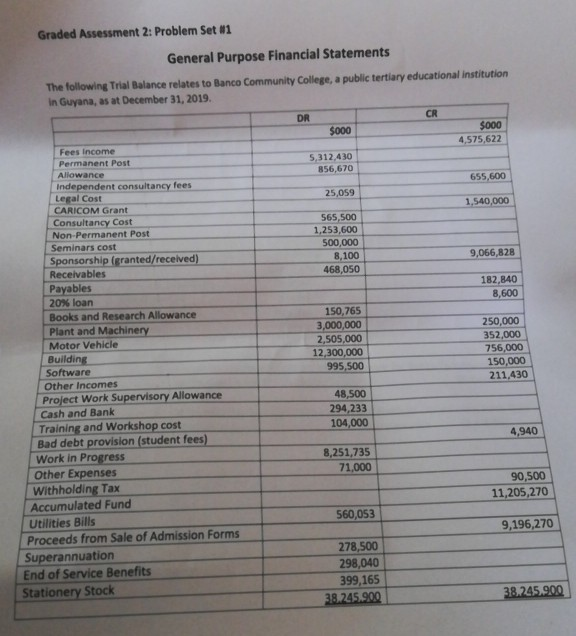

All Of The Following Are General-purpose Financial Statements Except

Imagine a bustling marketplace, not of fruits and vegetables, but of information. Accountants, investors, regulators, and business owners all gather, seeking clarity amidst the complex web of financial data. The lifeblood of this marketplace? Financial statements, providing glimpses into a company's health and future prospects.

At the heart of understanding corporate financial reporting lies a key concept: the categorization of financial statements. While many reports illuminate different facets of a company's financial performance, not all qualify as "general-purpose." The question "All Of The Following Are General-purpose Financial Statements Except" probes this very distinction, forcing us to delve into the purpose, audience, and standardized nature of these vital documents. This article will explore the world of general-purpose financial statements and how they differ from other financial reports.

