Adverse Information Is Described As Information That

In an increasingly interconnected world, the flow of information is constant, yet the nature of that information varies widely. Understanding the nuances of how "adverse information" is defined and utilized is critical, especially in sectors ranging from finance to national security.

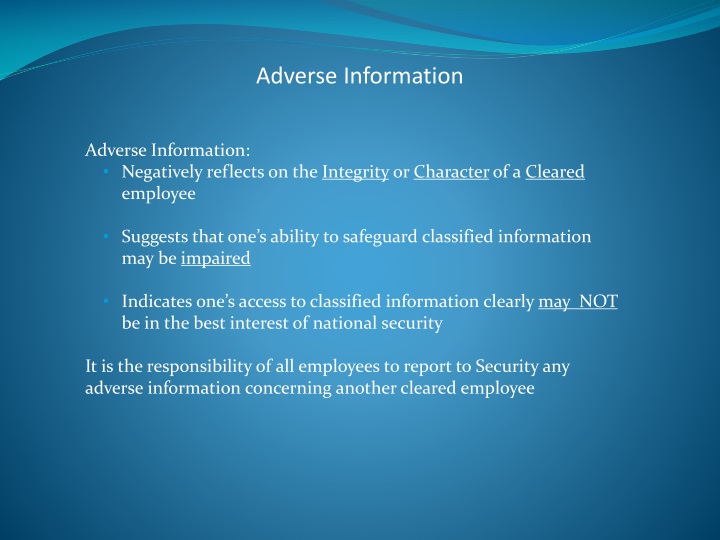

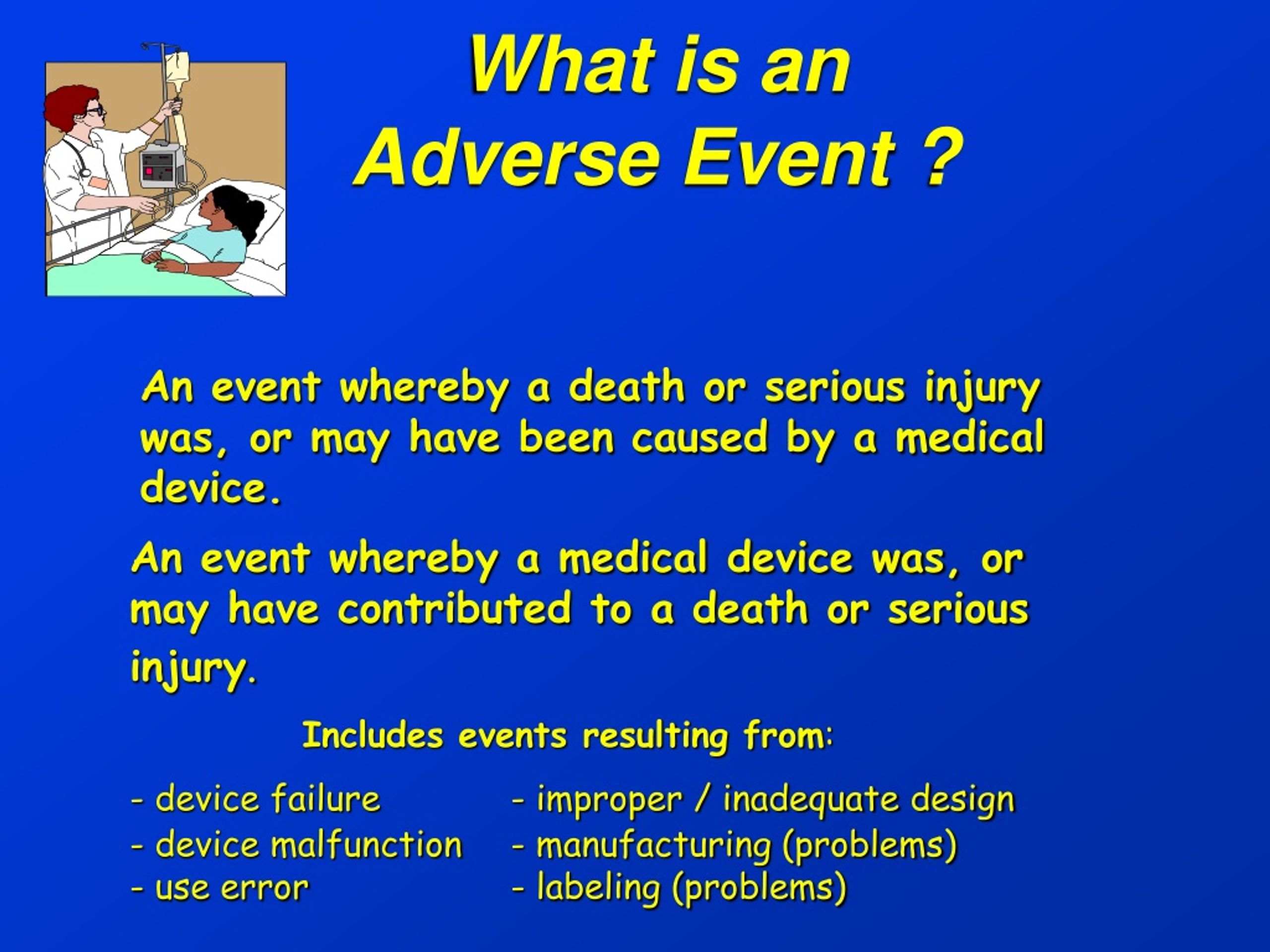

Adverse information, at its core, encompasses data that negatively impacts an assessment, decision, or evaluation of an individual, entity, or situation. This article explores the multifaceted definition of adverse information, its applications, and the potential ramifications across various domains.

Defining Adverse Information

Adverse information is not a static term. Its meaning is context-dependent and shaped by the specific regulations, industry practices, and legal frameworks in which it operates.

Generally, it refers to any data point suggesting a potential risk, failing, or negative attribute. This can range from credit report delinquencies to criminal records, or even reputational concerns flagged by news articles or social media.

