Accumulated Other Comprehensive Income Is Reported In The

Urgent accounting updates reveal significant fluctuations in companies' Accumulated Other Comprehensive Income (AOCI), impacting shareholder equity assessments.

AOCI, a critical component of financial reporting, reflects gains and losses excluded from net income. Recent market volatility is causing substantial shifts, potentially altering how investors perceive a company's financial health. The implications of these changes demand immediate attention.

Understanding Accumulated Other Comprehensive Income (AOCI)

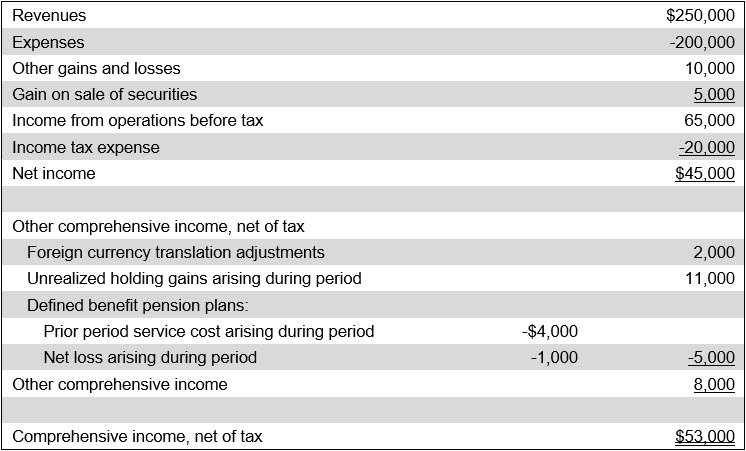

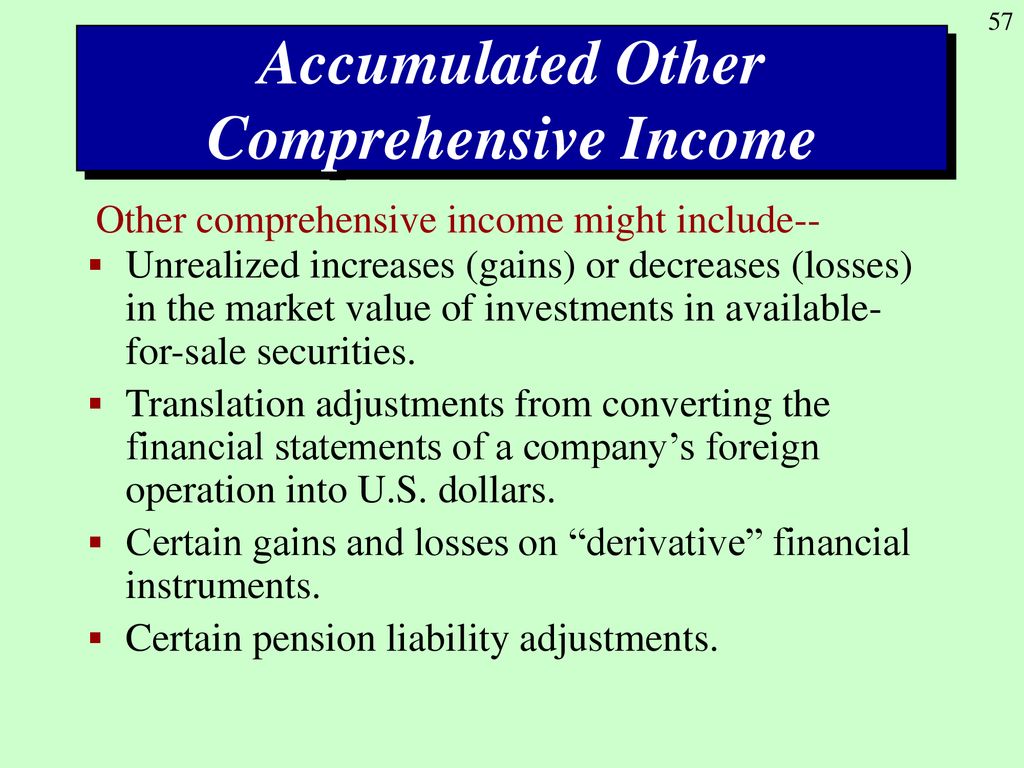

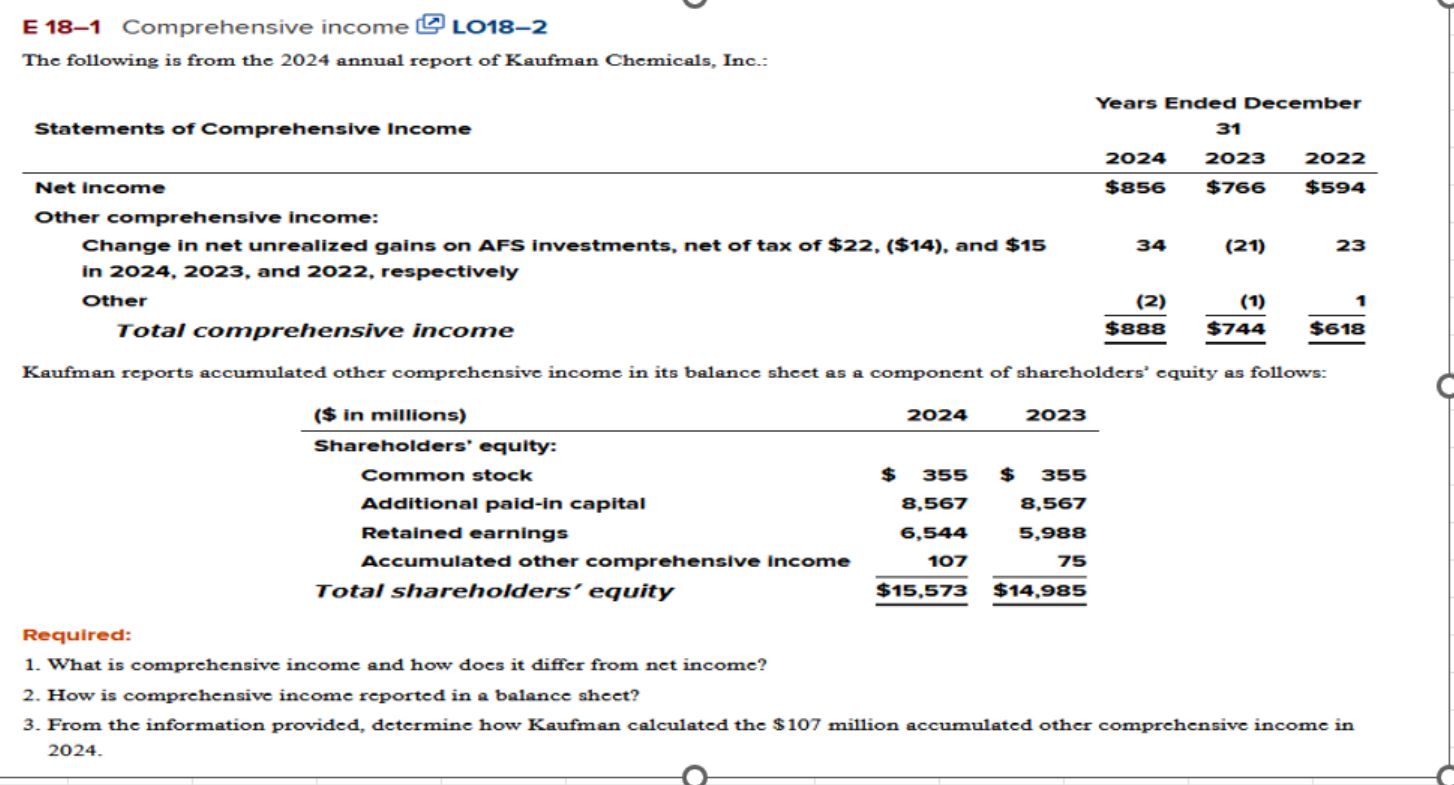

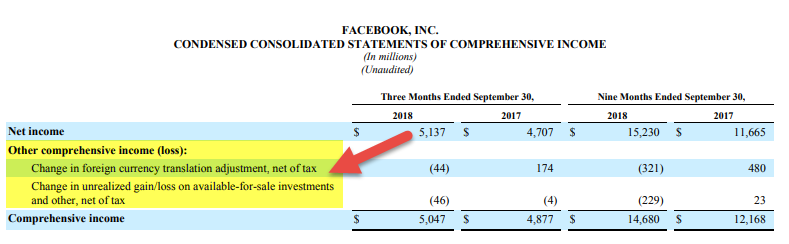

What exactly is AOCI? It's the cumulative sum of items like unrealized gains/losses on available-for-sale securities, pension adjustments, foreign currency translation adjustments, and changes in revaluation surplus (if applicable).

These items bypass the income statement, directly affecting the equity section of the balance sheet. The Financial Accounting Standards Board (FASB) mandates these reporting practices.

Where is AOCI Reported?

