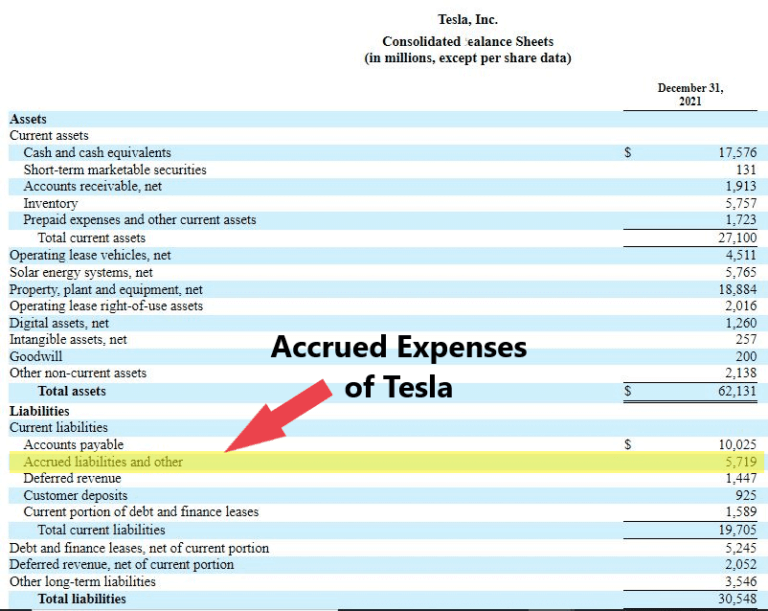

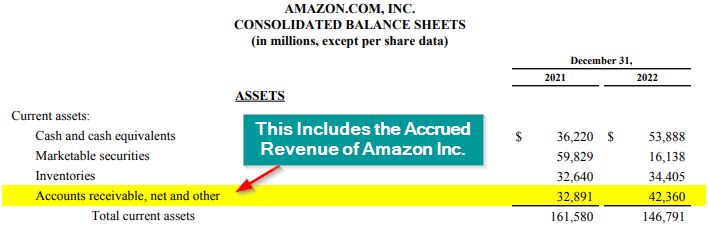

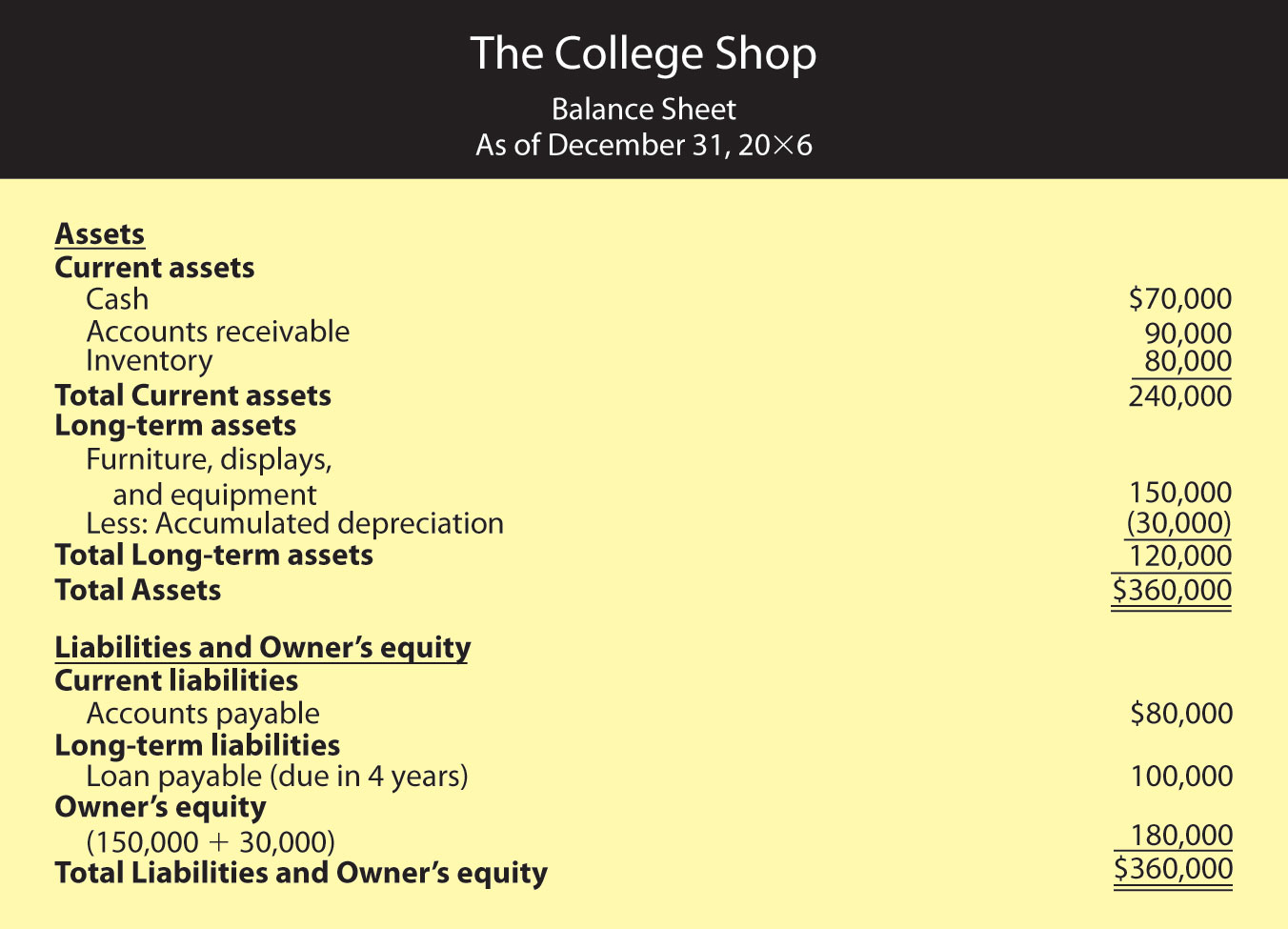

Accrued revenues are classified as an asset on the balance sheet. More specifically, they are usually categorized as a current asset. This classification reflects their nature as a resource the company expects to convert to cash within one year or the company's operating cycle, whichever is longer.

The reason accrued revenues are assets stems from the fact that they represent a future economic benefit to the company. The company has performed a service or provided a good, and is entitled to receive payment. This entitlement constitutes a valuable resource that can be used to generate future cash flow.

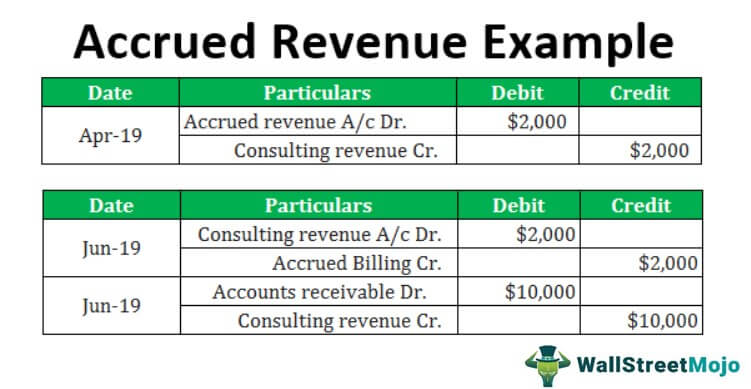

To illustrate, consider a consulting firm that completes a project for a client in December but does not invoice the client until January. The firm has earned the revenue in December, even though the cash hasn't been received. This earned revenue becomes an accrued revenue and is recorded as an asset (specifically, accrued revenue or accrued receivable) on the balance sheet as of December 31st.

The Accounting Equation and Accrued Revenues

The basic accounting equation, Assets = Liabilities + Equity, provides further context for understanding the impact of accrued revenues. When revenue is earned but not yet received, both assets and equity increase.

The asset side of the equation increases due to the recognition of the accrued revenue. Simultaneously, the equity side increases because revenue increases retained earnings. This dual effect maintains the balance of the accounting equation.

The subsequent collection of cash from the customer will then shift the asset from accrued revenue to cash, with no further impact on equity. The balance sheet remains balanced.