Financial Sector

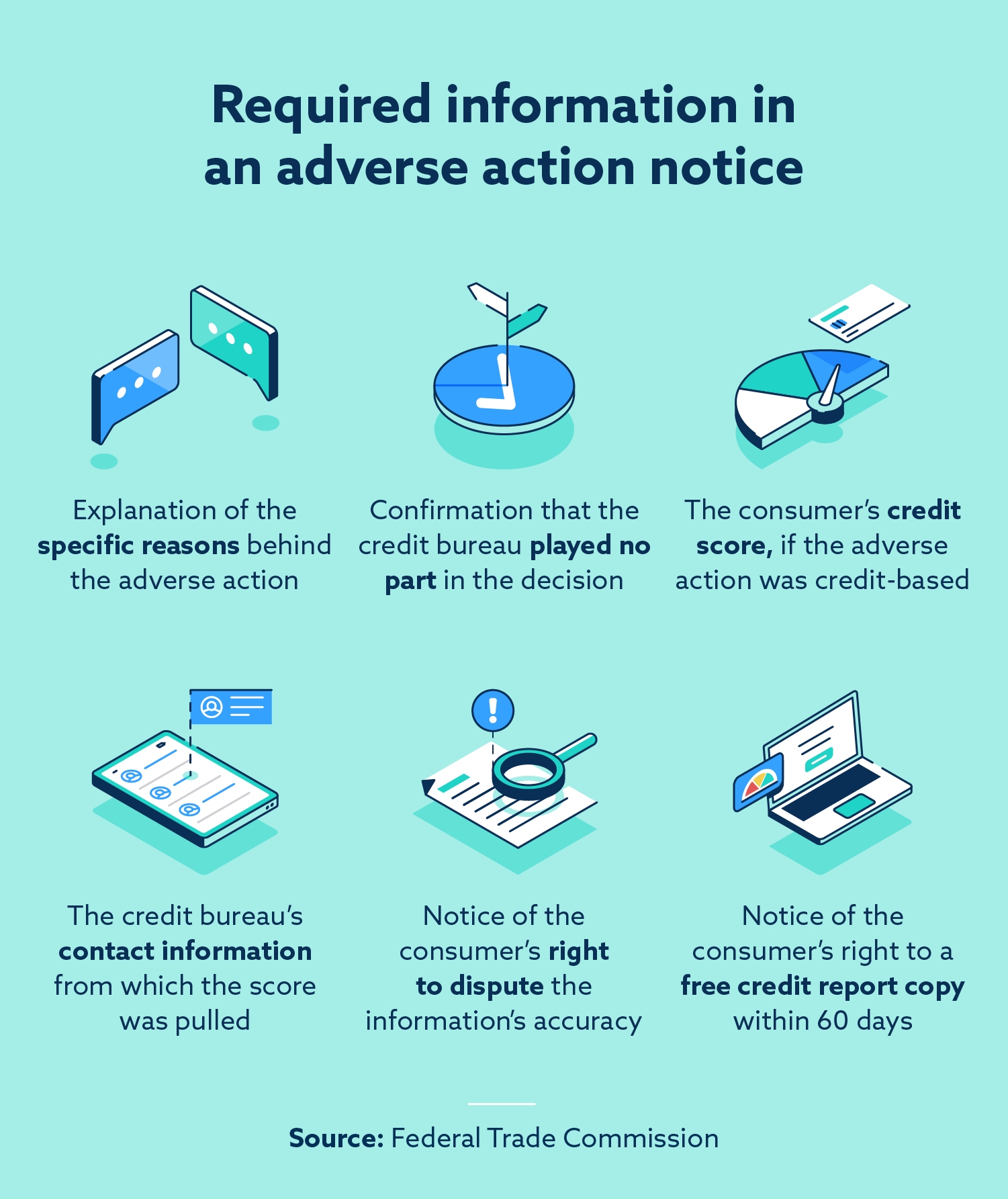

In finance, adverse information plays a crucial role in risk management. Credit bureaus, such as Equifax, Experian, and TransUnion, collect and disseminate data about consumers’ payment histories, outstanding debts, and public records like bankruptcies.

Lenders use this information to assess creditworthiness and determine loan terms. A history of late payments, high debt-to-income ratio, or a bankruptcy filing would all be considered adverse information that could negatively affect an individual's ability to secure a loan or favorable interest rate.

Furthermore, Anti-Money Laundering (AML) regulations mandate that financial institutions screen clients and transactions for adverse media and sanctions. This information helps prevent illicit financial activities.

