Accumulated Depreciation Equipment Is Shown As

Imagine a bustling workshop, the rhythmic clang of machinery harmonizing with the whir of gears. Each piece of equipment, from the oldest lathe to the newest robotic arm, plays a critical role in the creation of tangible goods. But time, wear, and tear march on, subtly altering the value of these essential assets. This quiet erosion is captured through a concept known as accumulated depreciation, a vital component in understanding a company's financial health.

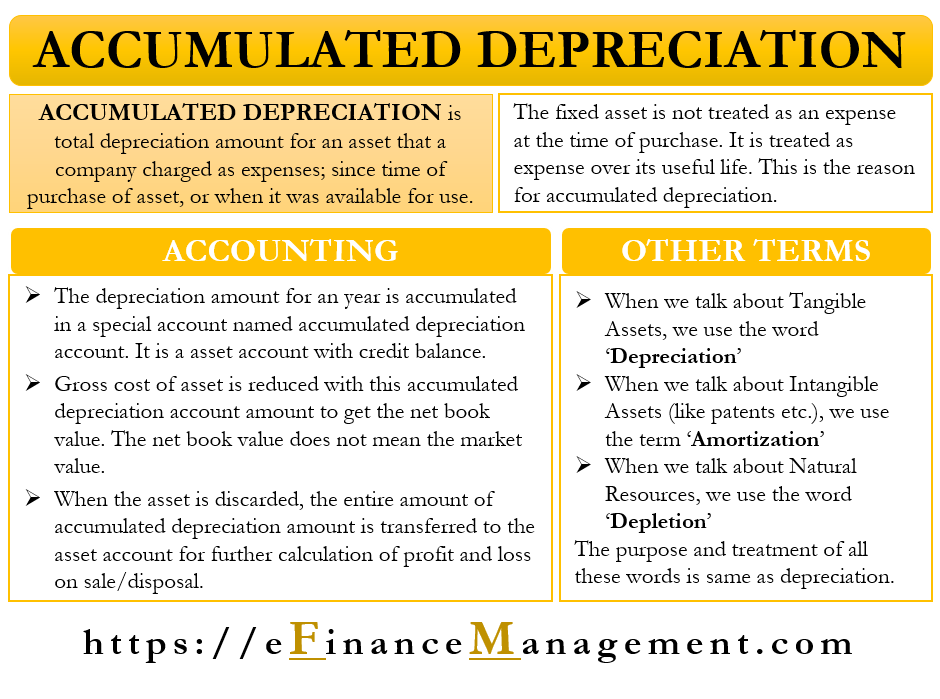

At its core, accumulated depreciation reflects the total amount of an asset's cost that has been expensed as depreciation since it was put into service. It's a contra-asset account, meaning it reduces the reported value of the asset it's associated with on the balance sheet. Understanding how accumulated depreciation is presented offers crucial insights into a company's asset management strategies and overall financial position.

The Balance Sheet: A Snapshot of Financial Position

The balance sheet is a fundamental financial statement providing a snapshot of a company's assets, liabilities, and equity at a specific point in time. Assets, representing what the company owns, are typically categorized as either current (short-term) or non-current (long-term). Equipment falls under the non-current, or fixed asset, category.