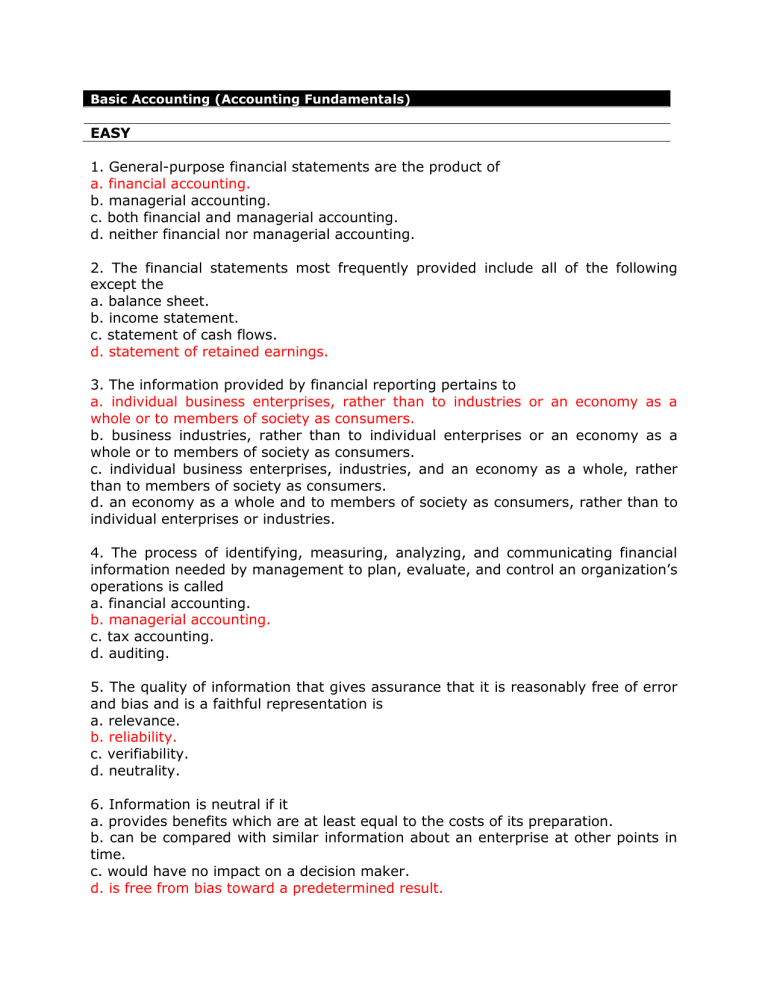

Understanding General-Purpose Financial Statements

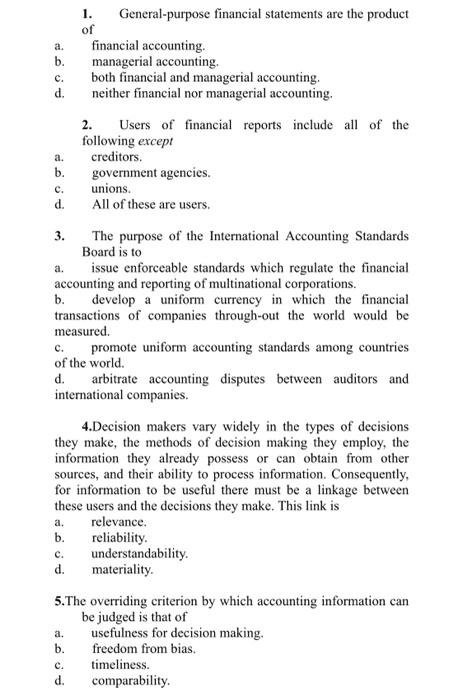

General-purpose financial statements are designed to meet the information needs of a wide range of users, primarily those who cannot demand reports tailored to their specific requirements. Investors, creditors, and the general public rely on these statements to make informed decisions. These reports provide a standardized view of a company's financial performance and position.

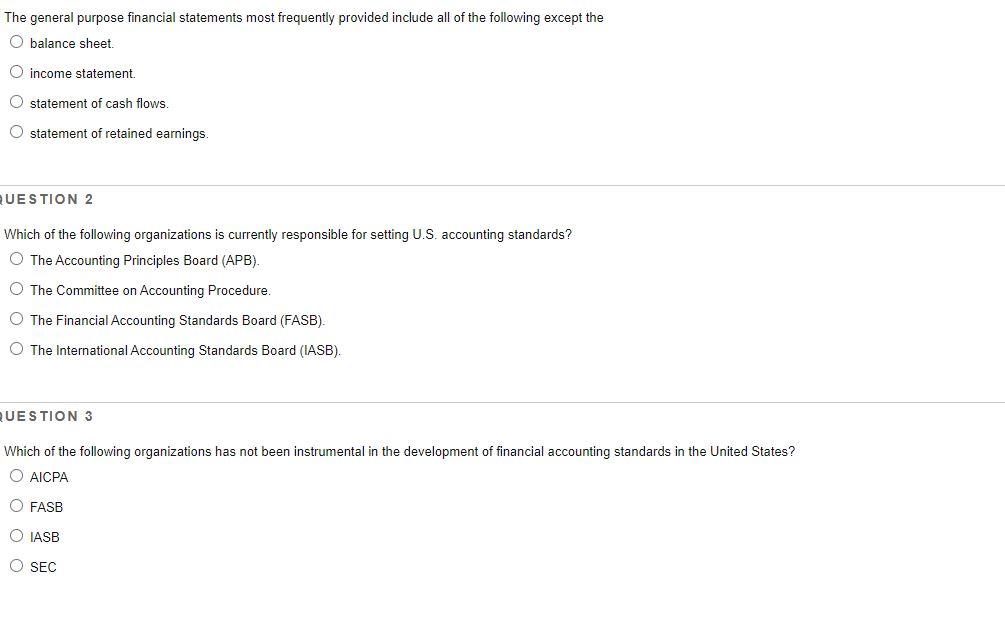

The International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) in the United States are the primary bodies responsible for setting the standards for these statements. They aim to create a common language for financial reporting. This standardization allows for easier comparisons between companies, regardless of their location.

