Algorithmic Trading With Interactive Brokers Pdf

The rise of algorithmic trading, where computer programs execute trades based on pre-set instructions, has been a significant trend in financial markets for years. Interactive Brokers, a prominent online brokerage firm, has long offered tools and resources to enable traders to engage in this automated practice.

This article examines the availability and usage of algorithmic trading resources offered by Interactive Brokers, specifically addressing the demand for comprehensive documentation, such as a hypothetical "Algorithmic Trading With Interactive Brokers PDF," and its implications for both novice and experienced traders.

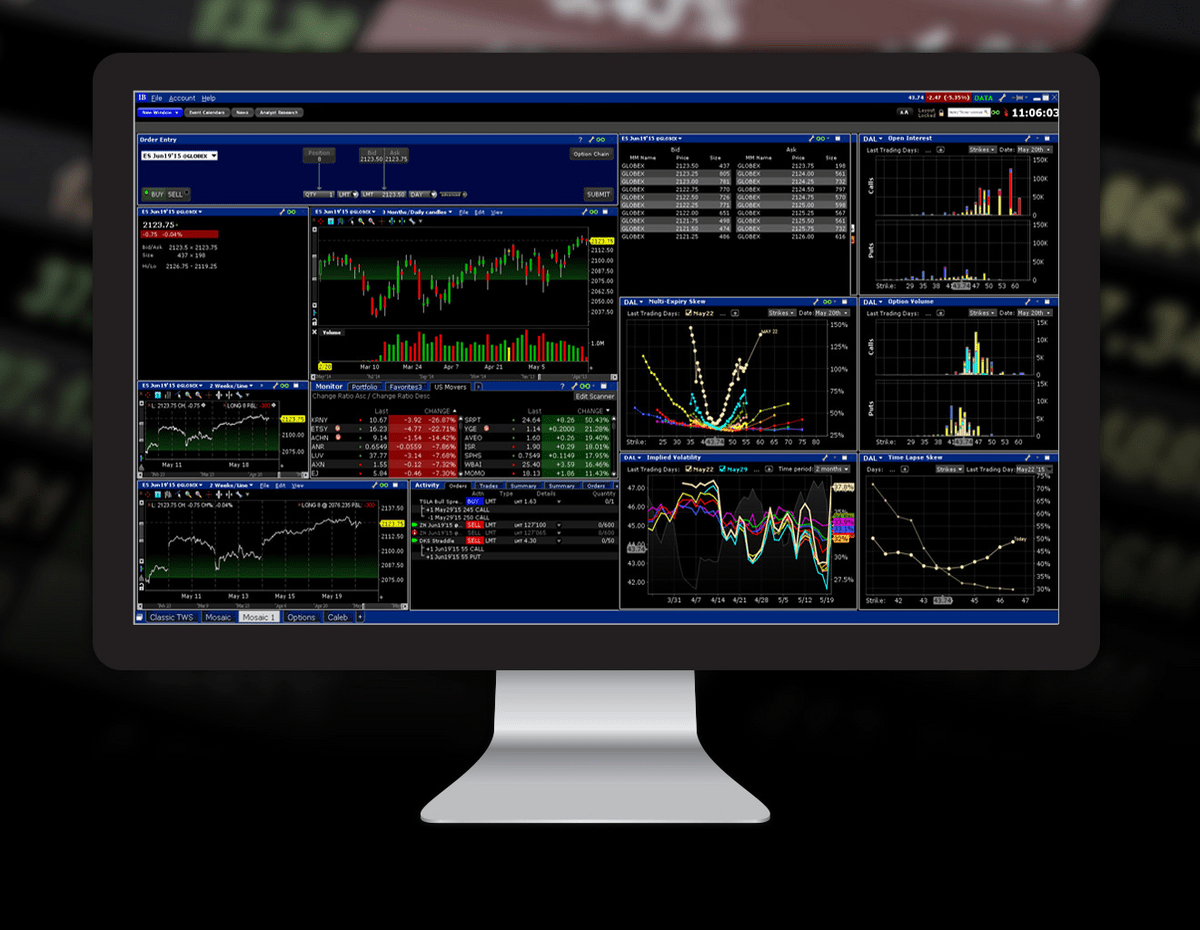

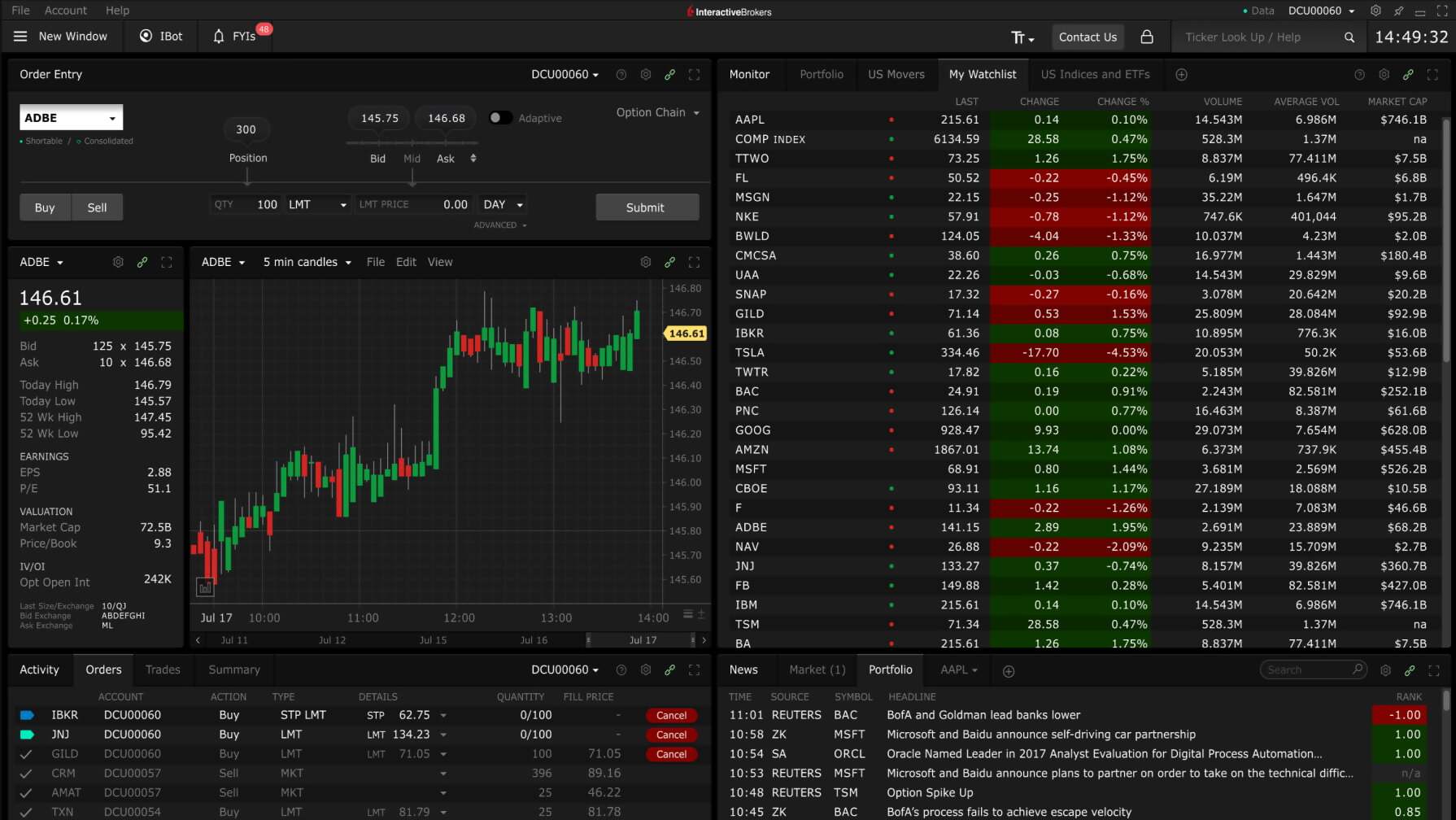

Interactive Brokers' Algorithmic Trading Platform

Interactive Brokers provides a robust platform for algorithmic trading, primarily through its Trader Workstation (TWS). TWS allows users to develop and deploy automated trading strategies using various programming languages.

The firm supports Application Programming Interfaces (APIs), including Java, Python, C++, and Excel, empowering users to connect their custom-built algorithms to the Interactive Brokers' trading infrastructure. This enables the automated execution of orders based on real-time market data and pre-defined trading rules.