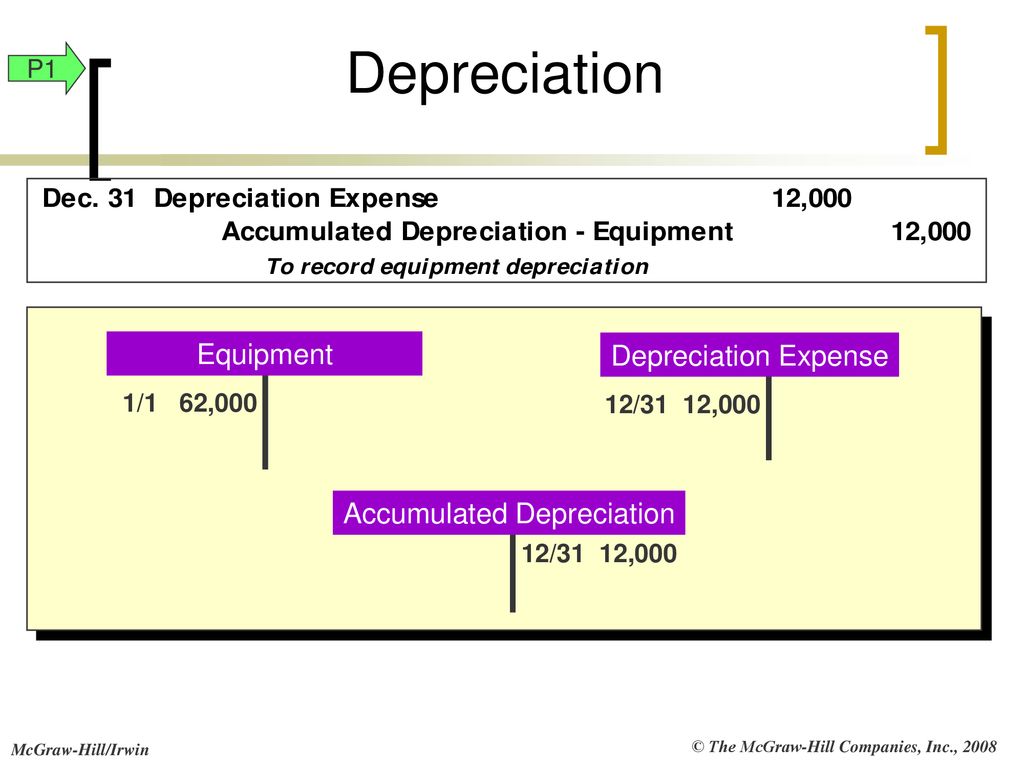

Within the fixed asset section, equipment is initially recorded at its historical cost – the original purchase price. However, accounting principles recognize that most fixed assets, like equipment, lose value over time due to usage, obsolescence, or technological advancements. This loss of value is systematically recognized as depreciation expense.

Depreciation Methods: Straight-Line and Beyond

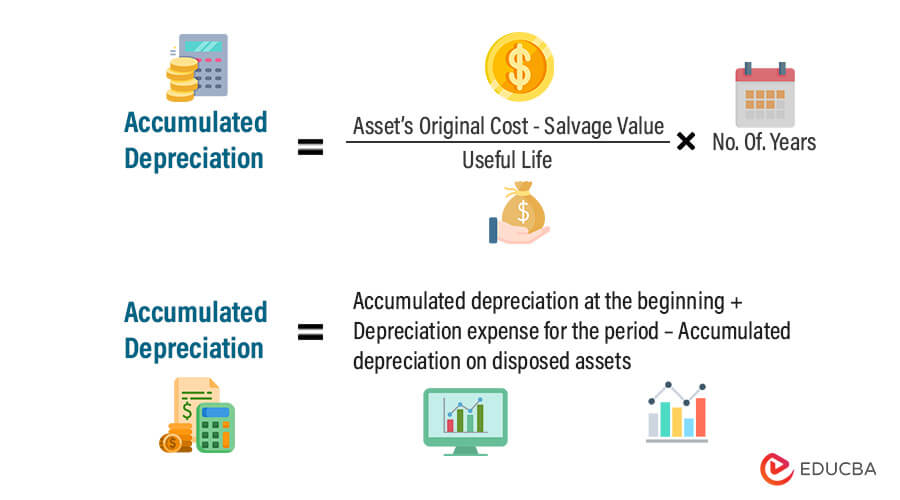

Depreciation expense is allocated over the asset's useful life using various methods. The simplest and most common is the straight-line method, which allocates an equal amount of depreciation each year. Other methods, like the declining balance method, recognize more depreciation in the early years of an asset's life.

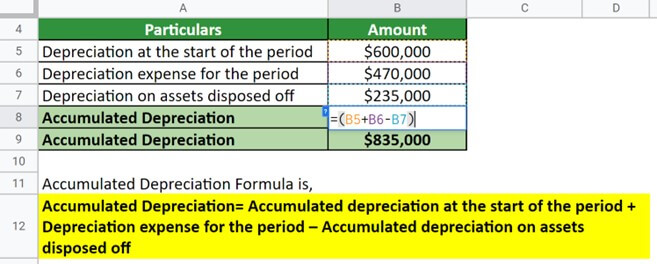

Each method aims to reflect the pattern in which the asset provides economic benefits. Regardless of the method chosen, the accumulated depreciation balance grows over time, reflecting the total amount of depreciation recognized to date.