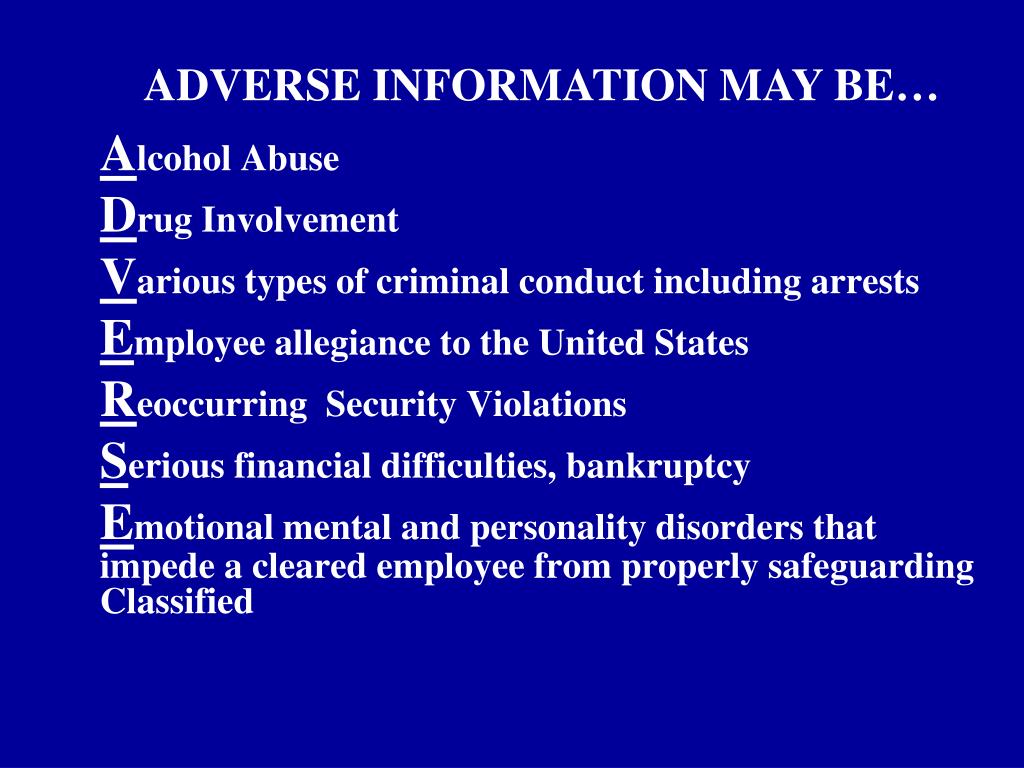

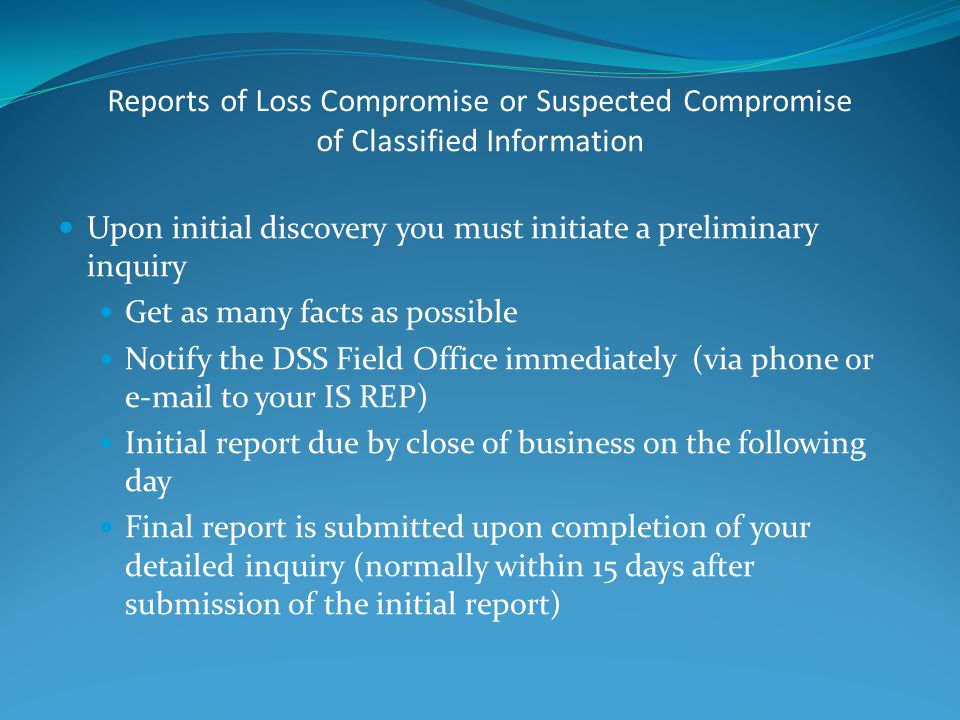

National Security and Law Enforcement

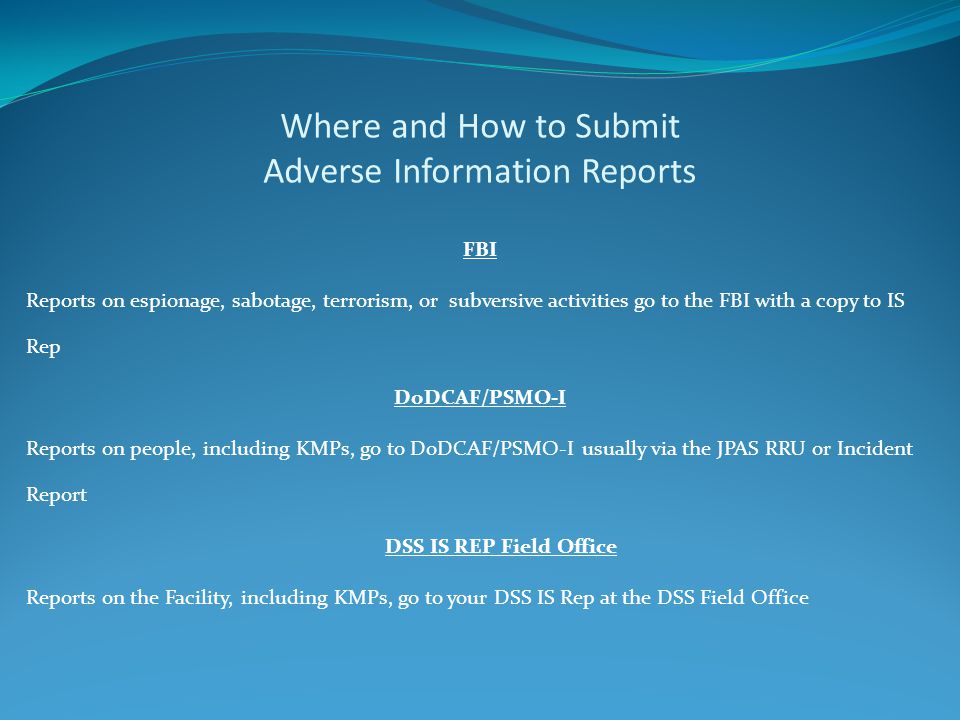

Adverse information is also vital to national security and law enforcement agencies. Intelligence agencies gather and analyze data from various sources, including human intelligence, signals intelligence, and open-source intelligence, to identify potential threats.

Adverse information in this context might involve links to terrorist organizations, suspicious travel patterns, or involvement in criminal activities. This data is used to inform risk assessments, prioritize investigations, and take preventative measures.