Components of General-Purpose Financial Statements

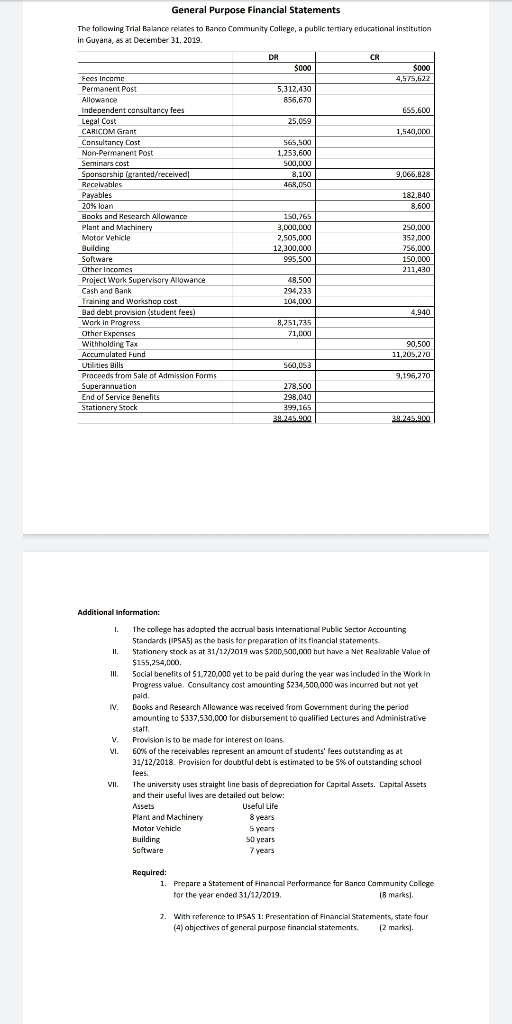

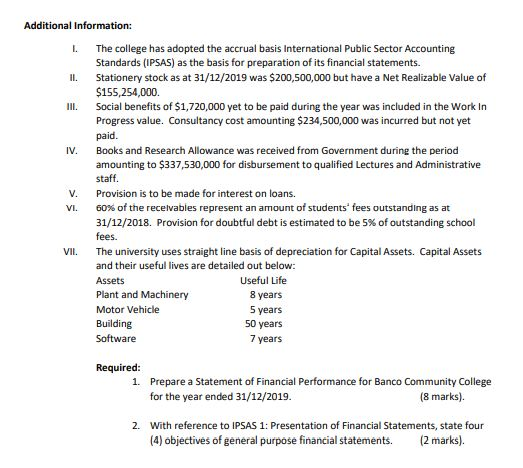

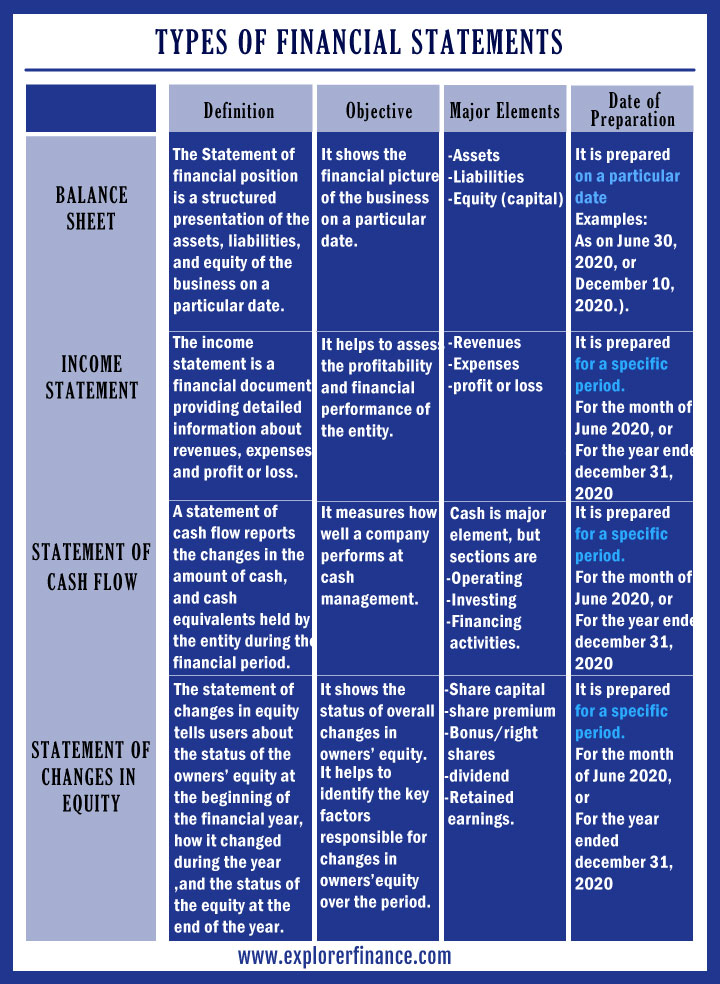

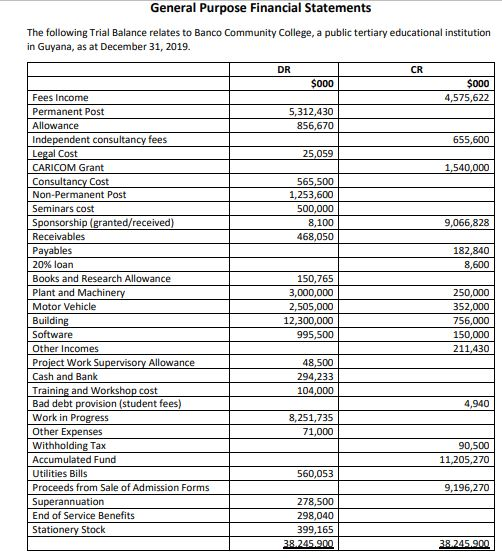

Typically, a complete set of general-purpose financial statements includes several key components. These components are the building blocks for understanding a company's financial standing.

First, there's the balance sheet, also known as the statement of financial position. It presents a snapshot of a company's assets, liabilities, and equity at a specific point in time. Think of it as a photograph showing what a company owns and owes at a particular moment.

