Adam Johnson Bullseye American Ingenuity Fund

The Adam Johnson Bullseye American Ingenuity Fund, a relatively new entrant in the investment landscape, is generating both excitement and scrutiny. Focused on identifying and capitalizing on nascent, innovative American companies, the fund promises significant returns while simultaneously fueling domestic growth. But is this promise sustainable, and does the fund's strategy expose investors to undue risk?

Launched in early 2023, the Adam Johnson Bullseye American Ingenuity Fund aims to outperform the S&P 500 by investing in a concentrated portfolio of small and mid-cap companies demonstrating disruptive potential in sectors like artificial intelligence, biotechnology, and renewable energy. This fund distinguishes itself with its aggressive growth strategy, aiming to achieve above-average returns by investing in companies perceived to be undervalued. The approach, while potentially lucrative, involves inherent risks associated with investing in smaller, less established businesses and the complexities of emerging technologies.

Investment Strategy and Performance

The fund's investment strategy hinges on rigorous due diligence, a proprietary scoring system that Adam Johnson designed to identify companies possessing a combination of strong intellectual property, a clear path to commercialization, and a management team with a proven track record. Johnson, the fund's founder and CEO, often speaks publicly about the need to foster American innovation. He advocates for a return to manufacturing and technological leadership within the United States.

Preliminary reports indicate a mixed performance record. While initial gains in the first quarter of 2023 were substantial, exceeding market averages, the fund experienced volatility throughout the remainder of the year. This volatility stemmed from macroeconomic uncertainty and market corrections impacting the technology sector.

Sources within the investment community note that the fund's concentrated portfolio – holding fewer than 30 positions – amplifies both gains and losses. This contrasts with more diversified funds that spread risk across a wider range of assets.

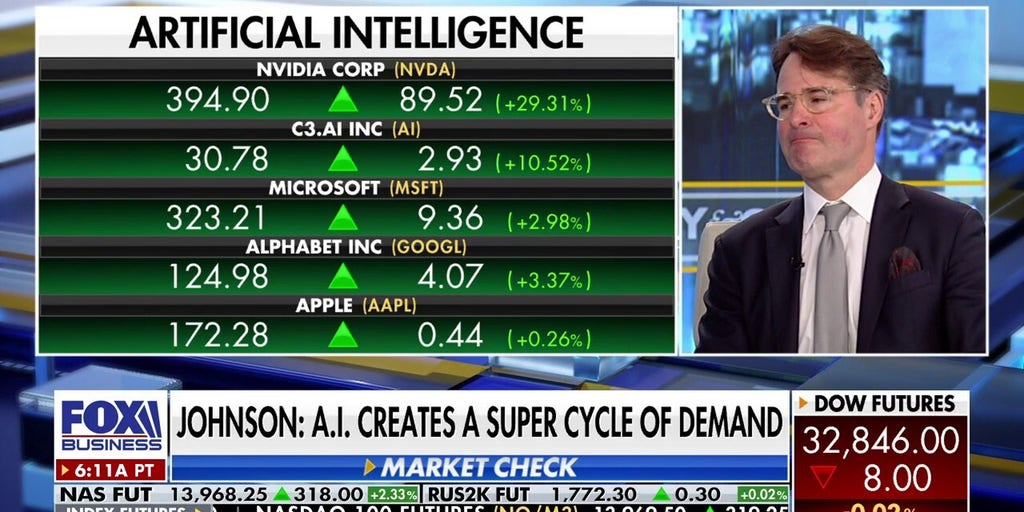

Sector Focus and Emerging Technologies

A significant portion of the fund's capital is allocated to companies involved in AI-driven solutions for healthcare and finance. The focus on these sectors aligns with the growing demand for technological advancements in these areas. Biotech firms developing novel therapies and diagnostics also constitute a substantial part of the portfolio.

Renewable energy companies, particularly those focused on energy storage and grid modernization, receive considerable attention. This aligns with national and global initiatives to transition to sustainable energy sources.

Some industry analysts question the fund's concentration in these high-growth but volatile sectors. They emphasize the need for careful risk management and a long-term investment horizon.

Management and Governance

Adam Johnson, a former Wall Street analyst, founded the fund after leaving a senior position at a major investment bank. His background includes expertise in equity research and portfolio management.

The fund's governance structure consists of an independent board of directors responsible for overseeing operations and ensuring compliance with regulations. The board includes individuals with experience in finance, law, and technology.

Critics have raised concerns about the fund's relatively short track record. They argue that a longer period of performance is needed to assess the fund's sustainability and Johnson's long-term investment acumen.

Risk Factors and Investor Suitability

Investing in the Adam Johnson Bullseye American Ingenuity Fund involves a number of risks. The fund's concentrated portfolio makes it vulnerable to significant losses if any of its holdings perform poorly.

The fund's focus on small and mid-cap companies exposes it to liquidity risk, as these stocks can be more difficult to buy and sell quickly without impacting prices. Furthermore, emerging technologies are inherently subject to technological obsolescence and market adoption challenges.

Given these risk factors, the fund is generally considered suitable for sophisticated investors with a high risk tolerance and a long-term investment horizon. Financial advisors often caution against allocating a significant portion of one's portfolio to a single, concentrated fund.

Market Perception and Future Outlook

The Adam Johnson Bullseye American Ingenuity Fund has generated considerable buzz within the investment community, attracting attention from both institutional and retail investors. Johnson's vocal advocacy for American innovation has resonated with many who seek to invest in companies contributing to domestic economic growth.

However, the fund's performance has been subject to scrutiny. Critics argue that the fund's early success may be attributable to favorable market conditions rather than exceptional stock picking.

Looking ahead, the fund's success will likely depend on its ability to navigate a complex and ever-changing market landscape. Factors such as interest rate fluctuations, geopolitical events, and technological advancements will all play a role in shaping the fund's future performance.

"The American ingenuity is there, and we can benefit from it. It's a matter of putting our capital to work in the right place." - Adam Johnson, in a recent interview.

Ultimately, the Adam Johnson Bullseye American Ingenuity Fund represents a high-risk, high-reward investment opportunity. While the potential for substantial returns exists, investors must carefully consider the risks involved and ensure that the fund aligns with their individual financial goals and risk tolerance. Investors should always seek professional financial advice before making any investment decisions.