Accumulated Depreciation: The Contra-Asset Account

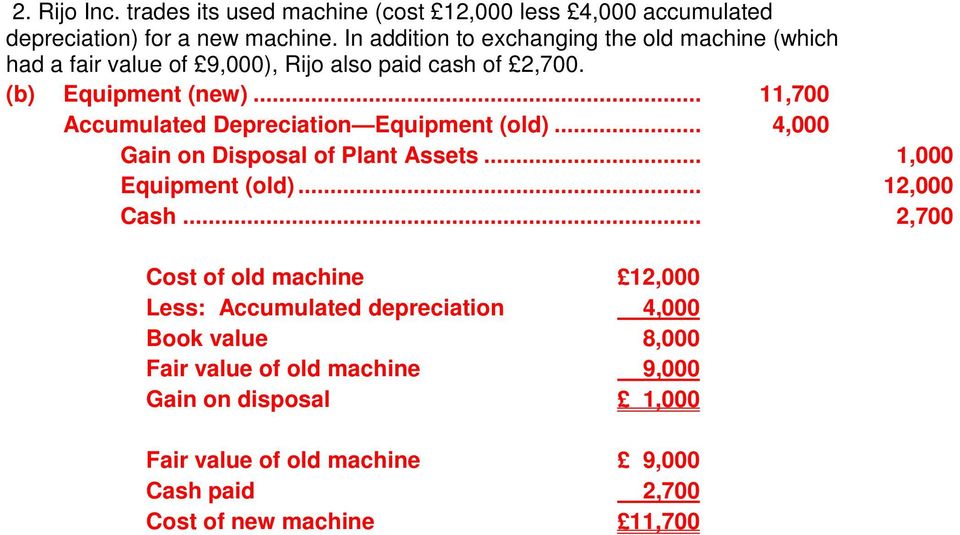

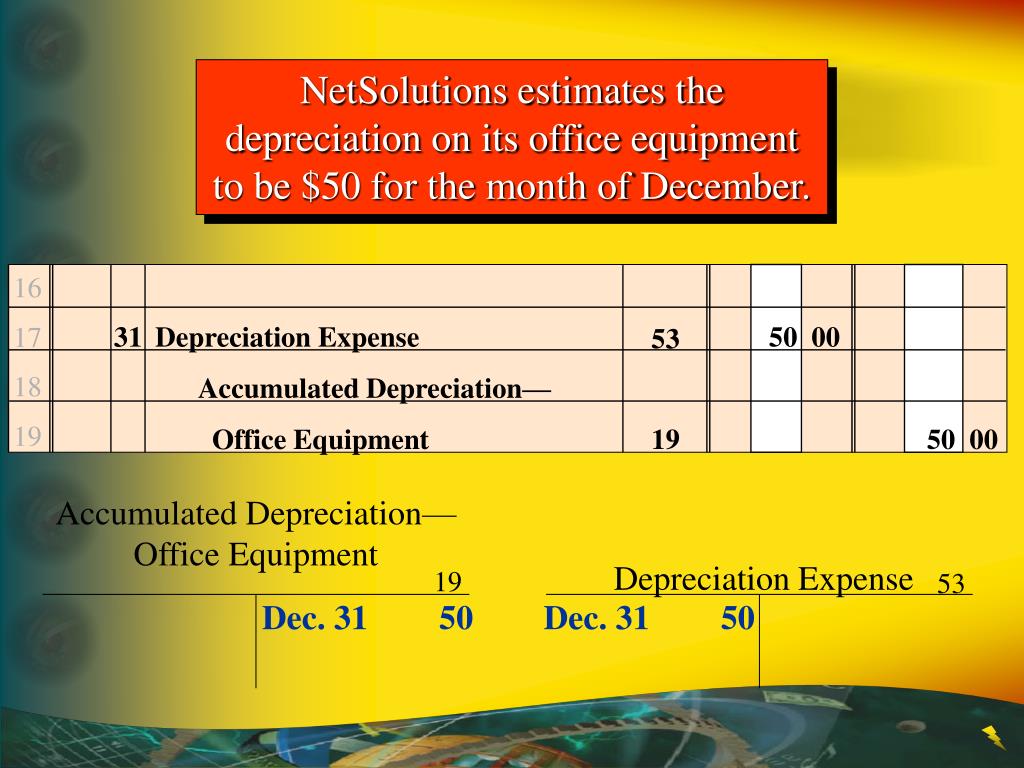

Accumulated depreciation is presented as a direct reduction from the historical cost of the equipment on the balance sheet. It's not an expense itself, but rather a running total of the depreciation expense recognized over the asset's life. This presentation gives stakeholders a clearer picture of the asset's net book value.