Next, we have the income statement, or the statement of profit or loss. This statement reveals a company's financial performance over a period, typically a quarter or a year. It outlines revenues, expenses, and ultimately, the net profit or loss.

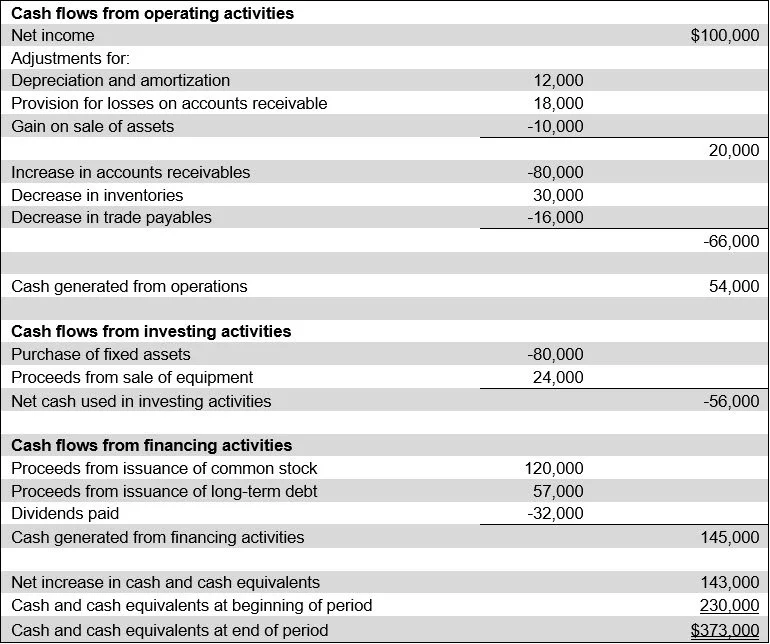

The statement of cash flows is another critical component. It tracks the movement of cash both into and out of a company. This statement is particularly important because it highlights a company's ability to generate cash and meet its obligations.

Finally, the statement of changes in equity shows how the equity of a company has changed over time. It outlines factors like net income, dividends, and other equity transactions. This provides insights into ownership structure and capital management.

