Advance Financial Flex Loan Requirements

Advance Financial, a Tennessee-based financial services company, offers Flex Loans as a line of credit designed to provide short-term financial solutions to individuals. Understanding the requirements for these loans is crucial for potential borrowers weighing their options.

This article breaks down the eligibility criteria, application process, and key terms associated with Advance Financial Flex Loans, providing a factual overview for consumers.

Eligibility Requirements for Advance Financial Flex Loans

The specific requirements for obtaining an Advance Financial Flex Loan can vary slightly depending on state regulations and internal company policies. However, some general eligibility criteria consistently apply.

Basic Requirements

Applicants typically need to be at least 18 or 19 years old, depending on the state. A valid government-issued photo identification, such as a driver's license or passport, is usually required to verify identity and age.

Proof of a steady source of income is almost always mandatory. This can include pay stubs, bank statements showing regular deposits, or other documentation demonstrating the applicant's ability to repay the loan.

A verifiable bank account in the applicant's name is also generally necessary for both receiving the loan proceeds and setting up repayment.

Credit Score Considerations

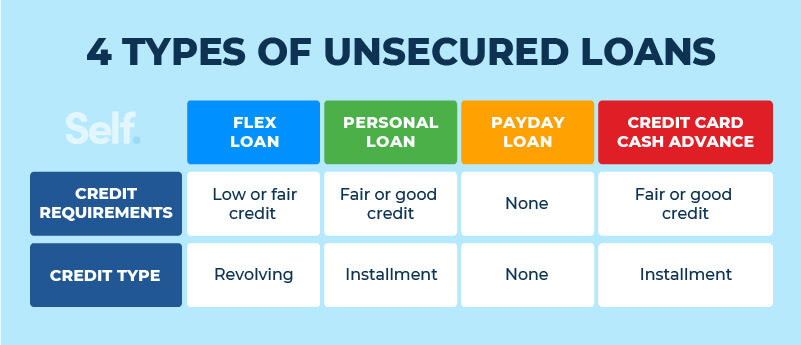

While Advance Financial advertises Flex Loans as an alternative to traditional loans, they do consider credit history. However, the credit requirements are often less stringent compared to those imposed by banks or credit unions.

Applicants with less-than-perfect credit may still be eligible. The company typically uses a variety of factors beyond just the credit score to assess risk and determine loan approval.

State-Specific Regulations

It's critical to understand that the availability and terms of Flex Loans are subject to state regulations. Certain states may have caps on interest rates, loan amounts, or repayment terms.

Advance Financial operates in several states, including Tennessee, Alabama, California, and others. Prospective borrowers should verify the specific regulations in their state of residence before applying.

The Application Process

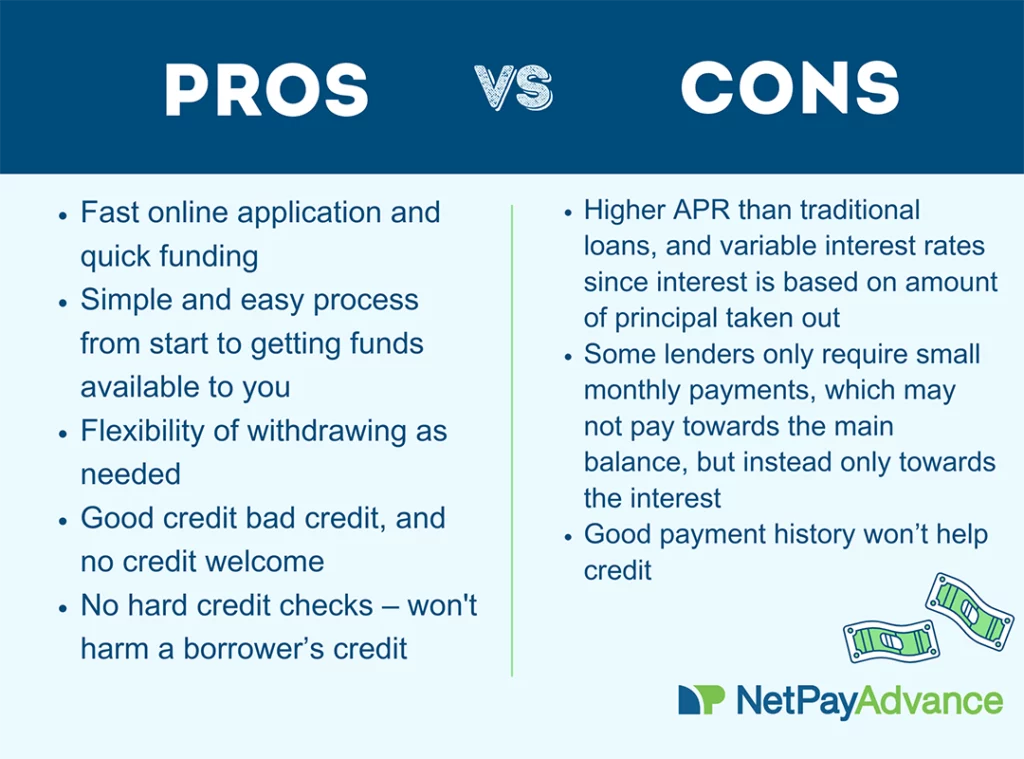

Applying for an Advance Financial Flex Loan typically involves either an in-person visit to a store location or an online application. The online application process generally mirrors the in-person process, requiring the same documentation and information.