Implications for Financial Statement Analysis

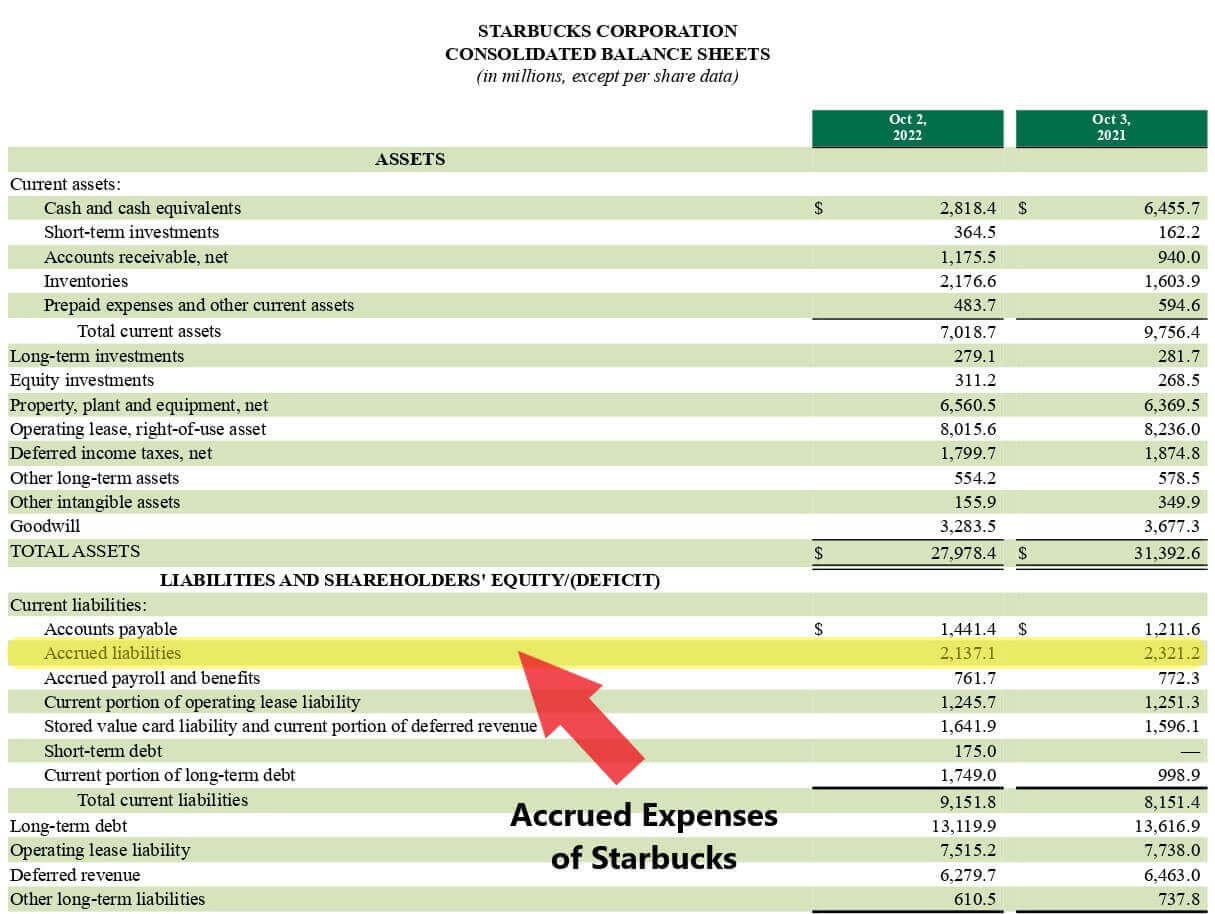

The presence of accrued revenues can significantly impact financial statement analysis. Analysts often use ratios and metrics to assess a company's liquidity, profitability, and solvency. Understanding accrued revenues is critical for interpreting these figures accurately.

For instance, a large increase in accrued revenues might signal rapid growth or aggressive sales tactics. It can also indicate potential problems with collections or customers who are slow to pay.

Conversely, a decrease in accrued revenues might reflect a slowdown in sales or improved collection processes. Investors must therefore consider accrued revenues in conjunction with other financial data to form a comprehensive assessment.

Potential Risks and Considerations

While accrued revenues represent a valuable asset, they also carry some inherent risks. One primary concern is the risk of uncollectibility. Customers may not pay their invoices, leading to a write-off of the accrued revenue.

Companies typically establish an allowance for doubtful accounts to estimate and account for potentially uncollectible receivables. This allowance is a contra-asset account that reduces the net realizable value of accounts receivable, including accrued revenues.

The determination of this allowance involves judgment and estimation. The adequacy of this allowance is a key area of scrutiny for auditors and financial analysts.

Example of Accrued Revenues

Consider a software company that provides subscription-based services. They grant access to their software for a year in exchange for annual payments. Customers are billed at the end of the service year.

During the year, the company earns revenue each month but doesn't invoice the customers. At the end of each month, the company recognizes accrued revenue for the services provided but not yet billed. This will be listed under asset.

When the customer is eventually billed, the accrued revenue account is reduced, and accounts receivable is increased, until cash is collected.

Looking Ahead: The Future of Accrual Accounting

Accrual accounting and the treatment of accrued revenues are fundamental aspects of financial reporting that are unlikely to change significantly. The principle of recognizing revenues when earned remains a cornerstone of sound financial practice.

Technological advancements may influence how companies manage and track accrued revenues, such as automated invoicing and improved credit risk assessment. However, the core accounting principles governing their recognition and presentation are expected to endure.

For investors and business professionals, a solid grasp of these principles will continue to be essential for effective financial analysis and informed decision-making.

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)