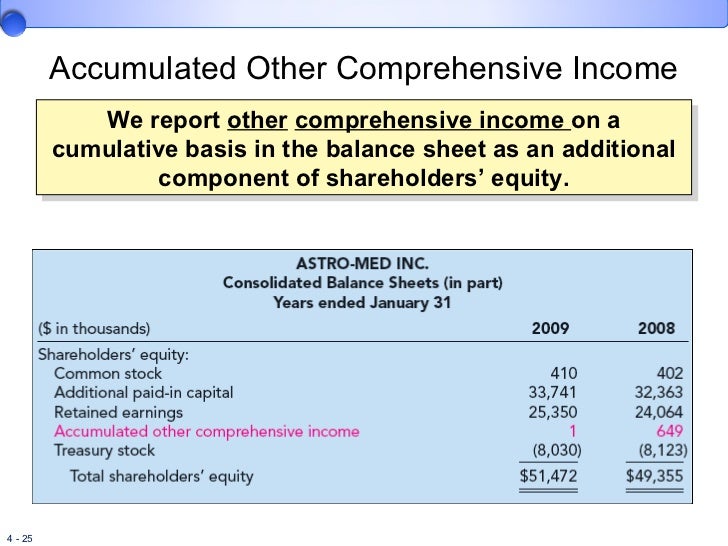

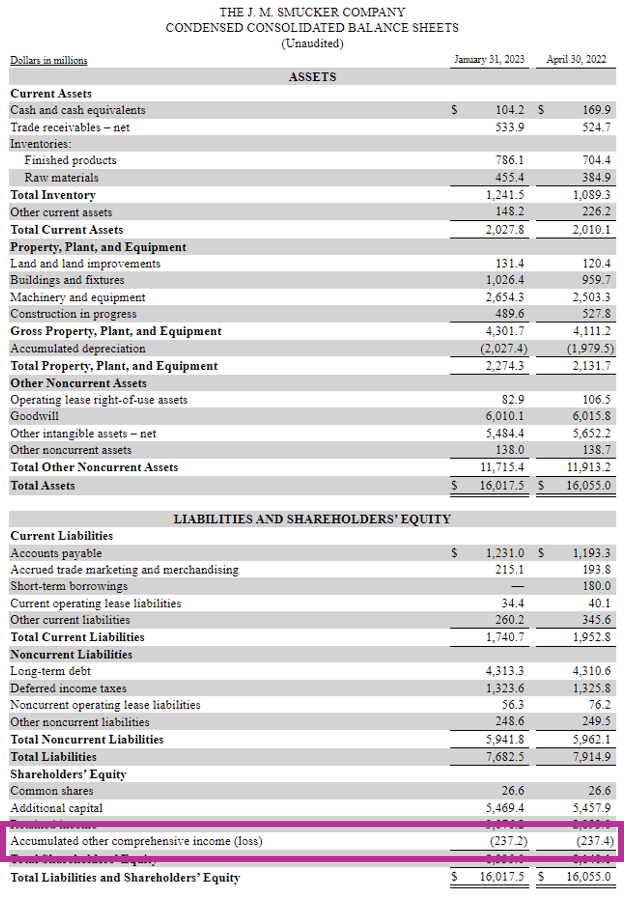

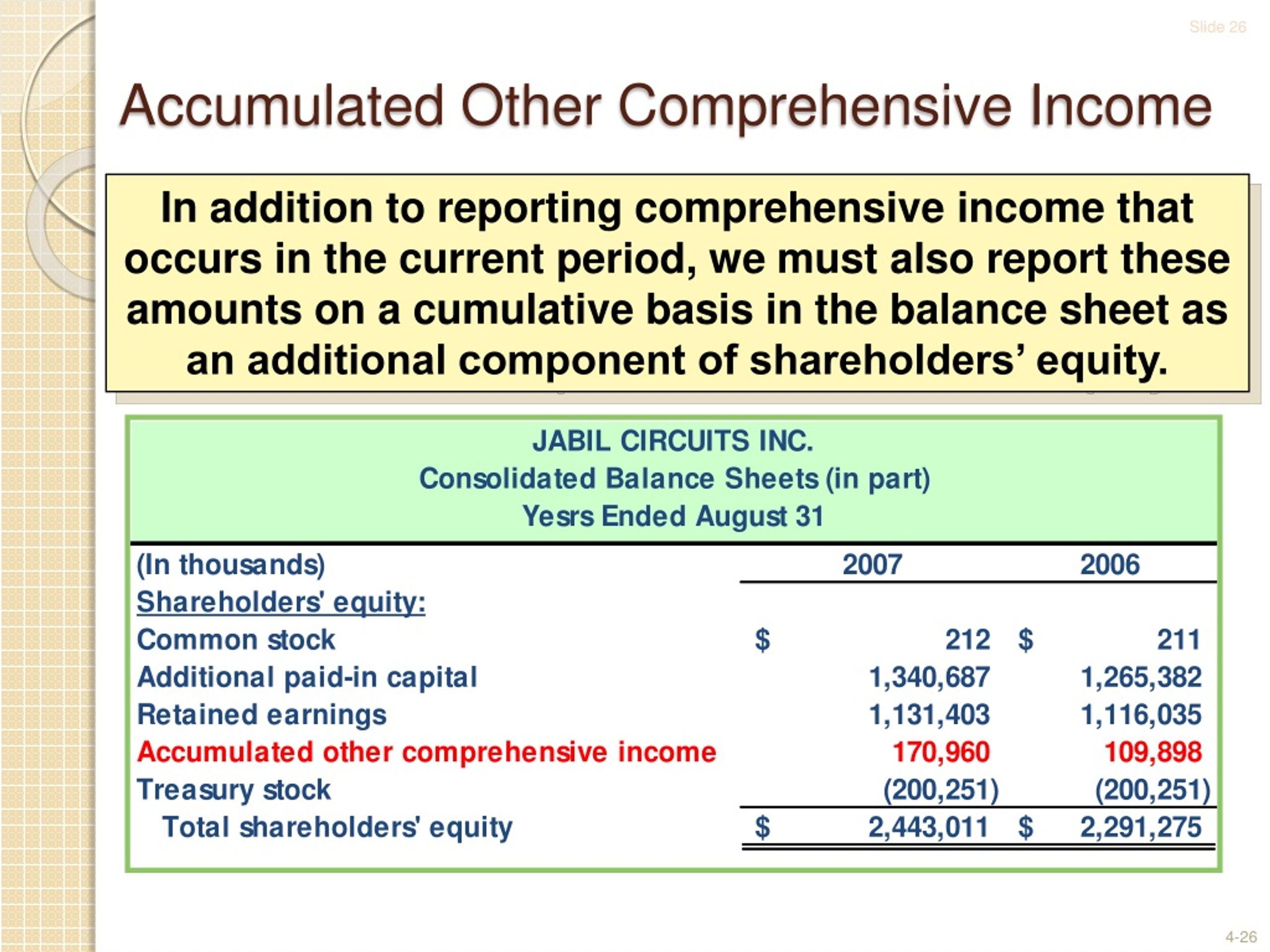

AOCI is reported within the equity section of a company's balance sheet. It's a separate line item, distinct from retained earnings and common stock.

Companies also present AOCI in a statement of comprehensive income. This statement can be presented in one of two ways: as a separate statement directly after the income statement, or as a combined statement of income and comprehensive income.

Why is AOCI Important?

AOCI provides a more complete picture of a company's financial performance. It includes elements that, while not impacting immediate profitability, affect long-term financial stability and value.

Ignoring AOCI can lead to an incomplete, potentially misleading assessment of a company's financial position. Investors and analysts use AOCI to get a holistic view.