The net book value (also called carrying value) is calculated as the original cost of the equipment minus the accumulated depreciation. For instance, if a machine was purchased for $100,000 and has accumulated depreciation of $60,000, its net book value is $40,000.

This value represents the remaining undepreciated portion of the asset's cost. It is the amount that would be reflected on the balance sheet after accounting for the asset's decline in value.

Why is it Important to Track Accumulated Depreciation?

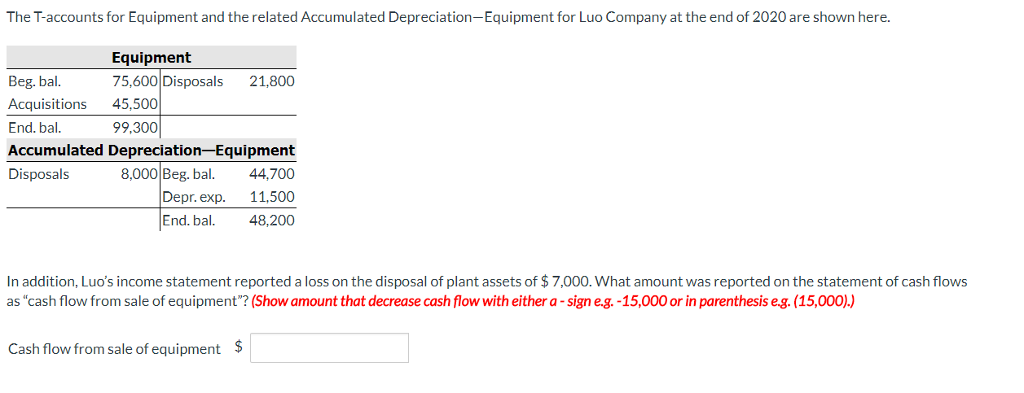

Tracking accumulated depreciation provides valuable information for several reasons. First, it allows for a more accurate representation of a company's financial position. Showing the historical cost without considering depreciation would overstate the value of the assets.