Applicants will need to provide personal information such as their name, address, date of birth, and Social Security number. They will also need to provide details about their employment and income.

After submitting the application, Advance Financial will typically conduct a verification process, which may include contacting the applicant's employer or checking their credit history.

Understanding Loan Terms and Repayment

Before accepting a Flex Loan, borrowers should carefully review the loan agreement and understand the terms and conditions. This includes the interest rate, fees, repayment schedule, and any penalties for late payments or defaults.

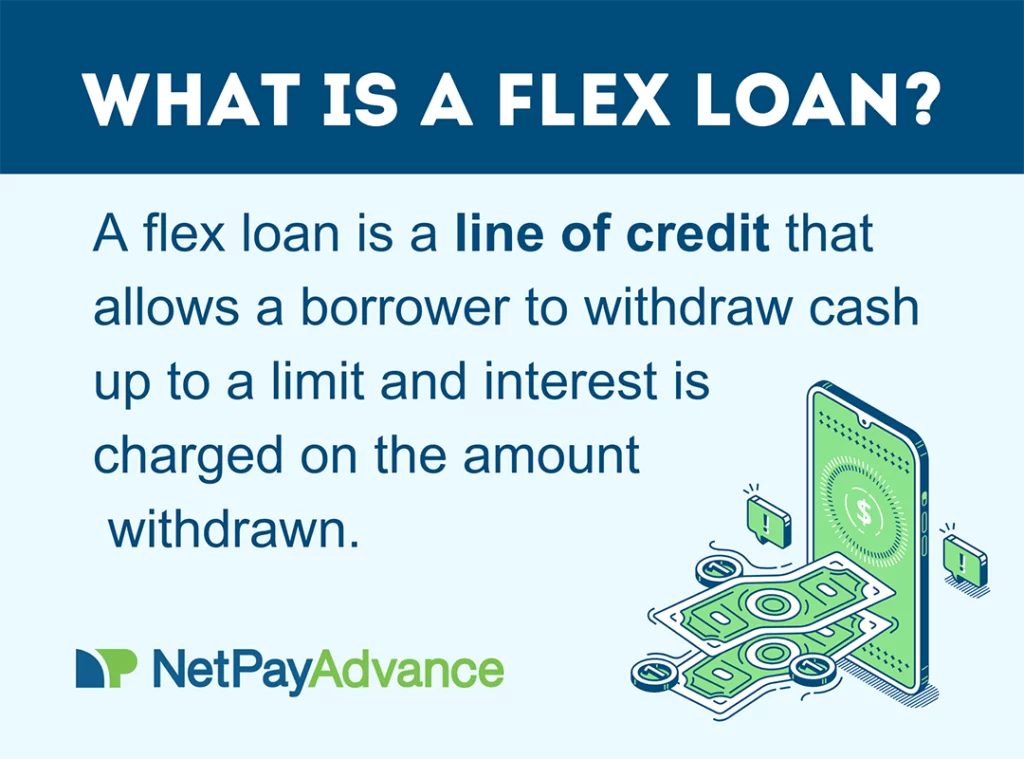

Flex Loans are designed to be a flexible line of credit, allowing borrowers to draw funds as needed up to a certain limit. Interest accrues on the outstanding balance.

Repayment terms can vary, but typically involve regular payments over a set period. It's crucial to understand the repayment schedule and ensure that you can afford the payments to avoid accumulating additional fees and negatively impacting your credit score.

Potential Impact and Considerations

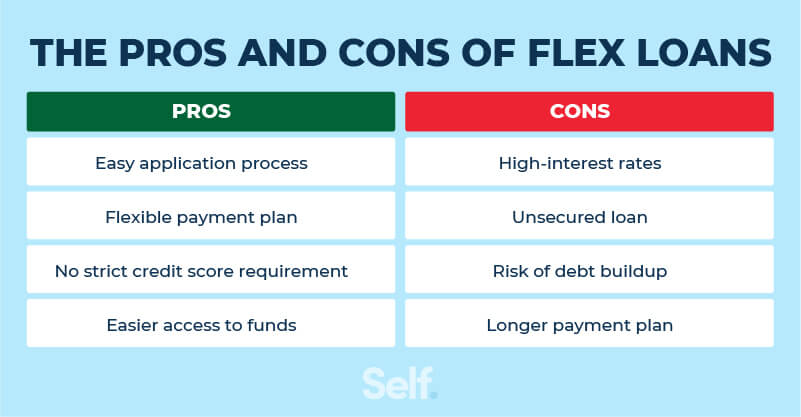

Flex Loans can provide a convenient source of funds for unexpected expenses or short-term financial needs. However, they also come with potential risks.

The interest rates on Flex Loans are typically higher than those on traditional loans or credit cards. Borrowers should carefully consider the cost of borrowing and explore other options before resorting to a Flex Loan.

It's essential to use Flex Loans responsibly and avoid relying on them as a long-term financial solution. Responsible borrowing and timely repayment are crucial to avoid debt accumulation and maintain a healthy financial profile.