Alongside these core statements, the accompanying notes to the financial statements provide crucial context. These notes offer explanations and details about the accounting policies used and further breakdown of items in the primary statements. They are an integral part of understanding the overall financial picture.

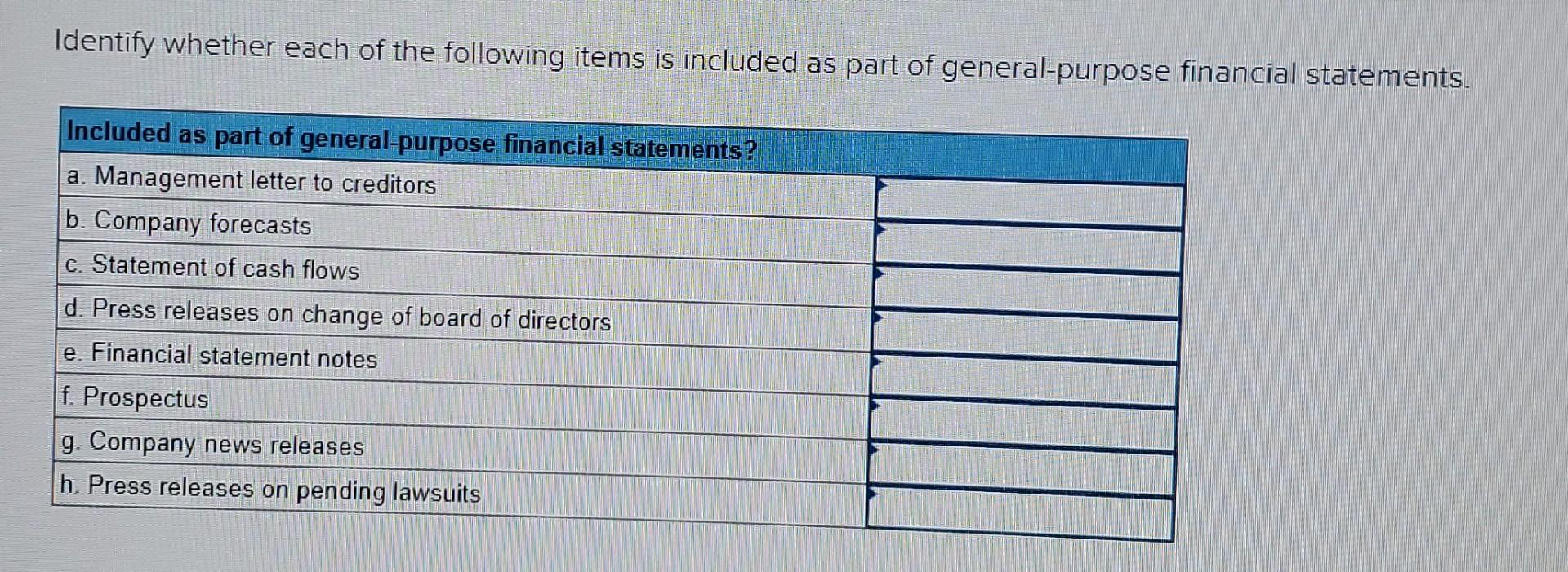

Distinguishing General-Purpose from Special-Purpose Statements

While general-purpose statements aim for broad accessibility, other types of financial reports serve specific needs. These "special-purpose" or "limited-purpose" reports cater to a particular audience or address a specific issue.

Reports prepared solely for internal management use often fall into this category. These reports might include detailed departmental budgets, variance analyses, or cost accounting reports. These reports are not bound by the same stringent standards as general-purpose statements.

Tax returns, while undeniably financial documents, are also considered special-purpose. They are prepared to comply with tax regulations and are specifically tailored for the tax authorities. They may use different accounting methods or focus on different metrics than general-purpose statements.

Regulatory filings, required by specific government agencies, can also be special-purpose. These filings might include reports for environmental compliance or industry-specific disclosures. Their format and content are dictated by the regulating body.