Recent Fluctuations and Market Impact

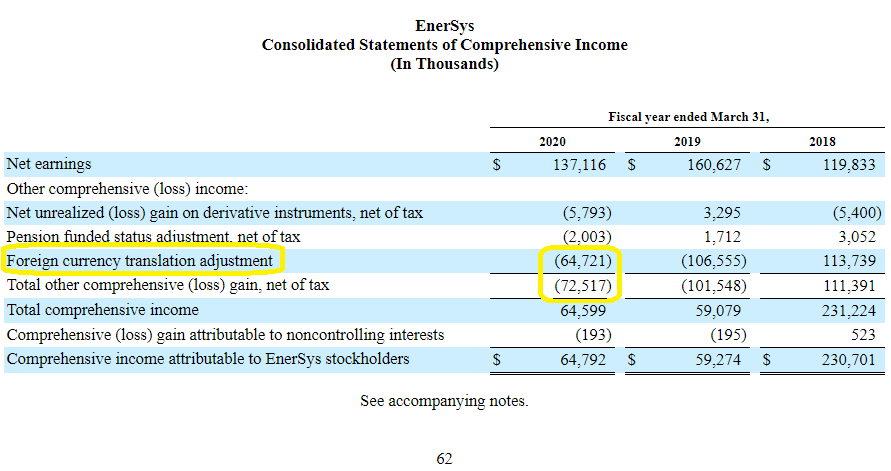

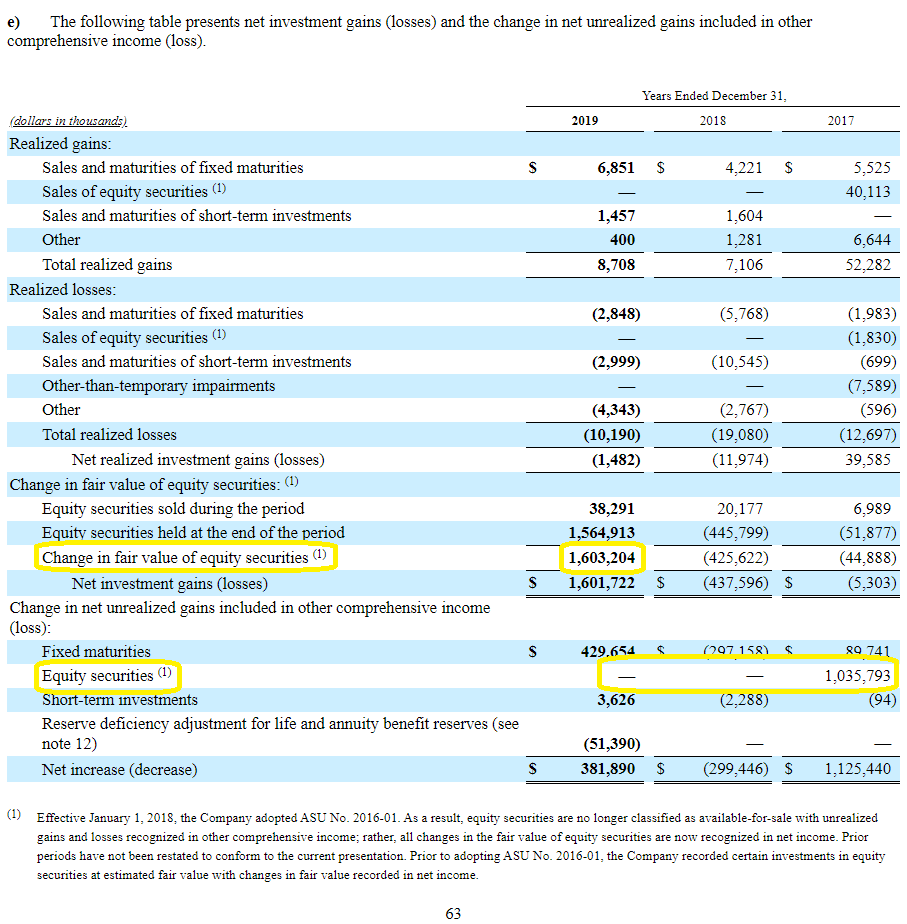

Recent market conditions – including interest rate hikes and geopolitical instability – have triggered major swings in AOCI. These swings are primarily driven by changes in the fair value of investments.

For example, rising interest rates decrease the value of fixed-income securities classified as available-for-sale. This results in a decrease in AOCI. Conversely, a weakening dollar can increase the AOCI for companies with significant foreign operations.

These fluctuations are especially pronounced in the financial services sector, where large portfolios of securities are common.

Case Studies: Companies Affected

Several major corporations have reported significant changes in their AOCI. Bank of America reported substantial fluctuations in its AOCI due to shifts in the valuation of its investment portfolio, according to their latest 10-Q filing.

Goldman Sachs also experienced volatility in its AOCI, reflecting the broader market trends affecting fixed-income assets.

These examples highlight the pervasive impact of market dynamics on AOCI across different sectors.

Accounting Standards and Compliance

Companies must adhere to Generally Accepted Accounting Principles (GAAP) when reporting AOCI. This includes proper classification and measurement of items included in comprehensive income.

The Securities and Exchange Commission (SEC) closely monitors compliance with these standards. Non-compliance can lead to regulatory scrutiny and financial penalties.

Detailed disclosures about AOCI components are essential for transparency and investor understanding.

Navigating AOCI Changes

Companies are taking proactive steps to manage the impact of AOCI fluctuations. These steps include hedging strategies to mitigate interest rate risk and currency risk.

Some firms are also reclassifying securities portfolios to minimize the impact of market volatility on AOCI. Transparent communication with investors is also crucial.

Analysts are advising investors to carefully examine AOCI components when evaluating a company's financial health.

Conclusion: Immediate Actions and Ongoing Monitoring

The recent volatility in Accumulated Other Comprehensive Income necessitates careful monitoring by companies, investors, and regulators alike. Financial professionals need to stay updated on AOCI.

Companies are urged to implement robust risk management strategies and enhance disclosures. Investors should carefully analyze AOCI data as part of their due diligence process. The SEC is expected to maintain vigilant oversight of AOCI reporting.

.jpg)

.jpg)