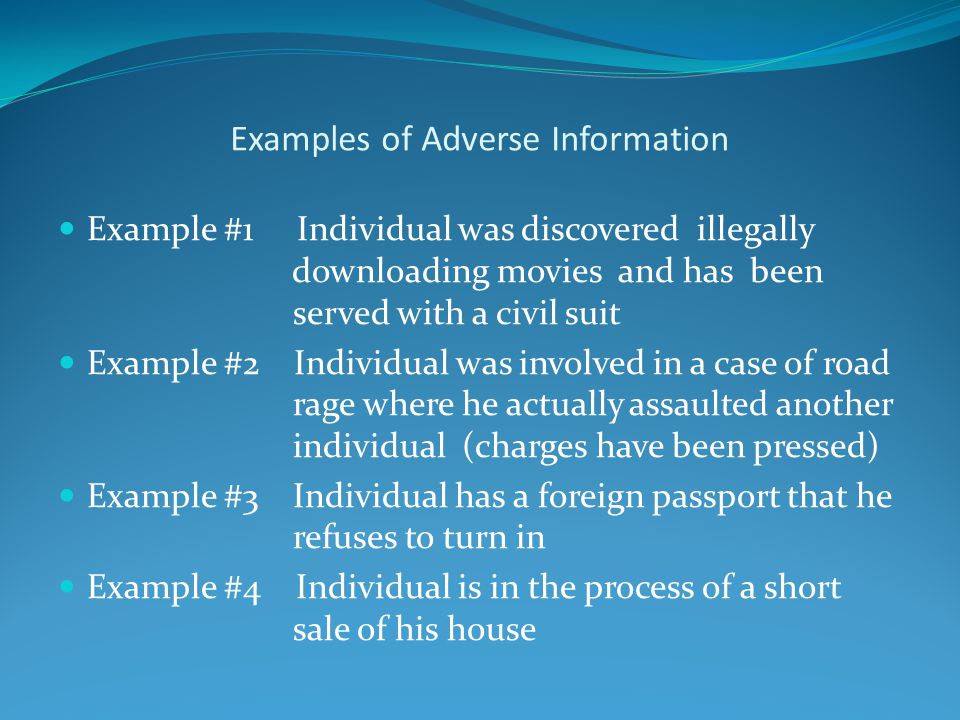

Law enforcement agencies utilize adverse information in background checks, criminal investigations, and security clearances. A criminal record, associations with known criminals, or a history of violence would all be considered adverse information that could raise concerns.

Human Resources and Employment

Employers often conduct background checks on potential hires, seeking to uncover any adverse information that could impact workplace safety or employee performance. This may include verifying educational credentials, checking criminal records, and confirming employment history.

Adverse information, such as a history of workplace misconduct, a criminal conviction related to theft, or falsified credentials, could lead to a job offer being rescinded or an employee being terminated. The use of social media checks as part of the screening process is increasingly common.

The Fair Credit Reporting Act (FCRA) regulates the use of background checks for employment purposes. Employers must obtain written authorization from candidates before conducting a background check and must notify them if adverse action is taken based on the results.

Challenges and Considerations

While adverse information is essential for informed decision-making, its use raises several ethical and practical concerns. One major challenge is the potential for inaccuracies or biases in the data.

Credit reports, for example, may contain errors that negatively affect consumers' credit scores. Background checks may be based on incomplete or outdated information.

Another concern is the potential for discrimination. If adverse information is used unfairly or disproportionately to deny opportunities to certain groups, it could violate anti-discrimination laws.

For example, basing hiring decisions solely on past criminal convictions without considering the nature of the offense or the time elapsed could have a discriminatory impact on minority groups.

The handling of adverse information must adhere to strict privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe. This regulation requires organizations to protect personal data and ensure that individuals have the right to access, correct, and delete their data.

Impact and Future Trends

The use of adverse information is likely to continue to grow as technology advances and data becomes more readily available. Artificial intelligence and machine learning are being used to analyze large datasets and identify patterns that might otherwise go unnoticed.

The increasing use of social media as a source of adverse information raises new challenges and opportunities. While social media can provide valuable insights into an individual's character and behavior, it is also prone to inaccuracies, biases, and privacy violations.

Regulatory frameworks need to adapt to address these challenges and ensure that adverse information is used fairly, accurately, and ethically. Stronger data protection laws, increased transparency, and robust mechanisms for correcting errors are essential.

Conclusion

Adverse information is a critical component of risk management, security, and decision-making across various sectors. While it provides valuable insights, its use must be approached with caution and guided by ethical principles and legal safeguards.

By understanding the nuances of adverse information, organizations and individuals can make more informed decisions while minimizing the risks of inaccuracy, bias, and discrimination.

The future of adverse information management will depend on the development of robust regulatory frameworks, advanced technologies, and a commitment to ethical data practices.