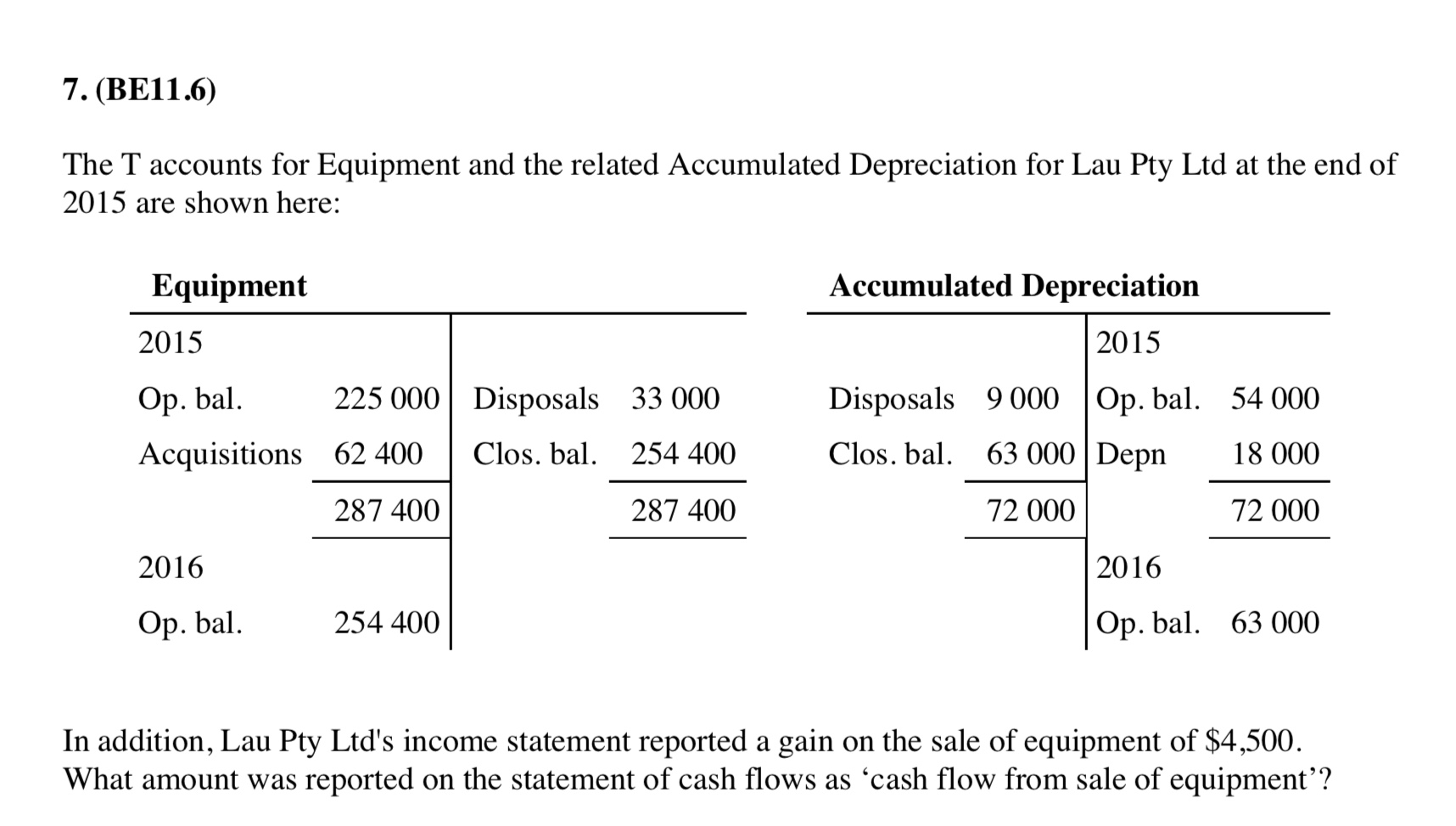

Second, it helps in evaluating the efficiency of asset utilization. A high accumulated depreciation relative to the original cost might suggest that the asset is nearing the end of its useful life or that maintenance costs might be increasing.

Third, investors and creditors use this information to assess a company's financial health and future prospects. Accumulated depreciation can affect various financial ratios, such as return on assets, which provides insight into how efficiently a company is using its assets to generate profits.

Examples in Practice

Consider Company A, a manufacturing firm with several pieces of equipment. Their balance sheet might show "Equipment: $500,000" and "Accumulated Depreciation: $200,000". This indicates that the equipment originally cost $500,000, and $200,000 of its value has been expensed as depreciation.

Therefore, the net book value of the equipment is $300,000. This information helps analysts assess the age and condition of the company's equipment base.

Contrast this with Company B, a similar manufacturing firm. If Company B shows "Equipment: $500,000" and "Accumulated Depreciation: $400,000", it suggests that their equipment is older and/or has been used more intensively than Company A's.

Interpreting Accumulated Depreciation: Beyond the Numbers

While accumulated depreciation offers valuable insights, it's essential to interpret it within the context of the industry and the company's specific circumstances. A company in a rapidly evolving technological field might have higher depreciation rates than a company in a more stable industry.

Additionally, a company's maintenance practices can influence the useful life of its assets. Regular maintenance can extend the lifespan of equipment, reducing the annual depreciation expense.

The depreciation method chosen also plays a role in the accumulated depreciation balance. Accelerated depreciation methods, for example, result in higher accumulated depreciation in the early years compared to the straight-line method.

The Bigger Picture: Accumulated Depreciation and Financial Analysis

Accumulated depreciation is a crucial element in financial analysis. It impacts a company's profitability, solvency, and efficiency ratios. Understanding its significance helps in making informed investment and lending decisions.

For example, a declining return on assets ratio, coupled with a high accumulated depreciation, could signal that a company needs to invest in new equipment to maintain its competitiveness. This information is vital for investors evaluating the company's long-term prospects.

Similarly, lenders use accumulated depreciation to assess the collateral value of a company's assets. The net book value provides a more realistic estimate of the asset's worth than its original cost.

Conclusion: A Story Told in Numbers

Ultimately, accumulated depreciation is more than just a number on a balance sheet. It's a story told in dollars and cents about the life cycle of a company's vital assets. It reflects the wear and tear, the technological advancements, and the strategic decisions that shape a company's financial landscape.

By understanding how accumulated depreciation is presented and interpreting its implications, stakeholders can gain a deeper appreciation for the complexities of financial reporting and make more informed decisions.

Like the quiet hum of machinery in a well-maintained workshop, accumulated depreciation serves as a constant reminder of the passage of time and the enduring value of responsible asset management.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)