While a single, comprehensive "Algorithmic Trading With Interactive Brokers PDF" may not exist as a standalone document, Interactive Brokers offers a wealth of information distributed across various resources.

Documentation and Resources

Interactive Brokers provides detailed API documentation, sample code, and tutorials on its website. These resources cover various aspects of algorithmic trading, from connecting to the API to placing orders and managing positions.

Traders can access the API Reference Guide, which outlines the functions and parameters available through the API. Furthermore, the Interactive Brokers' forum and knowledge base provide a platform for users to ask questions, share strategies, and troubleshoot issues.

These resources are essential for understanding how to effectively use the Interactive Brokers platform for algorithmic trading.

The Demand for Consolidated Information

The desire for a consolidated "Algorithmic Trading With Interactive Brokers PDF" highlights a need for a more streamlined learning experience. Many new users find navigating the various documentation pages and forum threads overwhelming.

A single document containing a step-by-step guide, practical examples, and troubleshooting tips would significantly benefit both beginners and experienced traders looking to optimize their algorithmic trading strategies on the platform. The lack of such document can create a barrier to entry for traders unfamiliar with programming and the platform.

The current dispersed nature of information requires users to piece together knowledge from different sources.

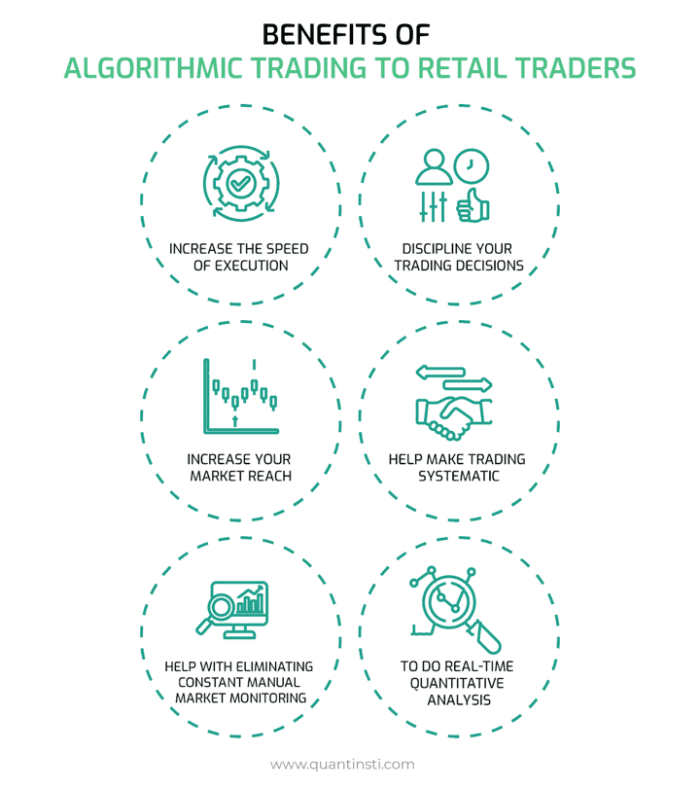

Impact on Traders and the Market

The accessibility of algorithmic trading platforms like Interactive Brokers has democratized the practice, allowing individual traders to compete with institutional investors. However, it also raises concerns about market volatility and fairness.

Algorithmic trading can exacerbate market movements if many algorithms are programmed to react similarly to the same market events. Understanding how to responsibly develop and deploy trading algorithms is crucial.

Interactive Brokers emphasizes the importance of risk management and provides tools for monitoring and controlling algorithmic trading activity. Furthermore, regulators are increasingly scrutinizing algorithmic trading practices to ensure market stability and integrity.

Looking Ahead

The evolution of algorithmic trading on platforms like Interactive Brokers will continue to shape the financial markets. As technology advances, we can expect to see even more sophisticated algorithms and trading strategies emerge.

The demand for comprehensive educational resources, like the hypothetical "Algorithmic Trading With Interactive Brokers PDF," will likely grow. Interactive Brokers and other brokerage firms may need to consider consolidating their documentation and providing more structured learning paths to cater to this demand.

Ultimately, the responsible development and use of algorithmic trading tools are essential for maintaining a fair and efficient market.

![Algorithmic Trading With Interactive Brokers Pdf [PDF] [DOWNLOAD] The Ultimate Algorithmic Trading System Toolbox](https://www.yumpu.com/en/image/facebook/63746484.jpg)