One key difference lies in the level of standardization. General-purpose statements adhere to established accounting standards, whereas special-purpose reports can be more flexible. Another difference is the intended audience. General-purpose statements aim for broad use, while special-purpose reports target a specific group. The 'except' from the prompt's question will always relate to a special-purpose statement.

Examples of "All Of The Following Are General-purpose Financial Statements Except"

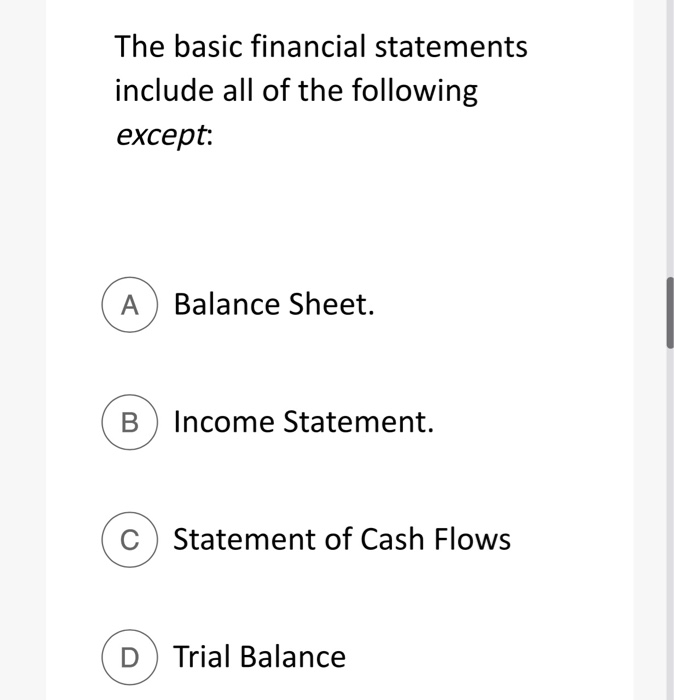

The multiple-choice question, "All Of The Following Are General-purpose Financial Statements Except," requires identifying which report doesn't fit the standardized, widely accessible definition. Let’s look at some examples.

If the options are: (a) Balance Sheet, (b) Income Statement, (c) Statement of Cash Flows, and (d) Management's Discussion and Analysis (MD&A), the answer would be (d). While MD&A accompanies financial statements, it is more narrative and interpretive, not a core financial statement itself.

Another example: (a) Statement of Changes in Equity, (b) Notes to the Financial Statements, (c) Tax Return, and (d) Income Statement. The answer here is (c), Tax Return, as it is prepared for a specific purpose (tax compliance) and audience (tax authorities).

A third example: (a) Balance Sheet, (b) Statement of Cash Flows, (c) Internal Budget Report, and (d) Income Statement. In this scenario, (c), Internal Budget Report is the correct answer. This is because internal budget reports are crafted solely for managerial use.

The Importance of Knowing the Difference

Understanding the distinction between general-purpose and special-purpose financial statements is crucial for several reasons. For investors, it ensures they are relying on standardized, comparable data when making investment decisions. It's critical to know which financial statements are intended for external users.

For creditors, it helps in assessing a company's creditworthiness using consistent metrics. Banks and other lenders rely on financial statements for granting loans.

For companies, it ensures compliance with reporting requirements and builds trust with stakeholders. Accurate and transparent financial reporting is essential for maintaining a positive reputation.

Moreover, recognizing the difference helps prevent misinterpretation or misuse of financial data. Applying general-purpose criteria to special-purpose reports, or vice versa, can lead to flawed conclusions.

Conclusion

In the intricate world of finance, the ability to distinguish between different types of financial statements is paramount. General-purpose statements, with their standardized formats and broad appeal, serve as vital tools for stakeholders. While special-purpose reports offer valuable insights for specific needs, they should not be confused with the comprehensive view provided by general-purpose statements.

The question "All Of The Following Are General-purpose Financial Statements Except" is more than a simple multiple-choice prompt. It is an invitation to understand the nuances of financial reporting and the vital role that these reports play in the global economy. This knowledge empowers individuals to make informed decisions, fostering transparency and trust in the marketplace.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)